- Whale activity and rising metrics signal bullish momentum as VIRTUAL targets $3.58 resistance.

- Market fundamentals strengthened with 1,290 active addresses and a transaction count of 763.

In a dramatic move, an unknown investor withdrew 854 Ethereum [ETH], worth $2.9 million, from Coinbase, acquiring 851,387 VIRTUALs, sparking speculation about the token’s future potential.

This significant purchase raises questions about whether Virtual Protocol [VIRTUAL] is gearing up for a breakout.

With the crypto market showing mixed trends, the surge in activity and key metrics of VIRTUAL have captured the attention of traders and analysts alike.

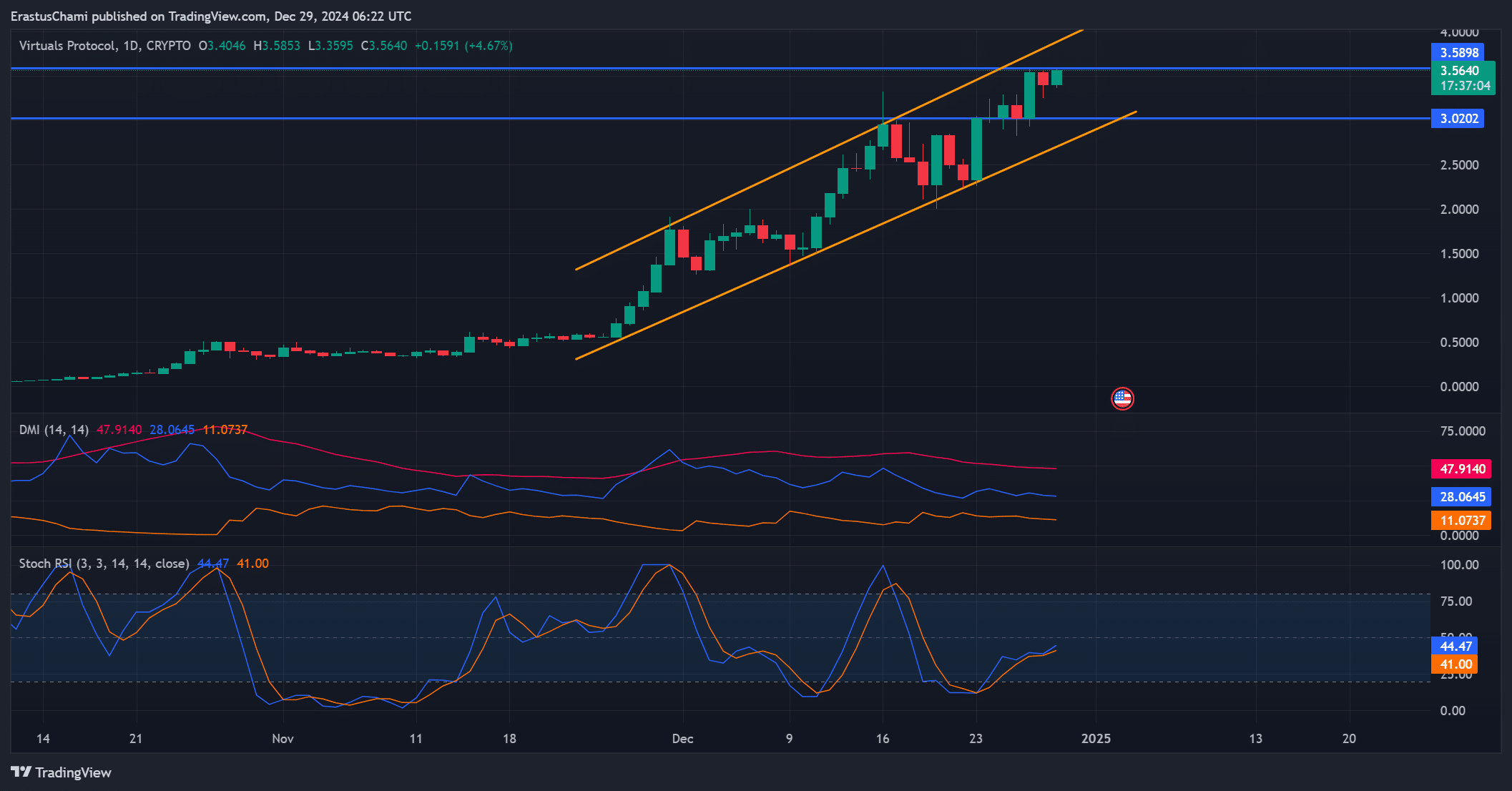

VIRTUAL price analysis shows steady strength

At press time, VIRTUAL was trading at $3.57, reflecting a 3.40% rise in the past 24 hours.

The token continued to follow a bullish trajectory within an ascending channel, with key resistance at $3.58.

The Directional Movement Index (DMI) showed a strong buying trend, with the +DI at 28 significantly outpacing the -DI at 11.

Furthermore, the Average Directional Index (ADX), at 47, indicated robust trend strength. Additionally, the stochastic RSI at 44.47 suggested that the token was nearing overbought territory, signaling potential short-term caution.

However, the consistent upward movement indicated momentum, and any corrections could provide opportunities for accumulation.

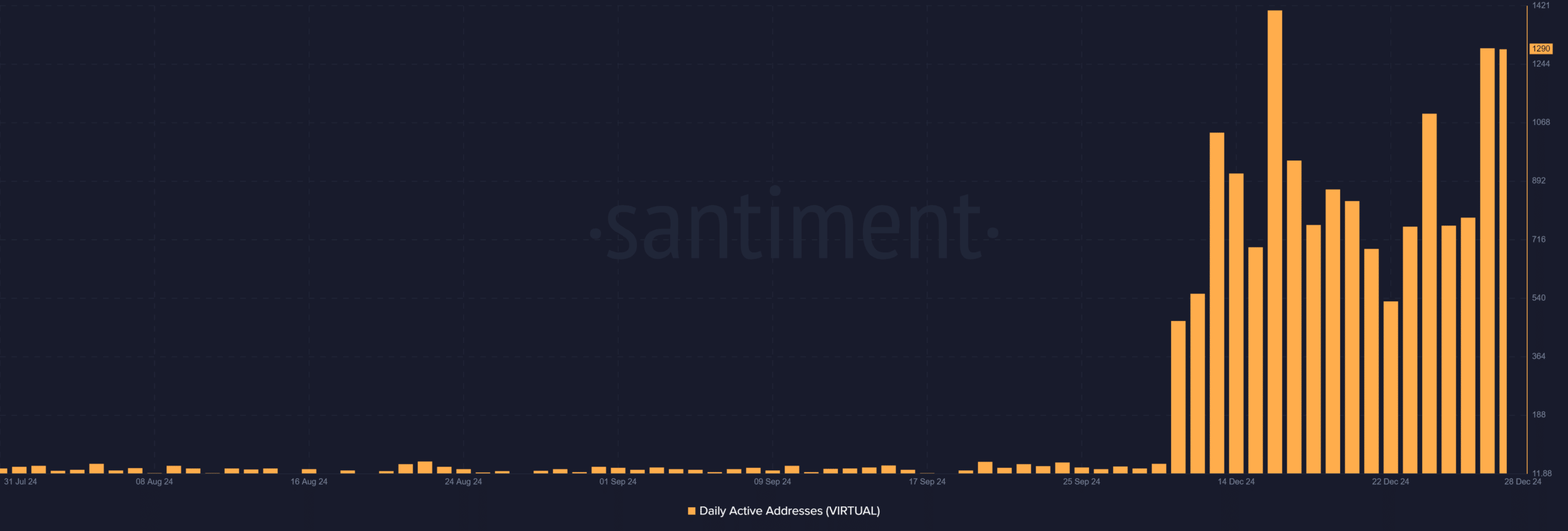

Daily active addresses show significant growth

The surge in daily active addresses reflected increasing network activity, with a recent high of 1,290 addresses.

This sharp rise indicated growing user engagement, which could stem from speculative interest or expanding use cases within the Virtual Protocol ecosystem.

Sustained increases in active addresses often signify strengthening fundamentals for a token. Consequently, the rising on-chain activity supported the narrative of a potential bullish breakout for VIRTUAL.

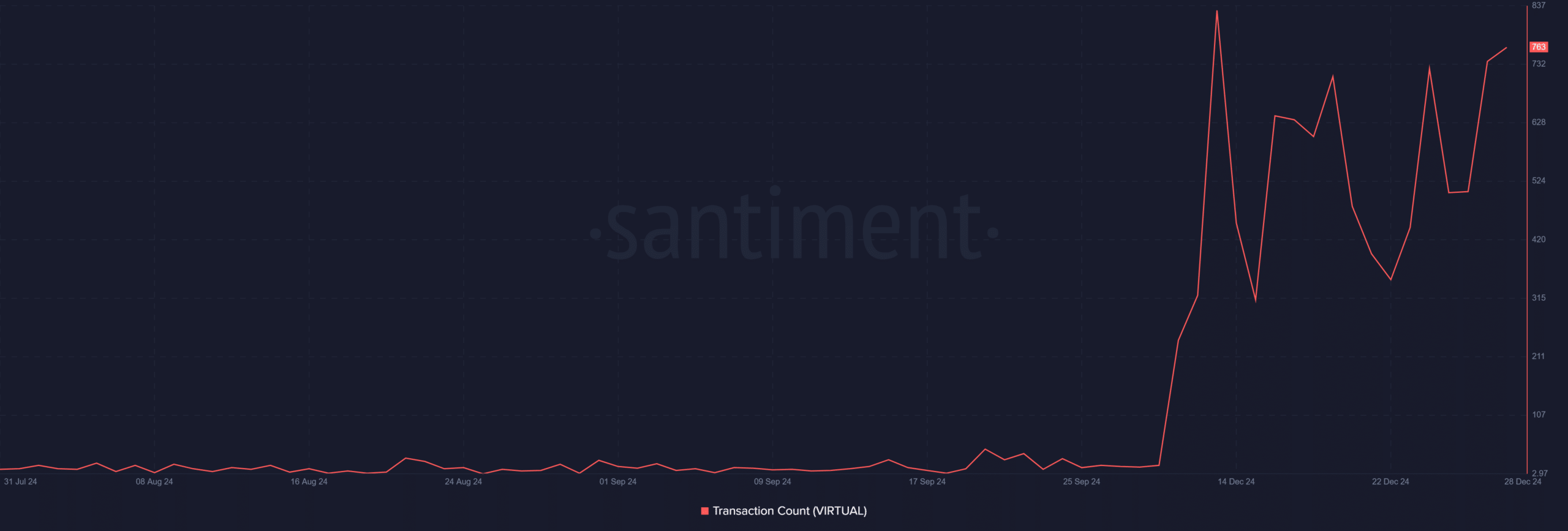

Growing network utility

Transaction activity for VIRTUAL has experienced a significant increase, with the transaction count reaching 763 as of the latest data.

This marks a substantial rise from levels under 200 in early December, showcasing a near fourfold increase in activity.

The sharp spike reflects a growing network utility, driven by heightened trading and interaction on the Virtual Protocol.

The surge suggests that both speculative and genuine use cases are gaining traction.

Therefore, the consistent rise in transaction volume aligns with other bullish indicators, reinforcing optimism for further price momentum.

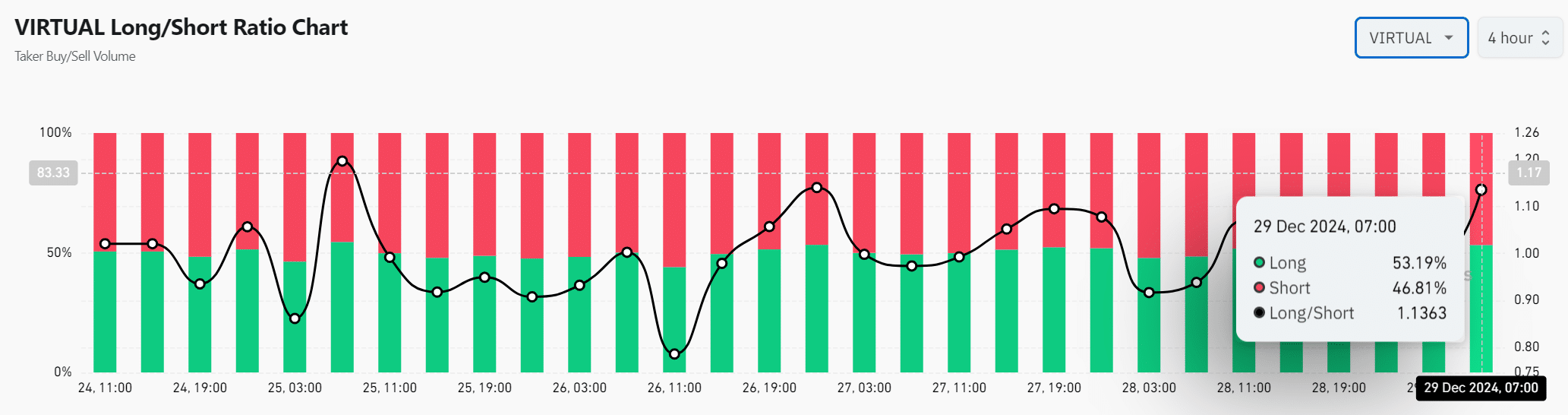

Long/Short Ratio indicates cautious optimism

The Long/Short ratio added another layer to the analysis, with 53.19% of positions favoring longs compared to 46.81% shorts.

This data demonstrated a cautiously optimistic outlook from traders, who expected VIRTUAL to maintain its upward trend.

Additionally, the steady accumulation of long positions highlighted increasing confidence despite resistance levels.

However, traders should remain vigilant for sudden sentiment shifts, as external market factors could affect momentum.

Is your portfolio green? Check out the VIRTUAL Profit Calculator

Thus, VIRTUAL appears to be on track for a breakout. The whale purchase, rising daily activity to 1,290 addresses, and strong market sentiment suggests a bullish outlook.

If VIRTUAL successfully breaks resistance at $3.58, it could initiate a significant rally in the near term.