- Ripple executives have slammed the SEC’s decision to file an appeal

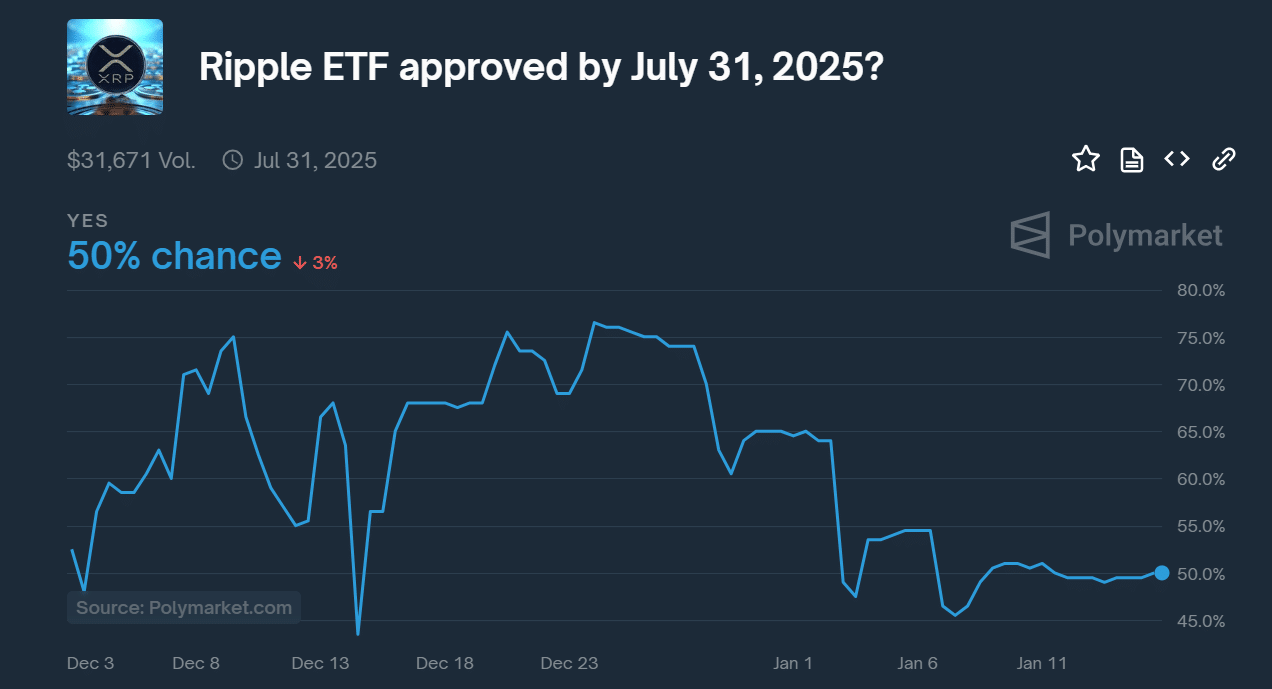

- XRP ETF approval odds were at 50/50 at press time, depending on the new administration.

Ripple’s leadership has slammed the SEC as the agency moved to appeal against the firm’s latest legal win. Stuart Alderoty, the firm’s chief legal officer (CLO), termed the agency’s move a “waste of taxpayer money.”

He said,

“On January 20, Gensler’s war on crypto ends at the SEC. We asked the SEC to agree to postpone the filing of their opening brief in their appeal of our victory (current deadline Jan 15) – and they refused. What a waste of time and taxpayer dollars!”

Worth noting, however, that Alderoty also reiterated his confidence that the new administration would resolve the appeal issue.

Ripple founder and CEO Brad Garlinghouse also criticized the appeal and termed it ‘sad.’

“Gensler, very much on brand – completely dismissive of the 2024 election and the American public – fully commits to his failed ‘regulation-by-enforcement agenda to the bitter, bitter end.”

XRP’s price unfazed

The agency’s appeal aims to challenge a 2023 court ruling by U.S judge Analisa Torres who deemed that XRP sales to retail over public exchanges didn’t merit securities transactions.

Additionally, the regulator fined Ripple $2 billion for securities violations. However, the court ordered only $125M linked to institutional XRP sales, which were found to be securities transactions.

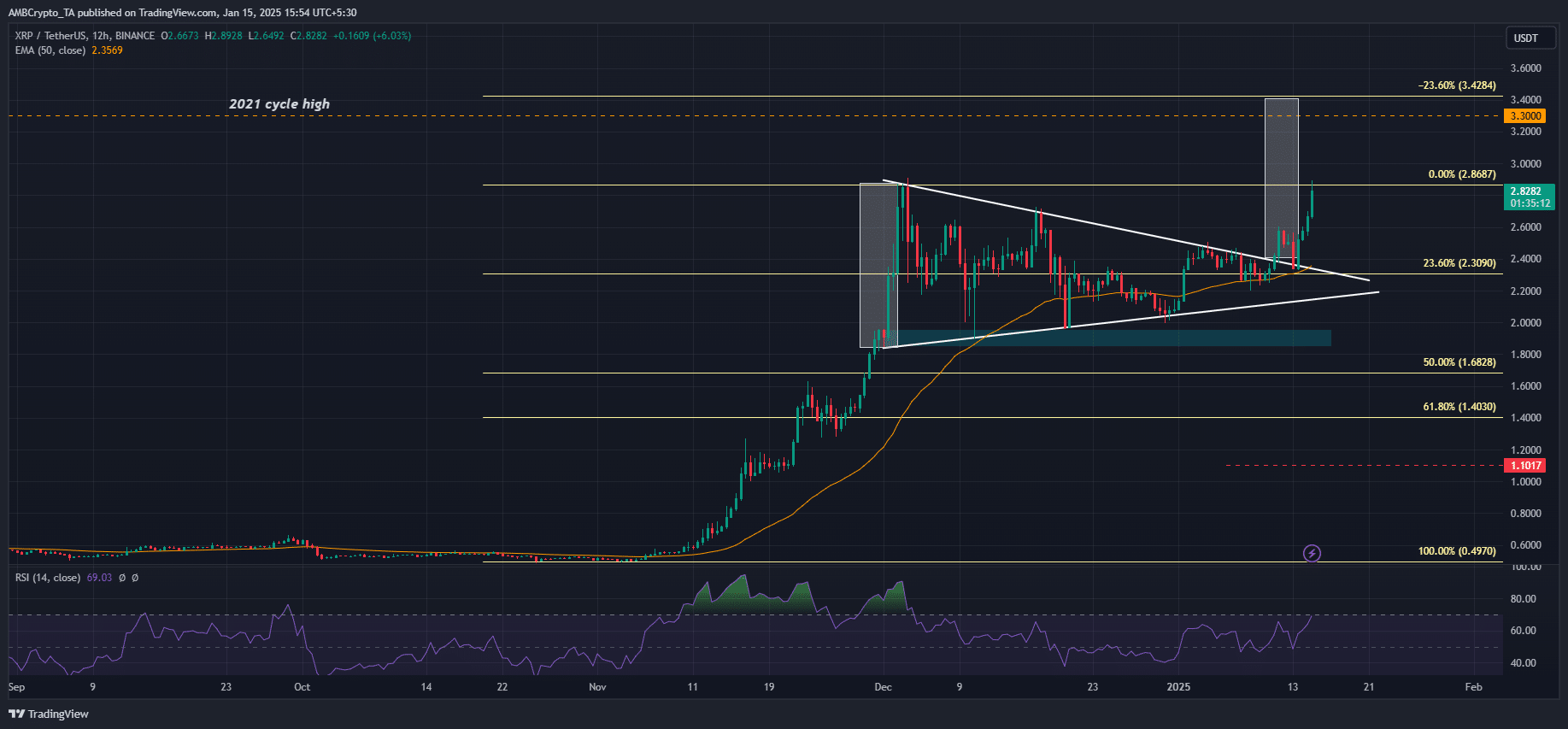

That being said, most pundits expect the appeal to be dismissed under the new administration. This optimism is evident on XRP’s price charts too as despite the update, XRP extended its breakout gains to 21%.

XRP could extend the rally to $3.4 if the typical textbook breakout plays out.

On the ETF front, the market is now pricing a 50/50 approval chance by the summer of 2025, according to the prediction site Polymarket. The new administration could offer XRP regulatory status and affect the ETF approval odds.

Source: Polymarket