- Ethereum whales transferred 120,000 tokens worth $217.4 million.

- ETH surged by 2.67% over this period.

Over the last two weeks, Ethereum [ETH] has been stuck in a consolidation range between $3100 and $3300 levels.

Although the altcoin has surged over this period to hit a recent high of $3446, it has struggled to keep pace and maintain the momentum. This has resulted in market indecision and a considerable lack of direction among whales.

As such, whales have made conflicting moves, with some selling while others are accumulating.

Ethereum whales transfer 120,000 tokens

Over the past 24 hours, Ethereum has faced massive whale activity. During this period, whales have transferred a total of $217.4 million worth of Ethereum.

According to Whale Alert, one whale transferred 29,999 ETH tokens worth $98.5 million to Binance. This transfer implies the whale intended to sell. Such a massive dump could negatively impact the market if it fails to absorb it.

Another whale transferred 30,000 ETH tokens worth $98.7 million from Arbitrum to an unknown wallet. When whales transfer tokens to unknown wallets, it suggests that they intend to accumulate in private wallets.

Thirdly, a whale transferred 6099 ETH tokens worth $20 million from OKEx to Cumberland. Usually, a transfer to Cumberland is not associated with selling but with liquidity provisions.

This shows that 36,099 tokens were accumulated, while 29,999 tokens were moved for selling.

What does the ETH chart say?

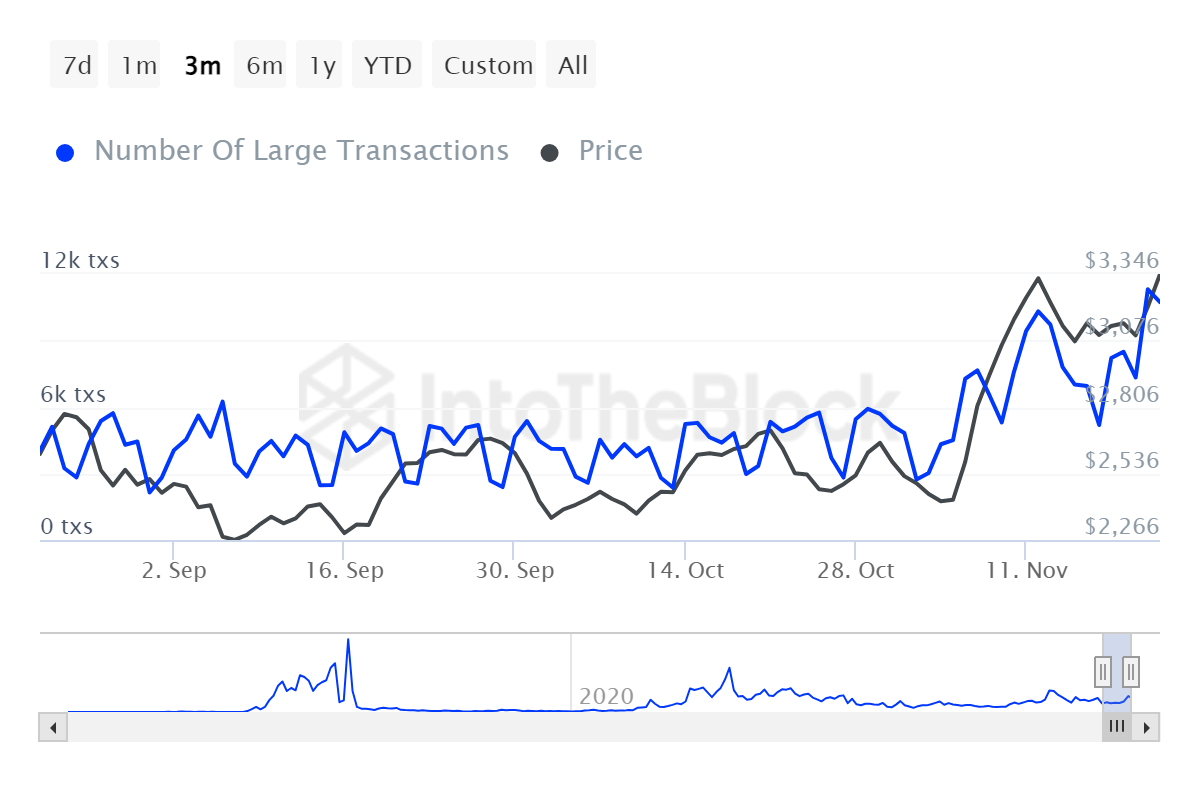

As observed above, whales were becoming increasingly active as there was a surge in large transactions. As such, over the past 24 hours, ETH’s whale transactions have surged to hit a five-month high of 10.73k.

This shows that whales are actively participating, thus strengthening the network’s fundamentals.

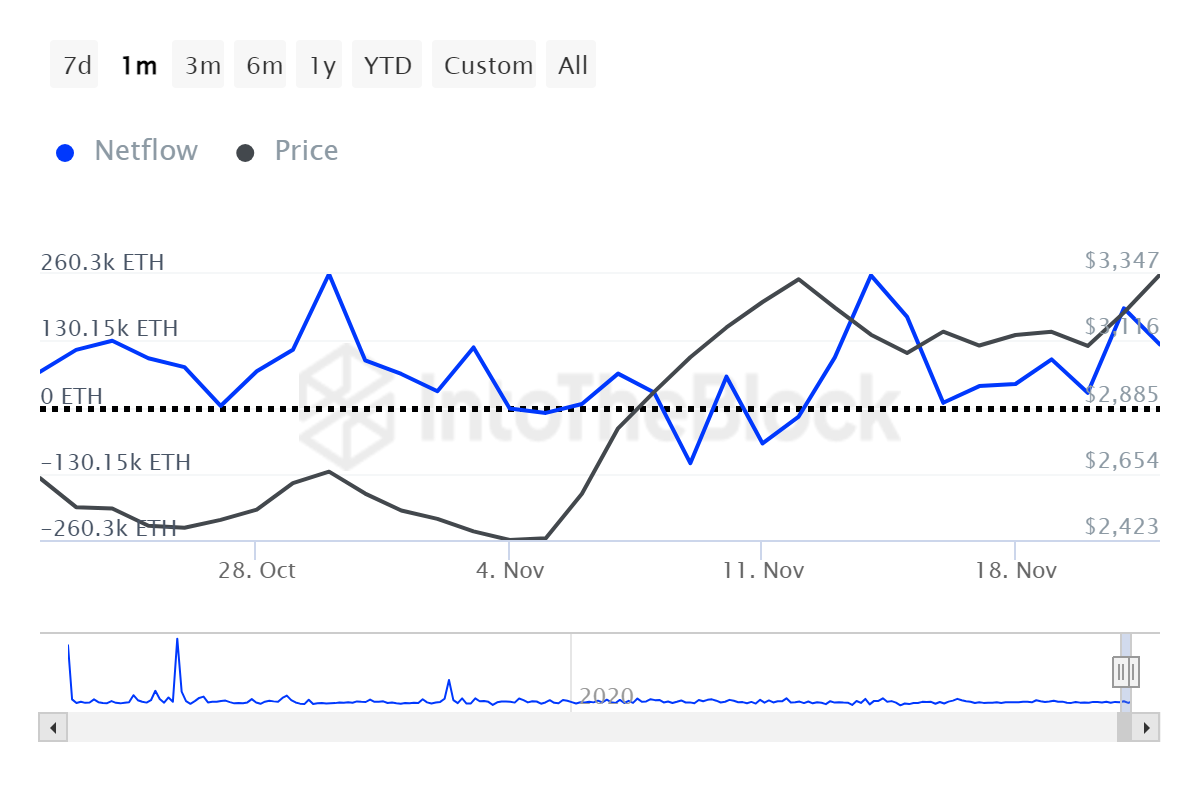

Also, we can see that these large holders are bullish, as there are more funds inflow than outflow. This is evident through the positive large holder’s netflow at 122.4k. This suggests that more whales are buying than selling.

AMBCrypto observed that whale transfers show more accumulation than outflows. Therefore, despite some whales potentially selling, the market is experiencing more inflow.

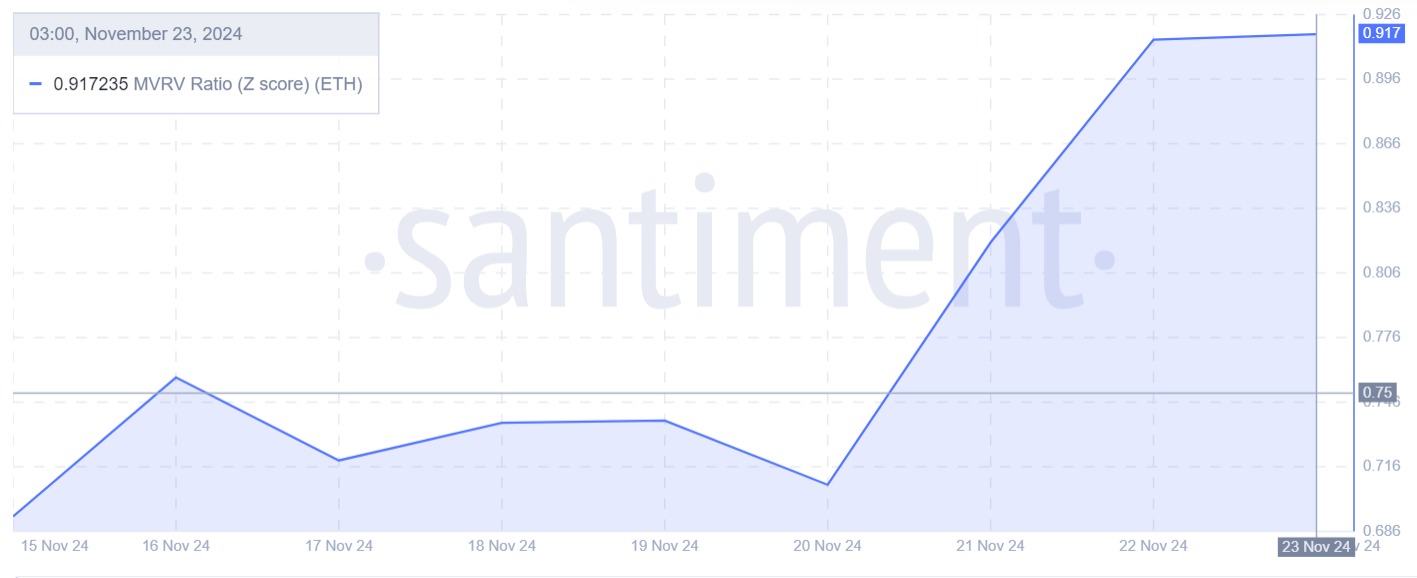

Finally, an MVRV (Z score) of 0.9 shows the altcoin is undervalued, thus providing a low-risk buying opportunity for whales to enter the market.

What next for the altcoin?

Whale transactions usually impact price action. Accordingly, ETH surged from a low of $3260 to $3350 at press time.

This shows whales’ accumulations outweigh the selling. Thus, the market has comfortably absorbed potential selling pressure.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Although ETH has struggled to maintain bullish momentum, large holders show signs of life.

If this positive sentiment holds, ETH will find the next significant resistance around $3560. If bulls fail to hold the trend, a reversal could happen, and ETH might decline to $3000.