Benefiting from the record high cash liquidity scale in the crypto market, there is still some probability that the crypto market will usher in another “true altcoin season” after the interest rate cut in December and the possible interest rate cut next year. However, considering the increasingly clear high interest rate environment, the possibility of liquidity seeping into altcoins in the crypto market has been significantly reduced, and the so-called “altcoin season” is more likely to be driven by contracts rather than spots.

“Value Storage” and “Value Expansion”

Whether it is the crypto or the traditional market, the market cycle law based on liquidity expansion and contraction still plays a crucial role. Before crypto assets became widely part of investment portfolios, investors had already formed a complete investment system based on economic cycles.

- The recovery of the economic cycle is usually first reflected in underlying assets that are highly linked to the macroeconomy; during the interest rate cut cycle, as interest rates decline, the yield of government bonds decreases. Investors withdraw liquidity from the money market and invest in the gold and index ETF markets. Gold and index ETFs have relatively low volatility and risk and potential return levels higher than government bonds, which are relatively attractive to institutional investors and even central banks.

- After sufficient liquidity flows into the “value storage assets” markets, the marginal revenue of gold and index ETFs begins to decline gradually. Investors are unsatisfied with the decreasing profit margin. As a result, they choose to invest some of their principal and realized profits in relatively volatile underlying assets such as copper, crude oil, and individual stocks to obtain higher potential returns.

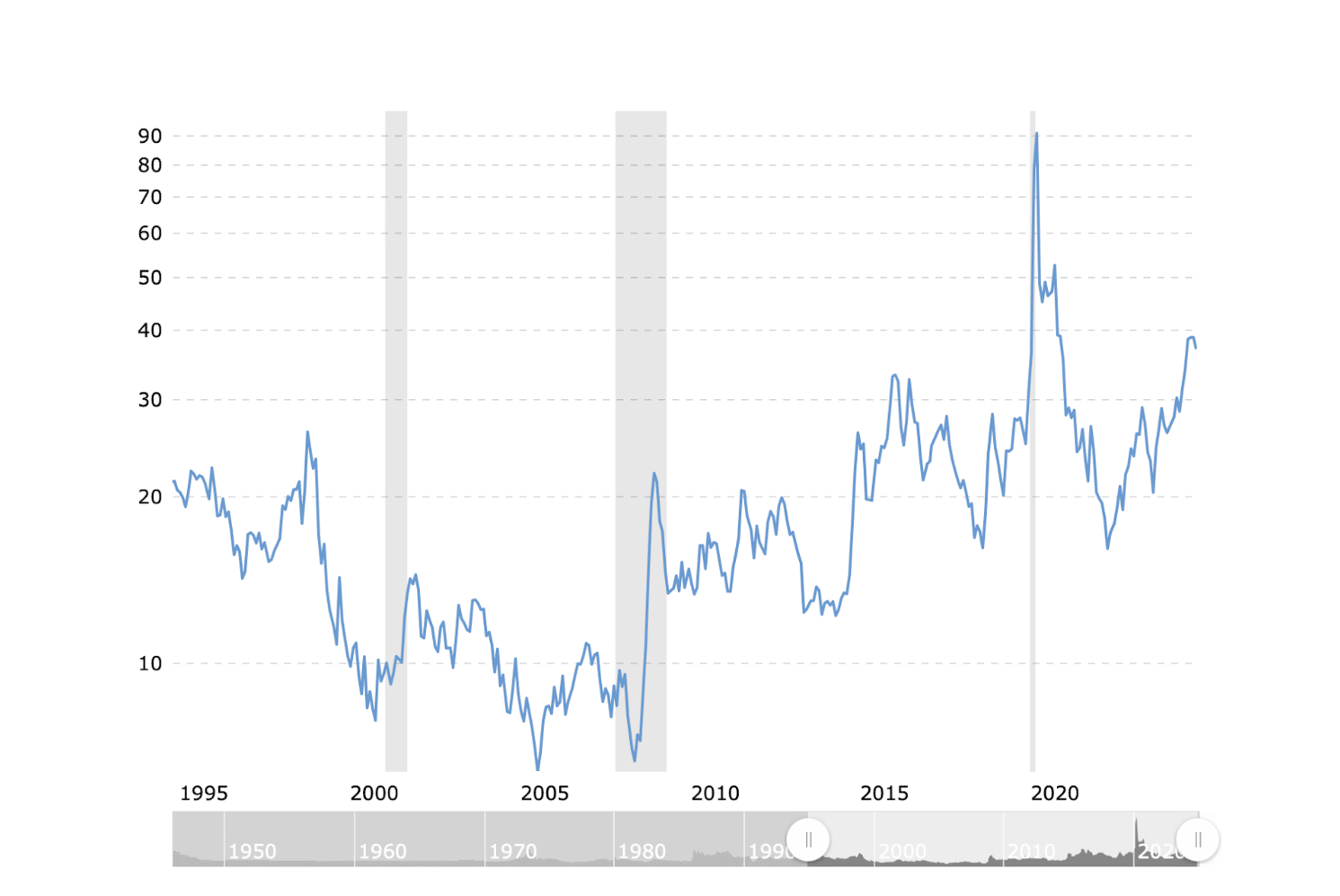

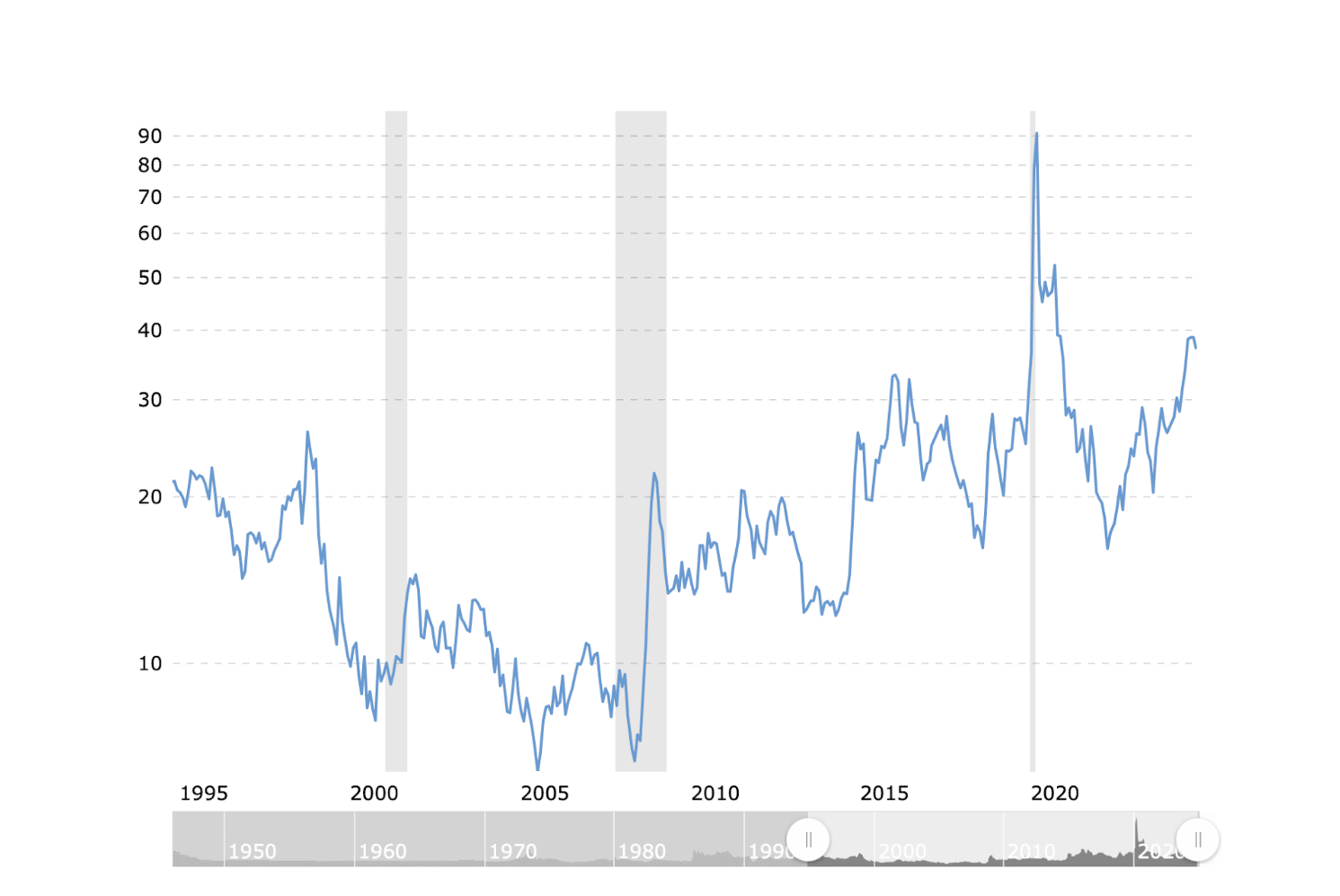

Gold to Oil Ratio. Generally speaking, crude oil performs relatively better in recovery and expansion cycles, and the opposite in liquidity contraction cycles. Source: macrotrends.net

- At the end of the interest rate cut cycle and the beginning of the interest rate hike cycle, investors first choose to sell high-volatility assets, take profits, and withdraw liquidity. Then, as the risk-free interest rate and bond yield rise, the attractiveness of low-volatility risk assets gradually decreases, and liquidity flows back to the money market, waiting for the start of the next interest rate cut cycle.

Assets with lower volatility usually have relatively high liquidity-carrying capacity and weaker speculative attributes. In contrast, assets with higher volatility usually have lower liquidity-carrying capacity and stronger speculative attributes. Therefore, assets with lower volatility are generally regarded as “value storage assets”, while assets with higher volatility are regarded as “value expansion assets”.

Let’s turn our attention back to the crypto market. Although BTC has a volatility level that gold and stock indices cannot match, BTC’s volatility is somewhat inferior compared to other crypto assets. Considering that BTC is highly integrated with the global market and is already a “macro asset” certified by Bloomberg, it can be regarded as a “value storage asset” within the crypto market. Of course, stablecoins can also be considered a “value storage asset”; while altcoins are undoubtedly “value expansion assets”.

In fact, based on the operation of the crypto market in the past few years, it is not difficult to find that the law of economic cycles also applies to the crypto market.

- Before and after the start of the interest rate cut cycle, liquidity entered BTC through spot ETFs and stablecoin channels, driving up the price and the market cap of BTC.

- With the further influx of liquidity, the marginal return of BTC is gradually decreasing. Investors are beginning to use leverage to ensure returns or instead choose to invest in non-BTC cryptos such as ETH, SOL, and even memecoins.

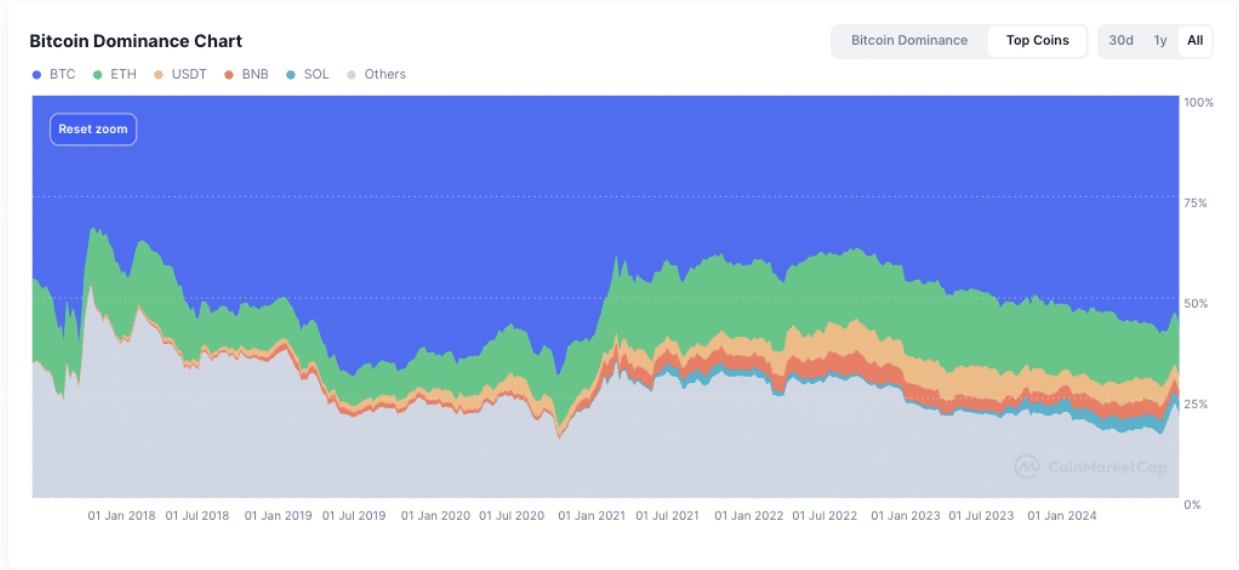

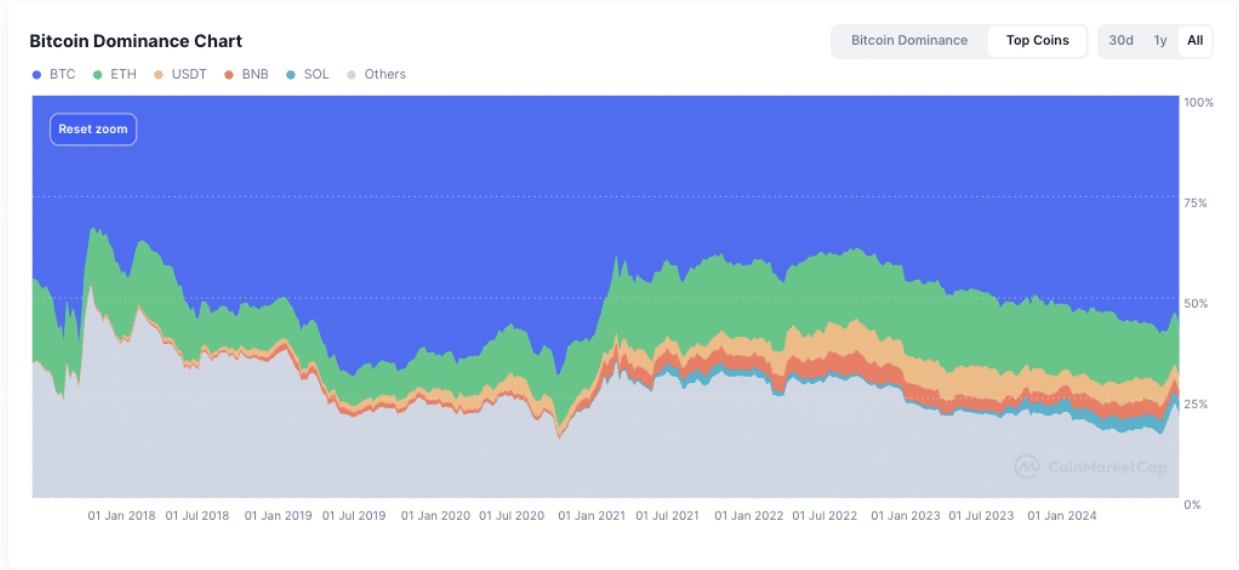

Changes in the market share of BTC from 2018 to the present. At the beginning of the interest rate cut cycle, the market share of BTC gradually increased. In contrast, in the later stage of the interest rate cut cycle, the market share of BTC gradually decreased. Source: Coinmarketcap

- When the interest rate cut cycle ends and the interest rate hike cycle arrives, investors prioritize withdrawing liquidity from non-BTC cryptos. A typical feature is that BTC’s decline at this time is relatively mild.

- Finally, investors withdraw liquidity from BTC and convert it into stablecoins, investing in the money market or simply holding it.

So, which period are we in now? Considering Powell’s attitude in the December interest rate decision, we are in the mid-stage of a rate cut cycle. There is still one more (in the best case, maybe two) rate cut on the way, and we may not see the end of this rate cut cycle until the middle of next year.

Implied interest rate curve based on SOFR futures. After Powell’s hawkish speech before Christmas, the interest rate market has priced the terminal rate of this round of rate cuts above 4%. Source: CME Group

However, we cannot ignore the impact of rising terminal rates. At interest rates above 4%, government bonds are still an ideal investment underlying asset for risk-averse investors. The increase in risk-free interest rates brought about by the rise in government bond yields has, to some extent, compressed risk premium, which has led to a certain degree of convergence in the potential return expectations of risky assets and is reflected in the pricing of derivatives.

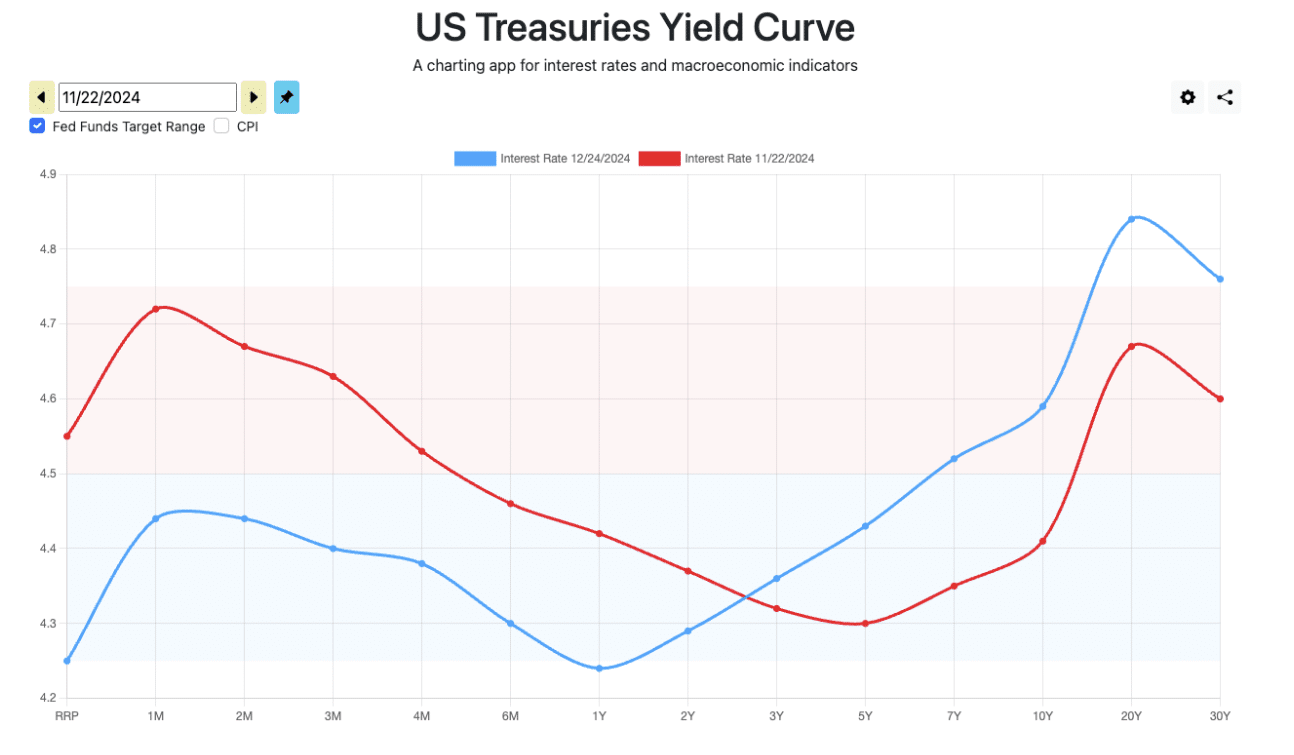

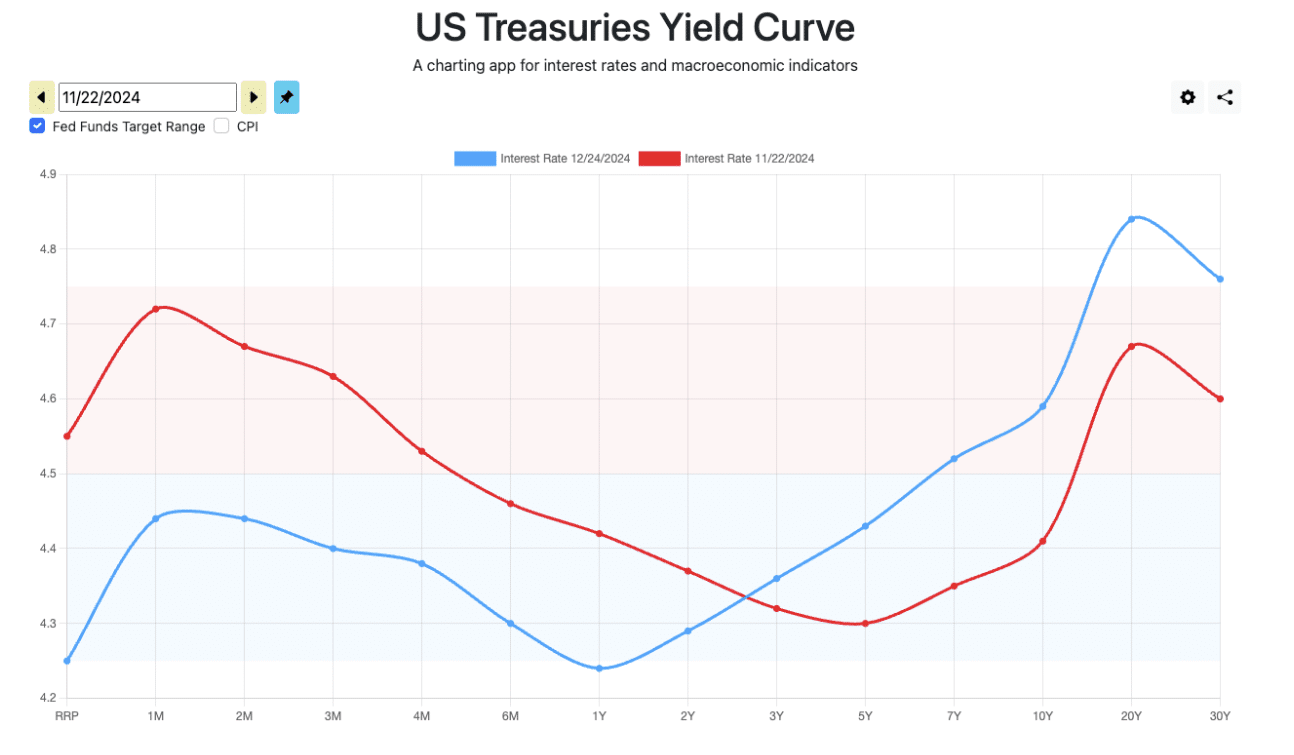

US Treasury yield curve changes. Since the end of November, the 10-year Treasury yield has risen by nearly 20 bps, close to 4.6%. Source: ustreasuryyieldcurve.com

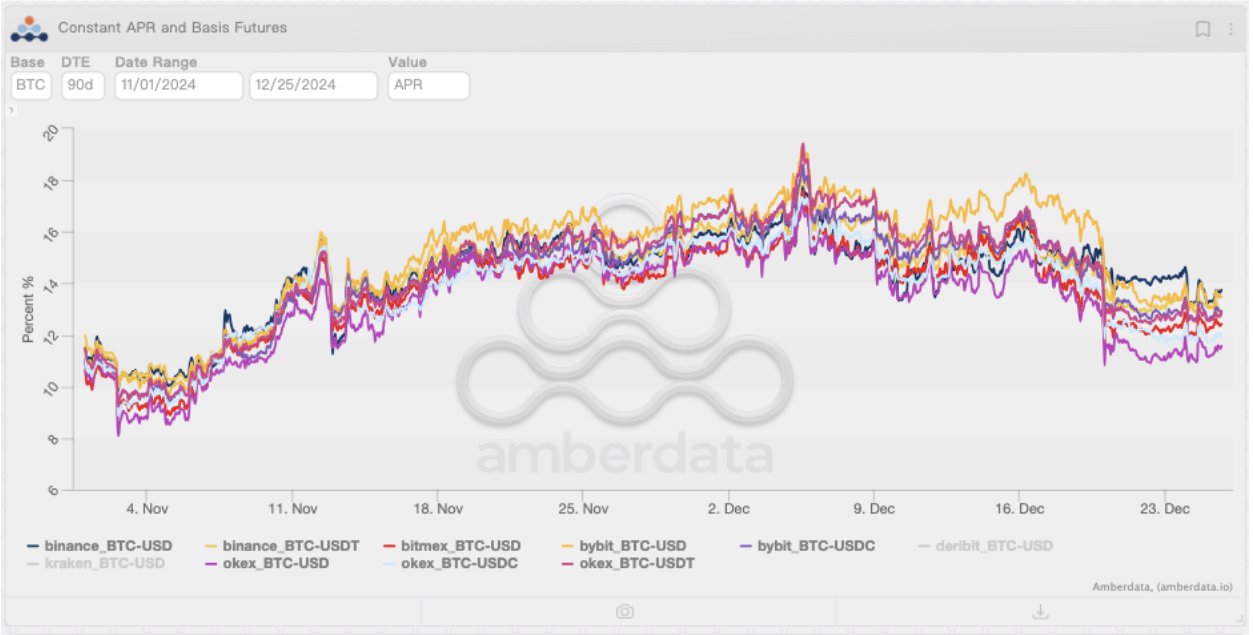

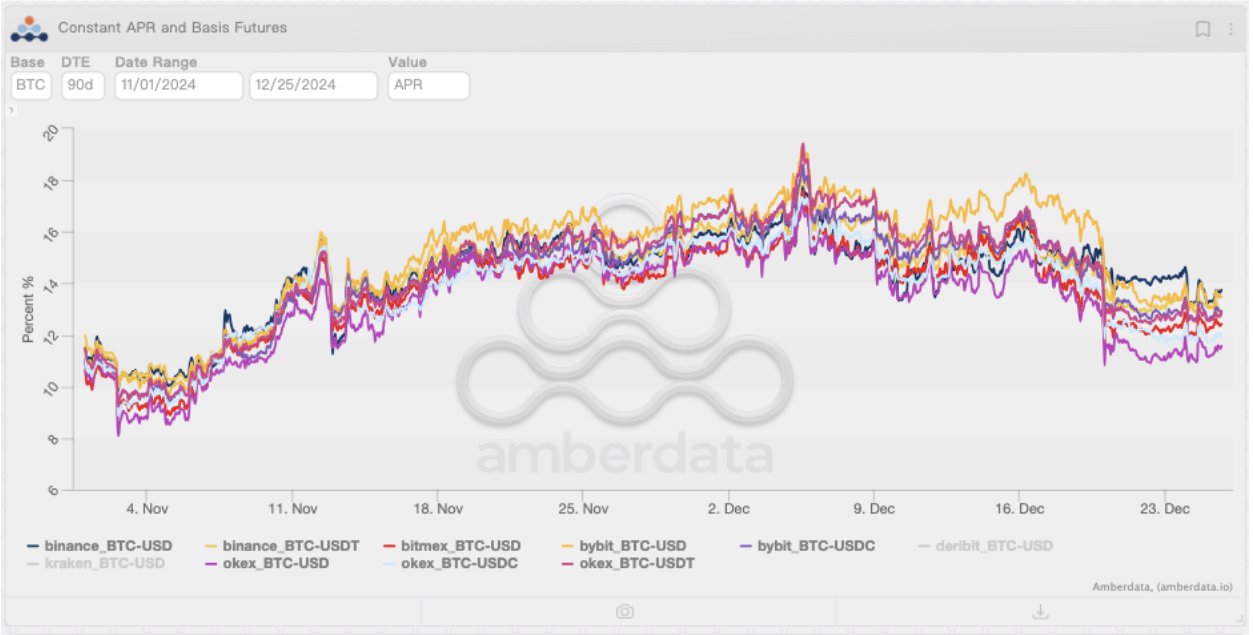

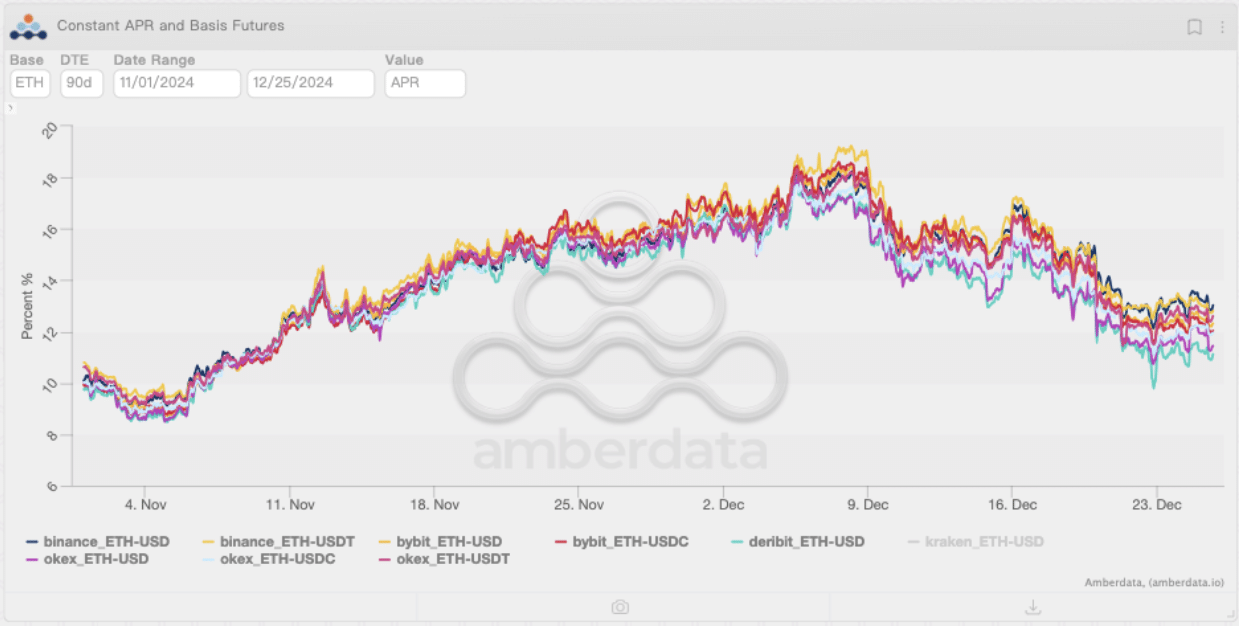

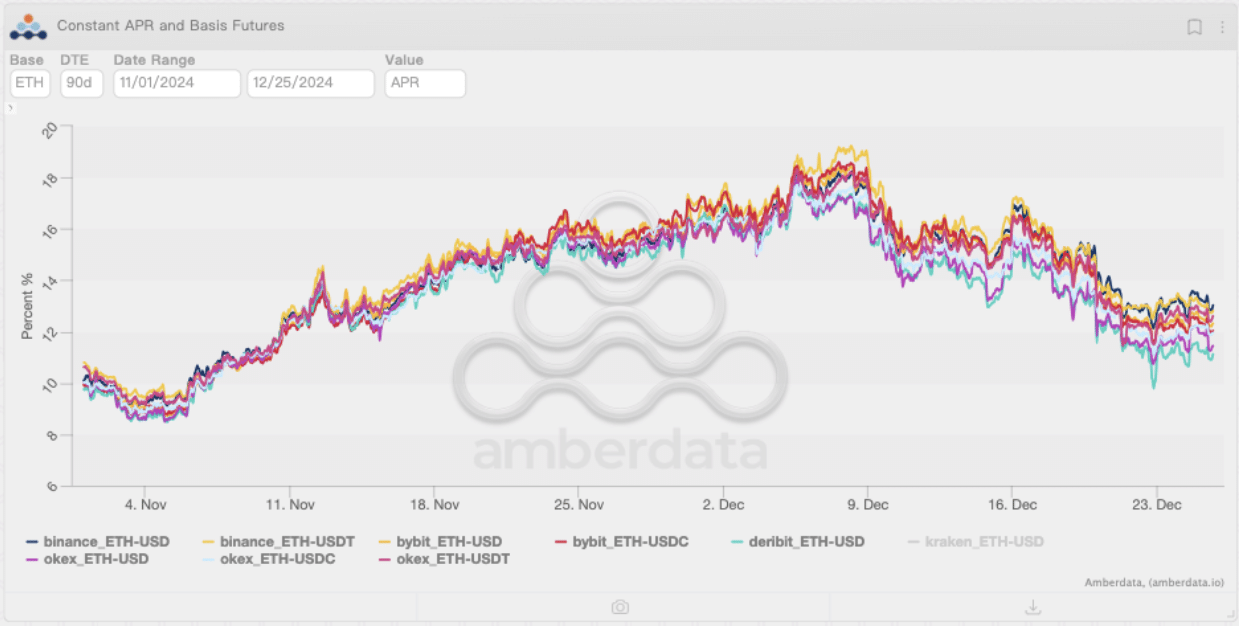

After the FOMC meeting on December 20th, the far-month futures premiums of BTC and ETH fell significantly, and the risk premium difference between BTC and ETH also began to widen again. The above situation indicates that in the high interest rate environment, despite still being in the bull market stage, investors are still cautious, and high interest rates are also a catalyst for investors to re-prefer holding “value storage assets”.

BTC futures APR changes. Source: Amberdata Derivatives

ETH futures APR changes. Source: Amberdata Derivatives

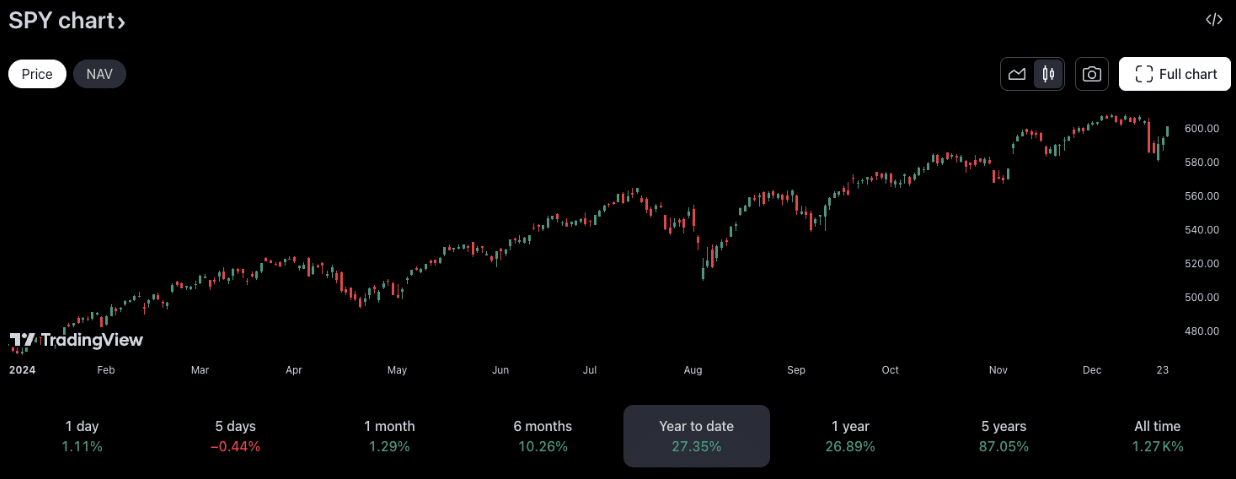

And in the traditional market, the return to the preference for “value storage assets” is also happening. Since December, the IWM (iShares Russell 2000 ETF), which tracks the investment results of an index composed of small-capitalization US equities), has begun to experience a decline, while the SPY, which represents the US stock market, has maintained sufficient resilience. Even after experiencing the impact brought by the FOMC, the SPY rebounded to near the previous high within a few days. In contrast, the IWM is still consolidating at a relatively low point since November.

SPY and IWM price changes. Source: Tradingview

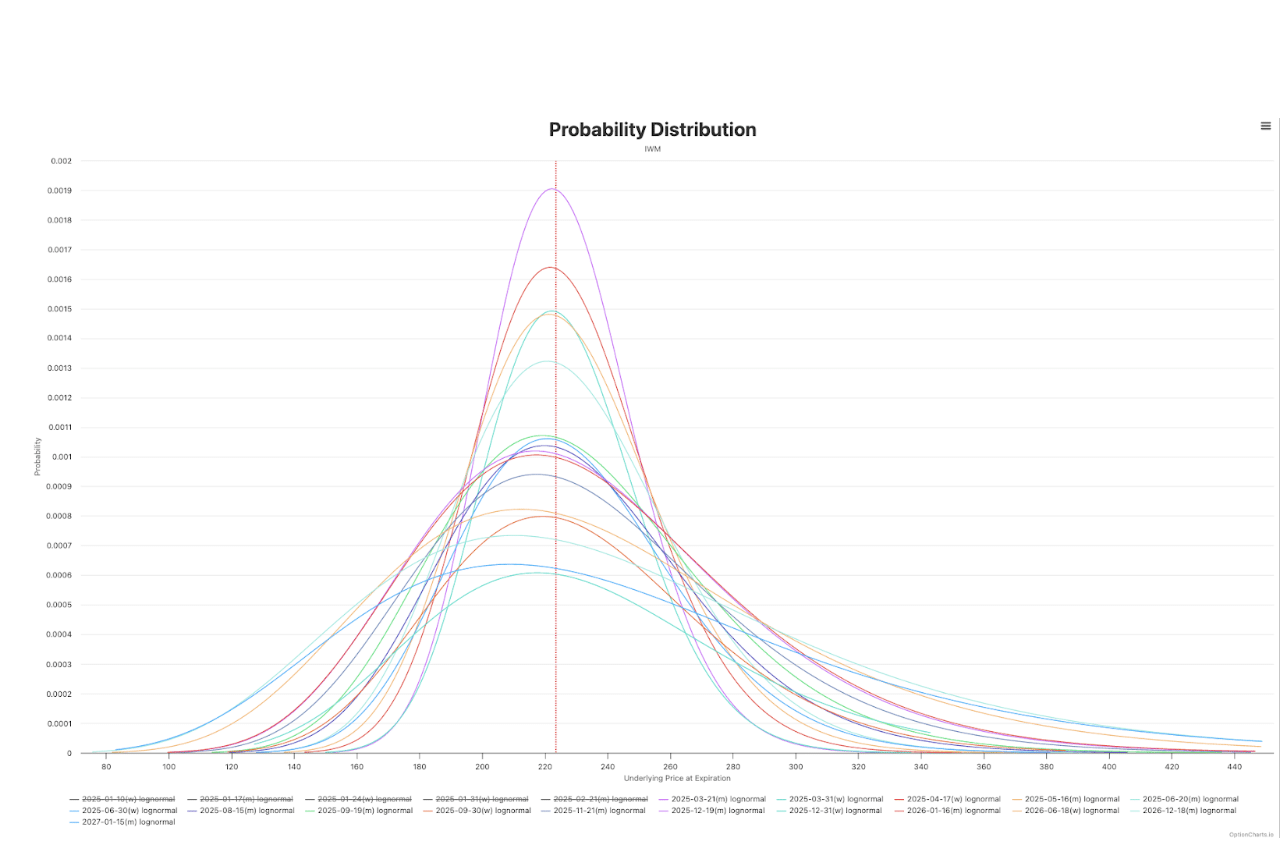

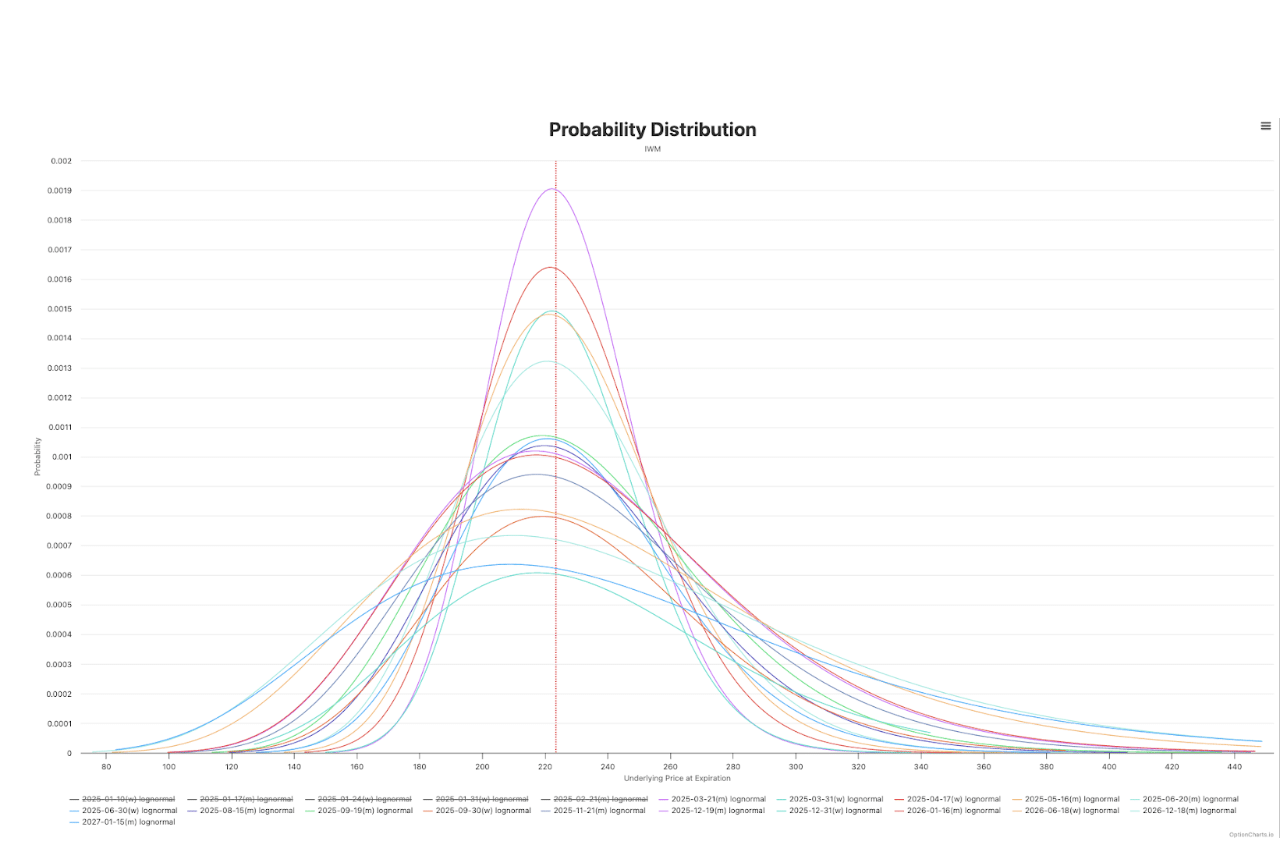

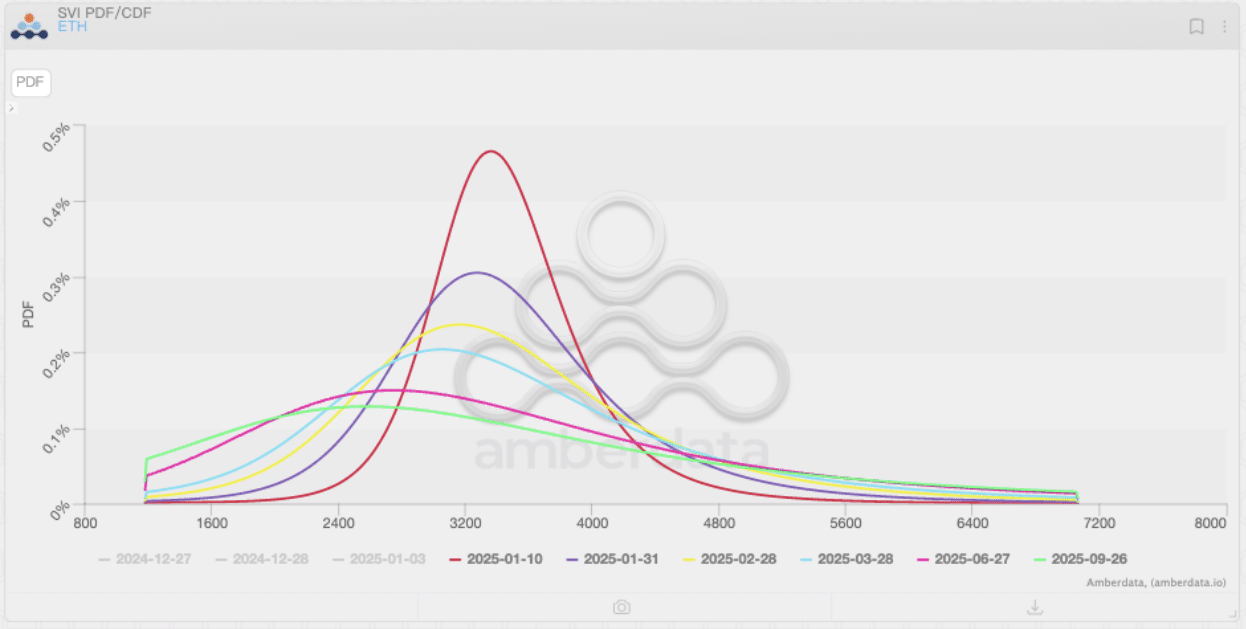

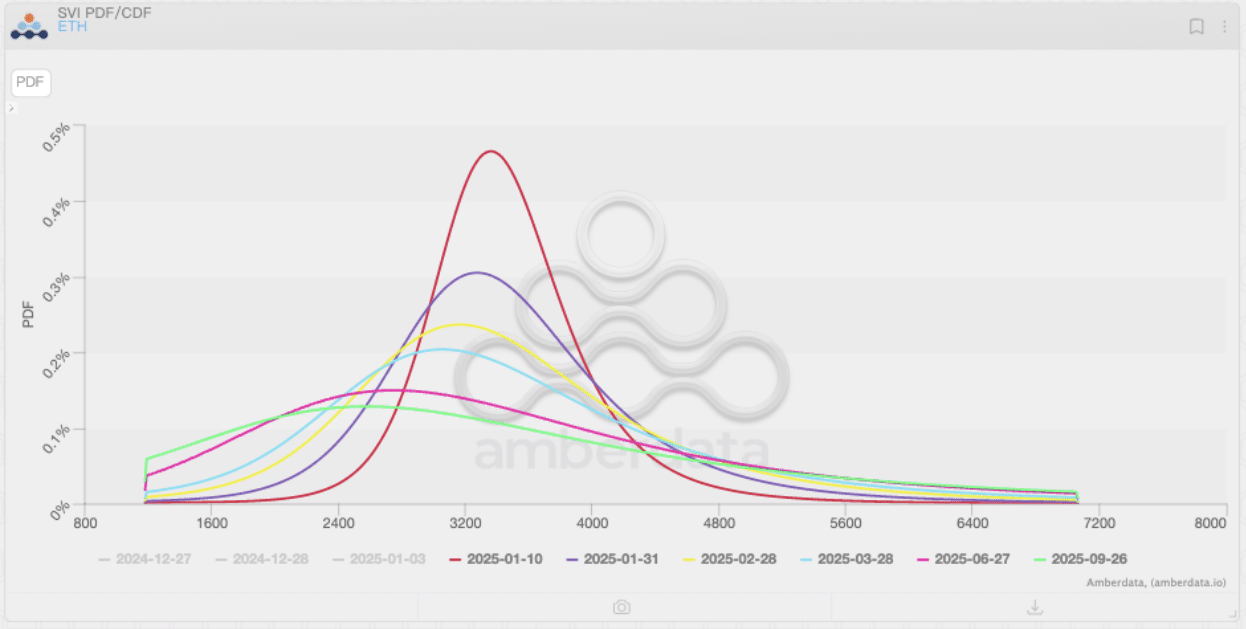

In addition, the left-skewed implied probability distribution in the options market further indicates investors’ cautious attitude towards “value expansion assets”. Compared with SPY and BTC, the left-skewed implied probability distribution of IWM and ETH is more significant, especially in far-month options, which means that investors expect a relatively higher probability of IWM and ETH’s poor performance in the medium and long term.

Implied probability distribution of IWM. Source: optioncharts.io

Implied probability distribution of ETH. Source: Amberdata Derivatives

When investors have poor expectations for high-quality value expansion assets, their expectations for secondary value expansion assets (such as altcoins) can be imagined. So, for crypto investors, will we experience a “bull market without altcoin season”? The answer is not necessarily so.

Possible Altcoin Season: “Vegan Bull” or “Real Bull”?

It must be admitted that the conditions for the appearance of altcoin season are relatively harsh. Since the appearance of BTC in 2008, there have only been two altcoin seasons: the “ICO Season” in 2017-2018 and the “DeFi Summer” in 2020-2021. Some interesting macro factors played an indispensable role in the two altcoin seasons.

- Interest rates are at a long-term relatively low level or showing a rapid downward trend, leading to a large accumulation of liquidity, with “nowhere to go” liquidity pouring into every market.

- Due to the long-term relatively low or absolute low interest rates, investors’ speculative sentiment has been fully stimulated.

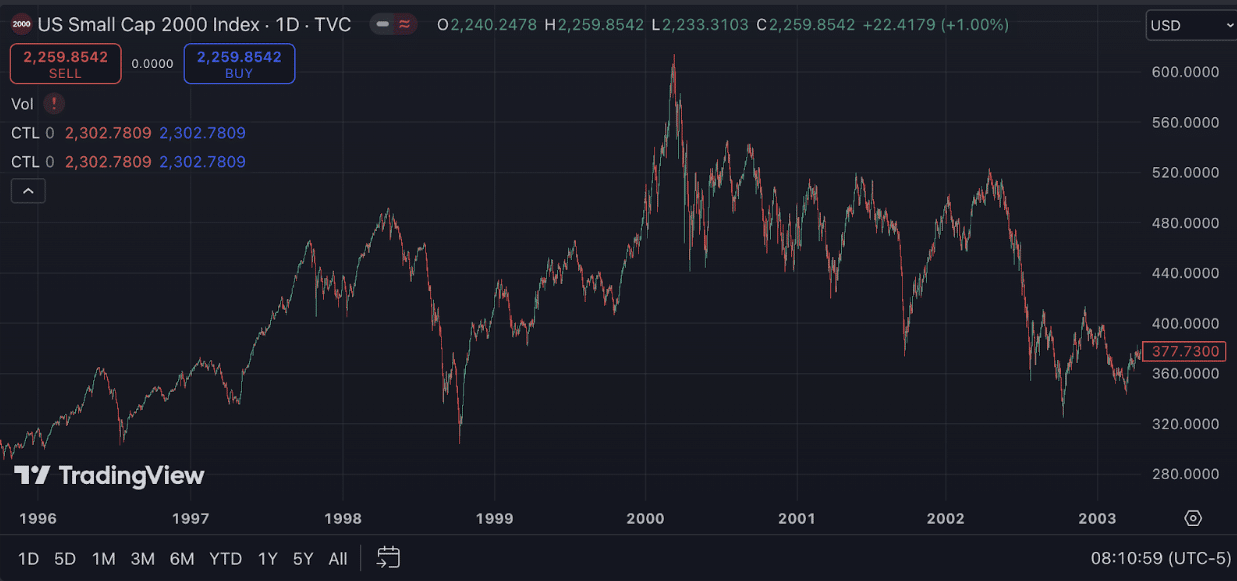

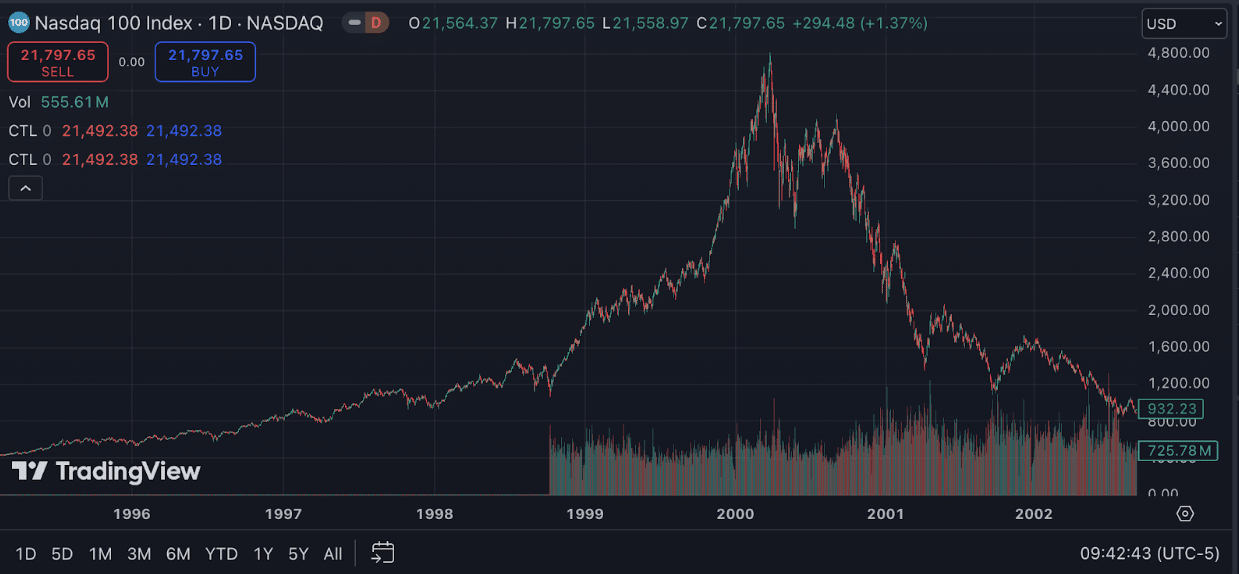

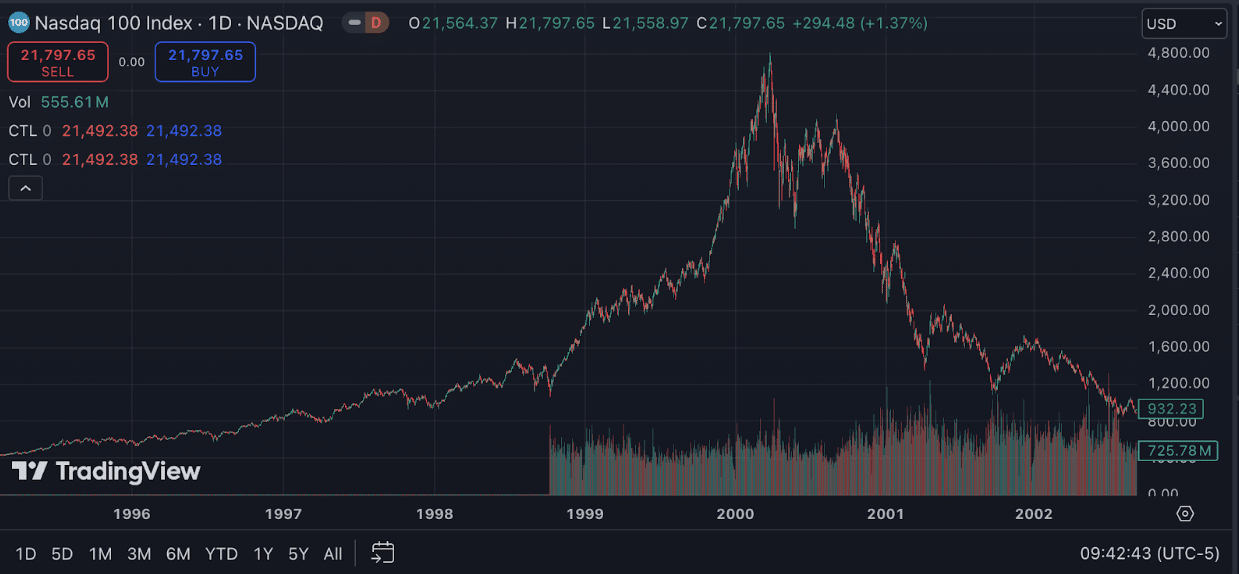

Before the birth of the crypto market, similar things were not uncommon in traditional markets. In fact, in the “dot-com bubble” of the 1990s, the Russell 2000 index and Nasdaq index had similar performances to the “altcoin season”, and the macro environment at that time was “nearly the same” as it is now.

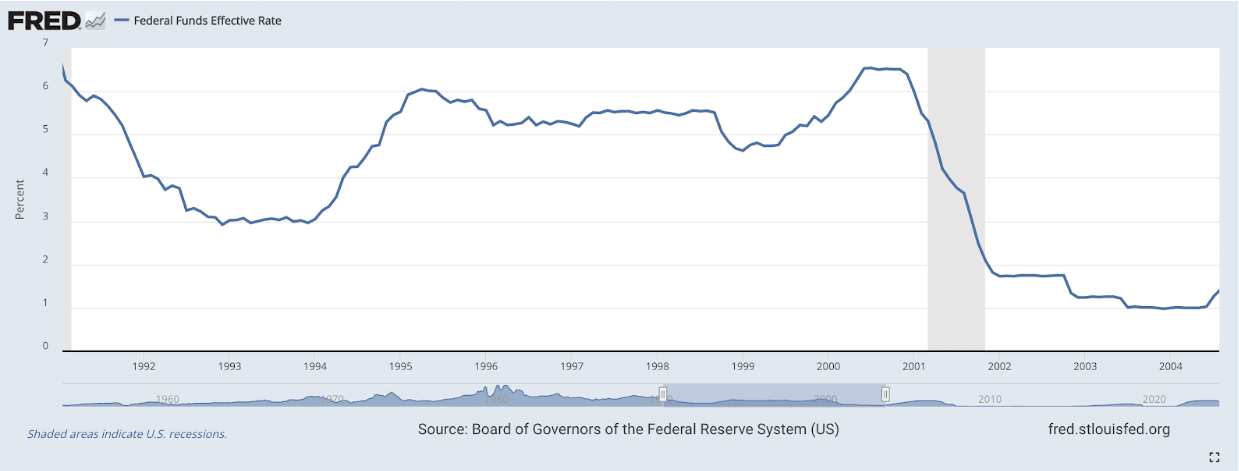

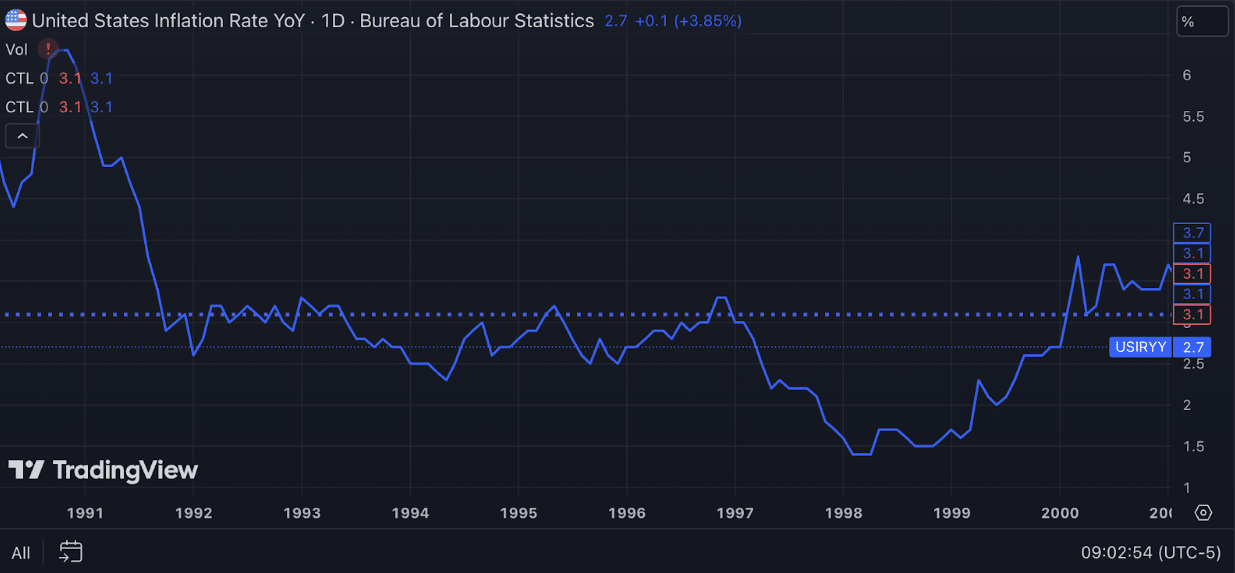

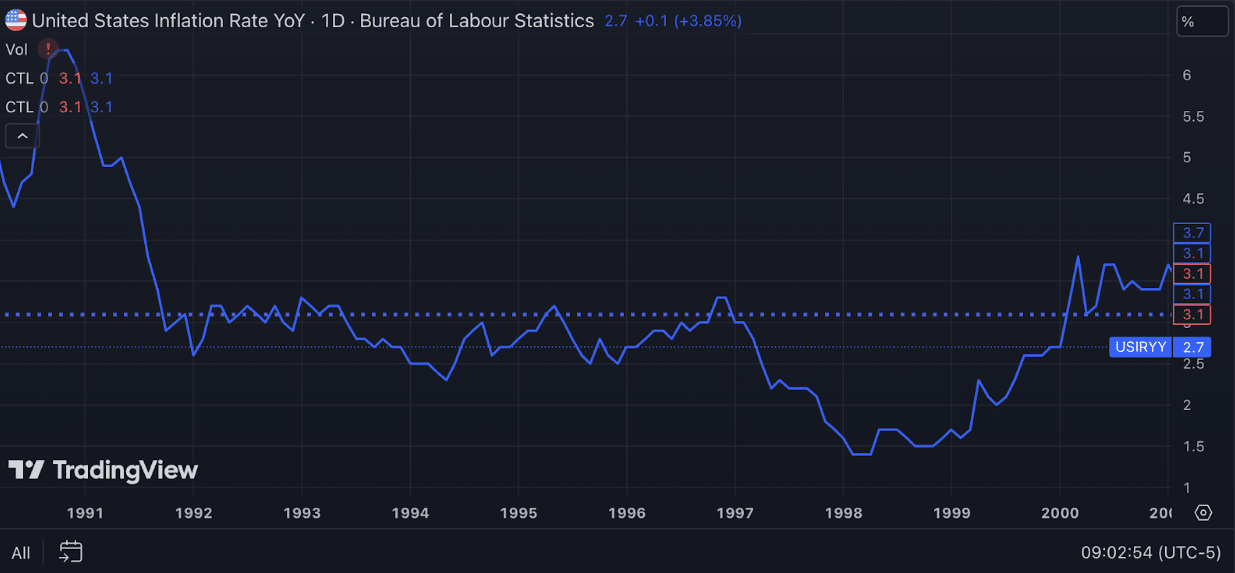

- After experiencing inflation and recession in the late 1980s and early 1990s, the annual inflation level in the US fell to around 3% in 1992, and the Fed also lowered interest rates to around 3% to stimulate economic recovery.

- With the economy’s recovery, the trend of inflation rebound began to emerge. In response, from February 1994 to February 1995, Greenspan raised the federal funds rate by 300bps to around 6%. (Think about what Powell did in 2022-2023!)

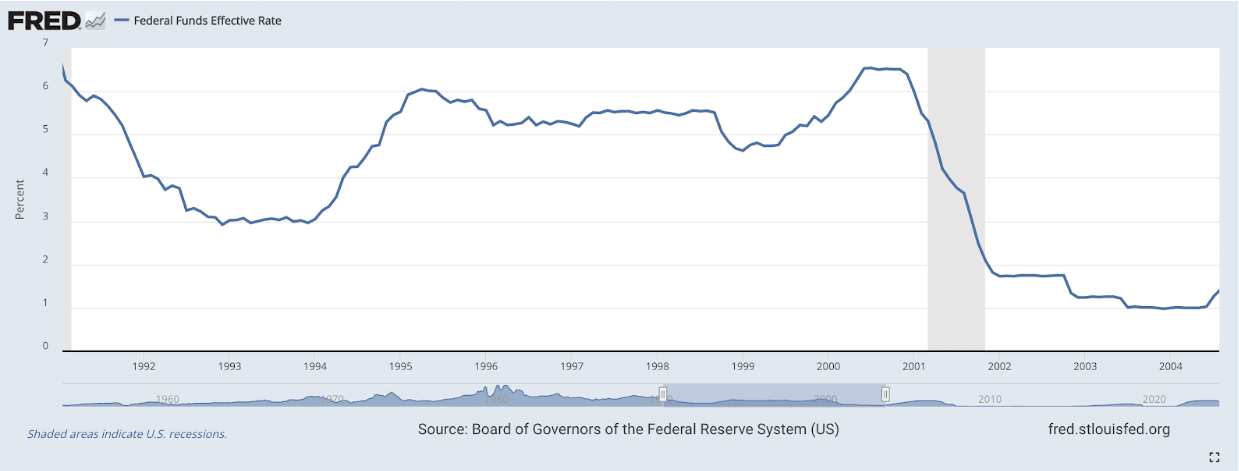

Changes in the Fed funds effective rate in the 1990s. Source: St. Louis Fed

- In a high interest rate environment, inflation is suppressed but maintains considerable sensitivity, and the risk of re-inflation is significant. Therefore, although the Fed cut interest rates twice in 1995-1996, the interest rate remained above 5.25%.

- In 1997, inflation continued to decline, and the time was ripe for further interest rate cuts. After inflation hit bottom in 1998, the federal funds rate was lowered to around 4.75%, reaching the end of this round of interest rate cuts. At this time, more than 3 years had passed since the interest rate peak in 1995.

US inflation rate YoY in the 1990s. Source: Tradingview

- Although the interest rate level at that time was “undoubtedly high” compared to the next 20 years, no one can predict the future. For investors who experienced a 6% interest rate level in 1995, the slow decline in interest rates has released enough liquidity in the past 3 years, and the “Dot-com narrative” combined with further interest rate cuts has fully stimulated investors’ speculative sentiment, ultimately giving birth to the “Dot-com Bubble.”

The Russell 2000 and Nasdaq indices movement before and after the “Dot-com Bubble”. Source: Tradingview

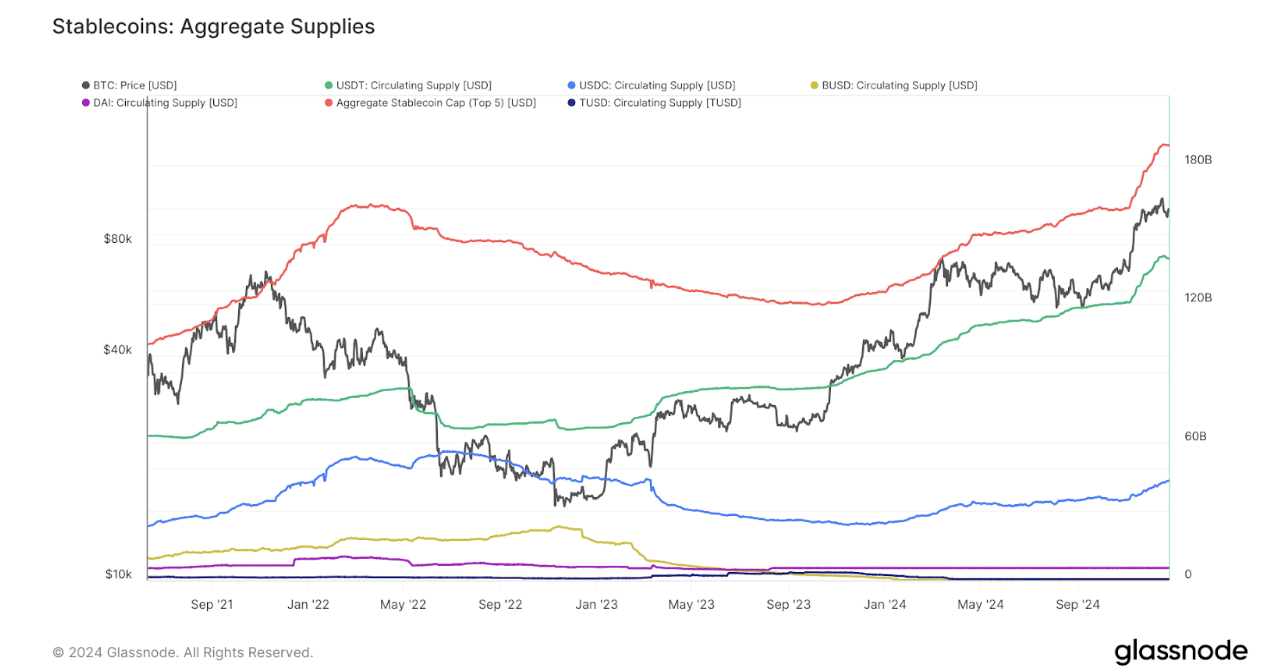

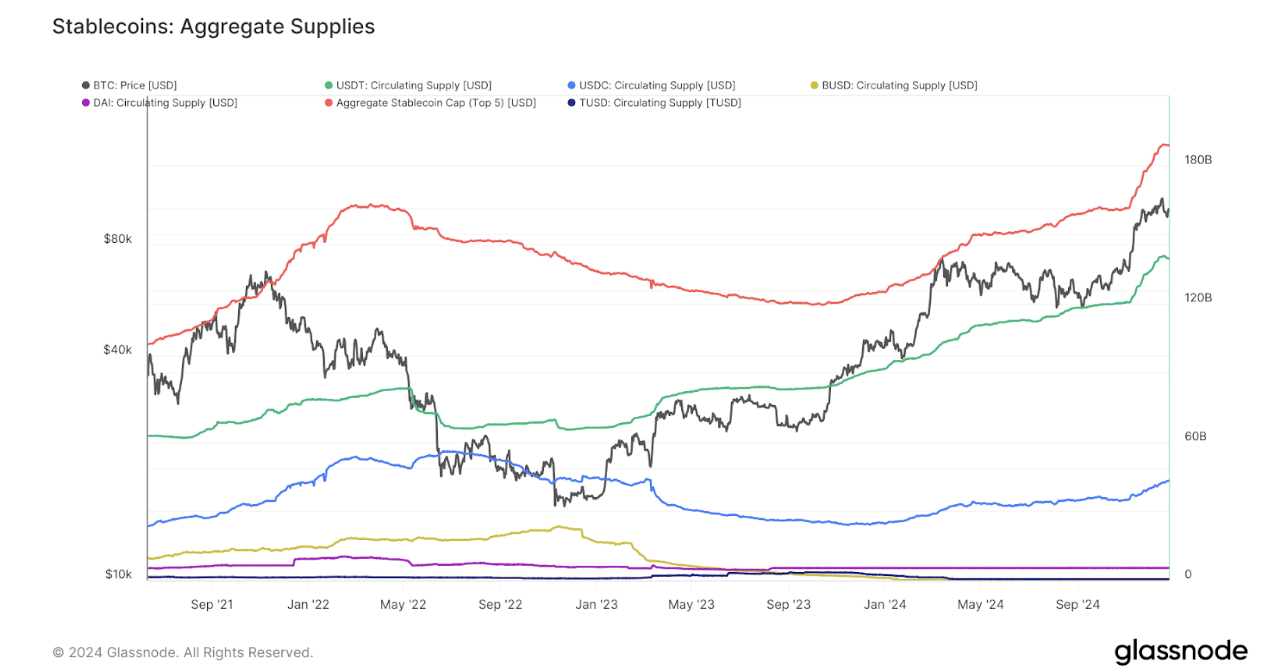

A quarter of a century later, the crypto market is in a similar position to the Nasdaq that year, and we have also found some “very similar” signs from a liquidity perspective. Although we are still in a high interest rate environment, the scale of cash liquidity within the crypto market has gradually expanded before the latest round of interest rate cuts. It has accelerated its expansion after the start of the interest rate cut cycle, providing a liquidity foundation for a possible altcoin season.

The aggregate supply scale of stablecoins. Stablecoins are usually regarded as a source of cash liquidity within the crypto market. Source: Glassnode

From the perspective of the interest rate market, considering that the current level of inflation sensitivity is not inferior to that of the 1990s, Powell may also adopt the strategy adopted by Greenspan in the 1990s, which is to prolong the interest rate cut cycle and moderately raise interest rates when necessary, to control inflation ultimately effectively. This means that the speed of obtaining liquidity in the crypto market will slow, but the accumulation of liquidity will not stop. Traders also hold similar expectations: although ETH and other cryptoassets are likely to perform poorly in the following months, the continuous accumulation of cash flow will still push up the valuation of non-BTC cryptoassets.

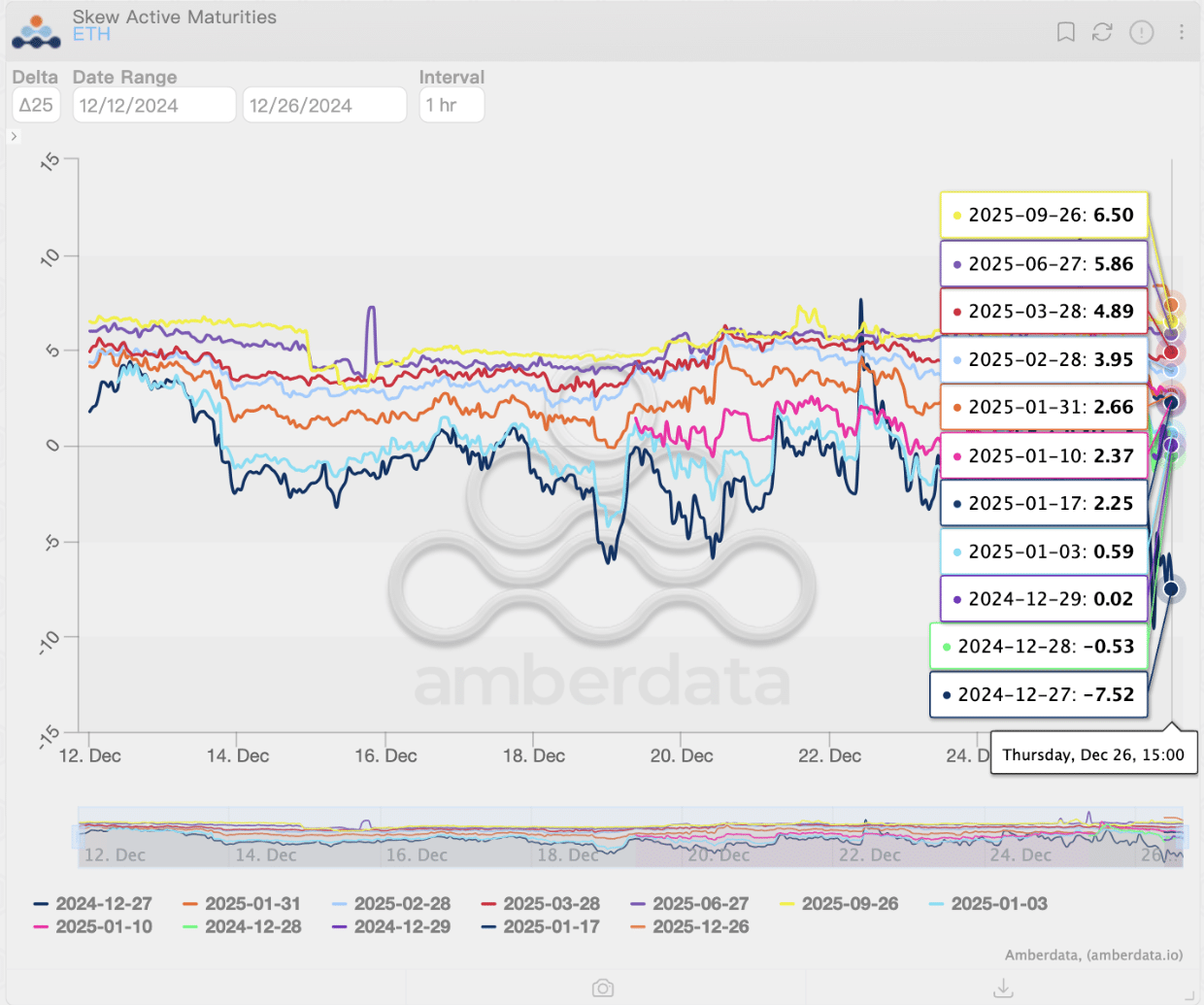

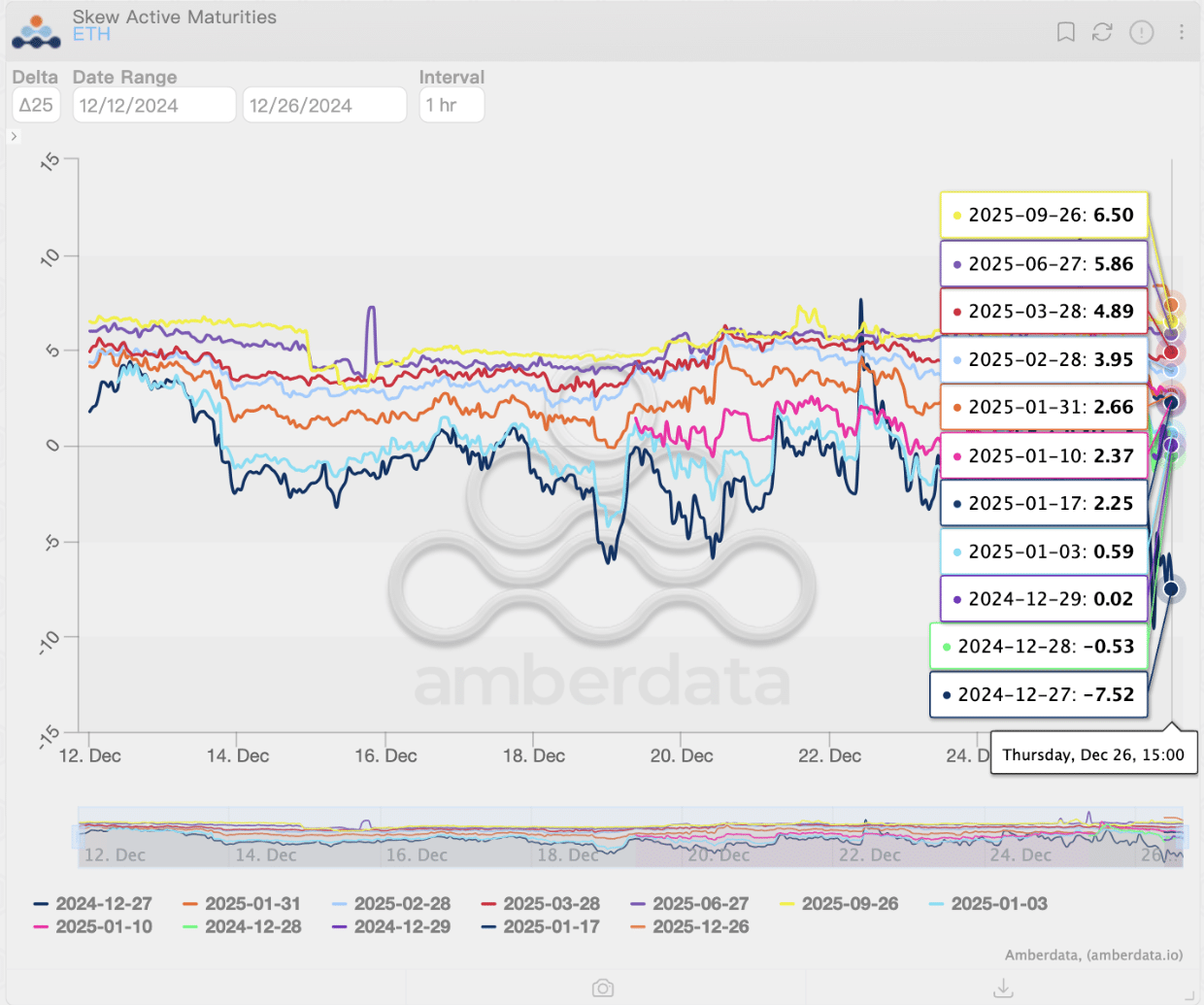

The skew changes of ETH options with different DTEs. Source: Amberdata Derivatives

However, similar to the 1990s, the bull market brought about by the accumulation of liquidity did not happen overnight. Before the bull market in 1999-2000, the rise of the Russell 2000 and Nasdaq indices was still relatively mild, accompanied by several pullbacks, and the real “booming” was already 4 years after the start of the interest rate cut cycle. Considering this round of interest rate cuts has only started for a few months, we may still have a long time before the “real altcoin season”.

Of course, before the arrival of the “real altcoin season”, the brief “vegan altcoin season” will still appear at certain moments. However, compared with the “real altcoin season”, the “vegan altcoin season” is not naturally generated based on the advancement of market cycles but is driven by forces from within the crypto market.

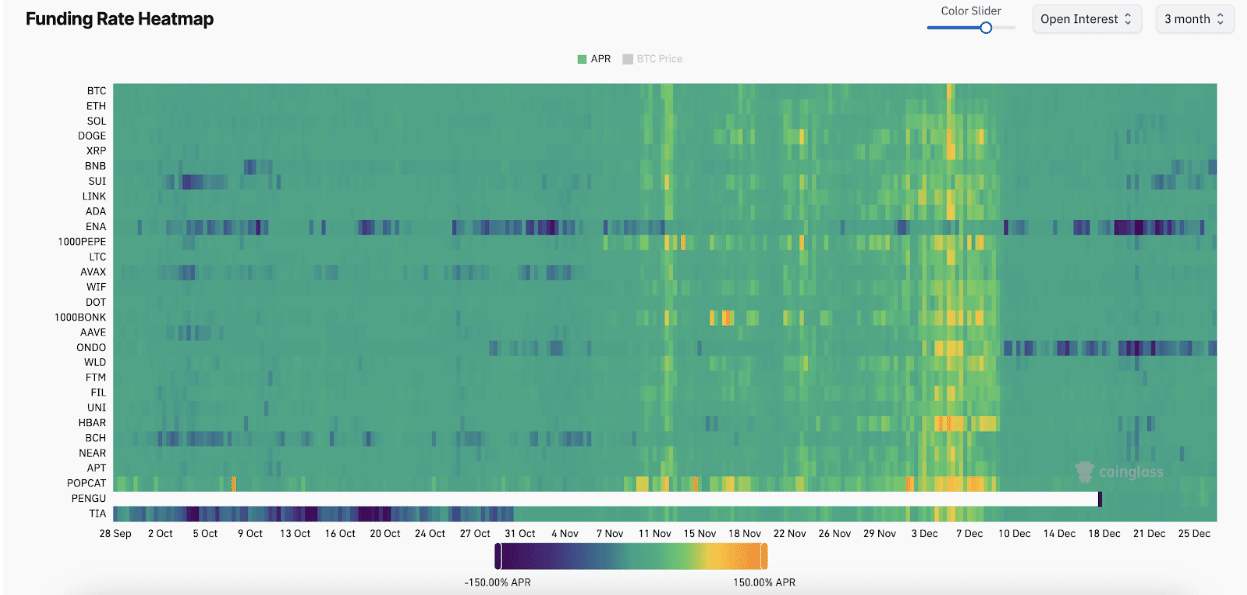

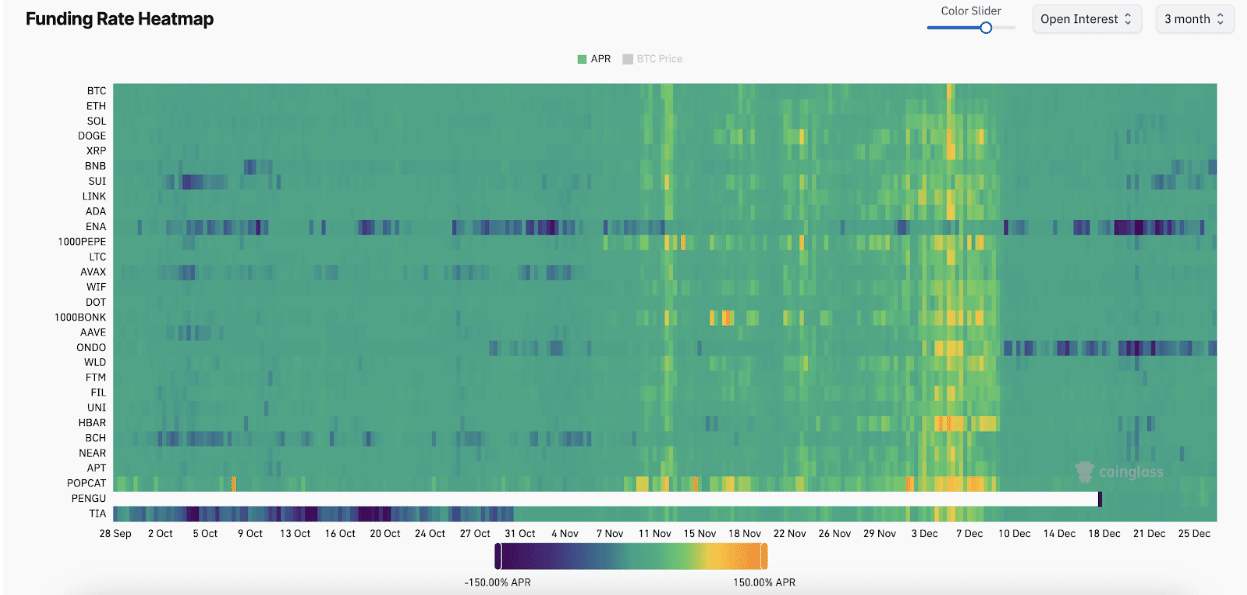

It is not difficult to distinguish between the “vegan altcoin season” and the “real altcoin season”. Due to the lack of spot buying, the “vegan altcoin season” is usually driven by leverage provided by derivatives, which brings high financing costs. The “vegan altcoin season” in November and December was accompanied by a rapid increase in perpetual contract financing rates, which is uncommon in a spot-driven market. High financing costs are unsustainable; after the deleveraging, the “vegan altcoin season” is over.

Funding rate heatmap. When the “vegan altcoin season” comes, funding rates and prices rise sharply simultaneously. Source: Coinglass

Indeed, investors are eager to see the wealth effect brought by the altcoin season. However, in the current macro environment, expecting the “real altcoin season” to come in the short term is not rational. The conditions are still not sufficient; we still need to be patient. Any blind investment in the “vegan altcoin season” may cause irreparable losses. Of course, if you want to buy a lottery ticket, good luck. But if you will use your salary, even pension, as a bet, please think thrice before trading.

Disclaimer: This is a paid post and should not be treated as news/advice.