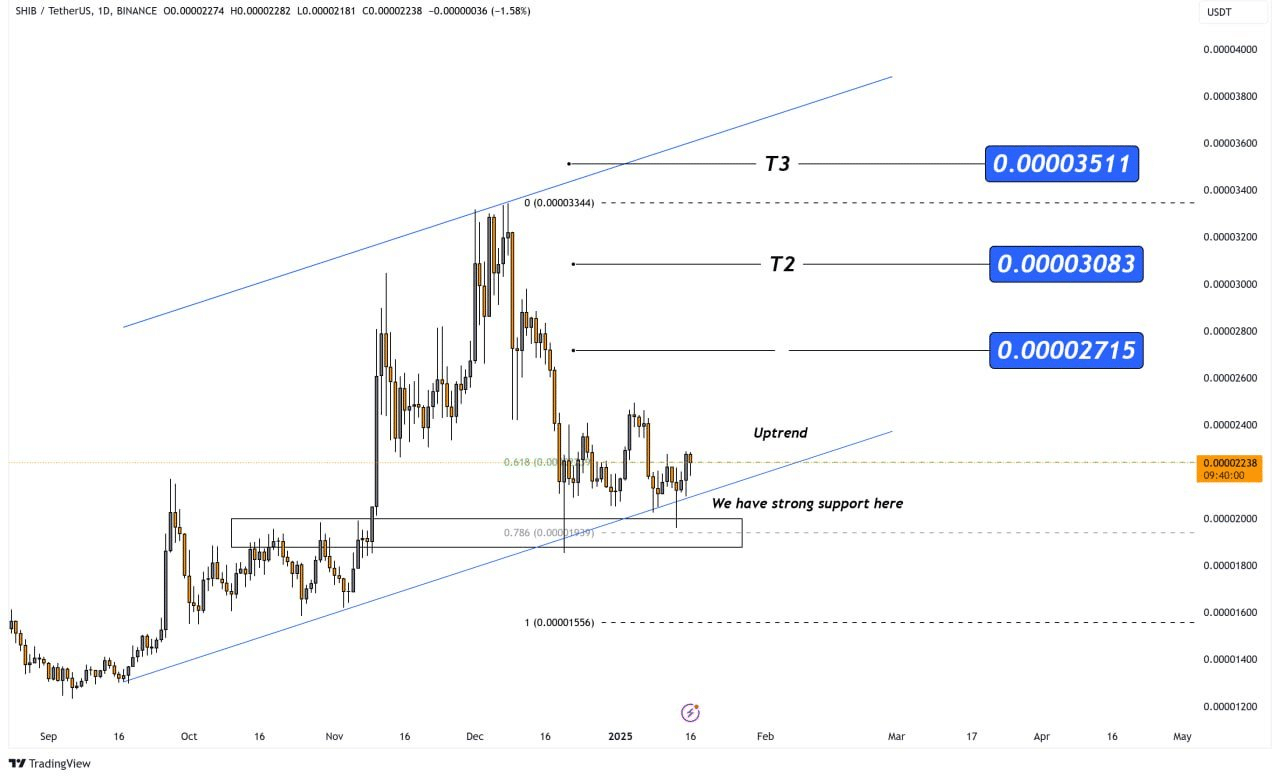

- The 0.618 Fibonacci retracement level served as a key support zone for SHIB, signaling a possible continuation of the uptrend.

- Shiba Inu’s ecosystem saw a significant drop in its burn rate, with only 9.38 million SHIB tokens burned.

Shiba Inu [SHIB] has gained attention for its recent price movements within an ascending channel.

Strong support at $0.00002181–$0.00002238 aligns with the 0.618 Fibonacci retracement level, indicating potential for further bullish momentum.

Current price dynamics of SHIB

The 0.618 Fibonacci retracement level serves as a key support zone, signaling a possible continuation of the uptrend.

SHIB’s bounce from this level, supported by trading volume, sets immediate targets at $0.00002715 (T1), $0.00003083 (T2), and $0.00003511 (T3).

Failure to hold above the 0.618 level may lead to a retest of lower support, potentially invalidating the bullish trend. Monitoring SHIB’s position within the ascending channel will be crucial for traders.

Potential for bullish continuation

SHIB’s price remains constrained within the ascending channel. This pattern signifies sustained bullish sentiment as long as the price respects the lower trendline.

A breakdown below the trendline could invalidate the bullish outlook, potentially dragging SHIB back toward $0.00002181.

On the upside, staying within the channel supports further momentum toward the next resistance levels. A breakout above the upper boundary would indicate accelerated buying pressure, potentially pushing prices beyond $0.00003511.

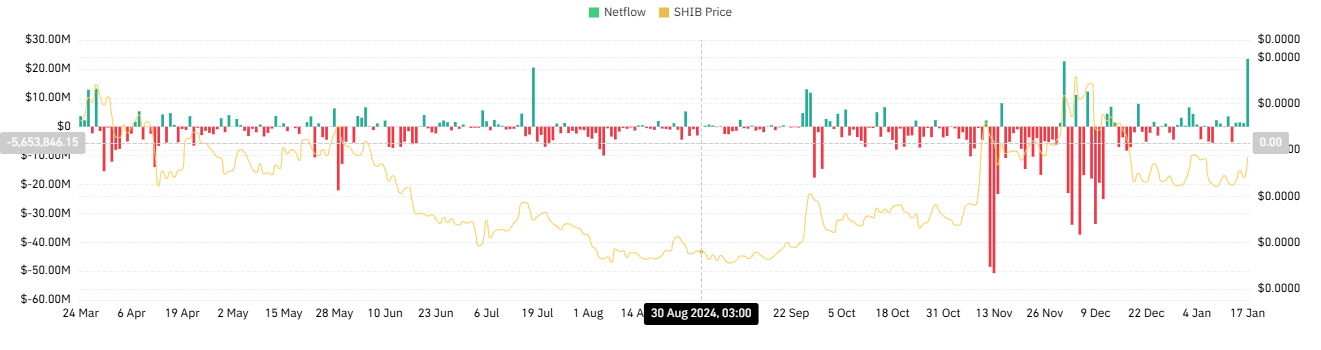

Highlights on market sentiment and accumulation

Recent data shows a nuanced inflow and outflow pattern for SHIB. While spot inflows highlight short-term profit-taking near resistance levels, consistent outflows underscore continued accumulation by long-term holders.

This interplay has kept SHIB’s price stable despite external pressures.

A sharp spike in net inflows, as seen recently, could signal mounting selling pressure if SHIB approaches $0.00002715. However, a balanced or declining inflow trend paired with steady outflows would likely pave the way for further gains toward T2 and T3.

Traders should remain vigilant to sudden changes in these metrics, as they provide key insights into market sentiment and price direction.

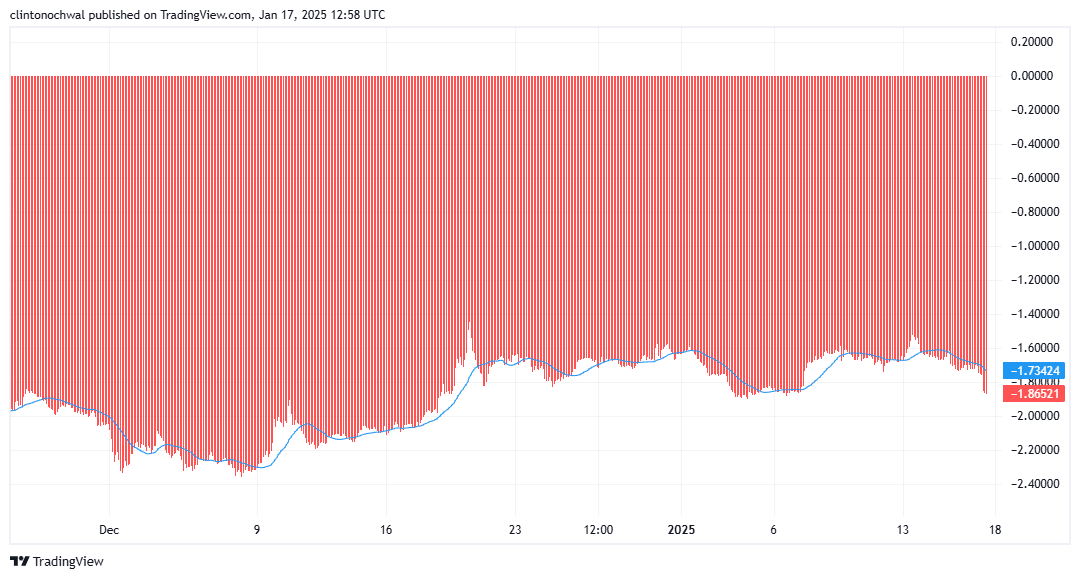

Funding Rates for SHIB have remained neutral to slightly positive, reflecting a balanced outlook among traders. Positive Funding Rates often suggest that traders are willing to pay a premium to hold long positions, reinforcing bullish sentiment.

In SHIB’s case, stable funding rates indicate that traders are cautiously optimistic, which aligns with its recent steady performance.

Market sentiment indicators, including the Fear and Greed Index, show moderate levels of greed. While this indicates confidence among market participants, traders should be wary of overbought conditions.

A sudden spike in greed levels could lead to a short-term correction, especially if SHIB fails to break above $0.00002715 convincingly.

Implications for SHIB’s ecosystem goals

On the other hand, the Shiba Inu ecosystem saw a significant drop in its burn rate, with only 9.38 million SHIB tokens burned on the 14th of January 2025, compared to previous days.

The most substantial single burn accounted for 8.91 million SHIB, underscoring how limited overall burning activity was.

Read Shiba Inu’s [SHIB] Price Prediction 2025-26

This marked a 55% decline in the daily burn rate, raising concerns about the project’s deflationary goals.

Simultaneously, Shibarium’s blockchain statistics highlighted steady network activity, with over 791 million completed transactions and 2.095 million addresses recorded.

However, no new contracts were deployed, and only one was verified that day. These figures indicate stability.