- Leading platforms such as Binance, Upbit, and Wintermute have recently added to their ONDO positions.

- Meanwhile, derivative traders engaging in sell-offs may find their activity short-lived as market sentiment shifts.

Despite last week’s marginal decline of 0.46%, Ondo [ONDO] has reversed course, gaining 3.64% on the daily chart. This rally has pushed its cumulative monthly gain to an impressive 49.42%, underscoring strong bullish momentum.

The rising accumulation by whales, combined with a tightening supply driven by spot traders, is set to create upward pressure on ONDO’s price.

As a result, AMBCrypto analysis finds that derivative sellers—who had previously benefited from bearish trends—may now face mounting losses if the bullish sentiment persists.

Whales continue accumulating ONDO

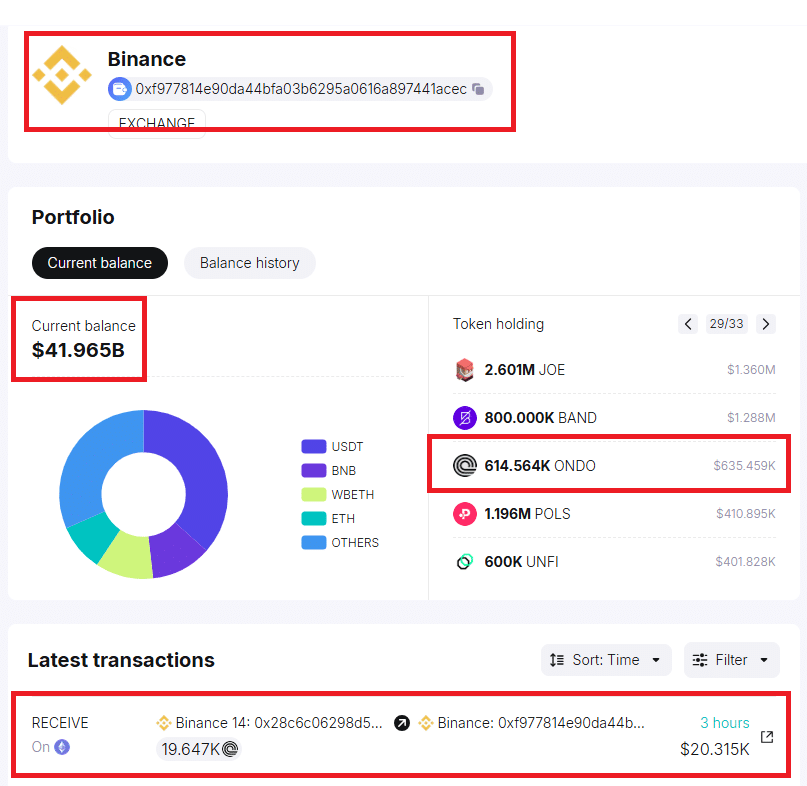

According to a Twitter analyst named Jacky, top crypto platforms have been deliberately increasing their ONDO holdings.

Upbit, South Korea’s largest cryptocurrency exchange, is among them. Over the last five months, it has steadily expanded its position, now controlling 1.86% of ONDO’s total supply.

In Jacky’s words:

“[Upbit has gone] from 50 million $ONDO to 185 million ONDO, accounting for 1.86% of the total supply.”

Similarly, Binance, which ANB Crypto recently reported as having accumulated ONDO, has continued adding to its holdings, increasing its balance from approximately 594,000 ONDO to 631,000 ONDO in just a few days.

Wintermute, a prominent cryptocurrency market maker, has also joined the accumulation spree alongside the other major players mentioned.

Generally, when whale accumulation occurs, it suggests that large holders are buying more of the token ahead of a potential rally. This typically drives the asset’s price higher, leading to greater profitability for those holding ONDO.

Supply squeeze incoming

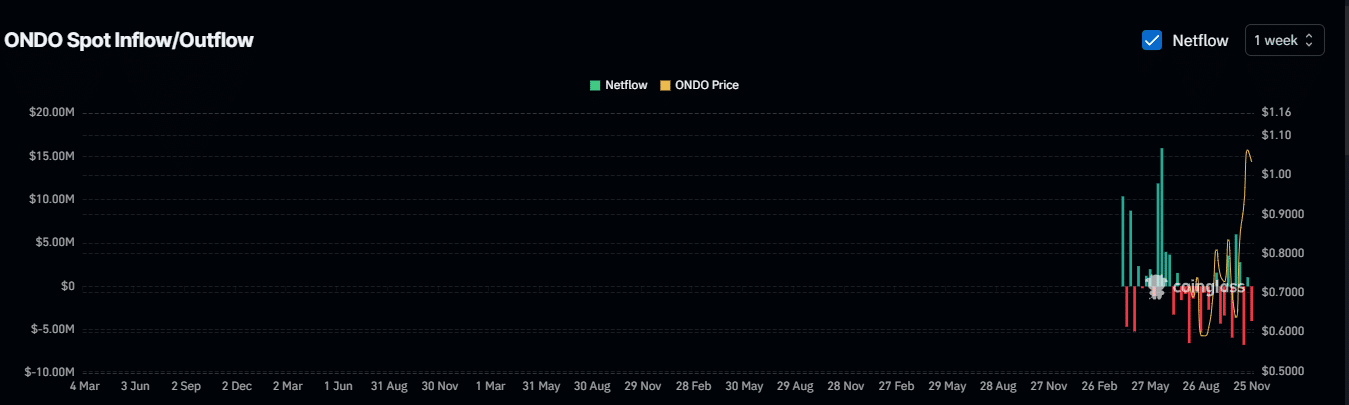

Spot traders are reducing the amount of ONDO available on exchanges, as the Exchange Netflow for the token has turned negative according to Coinglass.

This indicates that more ONDO is being withdrawn than deposited, leading to reduced availability of the asset on trading platforms and increasing the likelihood of a supply squeeze.

At press time, this segment of the market has moved approximately $4.10 million worth of ONDO in the past week to private wallets, showing a strong long-term commitment to holding the token.

If this trend continues, ONDO’s price rise could finally gain momentum as reduced supply on exchanges meets increasing demand.

Short derivative traders may face losses soon

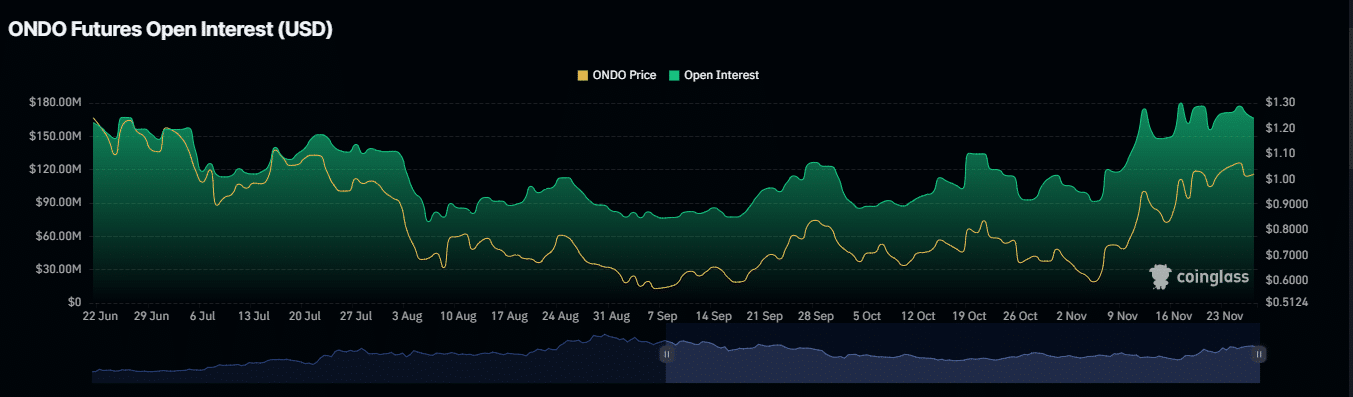

In the last 24 hours, approximately $297,180 ONDO worth of long positions were liquidated as the market’s directional bias briefly shifted to bearish.

Read Ondo’s [ONDO] Price Prediction 2024–2025

This aligns with the Open Interest—a metric that measures market sentiment based on the number of active, unsettled derivative contracts—which has declined. Notably, there is now an increase in unsettled short contracts.

Given the current sentiment among whales and spot traders, combined with ONDO’s daily gains of 3.46%, derivative traders betting on short positions may soon face significant losses if the bullish momentum continues.