- The last 24 hours witnessed a slight decline in burn rate.

- Metrics revealed that selling pressure started to increase on SHIB.

Shiba Inu [SHIB] has once again proven its worth as a deflationary asset with its massive burn rate. In fact, the token’s burn rate registered a multi-fold increase in just one week. But will this push be enough to send SHIB to the moon?

Shiba Inu’s burn rate skyrockets

The world’s second-largest memecoin shocked investors with its remarkable 7418% increase in burn rate in just a single week. Thanks to the increase, the blockchain’s burn mechanism burned more than 2 billion SHIB tokens.

The figure was massive as it reflected the blockchain’s robust’s deflationary nature. As per SHIBBURN’s data, to date, over 410,740,228,619,979 SHIB tokens have been burnt, which were worth over $12 billion as per the memecoin’s price at the time of writing.

Generally, a rise in burn rate is considered an optimistic development as it reduces the circulating supply, creating scarcity in the market. By the demand and supply rule, when supply drops and demand rises, prices tend to go up.

Therefore, this substantial rise in burn rate could have a positive impact on Shiba Inu’s price in the long run.

The burn rate declined slightly over the last 24 hours as the value dropped by over 87%. However, this shouldn’t be much of a concern, considering the 7x increase last week.

How is SHIB responding?

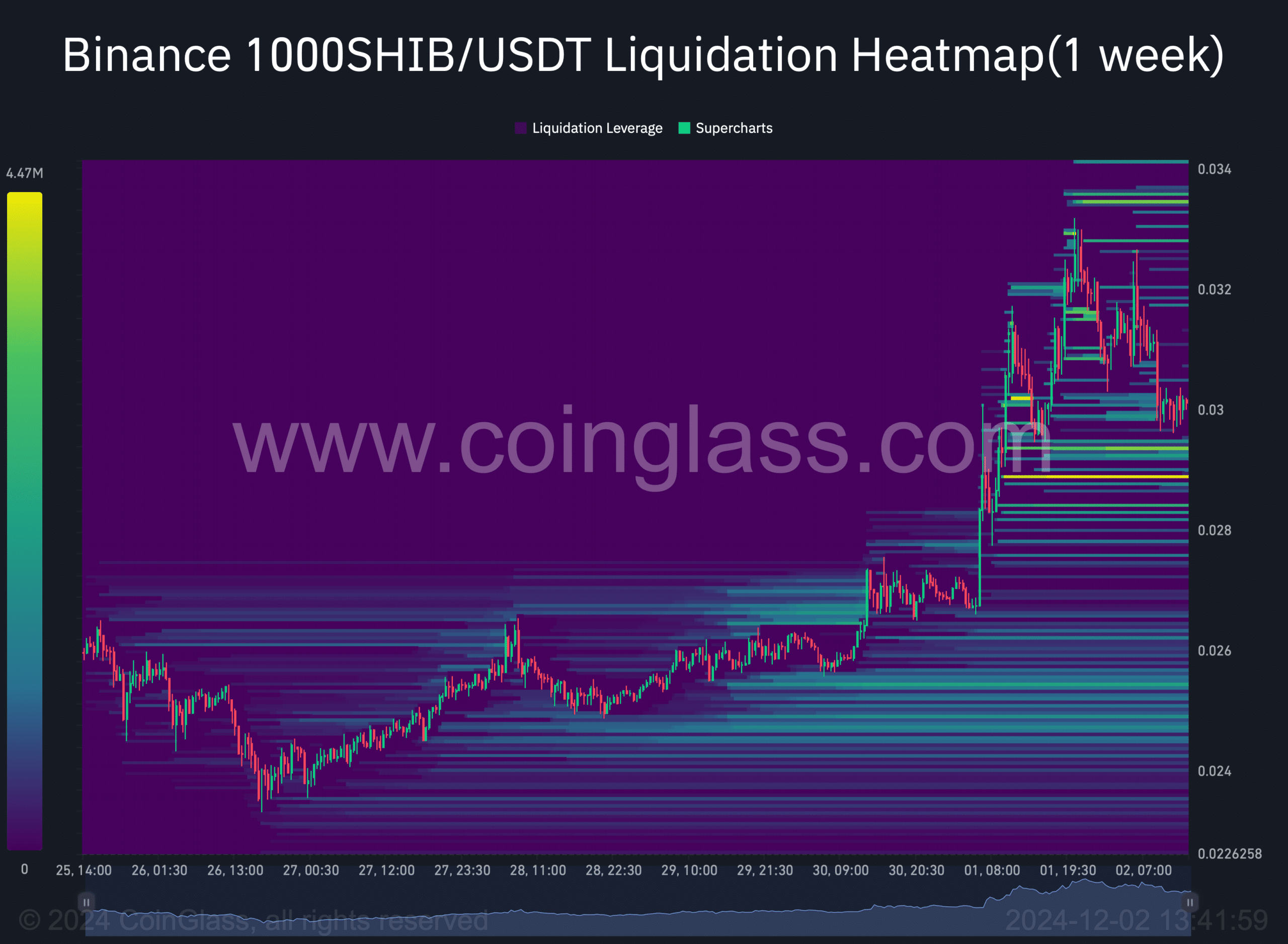

While the memecoin’s burn rate skyrocketed, its price also gained bullish momentum and surged by 15% last week. But, like its burn rate, its price also dropped in the past 24 hours by more than 3%. After the decline, SHIB was trading at $0.0000299 at press time.

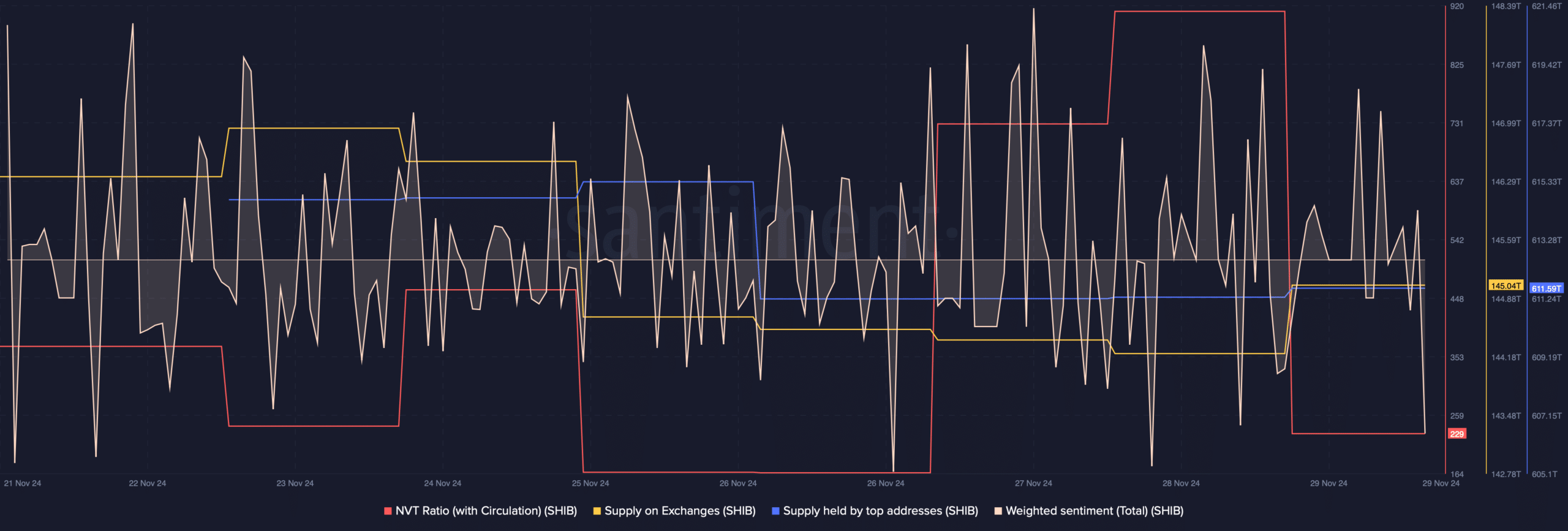

Therefore, AMBCrypto checked the Shiba Inu’s on-chain data to find out whether this declining price trend will last. Over the past week, Shiba Inu’s weighted sentiment majorly remained in the positive zone – reflecting high bullish sentiment.

However, after a sharp decline, SHIB’s supply on exchanges started to move up. This could be a result of profit taking and could also have played a role in SHIB’s latest price correction.

Whales were also following a similar selling strategy, as evident from the decline in the supply held by top addresses. Nonetheless, SHIB’s NVT ratio, after a steep increase, dipped on the 29th of November. A drop in the metric means that an asset is undervalued, hinting at a price rise.

Is your portfolio green? Check out the SHIB Profit Calculator

In case of a trend reversal, Shiba Inu might move northward and touch its resistance at $0.000033. However, if the bearish trend persists, then the memecoin might plummet to $0.000028.