- Data revealed a pattern of capital rotation from one altcoin to another, with minimal liquidity entering the overall altcoin market this cycle

- A significant decline in liquidity within the broader crypto market has also contributed to this trend

Over the last 24 hours, the larger cryptocurrency market has seen little movement, registering only a 0.11% hike. On the contrary, trading volume dropped sharply to $153.08 billion – Marking a 3.57% decline.

Several major altcoins, including Ethereum (ETH), XRP, and Dogecoin (DOGE), have fallen significantly on the charts too, falling by 0.81%, 0.54%, and 0.34%, respectively, within the same period.

While the market appears to be entering a recovery phase, with assets slowly regaining lost value, new insights suggest that an altseason—A period where altcoins significantly outperform Bitcoin—might remain delayed.

This delay can be attributed to a lack of significant changes in key market metrics, including liquidity flow and overall market sentiment.

Capital redistribution keeps altcoins under pressure

According to an analyst on Twitter, altcoins remain in a stalled phase, with limited liquidity flowing into these assets. This has inherently delayed the much-anticipated altseason, during which altcoins typically see significant upward momentum.

Charts presented revealed that altcoin market capitalization—represented on the right—has barely surged, with the same just slightly above $1.6 trillion. This seemed comparable to the peaks observed during the 2021–2022 altcoin rally.

On the contrary, Bitcoin exhibited a different trend. Its market capitalization has nearly doubled since hitting its previous all-time high in 2022, with the same now exceeding $2 trillion.

This means that the current market cycle is being led by Bitcoin, with the majority of new investment capital directed towards it, rather than altcoins. This shift can be attributed to the entry of institutional investors, with the launch of Spot Exchange-Traded Funds (ETFs) in the United States.

The stagnation of altcoin market capitalization suggests that funds are merely rotating between different altcoins, with little to no new liquidity entering the market.

If this trend persists, it would mean that the altseason will remain delayed. Altcoins may see only minor gains or isolated rallies based on prevailing market narratives.

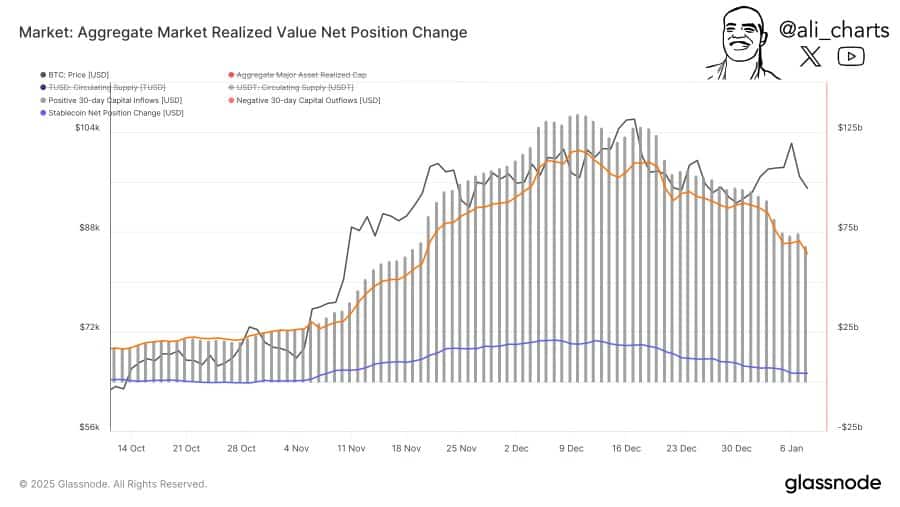

Meanwhile, the broader cryptocurrency market has also seen a sharp decline in liquidity. According to Glassnode’s Aggregate Realized Value Net Position Change metric, which measures liquidity inflows and outflows, liquidity has dropped by 49% over the past month, falling from $134 billion to $68 billion.

This liquidity crunch is evident in the market’s overall state, as many altcoins are yet to recover to their previous all-time highs, last reached in late 2024.

High Bitcoin dominance delays altcoin momentum

A key indicator for an altcoin rally has traditionally been a significant decline in Bitcoin dominance, often followed by successive market-wide gains for altcoins.

Bitcoin dominance measures the proportion of the total cryptocurrency market capitalization held by Bitcoin relative to altcoins. When Bitcoin dominance increases, altcoins typically underperform as capital flows back into Bitcoin. This trend is currently evident in the market.

At press time, Bitcoin dominance on CoinMarketCap stood at 56.72% – A relatively high value. A drop to around 45% would point to a shift in market control towards altcoins, potentially sparking an altcoin rally.

However, until key metrics such as Bitcoin dominance, capital inflow into the market, and liquidity in altcoins improve, the long-anticipated altseason will remain delayed.