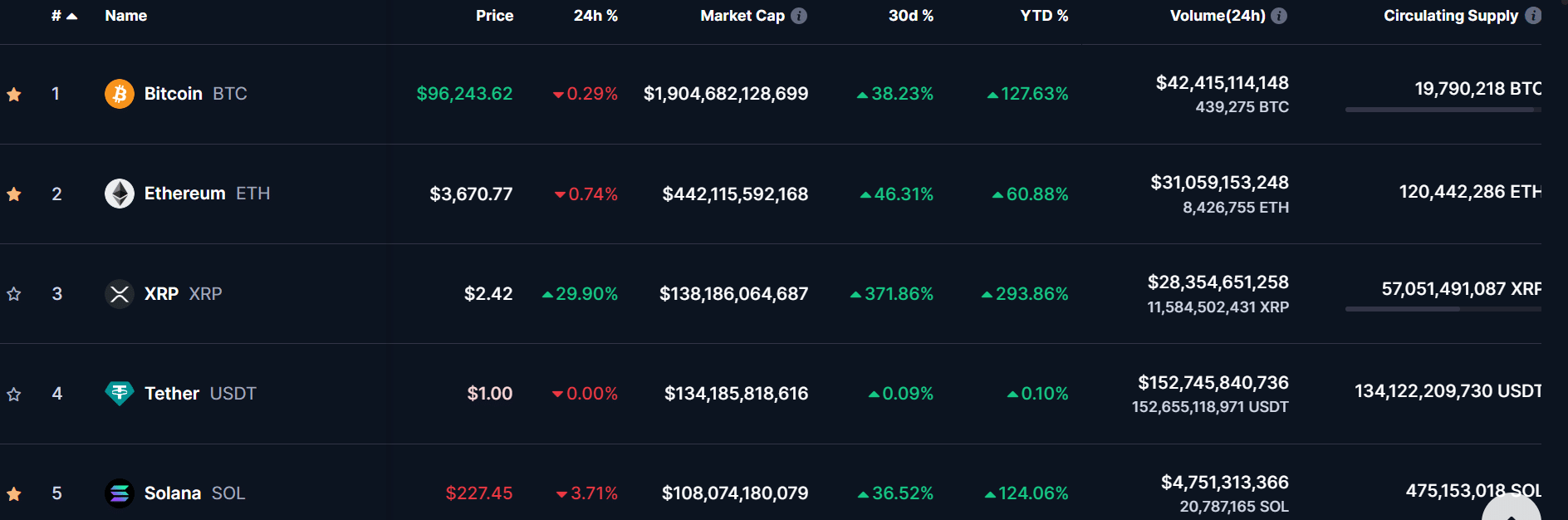

- XRP flipped USDT and SOL’s market cap after a weekend rally above $2.

- Will the uptrend be sustainable as whales get ready for profit-taking?

Over the weekend, Ripple [XRP] surpassed Tether’s USDT and flipped Solana [SOL] to become the third-largest cryptocurrency by market cap. XRP’s +25% pump over the weekend pushed it to $2.5.

The altcoin soared 370% in the past 30 days, with the market cap surging 5x from $29 billion to $138 billion. As of this writing, it eclipsed SOL’s market cap by $30 billion and was above USDT’s market size by $4 billion.

XRP flips Solana

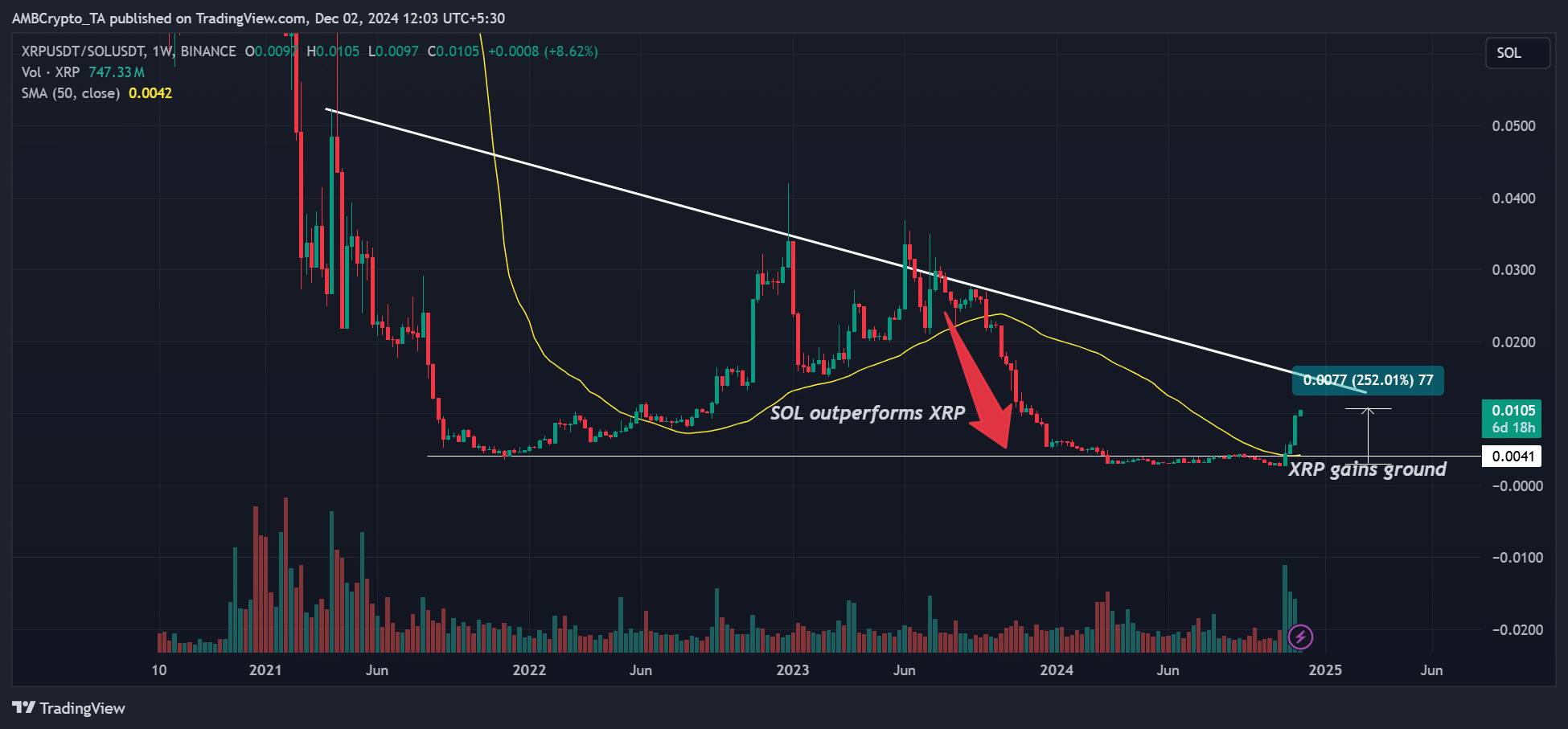

The development has caught most market pundits off-guard, especially Solana insiders, after SOL emerged as the darling of the bull run earlier in the cycle.

In fact, the XRP/SOL chart, which tracks XRP’s relative performance to SOL, indicated that the altcoin outperformed SOL in November and early December.

XRP rallied 250% against SOL in the past four weeks, meaning SOL holders could have bagged 250% returns compared if they opted for XRP.

The wild upswing followed reports of US SEC chair Gary Gensler’s expected resignation by 20th January 2025.

Since SEC has been a headwind for the blockchain firm, his resignation, alongside the pro-crypto administration, became a tailwind for the token.

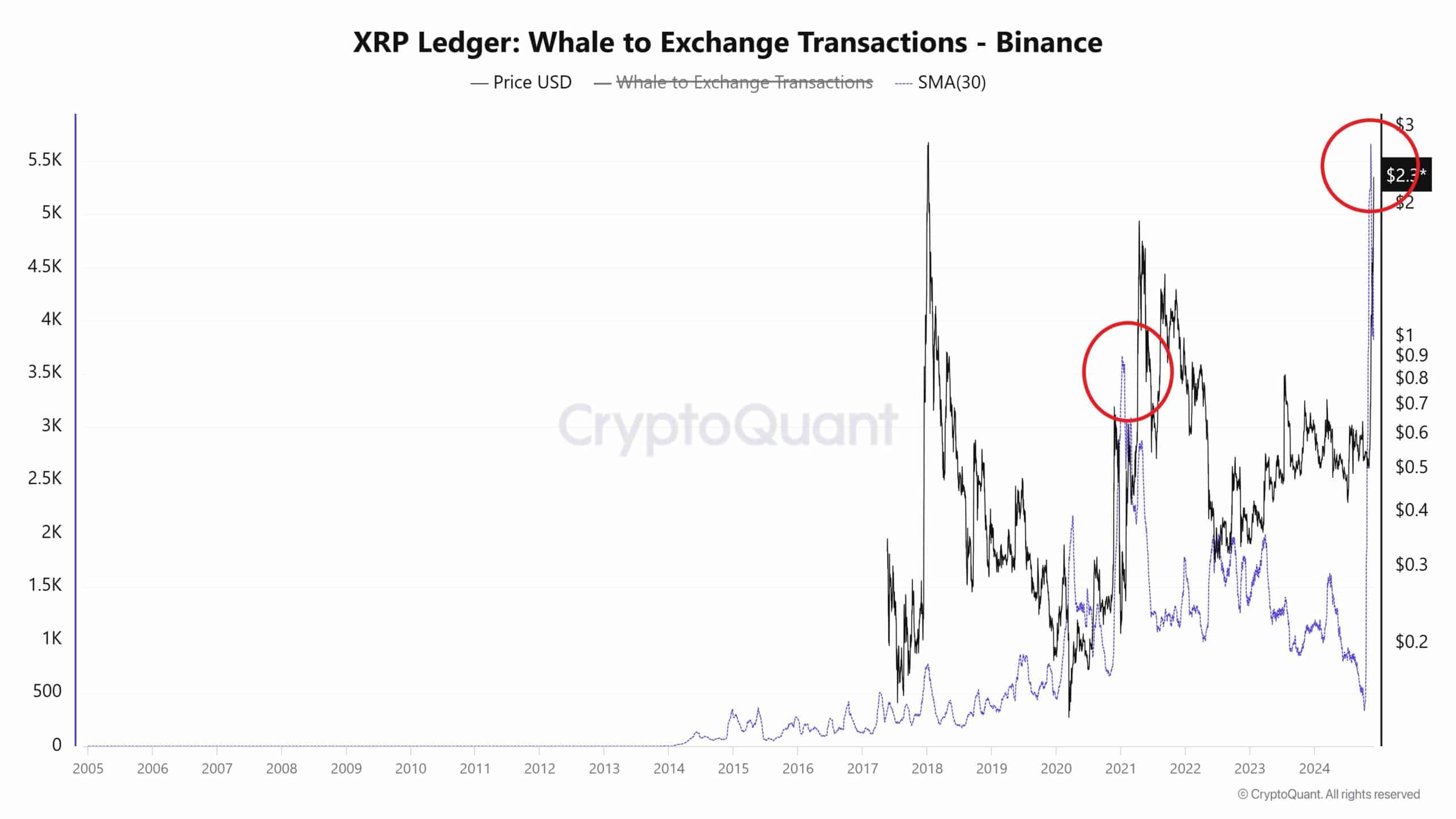

But how far can XRP go from here? According to CryptoQuant’s Woo Minkyu, the altcoin saw an uptick in whale interest and the large players appeared ready to book profits from the rally.

Notably, whale-to-exchange transactions spiked to record highs when XRP crossed above $2, rhyming with the past trends, which led to a short-term local top.

Minkyu projected a similar scenario could unfold before XRP goes forward. He said,

“The latest spike in whale-to-exchange activity coincides with XRP reaching a local price of around $2.3. This could indicate whales preparing for potential profit-taking or increased market activity.”

Read Ripple [XRP] Price Prediction 2024-2025

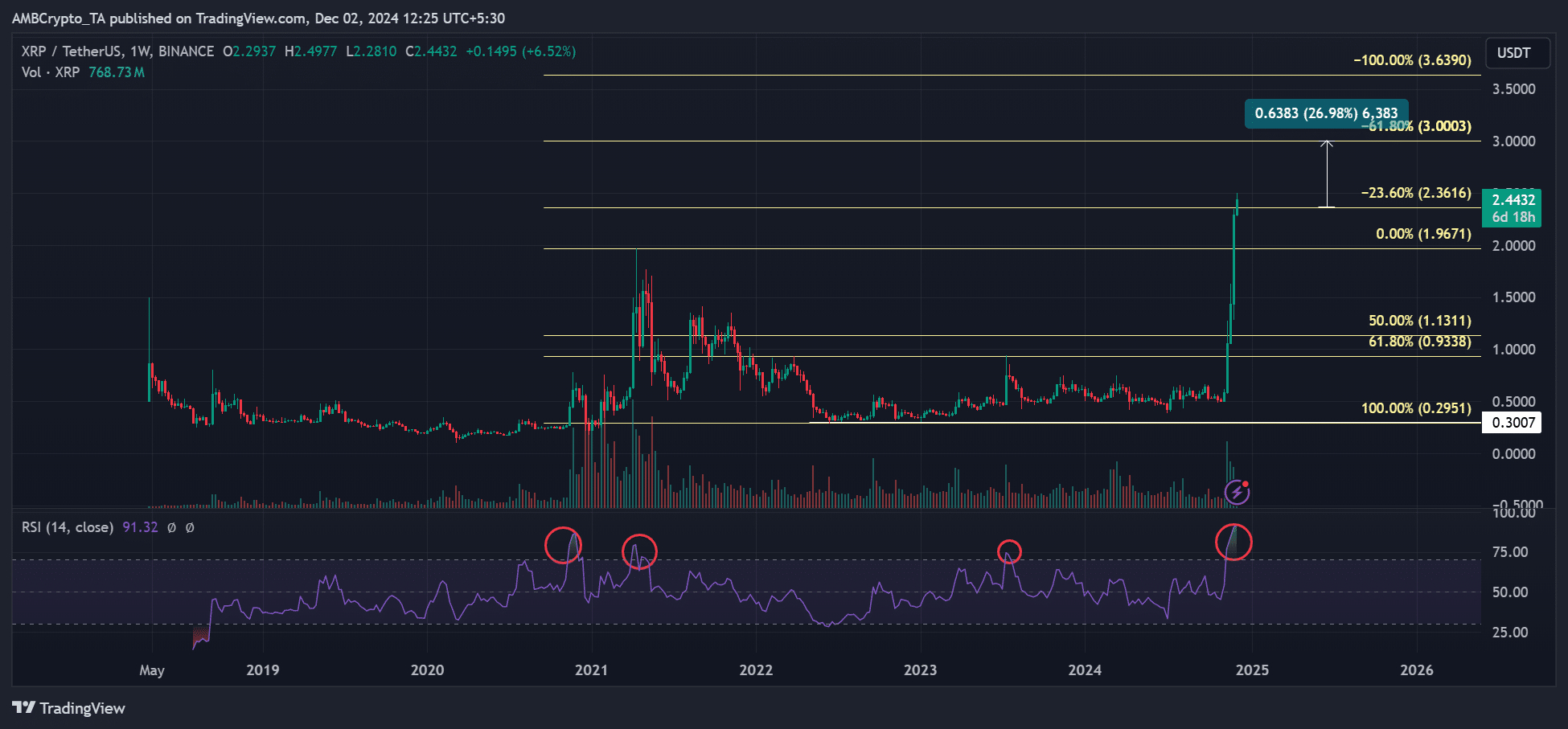

That said, the next price target and Fib level was $3, suggesting an extra 26% rally could be feasible if the massive bullish sentiment persists.

However, the weekly RSI flashed overheated signals and implied a likely price pullback. If so, the $2.36 and the previous cycle high of $2.0 could be key levels to watch in such a scenario.