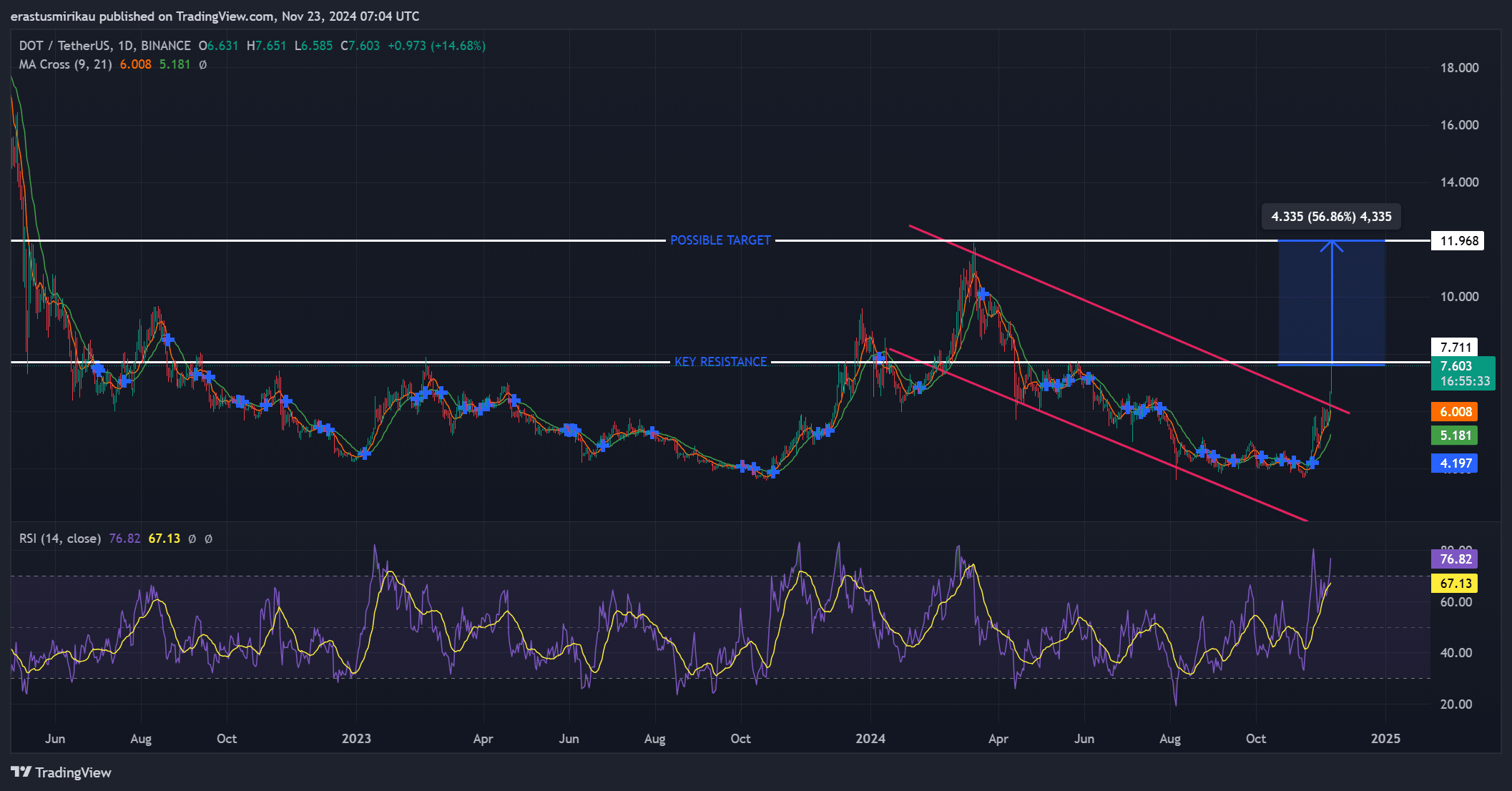

- Polkadot’s breakout above the descending channel highlighted a potential 56.86% upside to $11.96.

- Strong short liquidations and steady social metrics are driving DOT’s bullish momentum.

Polkadot [DOT] has garnered significant attention after breaking out of a long-standing descending channel, suggesting a strong trend shift.

At press time, DOT was trading at $7.55, up 21.94% over the past 24 hours. Its market cap has climbed to $11.49 billion, while 24-hour trading volume has surged 102.86% to $1.40 billion.

This breakout has positioned DOT at a critical juncture as it approaches a key resistance level at $7.71.

What does the breakout indicate for DOT?

Polkadot’s breakout above its descending channel has sparked optimism about its upward trajectory. DOT faces an immediate resistance at $7.71, a level that will determine whether its rally continues.

If this resistance is surpassed, the next target stands at $11.96, offering a potential 56.86% upside.

From a technical perspective, the recent moving average (MA) cross reinforced the bullish momentum. Furthermore, the Relative Strength Index (RSI) was at 76.8, indicating strong buying pressure.

However, traders should monitor RSI closely, as levels above 70 often suggest the asset was nearing overbought conditions, which could lead to short-term pullbacks.

Social engagement and dominance hold steady

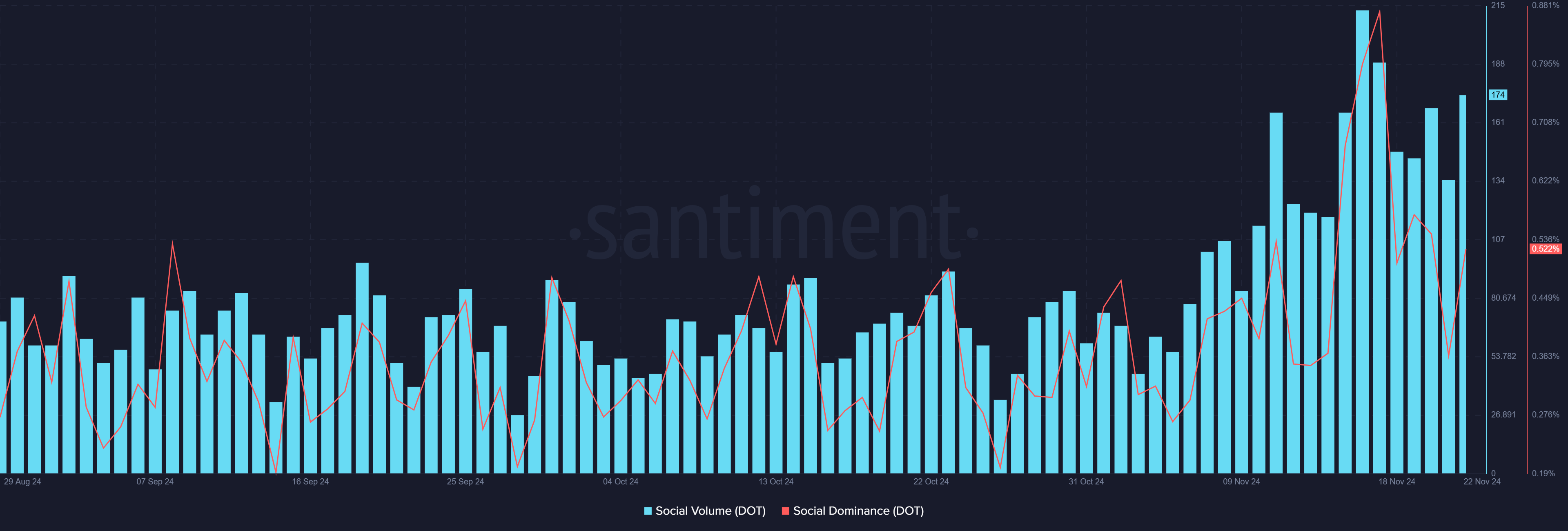

While DOT’s breakout has drawn attention, its social metrics remained moderate. Polkadot’s Social Volume was 174 at press time, and its Social Dominance was 0.52%.

These figures showed stable engagement, highlighting sustained community interest without dramatic spikes.

Consequently, this steady participation could support gradual, organic price growth rather than short-lived speculative activity.

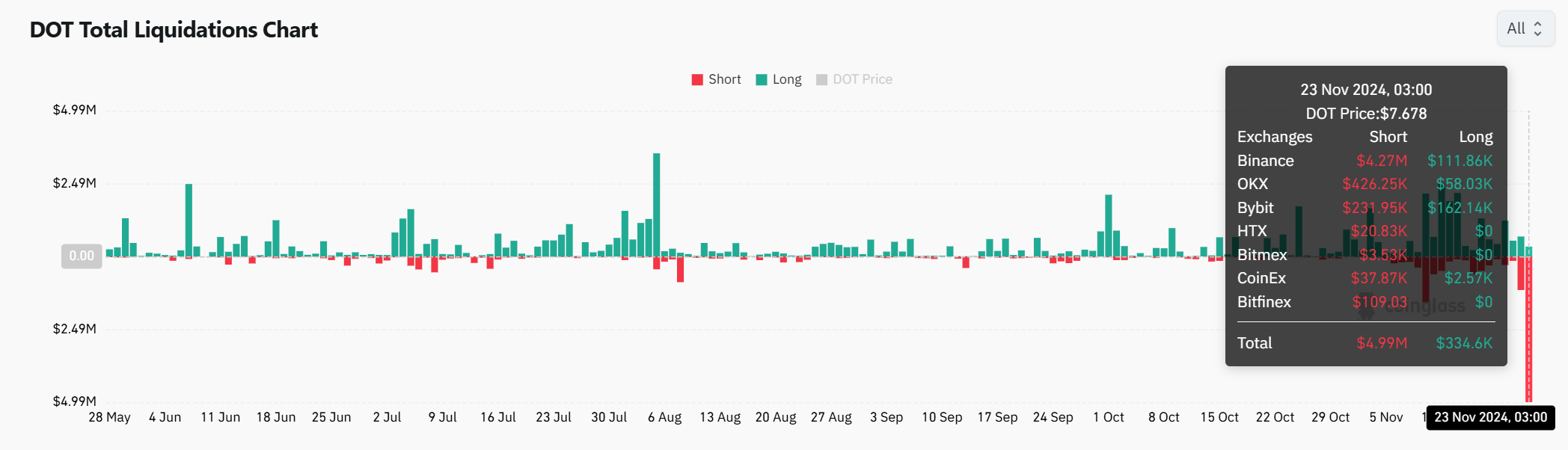

Liquidation data fuels the rally

Polkadot’s bullish movement has been significantly influenced by liquidation activity. Over $4.99 million in short positions have been liquidated in the past 24 hours, compared to just $334,600 in longs.

The imbalance has triggered a short squeeze, compelling bearish traders to close their positions and consequently amplifying DOT’s price momentum.

This has created additional upward pressure, pushing DOT closer to its resistance level.

Read Polkadot [DOT] Price Prediction 2024-2025

Can DOT hit $11.96?

Polkadot’s breakout, combined with strong trading volume, a bullish technical setup, and steady social metrics, points to sustained upward momentum.

If DOT can decisively break above $7.71, a move toward $11.96 becomes highly likely. Therefore, the current metrics suggest Polkadot’s rally is well-supported and poised for further gains in the near term.