- VET’s breakout from the descending channel faced a $0.037 retest.

- Technical indicators and bearish sentiment signaled consolidation before any potential recovery.

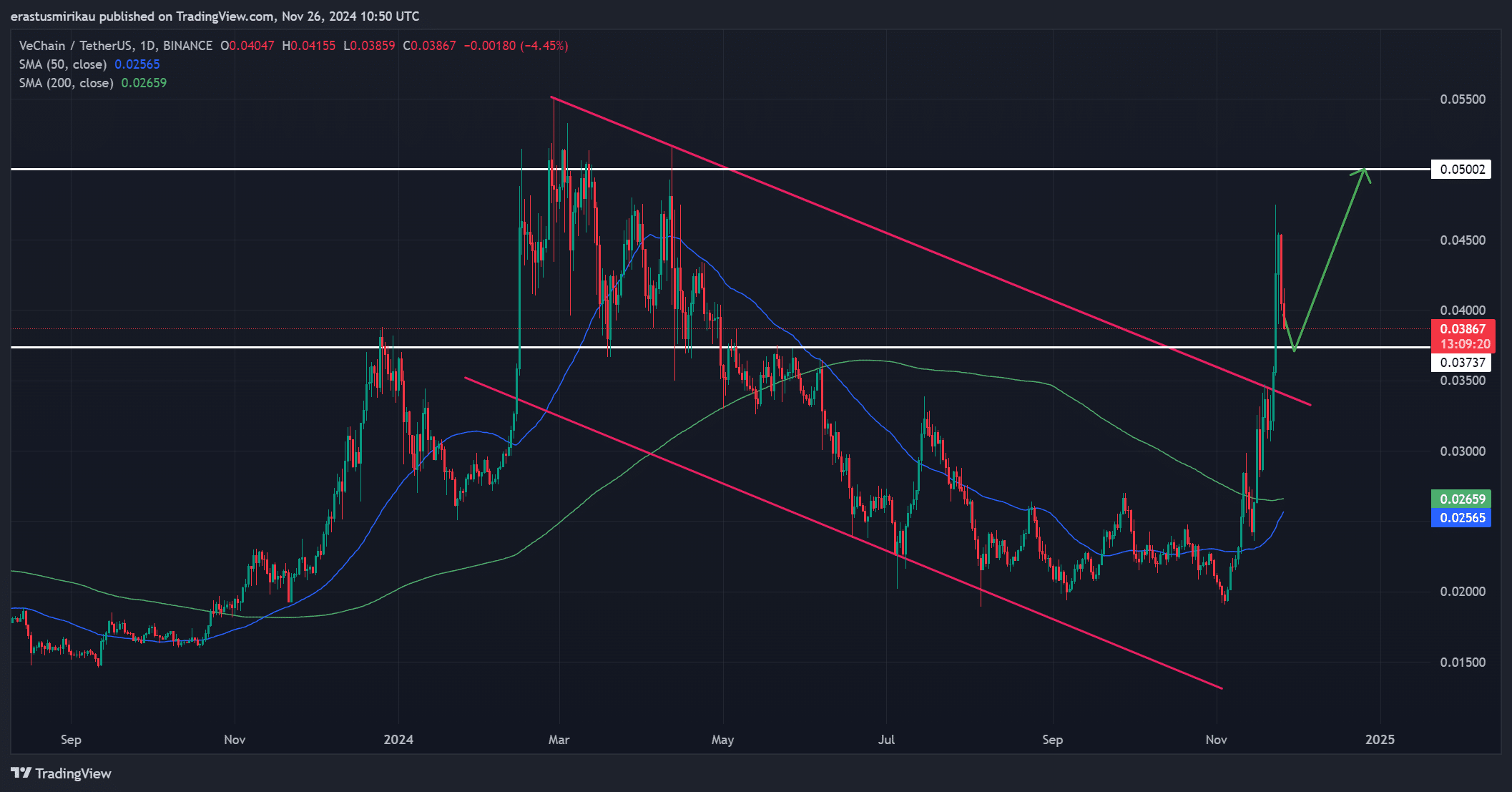

VeChain [VET] has experienced a sharp retracement after breaking out of its long-standing descending channel. The altcoin was trading at $0.03866, down 11.47% in the last 24 hours.

While the breakout initially signaled a positive shift in momentum, the recent price movement suggested caution, as VET appeared to be heading toward a critical retest of the $0.037 support level.

The next few sessions could determine whether VET regains bullish momentum or faces extended consolidation.

Can VET hold the $0.037 level?

The breakout from the descending channel was a significant development for VET. However, the retracement toward the $0.037 level highlighted the market’s uncertainty.

If this level holds, it could act as a foundation for the next move toward the $0.05 resistance.

Additionally, the 50-day SMA at $0.02566 and the 200-day SMA at $0.02659 were moving closer to forming a golden cross. Historically, such crossovers are bullish indicators.

Therefore, maintaining the $0.037 level is crucial to preserving upward potential.

What do technical indicators say?

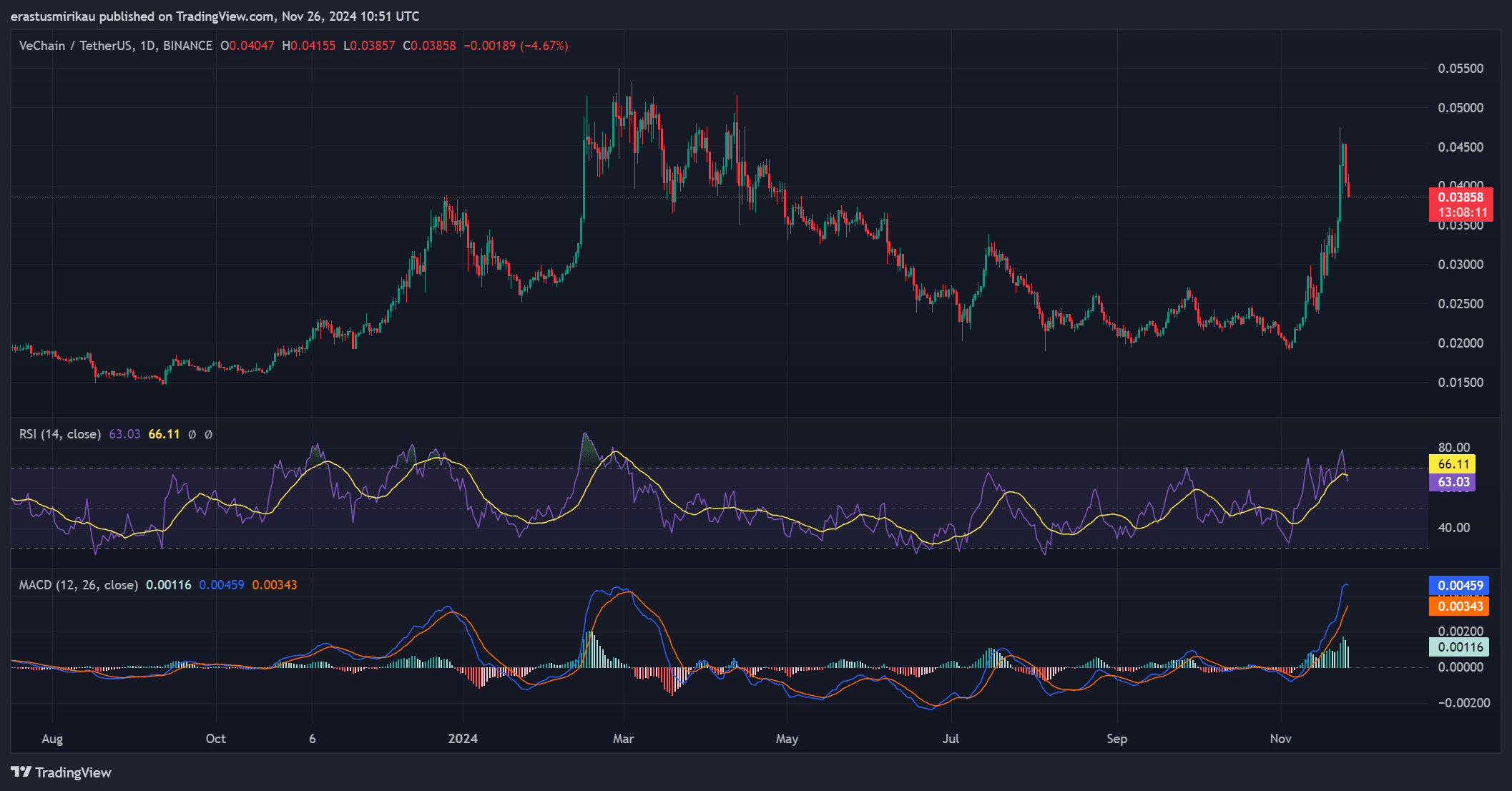

The RSI for VET was 63.03 at press time, slightly below the overbought threshold. While this reflected positive sentiment, the recent dip aligns with the price retracement, indicating reduced bullish pressure.

Meanwhile, the MACD’s bullish histogram was narrowing, suggesting momentum is fading.

The signal line was also nearing a bearish crossover, which could lead to short-term downward pressure.

Consequently, technical signals suggested that VET may consolidate further before attempting a breakout toward higher levels.

Are traders leaning bullish or bearish?

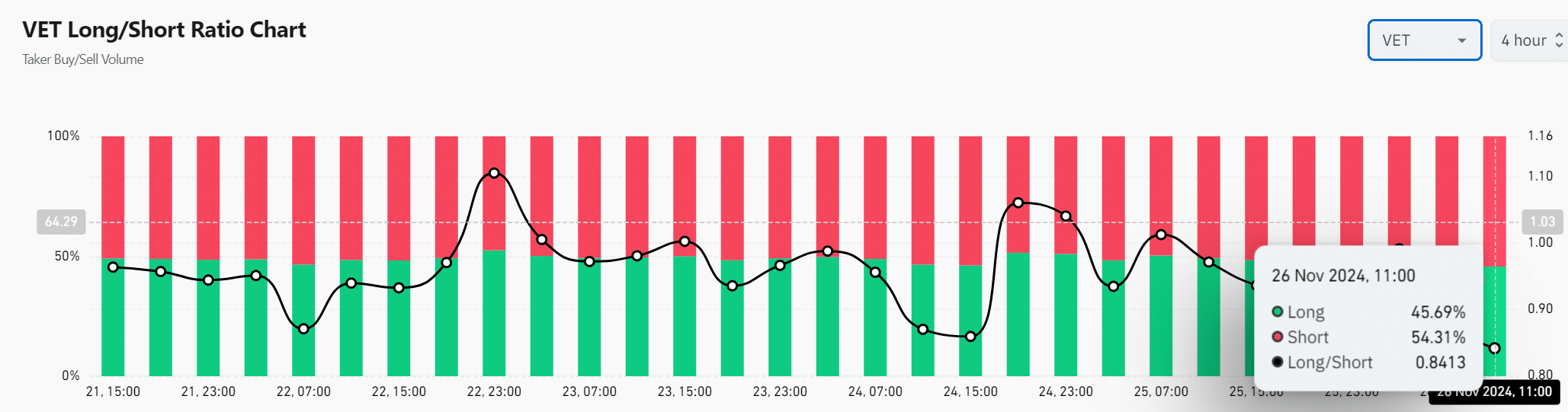

Market sentiment appeared tilted toward caution at the time of writing, as indicated by the Long/Short Ratio. 54.31% of traders held short positions, while 45.69% favored longs.

This imbalance suggested a lack of confidence in immediate upside potential, as traders anticipated further downside before a recovery.

Consequently, the $0.037 support will be a critical battleground between bulls and bears in the coming sessions.

What does development activity reveal?

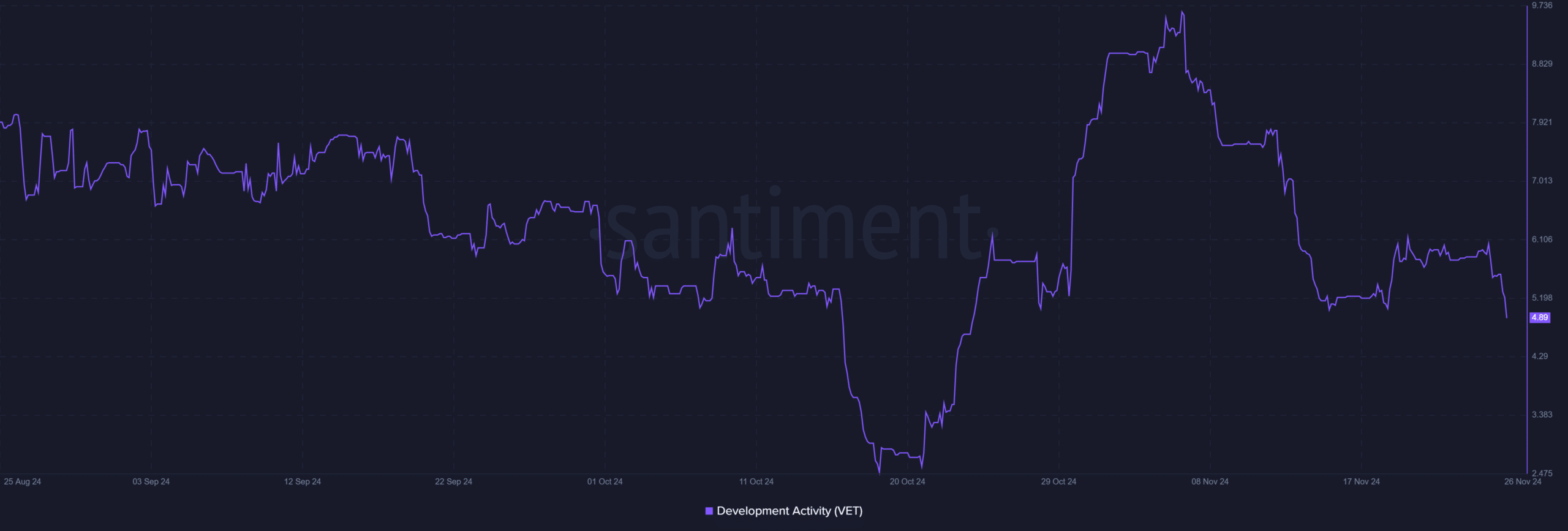

On-chain data shows a slight dip in VeChain’s development activity, which was at 4.89. While this is still a healthy level, the decrease from recent highs may undermine investor confidence.

However, steady development efforts could reassure long-term holders if the development activity stabilizes or improves.

Read VeChain’s [VET] Price Prediction 2024-25

VeChain’s trajectory hinges on the $0.037 support level. If this level holds, a recovery toward $0.05 remains possible, supported by the incoming golden cross.

However, failure to maintain $0.037 could lead to extended consolidation or further downside. The coming days will be critical in shaping VET’s short-term outlook.

![VeChain [VET] price prediction: Will $0.037 support spark recovery?](https://hamsterkombert.com/wp-content/uploads/2024/11/VeChain-VET-price-prediction-Will-0037-support-spark-recovery.webp.webp)