- Whale bought 416 million MEW for 10K SOL, sells for 16.27K SOL.

- Will profit-taking slow down MEW momentum?

After the whale’s exit, Cat in a dogs world [MEW] market performance shows moderate volatility. The token traded between a 24-hour low of $0.009228 and a high of $0.009704, reflecting cautious market sentiment.

At press time, MEW was 25.4% down from its all-time high of $0.01288, achieved on 17th November, just 12 days ago. The big question is, does the profit-taking set the highs for MEW coin?

Data from Lookonchain revealed that a whale sold 416.8 million MEW tokens for 16,270 SOL worth $3.94 million, securing a profit of 6,270 SOL which is $1.52 million.

The tokens were originally purchased on 15th July for 10,000 SOL using a Dollar-Cost Averaging (DCA) strategy.

The selloff has seen mild activity in MEW’s price as the market reacted to the sudden influx of tokens. This activity triggered increased volatility and trading volumes, highlighting how whale transactions can significantly influence token prices and market stability.

What do the Charts say?

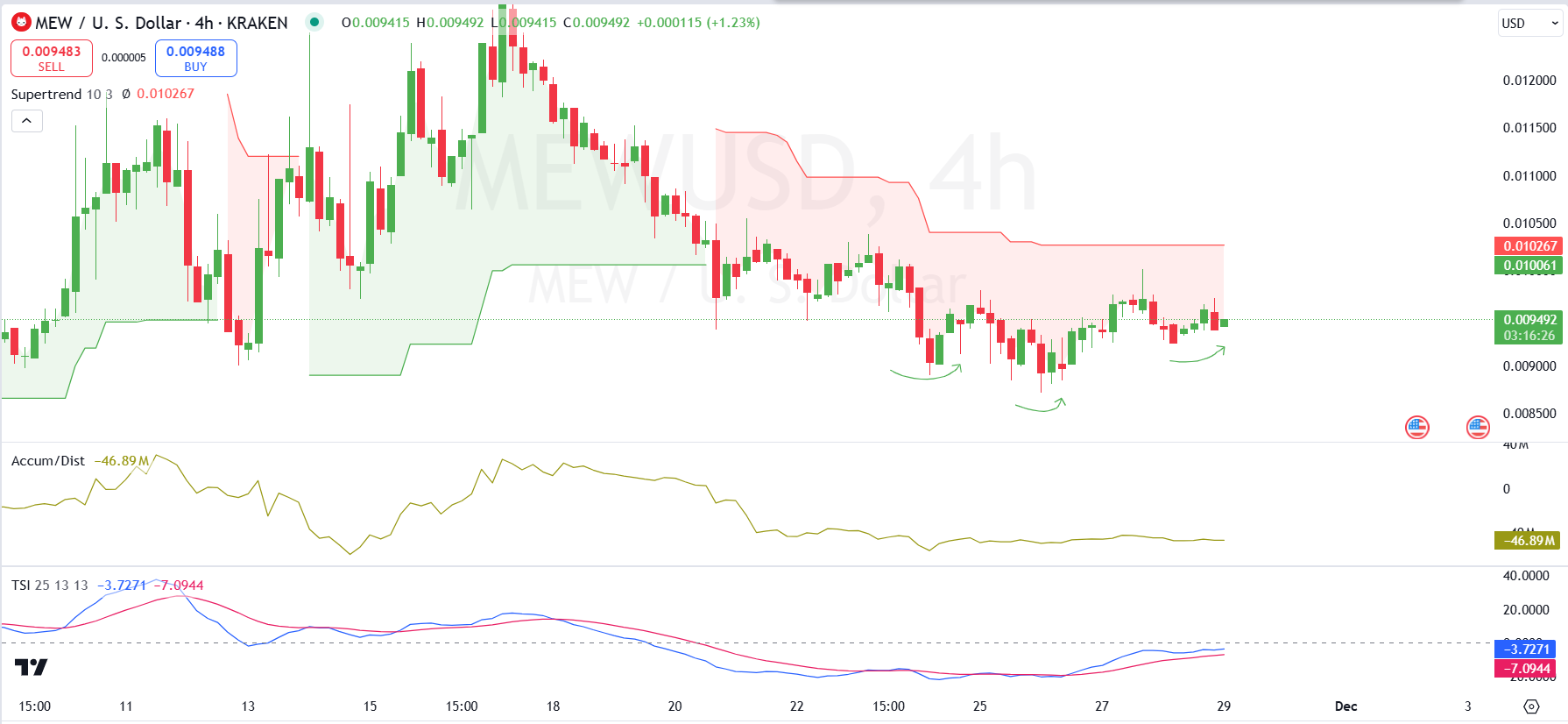

An AMBCrypto analysis of the MEW/USD 4-hour chart reveals a consolidating price action following recent market volatility.

The price is currently hovering around $0.0095, showing attempts to recover from Tuesday $0.0088 lows.

The Supertrend indicator highlights a bearish trend as long as the price remains under the $0.0102 resistance zone, marked by the red band. However, recent higher lows suggest growing bullish momentum.

The Accumulation/Distribution shows a decline in demand with a value of -46.89M, indicating ongoing sell pressure.

Despite this, the presence of multiple support bounces near the $0.009 level signals that buyers are defending this key area.

If the price successfully holds above $0.009, it could build a foundation for a bullish reversal.

Should MEW break above the $0.01 level, the trend may flip bullish, targeting an upside move toward $0.012.

The True Strength Index, while currently bearish, is approaching a potential crossover, which would confirm strengthening bullish momentum.

MEW price struggles as liquidity and interest fall

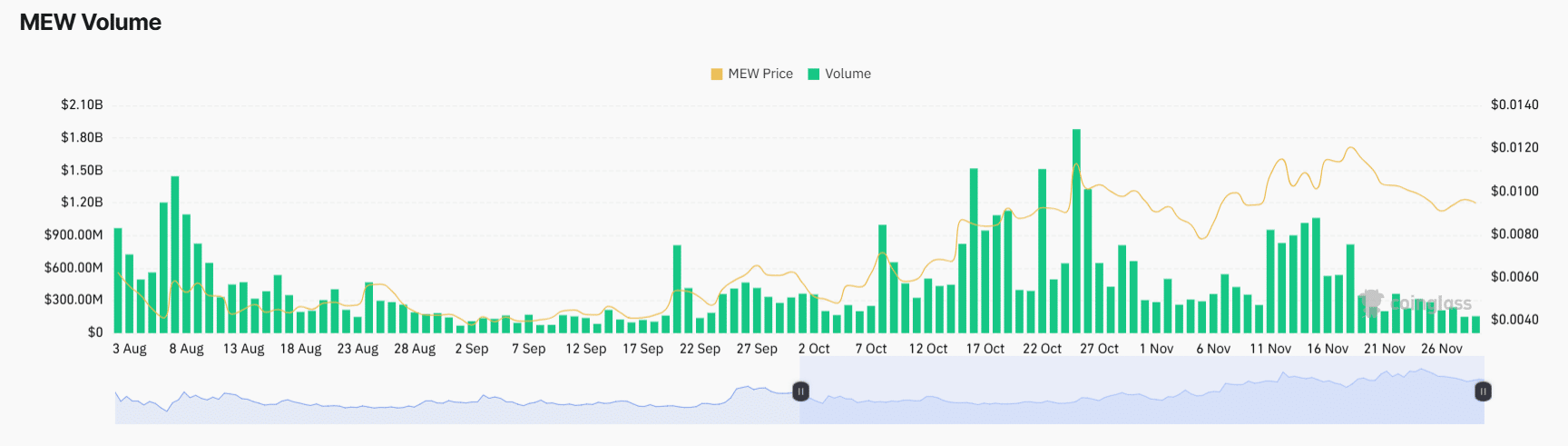

MEW’s trading volume experienced notable spikes during price rallies, such as in early August when volume exceeded $1.8 billion, and late October, reaching over $1.5 billion.

These periods of high activity coincided with price increases, demonstrating strong buying interest.

However, since mid-November, trading volume has declined significantly, averaging below $500 million, as the price dropped from its peak of approximately $0.013 to its current range around $0.009.

The decline in volume shows reduced market participation and lower liquidity.

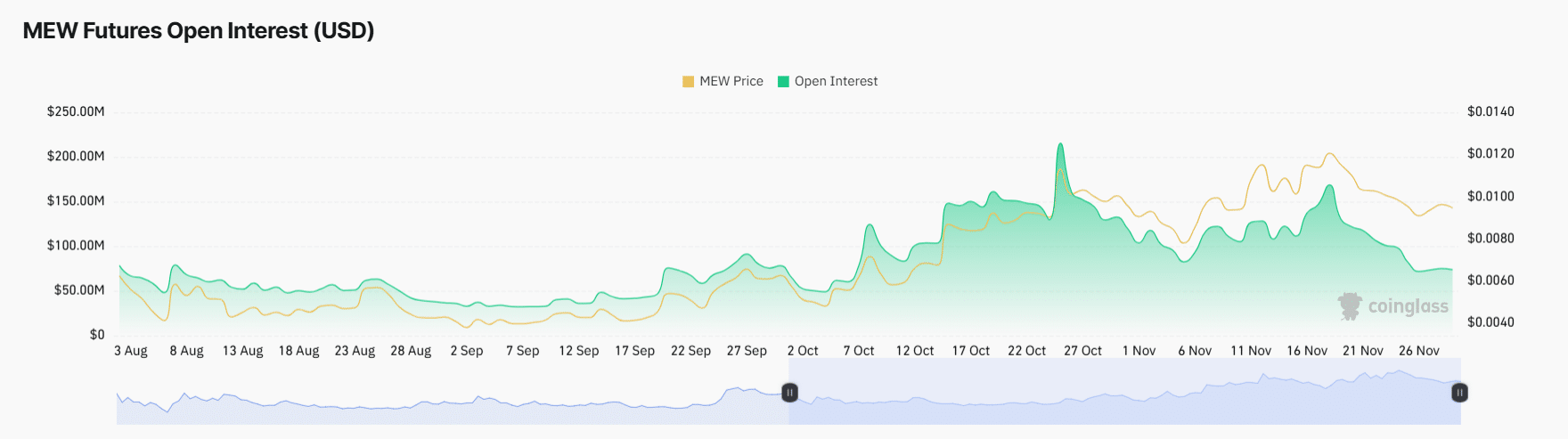

Open Interest in MEW Futures mirrored the price action, peaking at approximately $230 million during late October’s rally.

This rise in OI indicated strong speculative interest, with traders opening positions during the price surge.

However, OI has since declined alongside the price, falling below $50 million by late November.

Realistic or not, here’s MEW’s market cap in BTC’s terms

This reduction reflects a lack of new positions being opened and traders closing existing contracts, a sign of decreased confidence in sustained upward momentum.

The combined data highlights a bearish shift in market sentiment. These trends suggest that for MEW to regain upward momentum, it requires a significant increase in both trading activity and speculative interest.