- Polkadot’s breakout from a falling wedge pattern hints at a bullish reversal, aiming for $6.5.

- Strong technical indicators, rising social interest support DOT’s upward momentum.

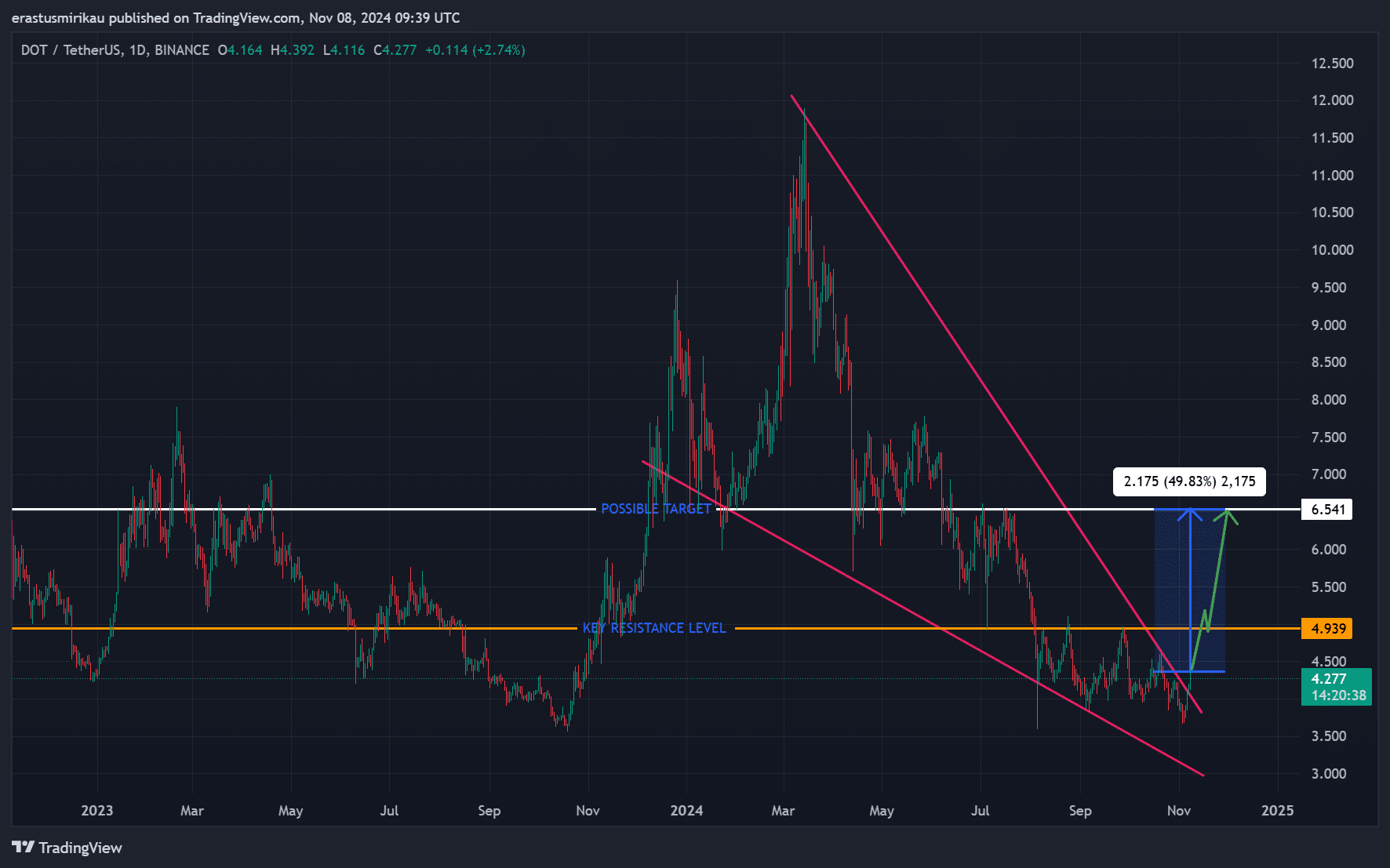

Polkadot [DOT] has recently broken out of a long-standing falling wedge pattern, suggesting a bullish reversal after a prolonged downtrend. Consequently, optimism is building around the potential for a strong rally, with key resistance levels and an ambitious price target in sight.

DOT trades at $4.28 at press time, reflecting a 4.98% increase over the past day. Additionally, the market cap has risen to $6.49 billion, signaling growing investor interest, while 24-hour trading volume has jumped by 7% to $245.96 million.

This uptick in volume and price suggests that the breakout is gaining attention and could potentially set Polkadot up for significant upside if it holds above critical levels.

Chart analysis: Key resistance and possible target for DOT

Breaking out of a falling wedge pattern, DOT has surged past a long-held descending trendline, which had acted as resistance since early 2024. However, the crucial resistance level lies just above the current trading price, around $4.939.

Should DOT clear this level, it could set its sights on the possible target of $6.541, representing a potential 49.83% gain from its breakout point.

Therefore, if Polkadot maintains its current upward momentum and establishes support above $4.939, the potential for reaching $6.5 becomes more plausible.

Technical indicators: Moving averages and low volatility favor bulls

DOT’s daily chart recently displayed a bullish moving average (MA) cross between the 9-day and 21-day MAs, typically a reliable signal of an upward trend.

This MA cross, therefore, aligns with the breakout pattern, strengthening the bullish outlook for DOT. Such a cross often attracts further buying interest, adding fuel to the recent rally.

The current Average True Range (ATR) for DOT stands at 0.197, indicating low volatility. Historically, low ATR values often precede large price swings.

Therefore, this volatility compression suggests that Polkadot could be gearing up for a more substantial move if it sustains its recent momentum.

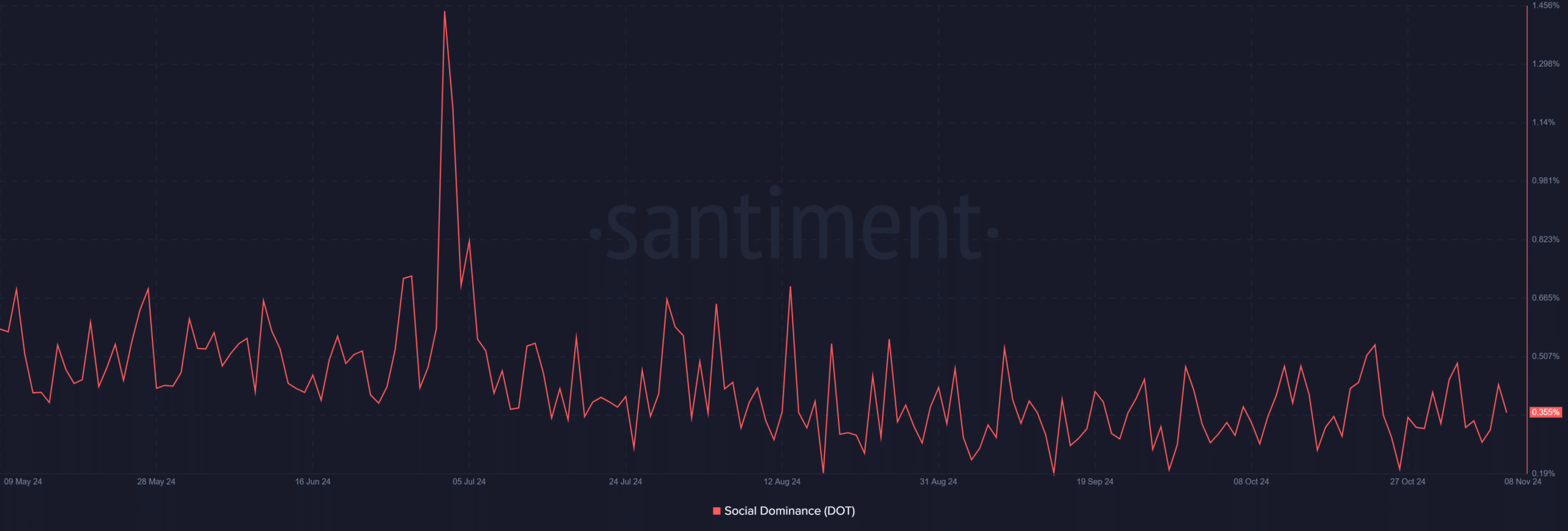

Social dominance: Rising interest in Polkadot

Polkadot’s social dominance, currently at 0.355%, has shown recent spikes, signaling growing interest within the crypto community. Consequently, heightened social engagement often aligns with increased buying pressure, supporting further gains.

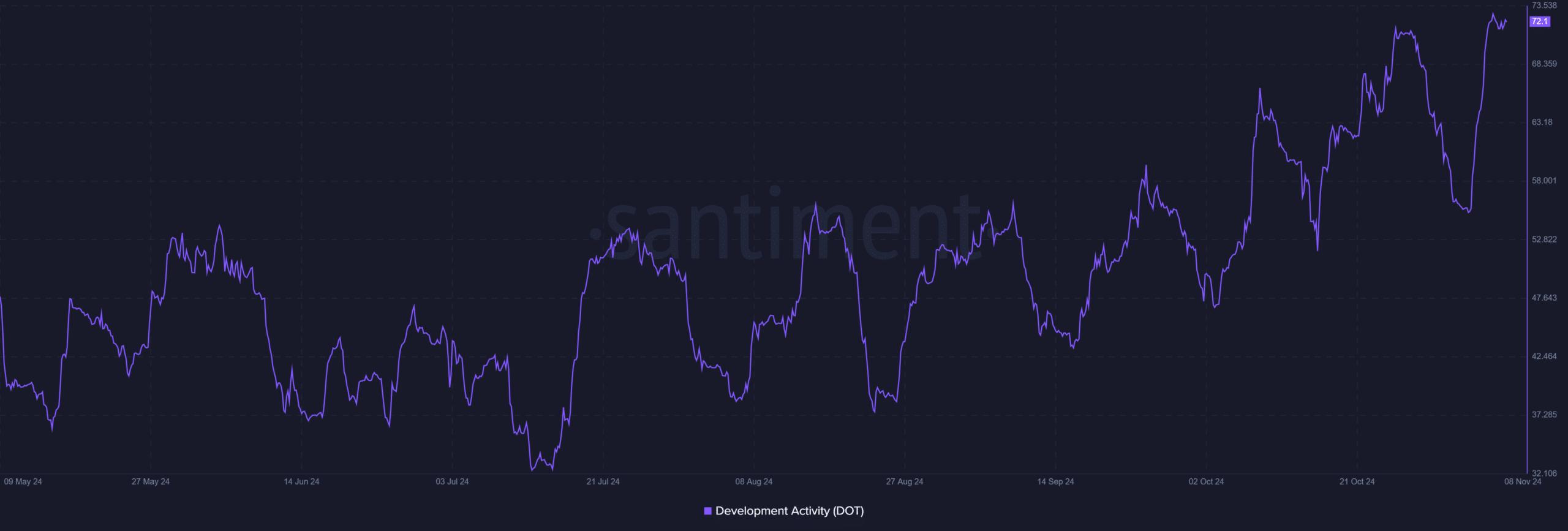

Polkadot’s development activity score was at 72.10, a healthy metric indicating active development on the platform. High development activity often reflects the team’s strong commitment to long-term growth, which can, in turn, boost investor confidence.

Therefore, sustained development activity provides a solid foundation for Polkadot’s ongoing bullish narrative.

Read Polkadot [DOT] Price Prediction 2024-2025

Can DOT reach $6.5 soon?

The breakout from the falling wedge, supportive technical indicators, and rising social and development activity all point to a promising outlook for DOT.

If DOT establishes support above $4.939, a rally to the $6.5 target appears achievable. The next few weeks, therefore, could be pivotal for determining if DOT can reach this bullish milestone.