- Ripple’s cap surged to $108.2 billion to reclaim the fifth spot

- XRP has surged by 21.08% to hit a three-year high

In the past 24 hours, Ripple [XRP] has made one of the greatest comebacks in the Crypto’s recent history. For the first time since 2018, XRP’s market cap has breached the $100 billion barrier to surpass Binance Coin [BNB].

According to CoinMarketCap, XRP’s market cap has reached $108.22 billion after a 21.38% spike over the past day. This increase has moved the altcoin to fifth place by market cap.

In 2018, XRP price rallied to set its all-time high at $3.13 while the market cap reached $120.76 billion. Interestingly, the recent uptrend raises questions about what’s driving Ripple’s uptrend and if it will keep its fifth spot.

Factors driving XRP’s market cap

According to AMBCrypto’s analysis, one factor driving the surge is the changing political environment in the United States. Since Donald Trump’s election, the altcoin has experienced a sustained uptrend as he promised to remove the current SEC chairman.

Gary Gensler announced his intentions to resign as the new administration takes over. There’s growing speculation that the SEC will drop the Ripple lawsuit with the new administration.

When the SEC started its many lawsuits against Ripple, the altcoin came close to dropping out of the top ten from the second position. Thus, with speculation of better crypto policies, Ripple investors are bullish and anticipate more gains.

Therefore, if the speculation becomes true, and the legal woes go away, Ripple’s XRP will maintain the fifth spot. Equally, there’s a high chance of surpassing Solana, which has struggled to rally over the past year.

Can XRP finally see a sustained Rally?

Undoubtedly, XRP is experiencing a bullish sentiment with a strong upward momentum.

This bullishness is evidenced by strong buying pressure. At the time of writing, the Stoch RSI made a bullish crossover 48 hours ago, showing that buyers are currently in total control.

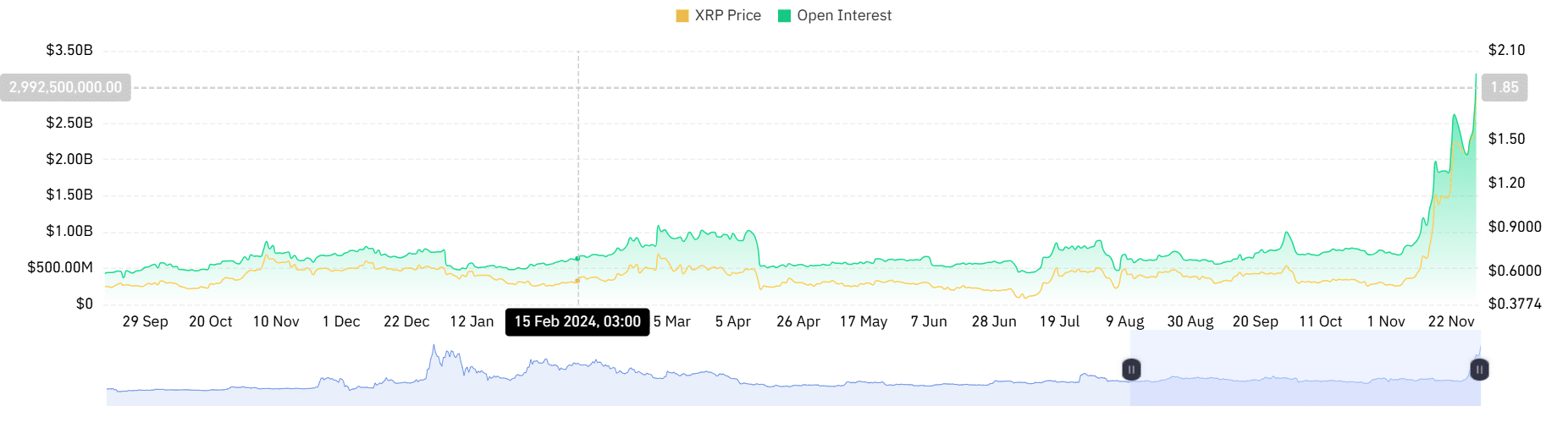

This dominance among buyers is further supported by a surge in Open Interest (OI). According to Coinglass, XRP futures’OI has surged to hit a new all-time high of $3.19 billion.

When OI rises, it implies that investors are opening new positions while existing ones continue to hold their trades.

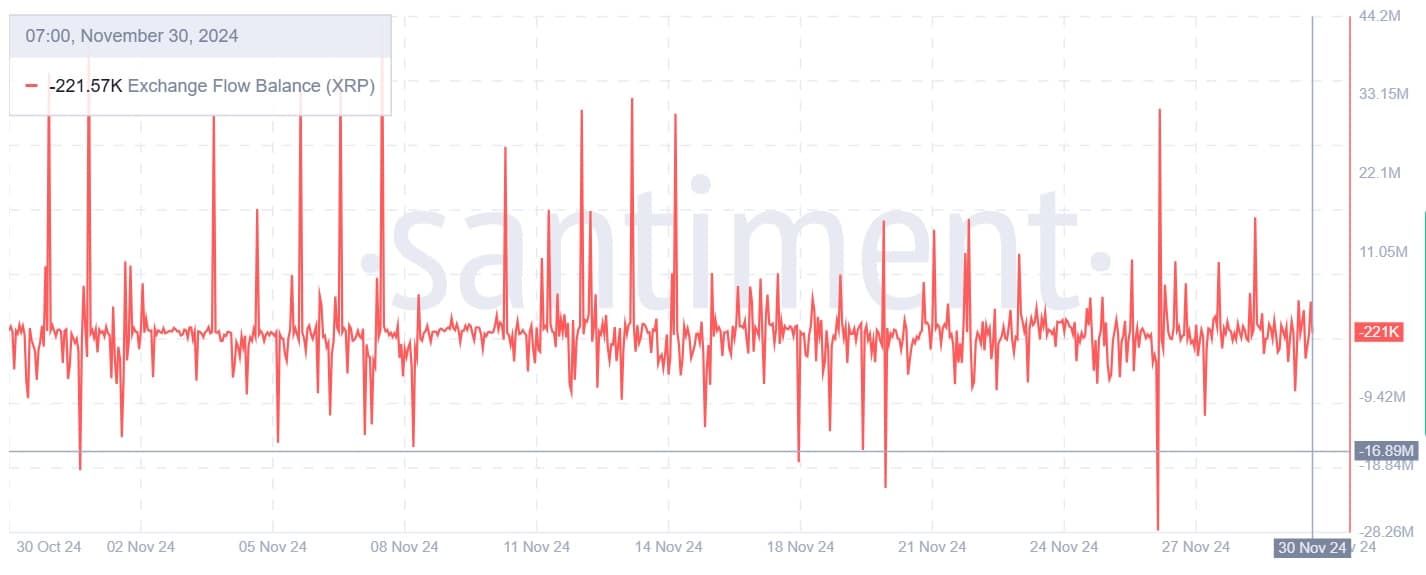

Additionally, Ripple’s Stock-to-Flow balance has turned negative at -221.57k, indicating more outflow from exchanges than inflow.

This means that more traders are moving their assets off exchanges to store in private wallets, associated with hoarding behavior.

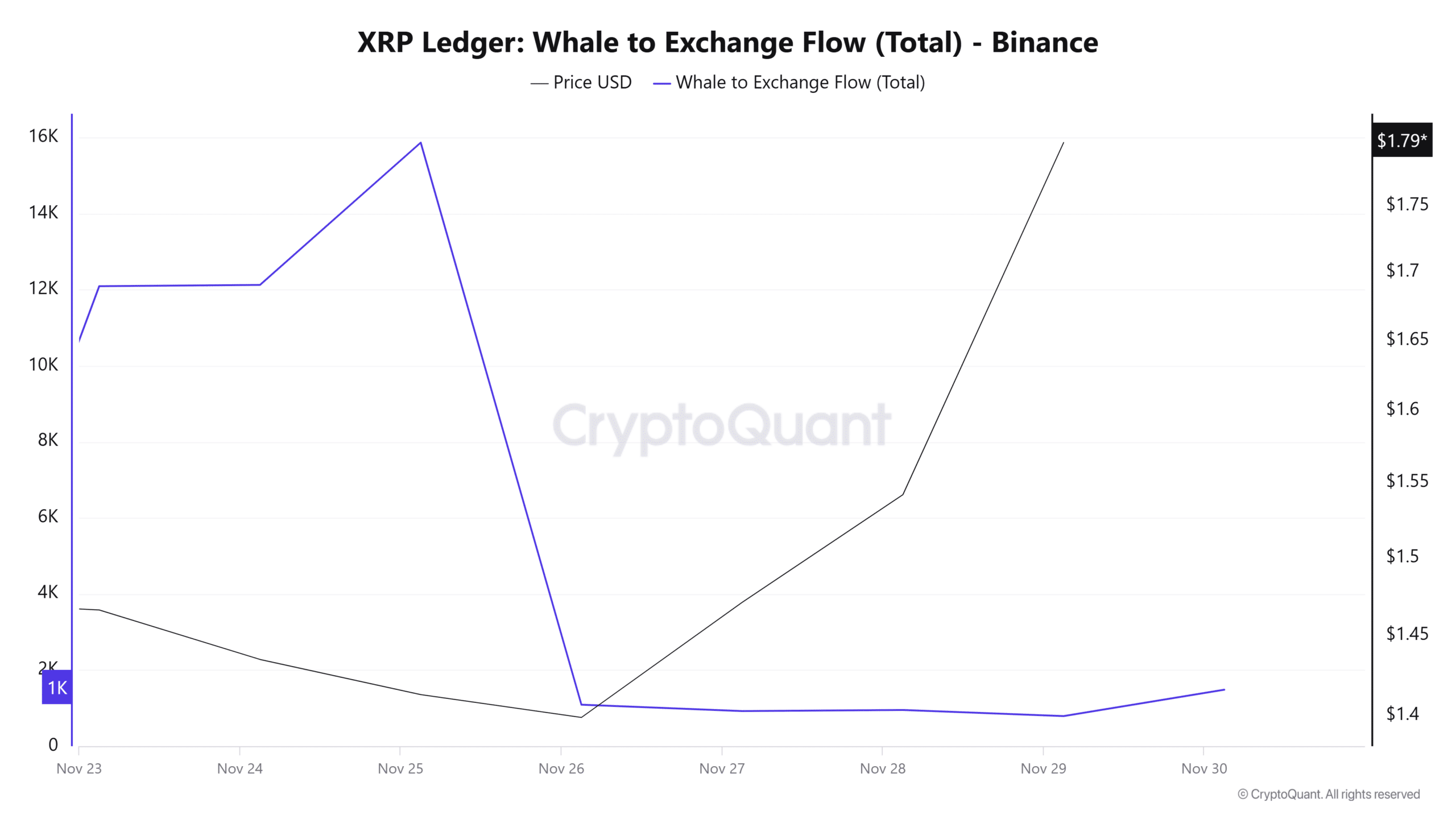

We can see this hoarding behavior, especially among whales. According to Cryptoquant, the Whale-to-Exchange flow has declined from 15.8k to 1.4k. This supports our earlier observation that investors are keeping their assets off exchanges.

What next for the altcoin?

In fact, at press time, XRP was trading at $1.89, marking a 21.08% increase over the past day.

Equally, the altcoin has gained on weekly and monthly charts, hiking by 22.12% and 262.29% respectively.

Despite the upsurge, XRP was still 50.94% below its all-time high of $3.84, recorded seven years ago. This suggests that the altcoin has room for growth and might be undervalued. Circulation NVT has declined from 1353 to 109, signaling this undervaluation.

Read XRP’s Price Prediction 2024–2025

Therefore, these conditions could set XRP for more gains on its price charts. If the momentum holds, after breaking out of the $1.6 resistance level, XRP will find the next resistance around $2.1.