- PNUT would present a better buying opportunity around the $1 mark.

- The RSI and the OBV showed rising seller dominance in the lower timeframe charts.

Peanut the Squirrel [PNUT] rallied extremely quickly earlier this month but has been steadily contracting in the past week. The psychological $1.5 and $1 levels are key for traders- the former has been ceded as a support level.

The sentiment across the crypto market was strongly bullish as Bitcoin [BTC] traded at $97k, just a stone’s throw away from $100k. Further gains for Bitcoin are likely, but this could see Peanut the Squirrel trapped in a retracement phase over the coming days.

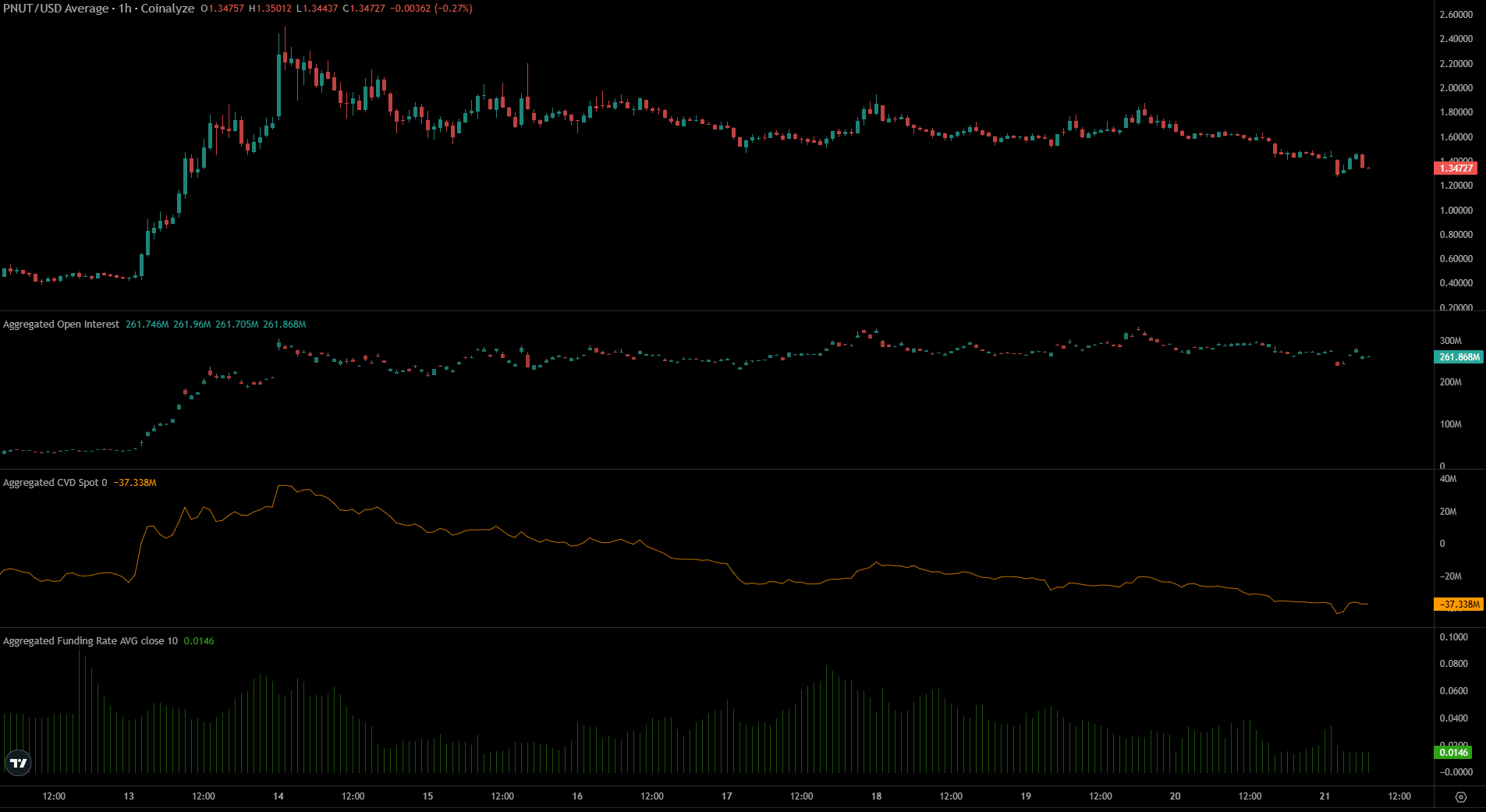

PNUT falls to the 50% retracement level

Source: PNUT/USD on CoinMarketCap

On the 4-hour chart, PNUT was losing steam. The bulls had valiantly defended the $1.5 zone since the 14th of November. The onslaught from the bears lasted a week, and they succeeded in pushing prices downward.

The Fibonacci retracement levels outlined $1.29, $1, and $0.6 as key support levels for Peanut meme buyers. The RSI on the 4-hour chart had fallen below the neutral 50 level to show that momentum was favorable for the bears.

This could see a downward move toward $1 and possibly $0.6. The OBV agreed with this finding. It was unable to stay above the past week’s lows. This OBV slump highlighted increased selling pressure and increased the chances of a retracement toward $1.

Speculative markets faced short-term bearishness

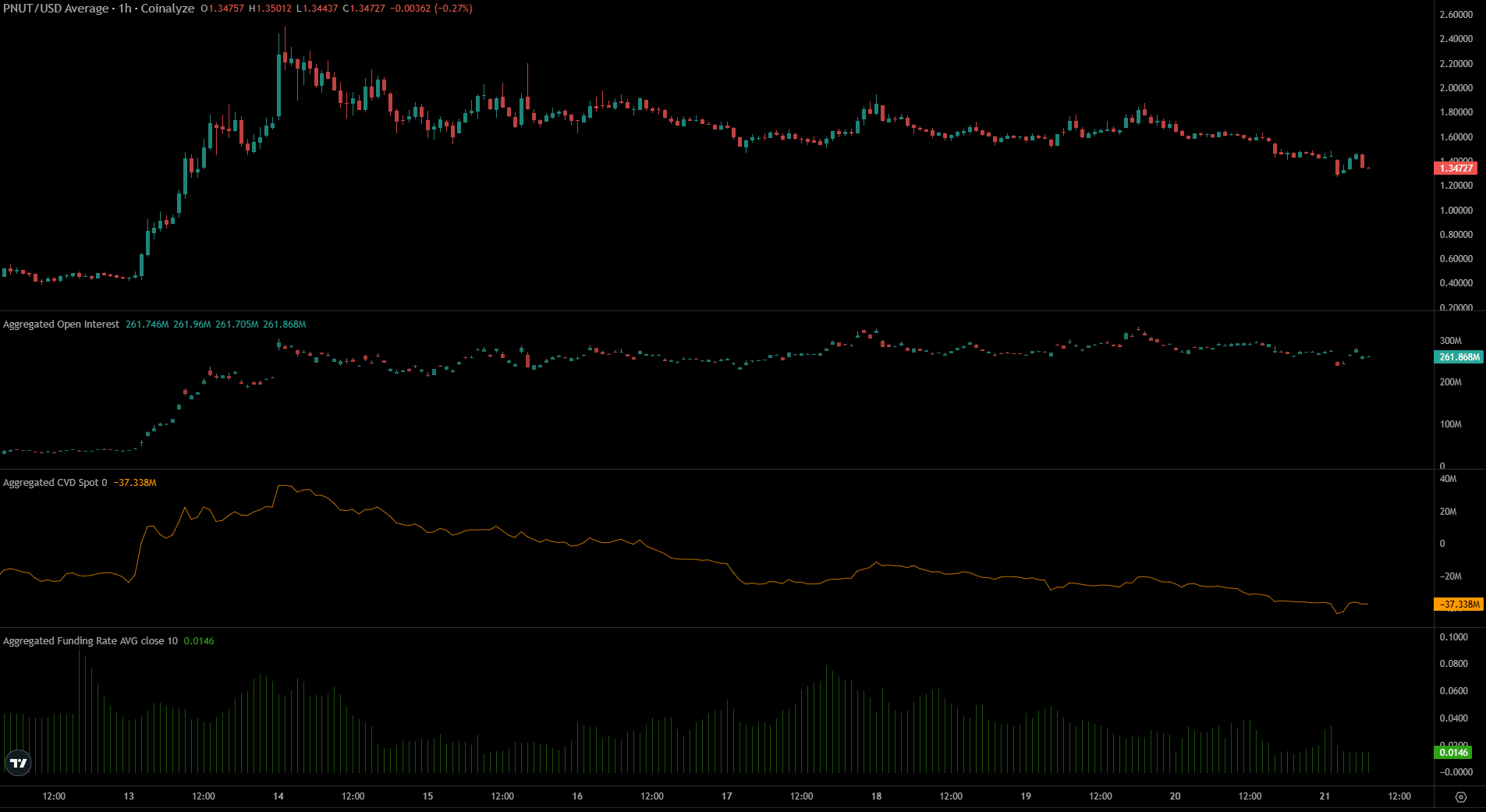

Source: Coinalyze

The spot CVD has been in decline over the past week, suggesting that spot market demand has been weakening. This finding aided the one from the OBV, showing that short-term bias was in favor of the sellers.

The funding rate has been falling, and the Open Interest has slowly dwindled from $318 million to $261 million in the past four days.

Read Peanut the Squirrel’s [PNUT] Price Prediction 2024-25

Together, they showed a drop in bullish conviction in the lower timeframes. The slow but steady PNUT losses meant that speculators were not eager to go long, even though Bitcoin was approaching the $100k mark.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.