- TAO approaches critical $685 resistance level after a surge in volume and technical strength.

- Market sentiment is supported by increased open interest, a bullish MA crossover, and low social dominance.

Bittensor [TAO] has recently experienced a significant surge in 24-hour trading volume, exceeding $500 million, reflecting strong interest and market activity.

The spike in activity signals heightened interest as TAO’s trading price climbs to $599.66, up by 8.01% in the last 24 hours. Consequently, TAO’s market cap has reached $4.43 billion at press time, further indicating renewed momentum as it approaches a key resistance level at $685.

With bullish sentiment building, TAO could be preparing for a significant move.

Technical analysis: Signs of a bullish breakout

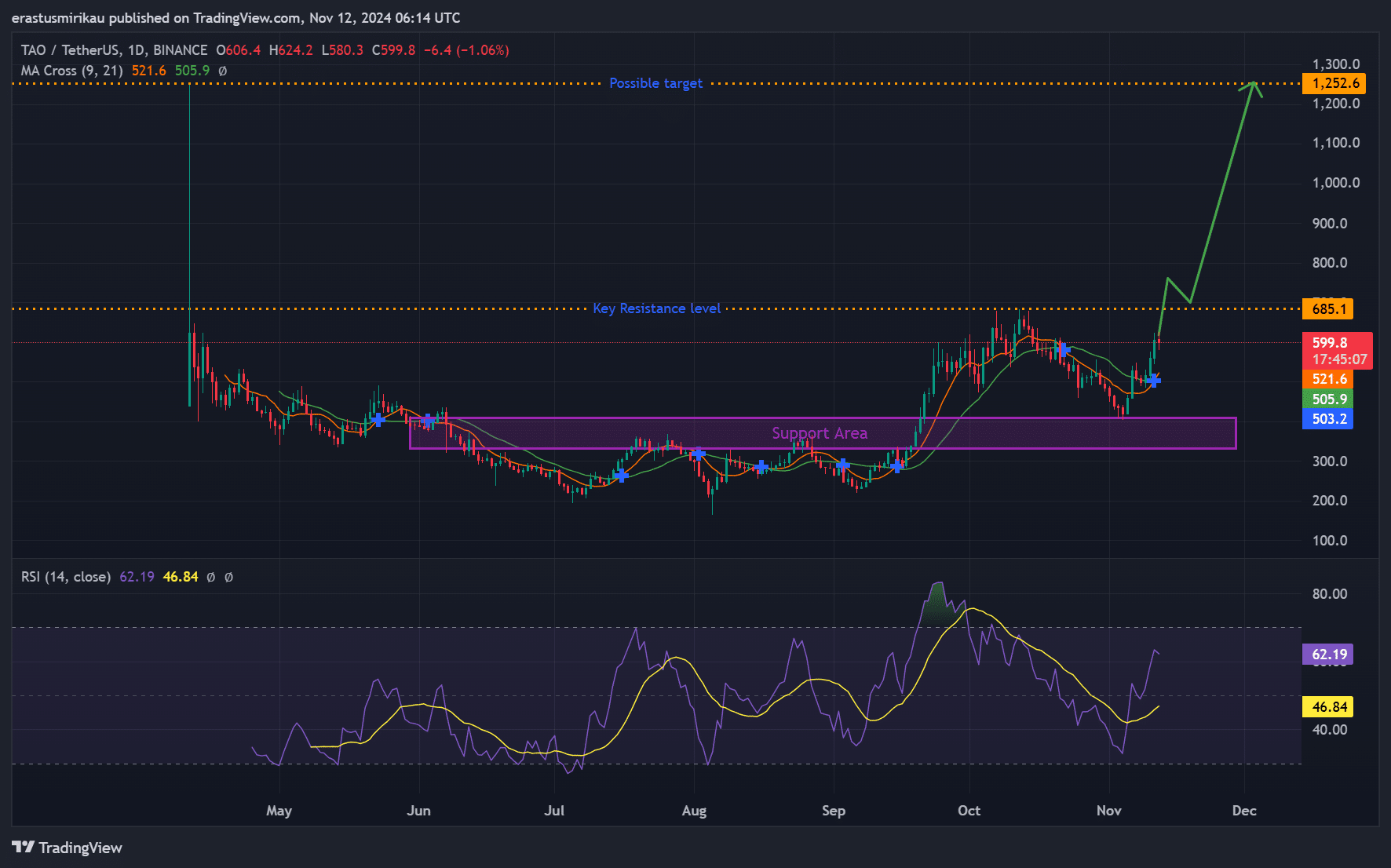

TAO’s technical indicators point to a potential breakout. After bouncing off the strong support zone between $400 and $500, the price is nearing the critical resistance level of $685.

Breaking above this point could clear the path to the next target of $1,252.6, offering a significant potential gain. However, continued buying pressure is essential for this rally to hold.

The Relative Strength Index (RSI) stood at 62.19, signaling that TAO is approaching overbought territory. This level might encourage some profit-taking if buying pressure eases. However, the RSI’s upward movement still aligns with a bullish outlook.

Additionally, the recent moving average (MA) crossover between the 9-day and 21-day MAs strengthens the bullish case. Both averages are trending upward, showing sustained momentum and strong buying interest.

Therefore, this MA crossover suggests that TAO’s rally may extend beyond a short-term bounce, pointing to a possible sustained uptrend.

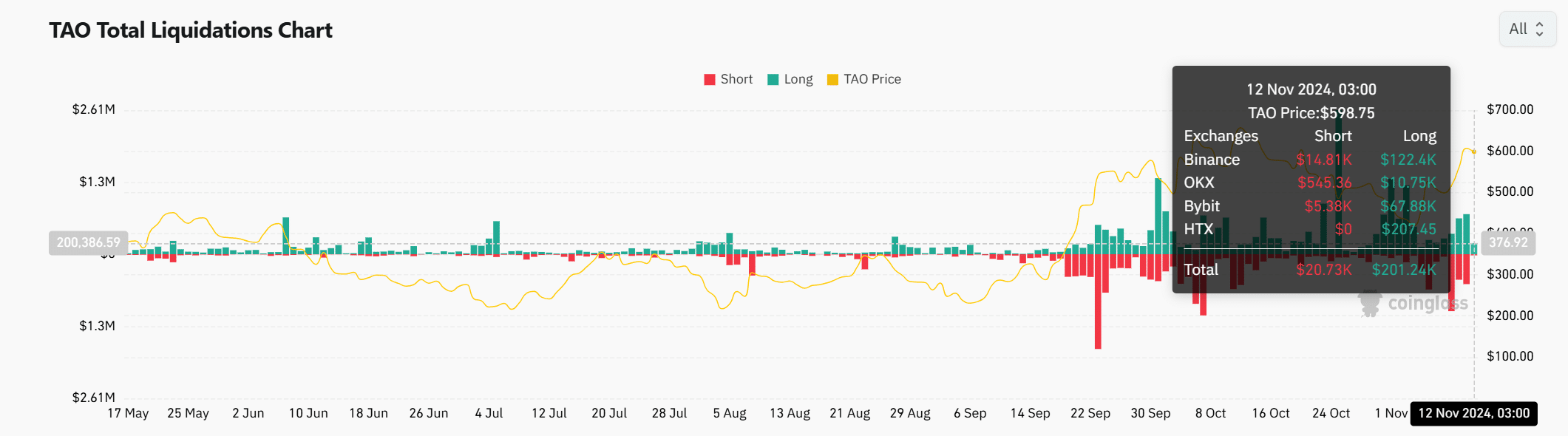

Liquidation data: A bullish imbalance

The latest liquidation data reveals an interesting trend: long positions exceed $200 million, significantly outpacing shorts. This indicates that market sentiment leans bullish.

However, this imbalance increases the risk of cascading liquidations if TAO faces sudden downward pressure, which could amplify losses and create volatility.

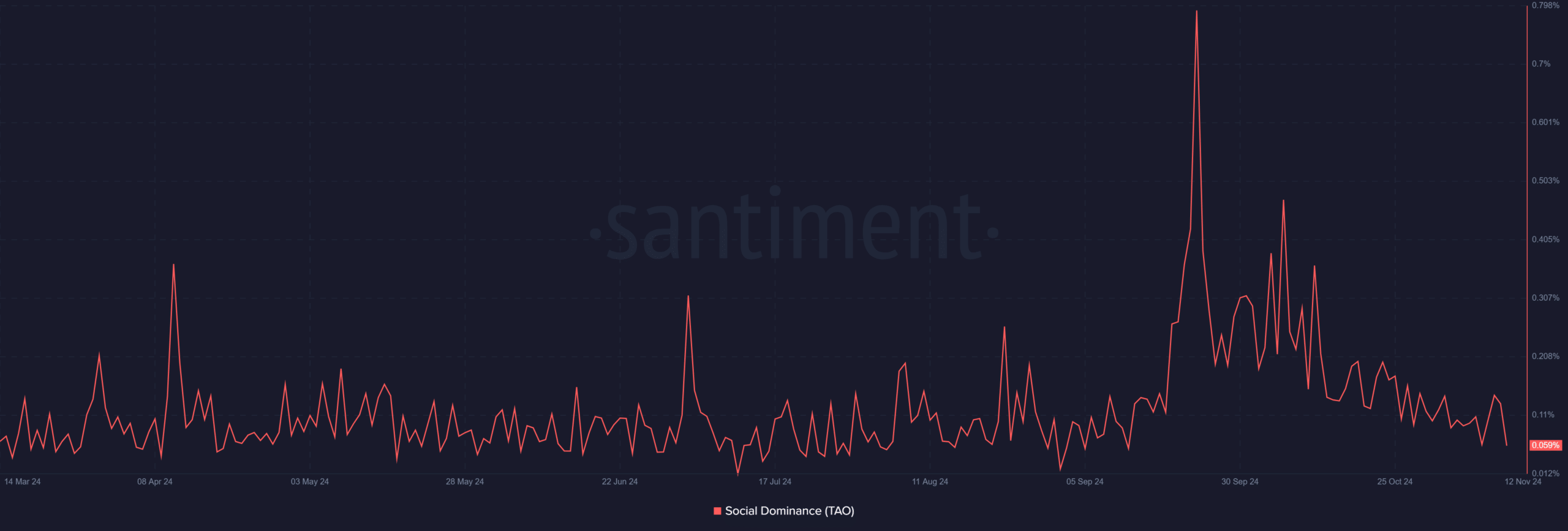

Social dominance declines amid rally

Interestingly, the social dominance has decreased, currently standing at 0.059%. This suggests that TAO’s recent price rally is less driven by retail hype and more by larger investors, potentially lending stability to its uptrend.

Consequently, this lower social dominance could help reduce speculative volatility.

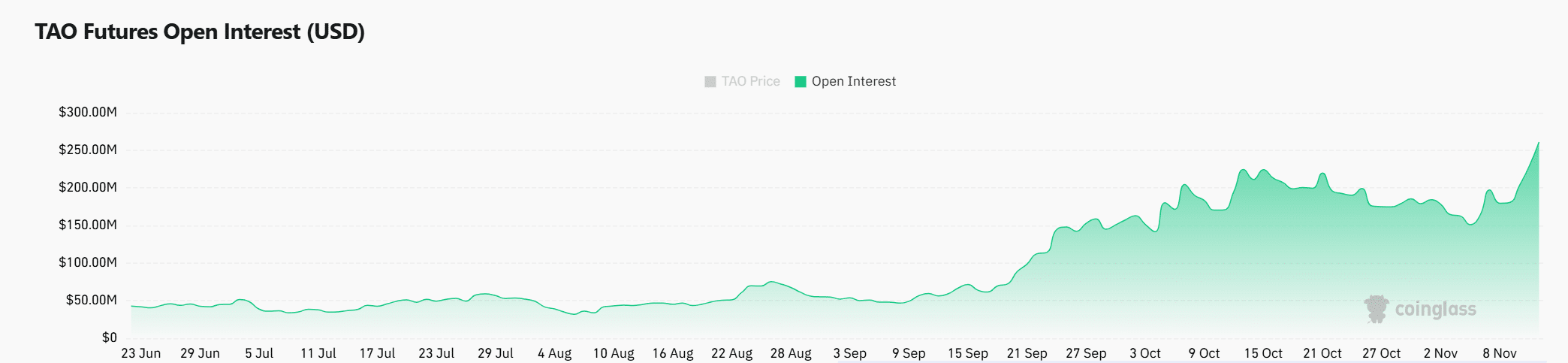

Open interest surge signals bullish sentiment

The open interest has risen by 12.58%, reaching $251.12 million. This uptick in open interest, coupled with rising trading volume, underscores strong investor confidence and commitment.

Therefore, this growth suggests that the market expects further upward movement, adding momentum to TAO’s current rally as it tests the $685 resistance level.

Read Bittensor’s [TAO] Price Prediction 2024–2025

TAO’s technical indicators, rising open interest, and strong trading volume suggest a likely breakout above $685. However, the RSI nearing overbought territory and declining social dominance warrant caution.

While TAO could reach its ambitious target of $1,252.6, any loss of momentum or sudden selling pressure may disrupt its path upward.