- Solana’s Open Interest climbed to hit a new ATH

- SOL’s price rose by 44.46% over the past month

Over the last 11 days, Solana [SOL] has recorded a significant uptrend on the charts. In fact, within weeks of hitting a local low of $155 earlier this month, the altcoin surged to a high of $225, hiking by 45.15%.

On the daily charts, SOL appreciated by 4.67%. Equally, the altcoin climbed on the weekly and monthly charts too, up by 9.85% and 44.46%, respectively.

Needless to say, recent market conditions have raised some questions about the factors driving the aforementioned hike. According to AMBCrypto’s analysis, one factor sustaining the uptrend is the rising demand and interest for SOL.

Solana Open interest hits a new ATH

This rise in demand and interest for the altcoin can be evidenced by the fact that investors are continuously opening new positions.

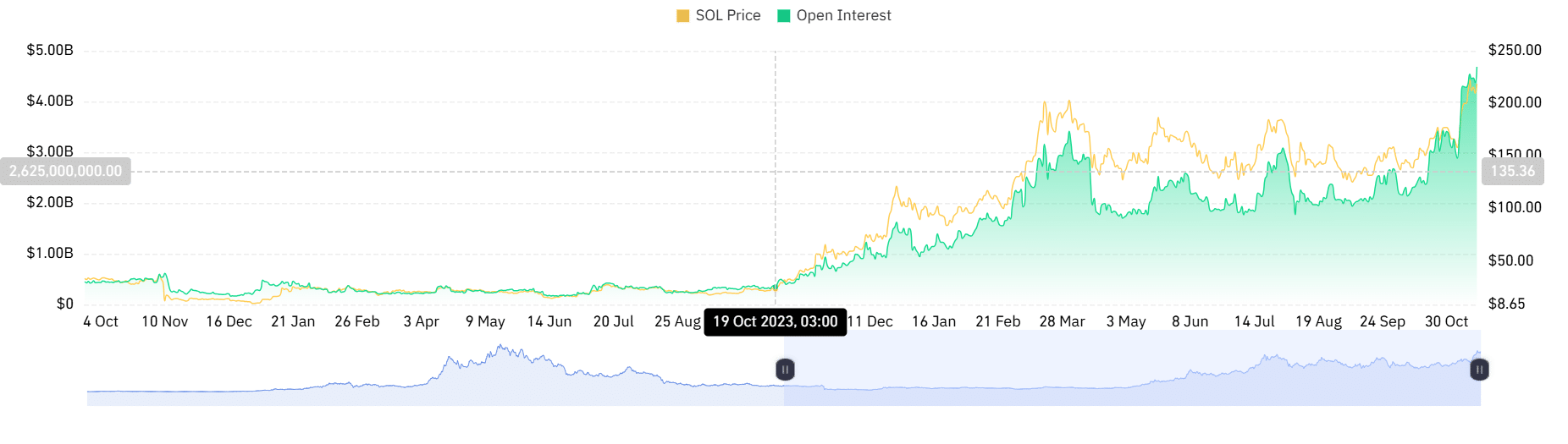

According to Coinglass’s data, Solana’s Futures Open Interest surged over the last 24 hours to hit a new ATH on the charts.

To put it in perspective, the altcoin’s Open Interest hit a record high of $4.68 billion. This uptick in Open Interest underlined higher demand for the altcoin with new investors opening new positions, while the existing ones hold their trade.

Usually, a higher Open Interest implies that an asset is noting higher investor favorability. Especially since they anticipate further gains on the charts.

With the overall crypto market rising and the total market cap hitting $3 trillion, Solana holders see potential in this bull market. This is motivating them to keep their positions while attracting new ones.

What do SOL’s charts say?

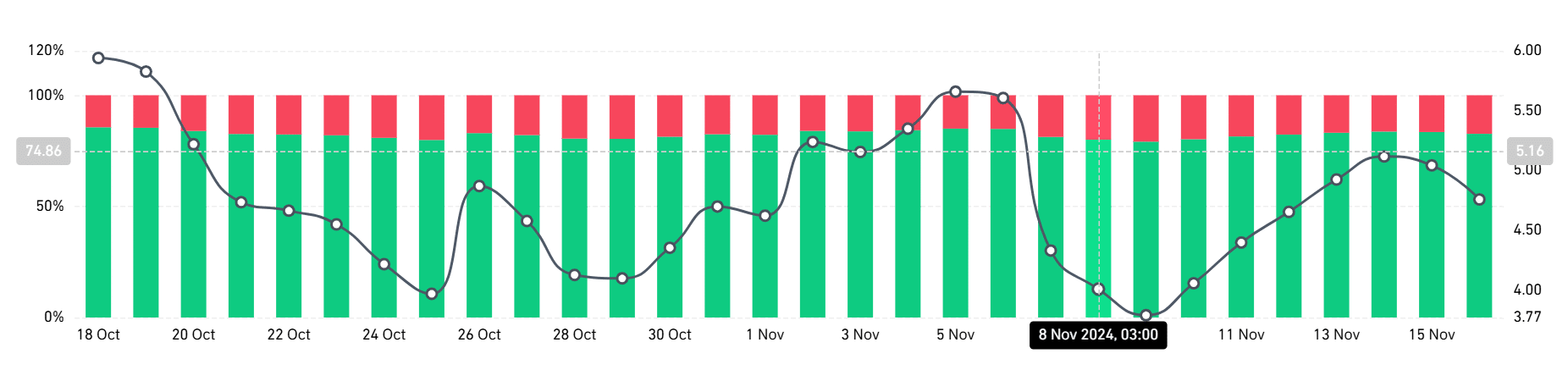

Solana has been seeing rising demand lately, especially for long positions. This demand for Futures can be evidenced by the fact that long position holders have been dominating the market.

On the daily chart, Solana’s perpetuals (long/short) revealed that longs controlled 82.56%, while shorts were at 17.44%.

This implied that a majority of the investors are betting on the crypto’s price to hike.

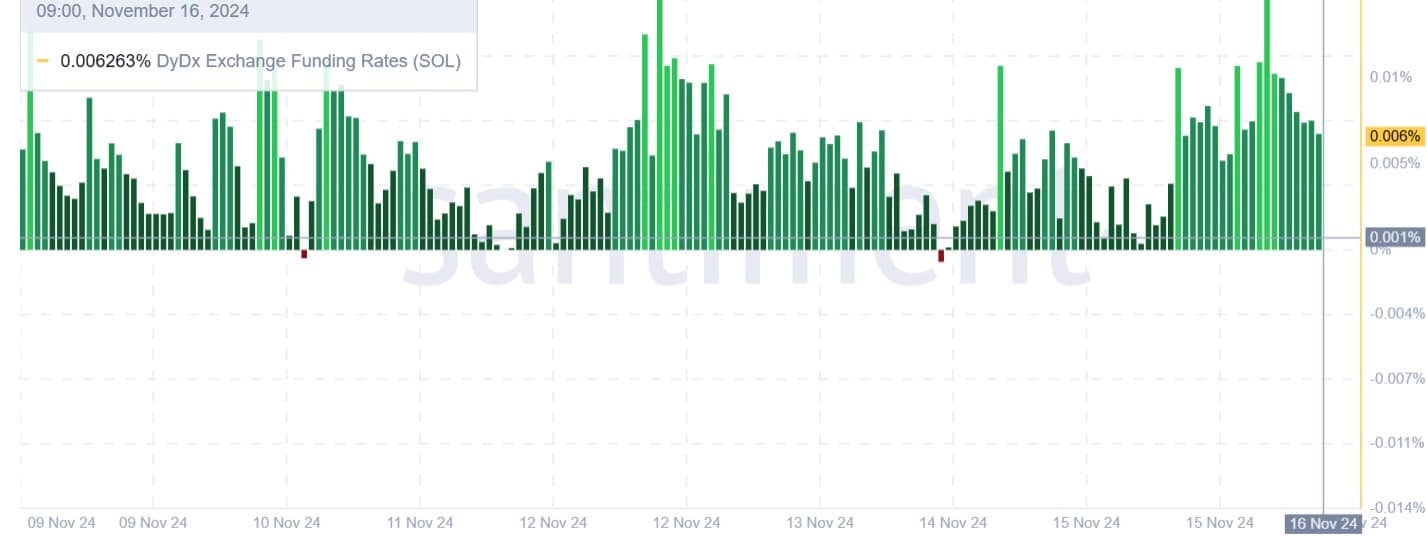

This demand for long positions is further supported by a positive DyDx exchange funding rate.

Figures for the same have remained largely positive over the past week, implying that investors are paying a fee to hold their positions during market downturns. Such a market trend is a sign of market confidence among investors.

What next for the altcoin?

With Solana’s Open Interest hitting a new high, it suggested that the market is overly bullish right now. As such, most investors are optimistic and expect the price to appreciate. Especially since these positions have been largely long positions.

In light of these favorable conditions, SOL could record more gains on the price charts. If so, SOL will reclaim the $222 resistance level. A breakout from here will see the altcoin find the next resistance at around $242.