- SOL’s oversold condition could offer a great buying opportunity, per analyst.

- Despite the weak market sentiment, SOL hit key confluence support at $175.

Solana [SOL] has been the most oversold top altcoin, but its over 30% pullback could be a great buying opportunity per some pundits.

According to pseudonymous analyst Marty Party, the SOL’s daily RSI (relative strength index) has dropped to levels last seen in mid-2023. Per Marty, this was an ideal place to long the altcoin.

Will $180 hold?

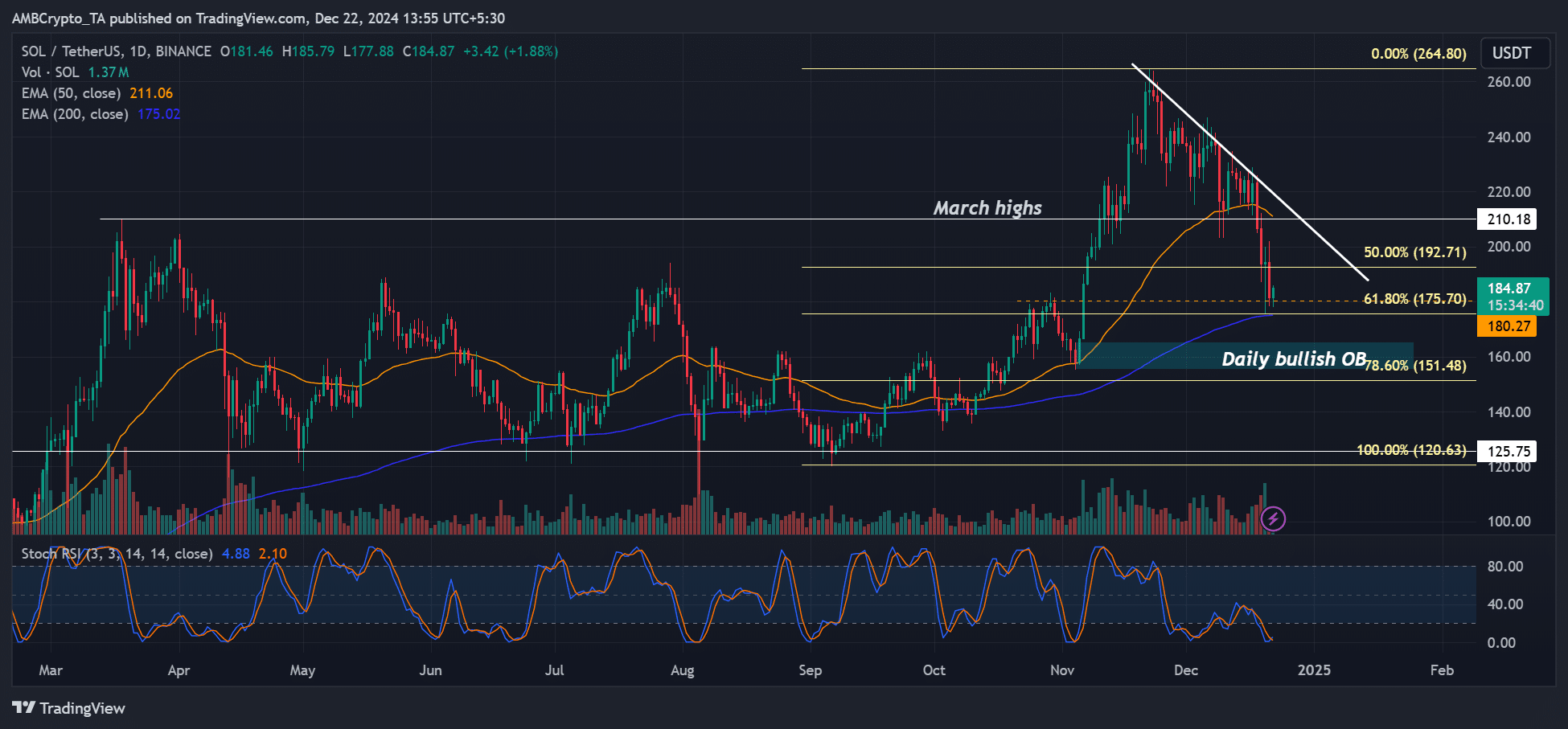

Since its November peak, SOL has declined from $264 to a low of $175. But the pullback has hit a key confluence area which, if held, could validate Marty’s thesis.

Throughout 2024, SOL’s dumps reversed at the 100-day EMA (Exponential Moving Average, blue). This pattern has repeated in June, July, and October.

As of this writing, the recent pullback stabilized at the moving average ($175). Interestingly, the level also coincided with the golden level (61.8%) of the Fibonacci retracement tool, as measured from September’s lows.

In most cases, price trend reversals happen at the golden ratio level. So, if the pattern repeats, SOL could bottom out at $175 with a potential deviation of $160.

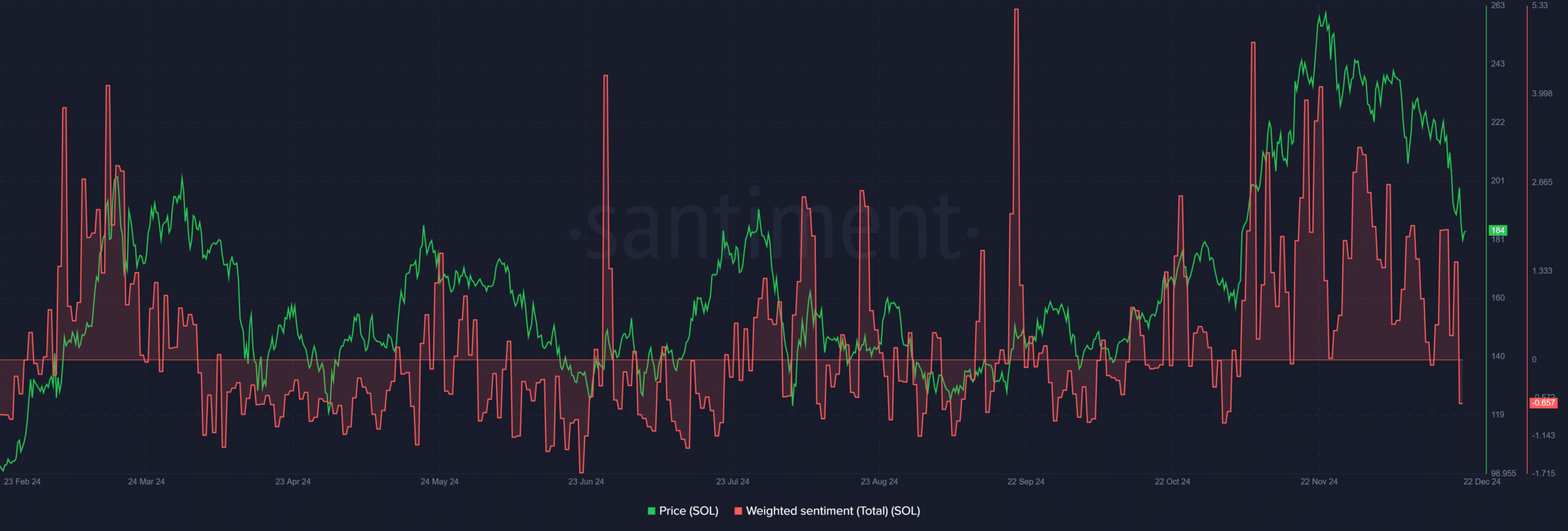

That said, the overall market sentiment was still negative on SOL, which could be ideal for long-term investors eyeing discounted SOL.

But it’s also worth noting that this was the first time SOL sentiment turned negative since November.

So, how’s the market positioning at this key confluence level and weak sentiment?

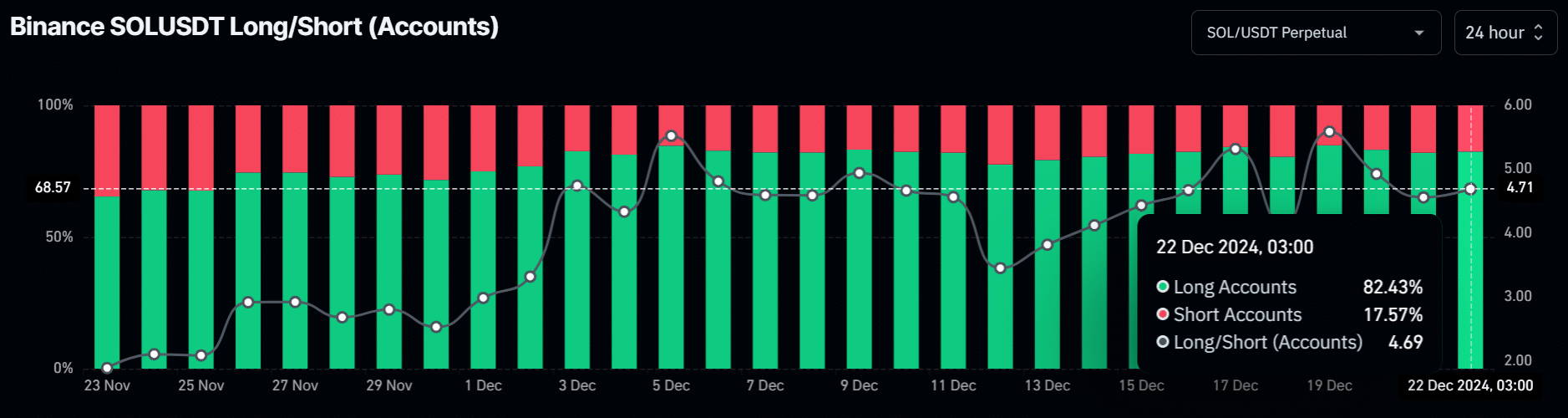

According to Coinglass, over 82% of top traders in the Binance exchange had long SOL positions.

Read Solana [SOL] Price Prediction 2024-2025

Although this was a slight drop from the 84% level seen on 19th December, it suggested that most players were still bullish on SOL’s recovery prospects.