- Pepe surged by 6.5% over the past week, although bearish sentiment persisted.

- A whale withdrew 150 billion tokens from Binance.

Since hitting a new ATH of $0.00025, Pepe [PEPE] has formed a flagpole, a bearish pennant, signaling a potential continuation of a downtrend.

As such, the memecoin has dropped from $0.000025 to a low of $0.0000173 indicating a strong downward momentum.

In fact, at the time of writing, Pepe was trading at $0.00001963. This marked a 6.5% increase over the past 24 hours. Also, the memecoin has surged by 105.02% on monthly charts.

Despite this uptick, the memecoin remains approximately 23.24% below its ATH recorded two weeks ago.

As Pepe continues to decline, it has offered buying opportunities for large holders and retail traders in equal measures. Equally, some whales have turned to hoarding as they avoid selling in losses.

Whale withdraws 150 billion tokens

According to On-chain tracker Lookonchain, one of the whales who have turned to hoarding has withdrawn 150 billion Pepe tokens from Binance.

These tokens are worth $2.94 million based on the current rates. When whales withdraw from exchanges, it suggests they are moving their assets to private wallets for long-term holding. Such a move indicates that they are not intending to sell in the short term.

With this activity, it seems the whale is preparing to keep the tokens until they are profitable.

What do Pepe’s charts say

While whale transfers to private wallets are usually a bullish signal, other market indicators tell a different story.

For starters, Pepe’s Chaikin Money Flow (CMF) has declined, hitting a negative value over the past week. Such a sustained dip shows that sellers are starting to dominate the market while buyers are losing momentum.

This is further evidenced by the fact that ADX has surged over the past week to 38 while +DI has declined to 23 over the same period. When directional indexes are set like this, it shows that the downward momentum is strengthening while the uptrend is exhausted.

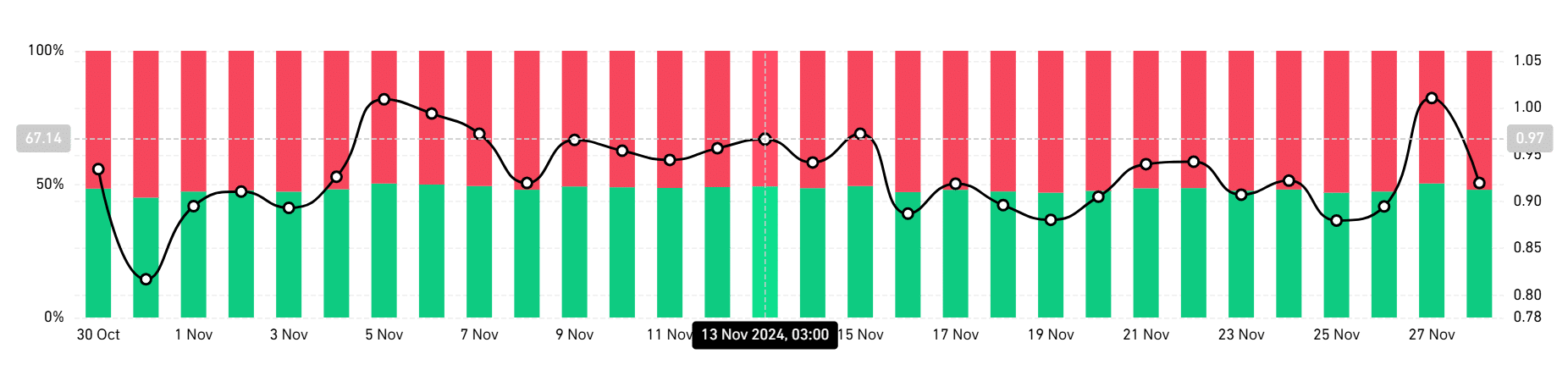

We can further see this loss of momentum among buyers, as most investors are now bearish. According to Coinglass, Long/Short Ratio, shorts position holders are dominating the market.

This implies that most of the participants are going short and expect the prices to decline.

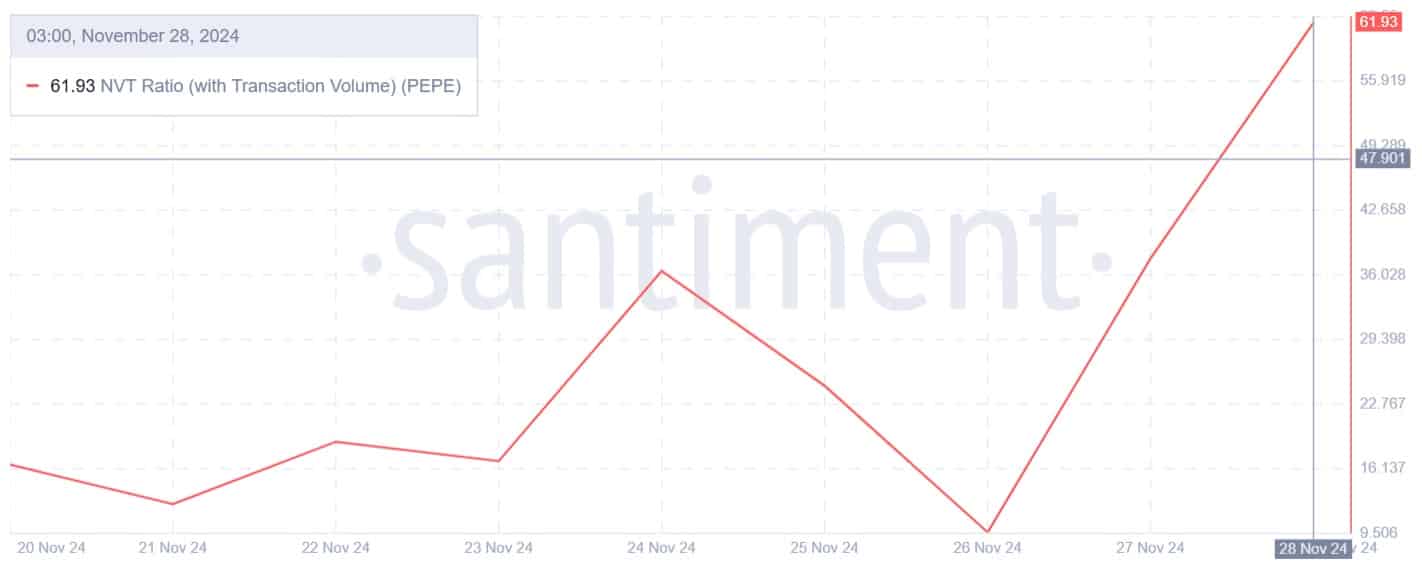

Pepe’s NVT Ratio has spiked from 9.6 to 61.93 at press time. This massive spike suggests that the memecoin may be overvalued, and the price rise is driven by speculation. On-chain activity has declined as prices rise, indicating weak market fundamentals relative to market cap.

Read Pepe [PEPE] Price Prediction 2024-2025

Although Pepe has gained on daily charts, bearish sentiments remain strong. If bears take control of the market, the memecoin could decline further on price charts. If this happens, Pepe will find support around $0.00001720.

Notably, if whales continue transferring to private wallets, Pepe could reclaim the $0.00002 resistance level.