- A breakout above the bull pattern could result in a 60% price hike on the charts

- Metrics like trading volume also hinted at a trend reversal

Dogwifhat [WIF] investors faced a lot of trouble last week as the memecoin’s price dropped significantly on the charts. However, there may be good news soon, especially since the altcoin’s latest bearish trend is expected to end soon with WIF testing a crucial support level.

A successful test could lure bulls and help the memecoin reclaim its lost value in the coming days.

Are WIF’s troubles over?

The popular memecoin’s bears dominated market bulls last week as the crypto’s price dropped by 7%. This bearish trend continued over the last 24 hours too, with WIF losing 4% of its value.

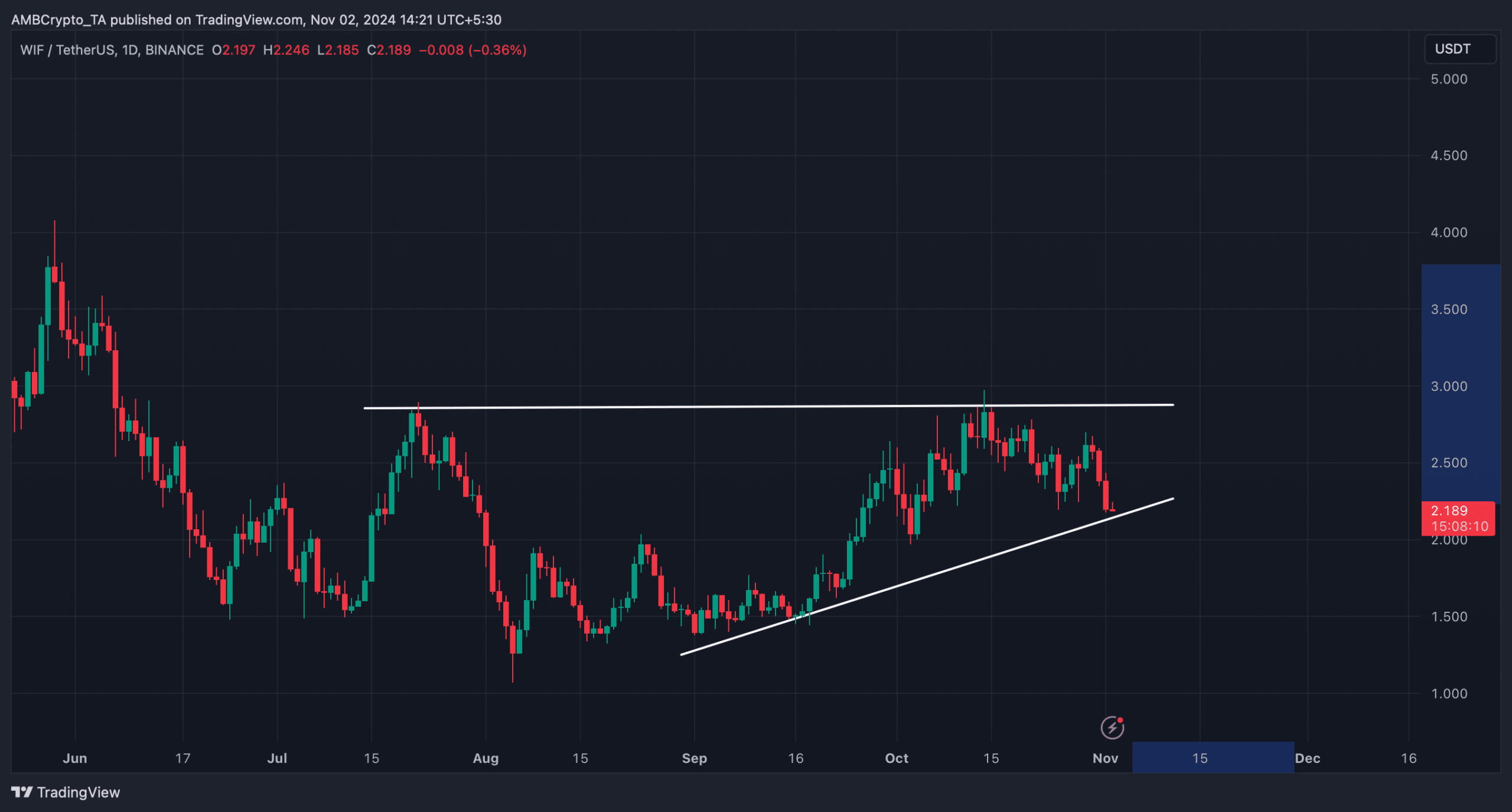

However, investors shouldn’t lose hope as a bullish pattern seemed to appear on WIF’s chart. In fact, AMBCrypto’s analysis of the memecoin’s daily chart revealed the appearance of a bullish ascending triangle pattern.

The pattern first appeared in late July and since then, WIF’s price has been consolidating inside it. In fact, the most-recent downturn could just be a result of this consolidation.

At press time, WIF was testing the support for this pattern. In case the memecoin manages to do so, then the bearish trend might end and push WIF towards the resistance. A successful breakout above this pattern could as well result in a 60% price hike in the coming weeks or months.

Therefore, investors must remain patient and see which way WIF heads.

What to expect from WIF

Since the chances of WIF consolidating inside the pattern seemed high at press time, AMBCrypto then assessed Dogwifhat’s on-chain data.

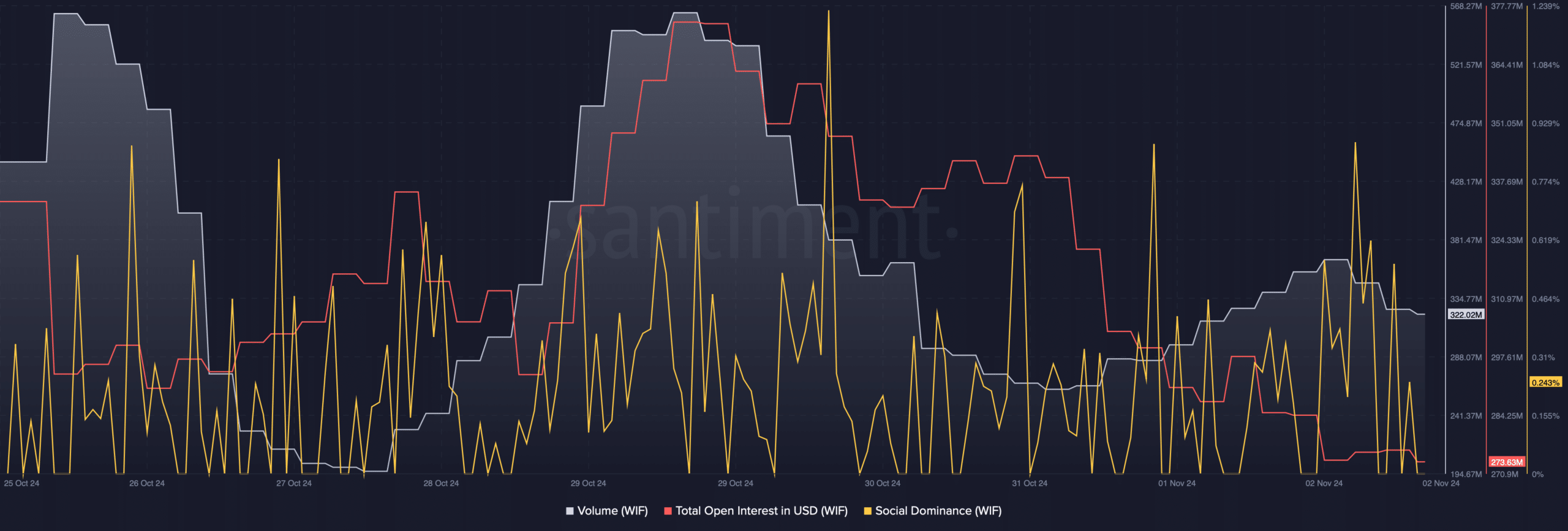

As per our analysis of Santiment’s data, WIF’s social dominance remained relatively high, reflecting its popularity in the crypto space. Other datasets also looked pretty optimistic.

For instance, WIF’s trading volume declined along with its price. The memecoin’s Open Interest also followed a similar pattern. Whenever the OI drops, it hints at a change in the ongoing price trend. Taken together, both these metrics pointed to a bullish trend reversal soon.

Finally, our assessment of Hyblock Capital’s data revealed yet another metric that pointed to a major trend reversal.

Consider this – WIF’s sell volume declined from 100 on 01 November to 9.2 on 02 November. A drop in the metric means that the market is losing interest in a security and a reversal may be coming soon.

Is your portfolio green? Check the dogwifhat Profit Calculator

However, nothing can be said with utmost certainty considering the volatile and unpredictable nature of the crypto market. A sustained price drop could push WIF down to $1.9.

In case of a slip below that support level, investors might witness a fall to $1.4.

![Mapping how and why Dogwifhat [WIF] might surge by 60%](https://hamsterkombert.com/wp-content/uploads/2024/11/Mapping-how-and-why-Dogwifhat-WIF-might-surge-by-60.webp.webp)