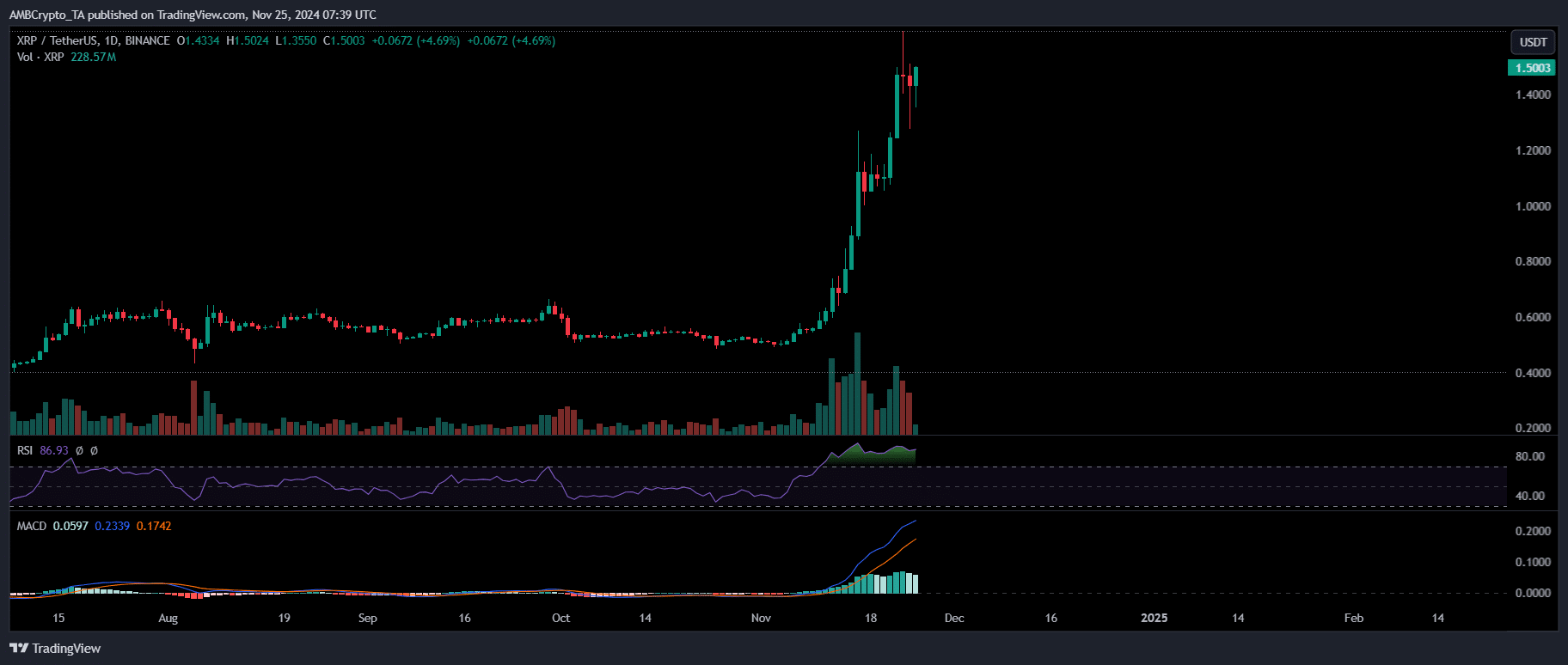

- XRP holds steady at $1.50, uncertain which way momentum will swing.

- More volatility is expected ahead as market forces battle for dominance.

Following the election results, this market cycle saw significant capital shifts. Bitcoin [BTC] led the charge, while Ethereum posted daily gains of over 10% at its peak.

But after a week of explosive growth, the rally started to cool, and most altcoins settled. That’s when Ripple [XRP] stole the spotlight. A dramatic surge in investor sentiment pushed XRP to reclaim the $1 milestone – a level it hadn’t seen in three years.

Yet, the road back to its all-time high of $3.40 – last seen nearly seven years ago – is anything but smooth. With erratic price action shaking up the daily chart, XRP has struggled to maintain bullish momentum and break past the $2 mark.

Now, with multiple metrics flashing signs of overheating, the true test begins. Bulls must defend the $1.40 level with conviction.

If that level fails to hold, a pullback to around $1 could offer a more attractive entry point, pushing back XRP’s advance toward its psychological target and a potential new all-time high.

XRP’s fate hangs at the midway point

Certainly, after three years of a steady downtrend, XRP’s resurgence sparked renewed FOMO in the market. On the day XRP hit $1, active accounts on the XRP ledger surged to a yearly high of around 48K. However, within just a week, that number has dropped to 30K, reflecting a 37.5% decline.

These abrupt exits have disrupted the momentum needed to break the $2 barrier, leading to a more than 2% decline after it crossed the halfway point two days ago, with XRP currently priced at $1.46 (at the time of writing).

Typically, new interest in a cycle emerges in two key scenarios: when a coin breaks through key psychological resistance or when it hits a local bottom, providing a “dip” for traders to enter and aim for outsized returns in the following sessions.

Therefore, the responsibility now lies with the dominant bulls. If they defend the current price level and view the recent pullback as a false dump, a breakout above $2 could act as a psychological catalyst, sparking renewed FOMO and driving more market interest, reminiscent of previous cycles.

However, if the bulls lose confidence in XRP’s long-term potential, a pullback to around $1 could form a local bottom, offering an attractive entry point for new traders looking to capitalize on a rebound.

This places Ripple at a crossroads, where the next move will define whether the momentum will build toward $2 or retrace to new entry points around $1.

Brace for more volatility ahead

On one hand, analysts suggest that XRP could undergo a retracement before making a move toward $2. With a 230% rally in less than 20 days, the token appears overextended, making the $1.00–$1.20 range an appealing entry point for those expecting a correction.

On the other hand, whales holding between 1 million and 10 million XRP appear unfazed by these speculations, having accumulated over $50 million worth of XRP tokens over the weekend.

This accumulation has played a crucial role in preventing XRP from dropping below the $1.20 range, a level it briefly touched two days ago, marking the lowest price of the day.

Meanwhile, in the derivatives market, sentiment is leaning towards shorts, with traders betting on XRP’s retracement. This makes the role of whales even more crucial in counteracting a potential long-squeeze.

Realistic or not, here’s XRP market cap in BTC’s terms

The coming days will likely show which side takes control in this tug-of-war. However, the bulls’ drive to keep XRP from falling after so many challenges gives them a strong psychological edge.

With continued confidence, the likelihood of breaking $2 grows, as bulls work to reignite FOMO in the market.