- XRP surged 6% and surpassed the $107B market cap, primarily driven by whale accumulation.

- There was key resistance at $2.00, with potential for a short-term pullback.

XRP has made waves today, surging 6% and surpassing the $107 billion market cap, reigniting investor interest and raising questions about its future trajectory.

With this dramatic rise, many are left wondering: Is XRP on the cusp of a major bull run, or are we simply witnessing another fleeting price surge?

Breaking down XRP’s price surge

XRP’s latest surge, gaining 6% in daily performance, marks a continuation of its explosive momentum, with its market cap soaring past $107 billion.

The dramatic uptick reflects heightened trading volume and intensified investor confidence and aligns with a broader market rally and recent legal clarity from the Ripple-SEC case, likely fueling bullish sentiment.

Additionally, the spike in volume and sustained price growth above $1.85 suggested significant whale accumulation and aggressive market participation.

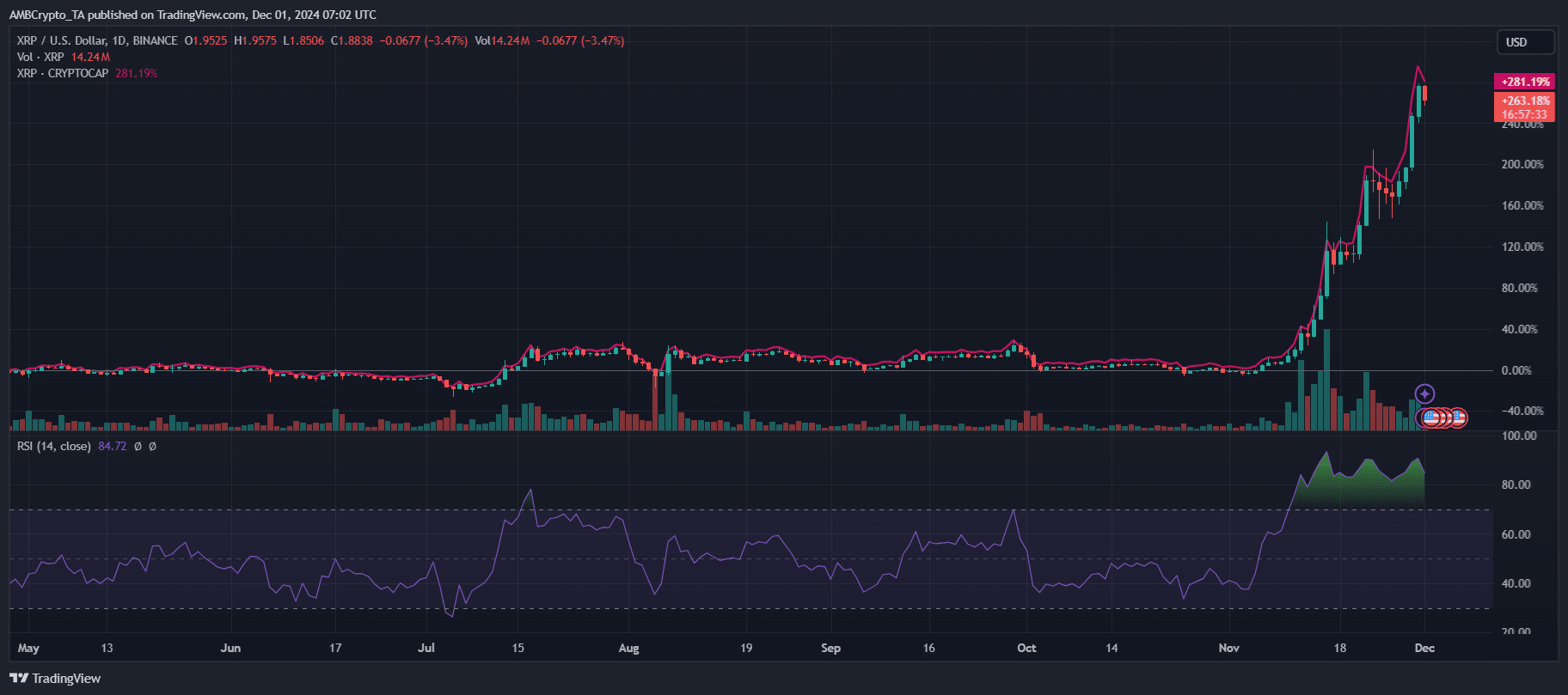

Technical indicators highlighted resistance near $2.00, a critical psychological and structural level.

The question now remains whether XRP can sustain its upward trajectory or succumb to profit-taking amid the elevated RSI and market euphoria.

Short-term momentum or long-term rally?

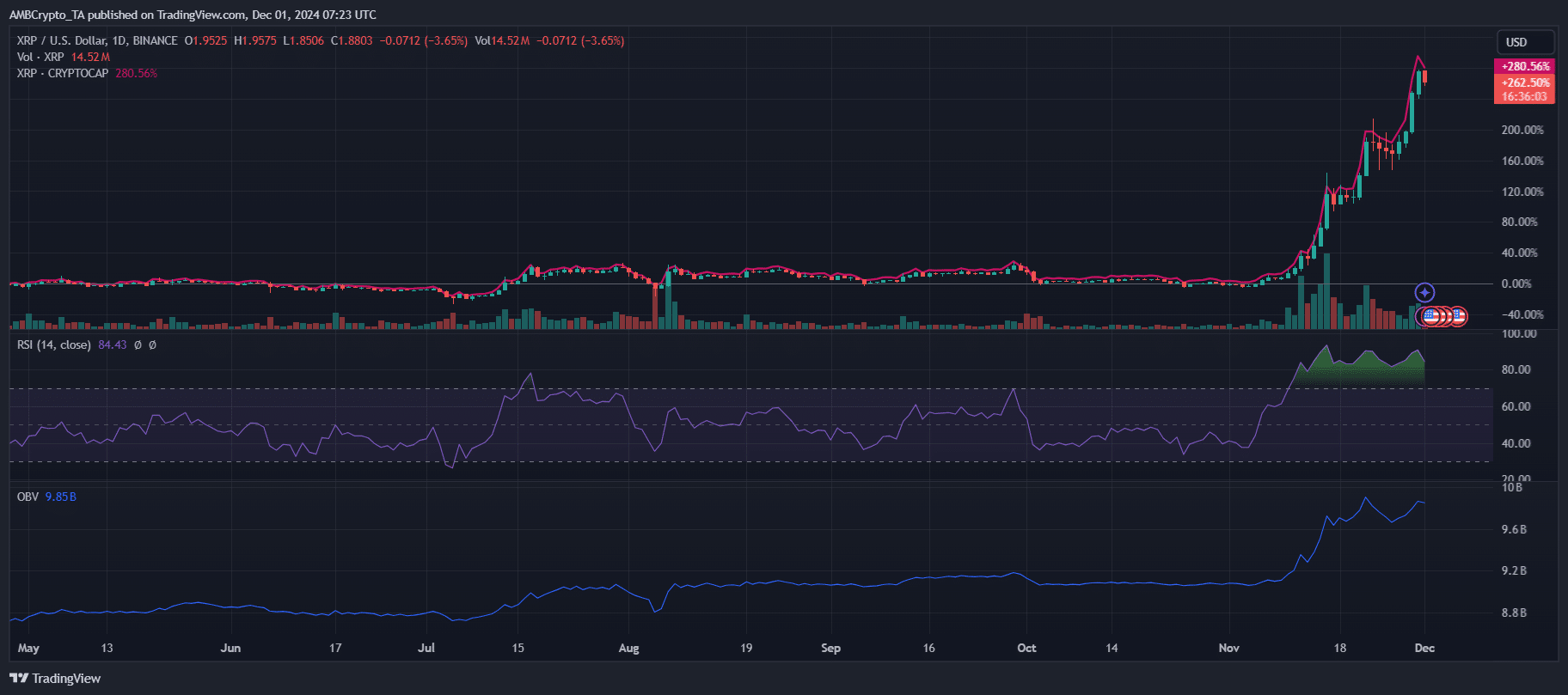

The RSI of 84.49 signals overbought conditions, suggesting a potential short-term pullback as the price tests resistance near $2.

Despite this, the OBV has climbed to 9.85 billion, reflecting strong accumulation and sustained bullish interest.

Historically, elevated RSI levels often precede profit-taking, yet continued OBV growth could indicate that institutional buyers and whales are anchoring the rally.

Key support lies near $1.75, a level that aligns with recent breakout zones, while $2.00 remains a psychological and technical barrier.

The divergence between increasing volume and stretched momentum metrics implies a tug-of-war between bullish euphoria and consolidation risks.

Whether XRP sustains its current trajectory hinges on its ability to attract fresh liquidity while navigating overextended conditions.

XRP has historically demonstrated explosive growth during previous bull runs, such as in 2017, when its value skyrocketed by over 36,000%.

Similarly, in late 2021, XRP experienced another significant surge, fueled by growing adoption and market speculation.

The current momentum shows striking parallels to these earlier patterns, with rising trading volumes and renewed investor confidence.

However, unlike past cycles, regulatory clarity and adoption of XRP’s utility in cross-border payments could play a pivotal role in sustaining this rally.

Possible catalysts behind XRP’s recent surge

The ongoing rally can be attributed to multiple factors. Regulatory clarity from Ripple’s recent legal victories has revitalized institutional confidence, while partnerships in cross-border payment sectors highlight XRP’s utility.

Increased whale activity, as indicated by rising OBV levels, signals significant accumulation. Broader market sentiment, buoyed by Bitcoin’s strength and altcoin rallies, has amplified bullish momentum.

Read XRP’s Price Prediction 2024–2025

Additionally, the nearing implementation of new liquidity corridors for RippleNet and growing traction in Asia-Pacific markets likely contributed to the surge.

Together, these factors position XRP as a standout performer, potentially paving the way for sustained growth in a rapidly evolving market landscape.