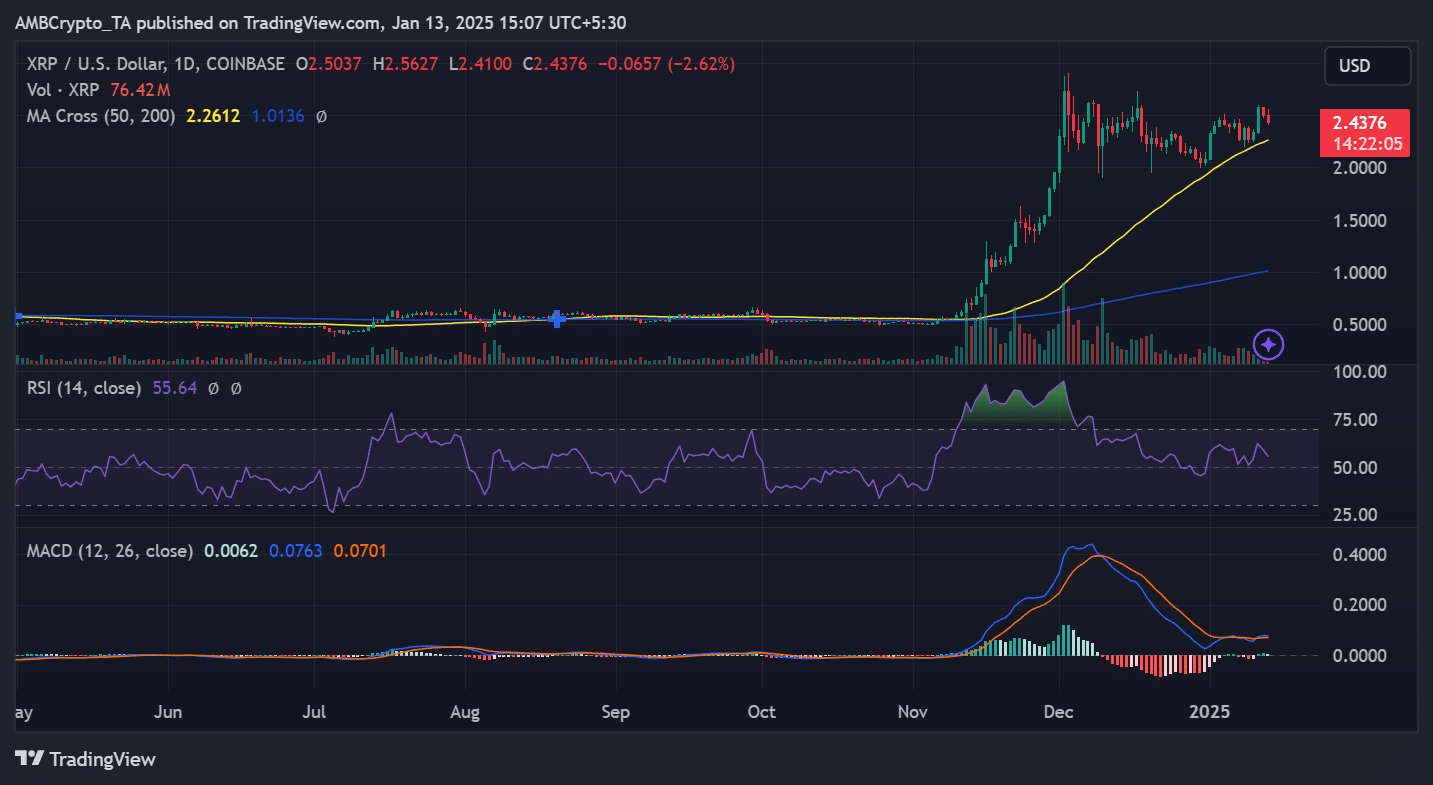

- RSI and MACD’s readings on XRP’s price charts highlighted minimal divergence

- XRP continues to hold above the 50-day MA at $2.26, despite losses over last 24 hours

XRP continues to dominate market discussions, fueled by significant price movements and heightened social engagement. At the time of writing, XRP was trading at $2.44, following a 2.62% intraday decline. Despite the dip, however, its technical setup and broader market signals presented a complex narrative for traders and investors alike.

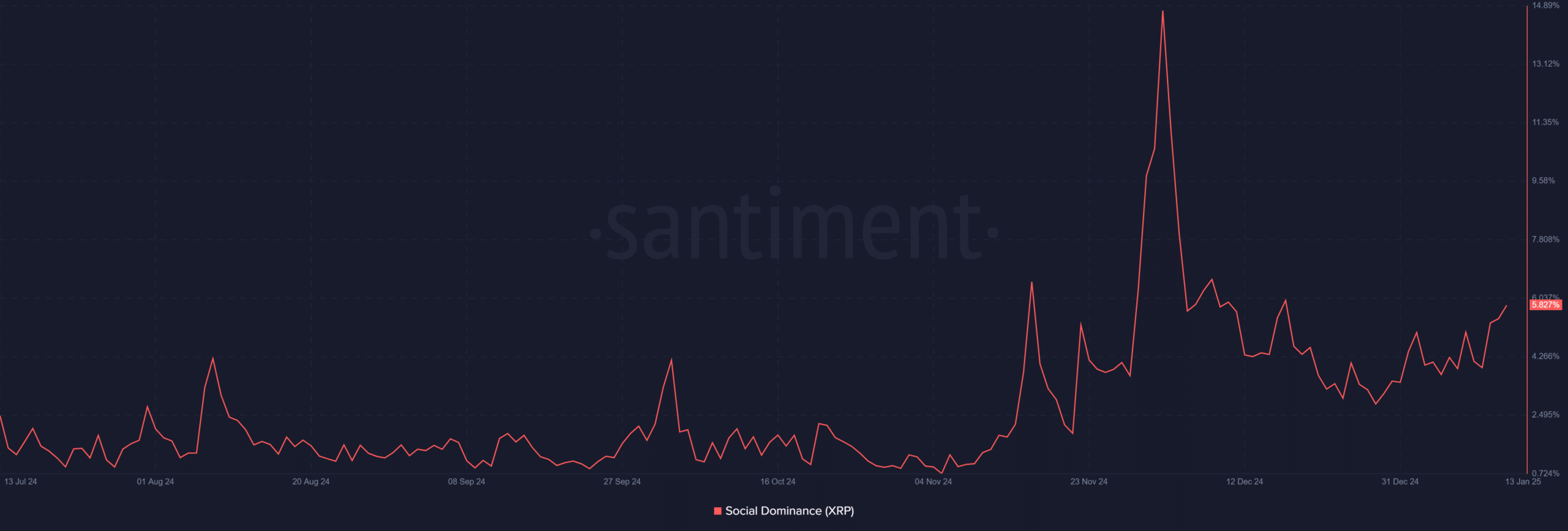

XRP’s social dominance surges

Santiment’s Social Dominance chart revealed a sharp uptick in discussions around XRP, climbing to 5.8% of all crypto mentions. This marks one of the highest levels of engagement for it in recent months, signaling growing interest from retail investors.

Such surges in social dominance often precede significant price movements, though they also introduce volatility.

While a hike in social activity can spark short-term momentum, it may also signal speculative behavior. Historically, similar spikes in XRP’s social dominance have been followed by either sharp rallies or abrupt corrections, making this metric an essential consideration for traders.

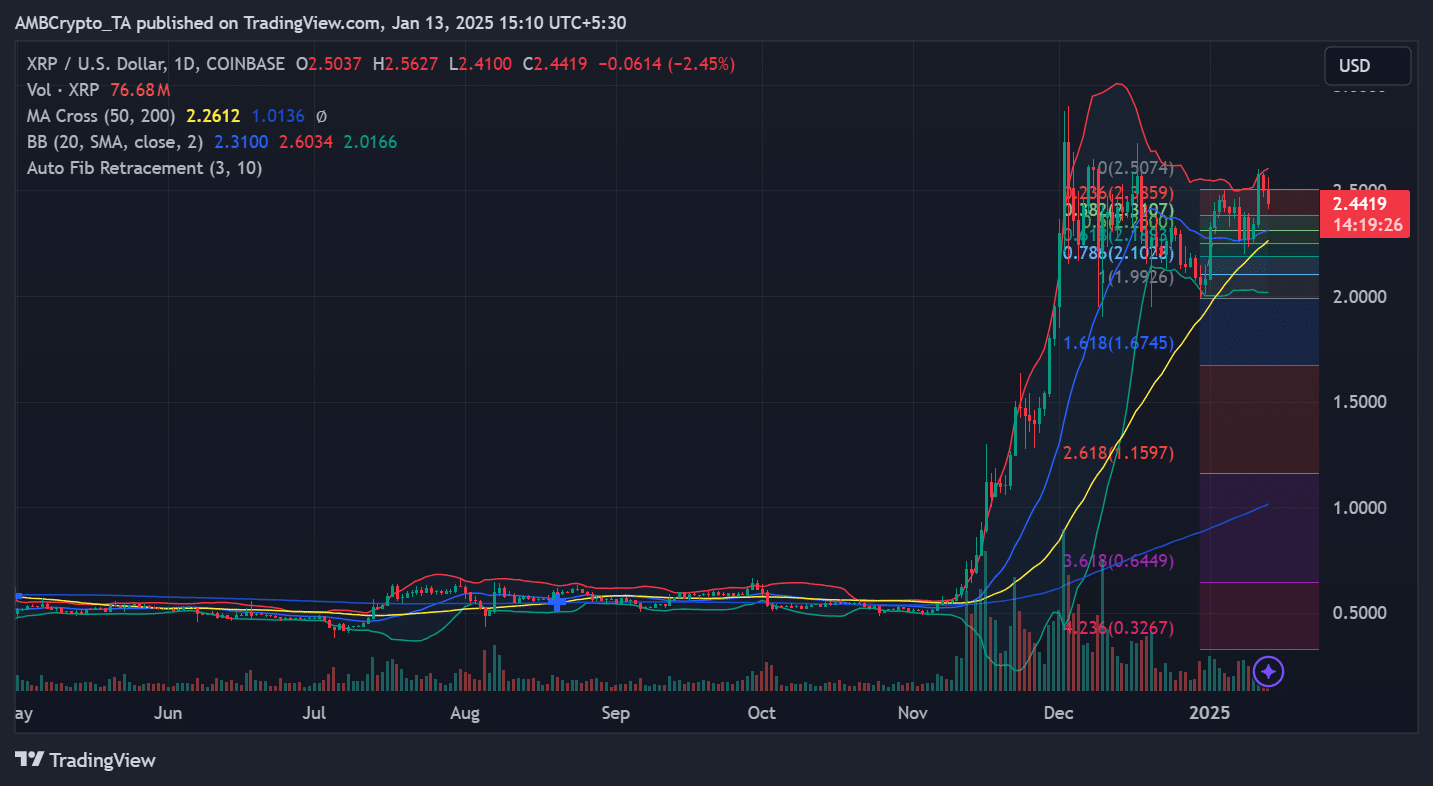

XRP’s support and resistance levels

XRP‘s price chart on TradingView highlighted a critical battle between bullish and neutral signals. The 50-day moving average at $2.26 sat above the 200-day moving average, forming a golden cross. This bullish indicator seemed to reinforce long-term positive sentiment across the board.

However, the press time price remained below the psychological barrier of $2.50 – Indicating a consolidation phase.

Key Fibonacci retracement levels suggested $2.01 as strong support for XRP, with resistance at $2.60. A breakout above $2.60 could trigger a bullish continuation, targeting levels near $3. On the other hand, failure to hold $2.01 could lead to a deeper correction, potentially driving the price towards $1.50.

Bollinger Bands indicated low volatility, with it consolidating near the middle band. Historically, this setup often precedes significant price action, making it a pivotal moment for traders to watch.

Momentum indicators for signal consolidation

Momentum indicators provided further insights into XRP’s current state. The RSI (Relative Strength Index) stood at 55.64, reflecting neutral momentum. This seemed to align with the consolidation phase, where neither buyers nor sellers dominate the market.

A move above 70 would signal bullish momentum, while a drop below 30 could mean increasing bearish pressure.

At the time of writing, the MACD (Moving Average Convergence Divergence) flashed caution as it approached a potential bearish crossover. If this crossover materializes, XRP may face short-term selling pressure, underlining the need for vigilance in the coming days.

Stablecoin reserves and market stability

Despite mixed technical signals, however, broader market dynamics may offer some hope for XRP.

For instance – Glassnode data highlighted elevated stablecoin reserves on exchanges, particularly in USDT and USDC. These reserves represent sidelined liquidity, ready to re-enter the market. In the event of price weakness, this liquidity could act as a stabilizing force, cushioning XRP’s price against major sell-offs.

The prevailing technical and market conditions place XRP at a pivotal juncture. On the one hand, rising social dominance and strong support levels underline the potential for a bullish breakout. Conversely, mixed momentum indicators and key resistance at $2.60 demand caution.

A successful breakout above $2.60 could reignite XRP’s rally, targeting $3 and beyond. However, a failure to hold $2.01 as support may lead to a deeper correction, with the next significant level near $1.50.

– Realistic or not, here’s XRP market cap in BTC’s terms

As the market awaits a decisive move, the balance between technical analysis and sentiment-driven factors will be key in determining XRP cryptocurrency’s next chapter.