- SEI has been eyeing $0.65 as the next key target.

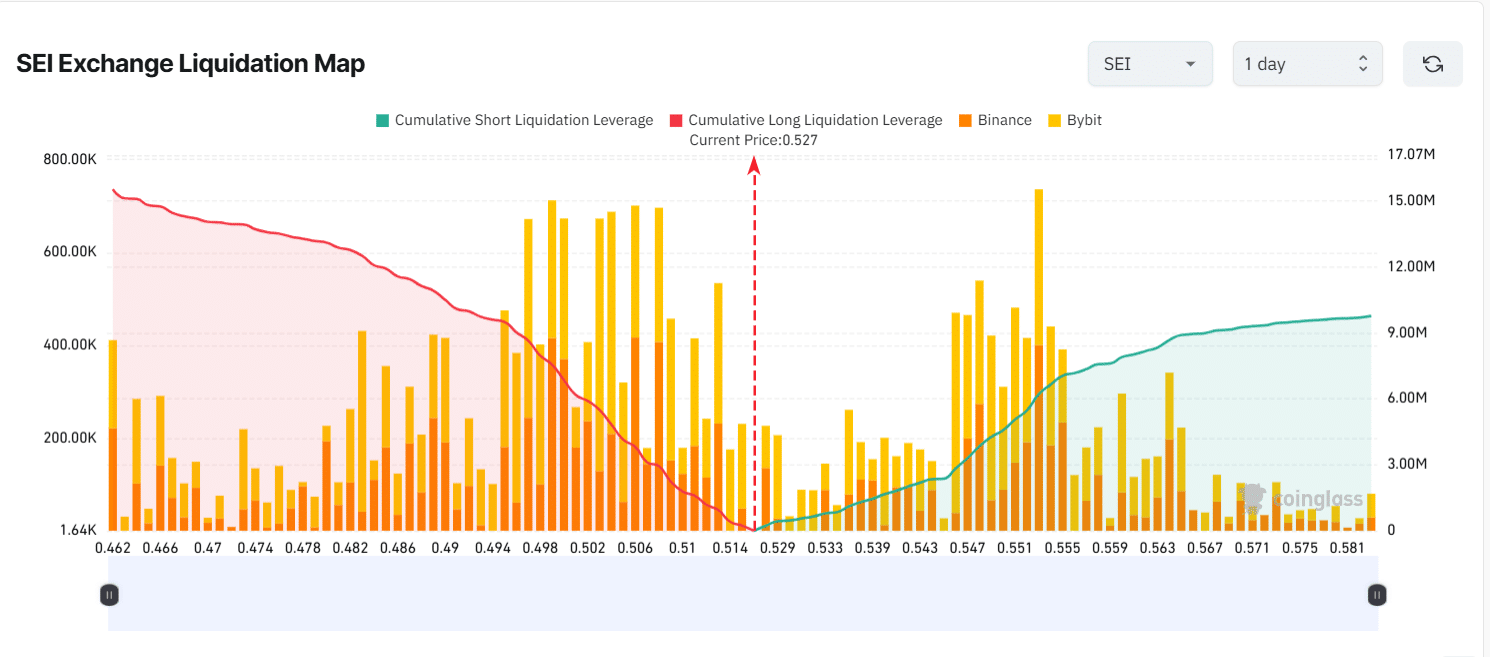

- The liquidation map showed key pressure points at $0.514 and $0.550.

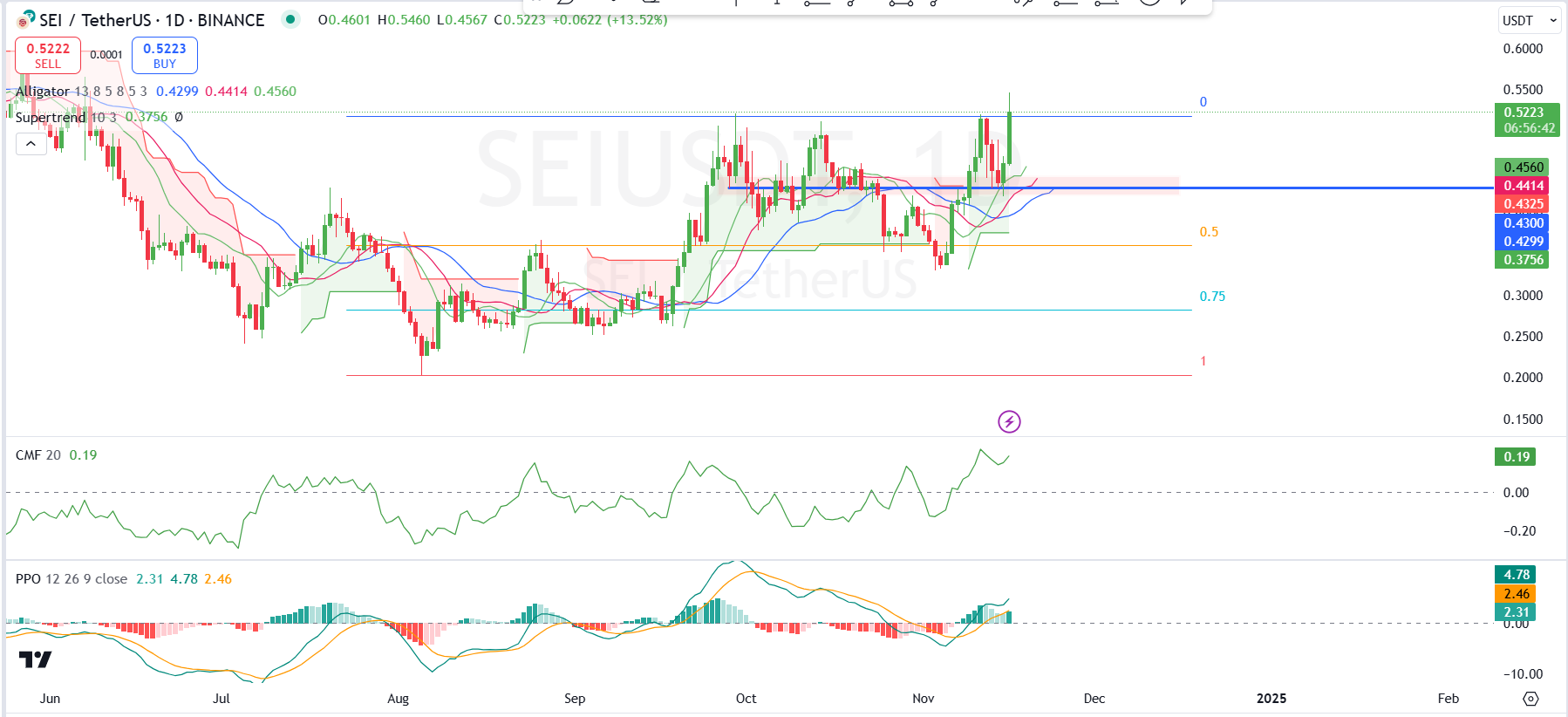

Sei Network [SEI] has shown a remarkable recovery, posting a 60% increase over the past two weeks. This turnaround followed a recent retracement to the 50% Fibonacci level on the daily chart.

At the time of writing, SEI’s price was $0.5264, representing a 14% gain in the last 24 hours.

Meanwhile, the trading volume has reached $783.84 million, indicating strong market interest.

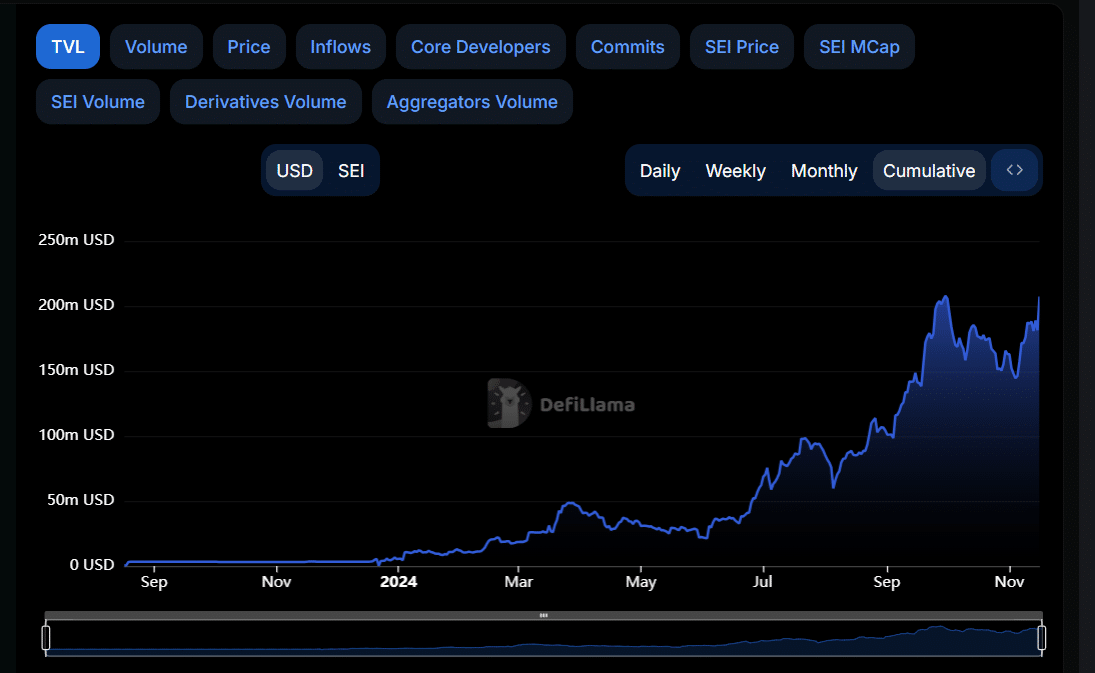

Additionally, its Total Value Locked was $207.32 million, reflecting a solid foundation of user engagement and platform activity.

Analyst predictions

SEI’s price initially surged upward, forming a flagpole, followed by a consolidation phase within a downward-sloping channel.

The breakout above the flag’s upper boundary now confirmed renewed bullish momentum.

The breakout point was at $0.4600 at press time, and using the bull flag’s structure, the projected target price was $0.65.

This projection is calculated by adding the height of the flagpole to the breakout level, suggesting significant upside potential for SEI if the breakout remains intact.

SEI signals strong uptrend

SEI’s daily chart price has broken above key resistance levels, moving toward its recent highs, indicating a potential continuation of the uptrend.

Key resistance lay at around $0.5460 while $0.4414 served as a critical support level, aligning with the mid-line of the Supertrend and moving averages.

The Alligator lines were widening, confirming a trending market with the price firmly above these lines, indicating sustained bullish momentum.

The Supertrend was green, reinforcing the positive trend, as long as the price remained above the trendline.

The Chaikin Money Flow value of 0.19 highlighted positive buying pressure, suggesting strong capital inflows into SEI.

Investor utility on the rise?

The Total Value Locked (TVL) for SEI has shown a consistent and impressive uptrend over the past year, now reaching approximately $207.32 million.

This growth highlighted the platform’s increasing adoption and strong user engagement within the DeFi ecosystem.

Starting from negligible levels in late 2023, the TVL experienced accelerated growth in 2024, with significant surges in March, July, and November, suggesting key periods of development or user activity.

This rising trend in TVL, alongside the increasing trading volume, signaled a robust foundation for SEI’s DeFi applications.

Such consistent growth indicated that users were locking funds for long-term use, a positive sign for the platform’s stability and scalability.

Shorts under pressure

The cumulative short liquidation leverage (green) rose as the price moved higher, indicating increased pressure on short positions above $0.527.

Meanwhile, the cumulative long liquidation leverage (red) decreased as the price dropped below this level, suggesting a higher risk for long positions at lower prices.

The liquidation clusters highlighted key areas of interest. Notably, there was a concentration of long liquidations around the $0.514 level and short liquidations above $0.550.

Read Sei’s [SEI] Price Prediction 2024–2025

This indicated that any significant price move toward these levels could trigger cascading liquidations, leading to heightened volatility.

With the press time price at $0.527, SEI was positioned at a critical point, where breaking out to the upside could pressure shorts, while a breakdown risked triggering long liquidations.