- Analysts predicted that Ethereum could outperform Bitcoin due to key indicators.

- Ethereum spot ETF inflows and ascending price channels indicated potential price targets up to $10,000.

Ethereum [ETH] has so far been unable to keep up the pace with Bitcoin’s [BTC] consistent upward momentum.

While Bitcoin has registered new all-time highs in recent weeks, Ethereum still remains 36.2% decrease away from its all-time high of $4,878 registered in 2021.

At the time of writing, ETH traded at a price of $3,111 down by 0.6% in the past day and roughly 1% in the past week. This performance disparity has raised questions about whether Ethereum can catch up to Bitcoin.

Despite this lackluster movement, some market analysts remained optimistic about Ethereum’s potential.

One such analyst, Ali, recently expressed a positive stance on social media, predicting that ETH will soon outperform Bitcoin.

Ali’s confidence stemmed from multiple indicators, including the “alt season indicator.”

According to him, every market cycle historically experiences a phase where Ethereum outpaces Bitcoin, but this has yet to occur in the current cycle. Ali viewed this as a potential buying opportunity.

What’s supporting Ethereum’s upside?

Ali also highlighted the MVRV (Market Value to Realized Value) metric as a significant indicator for Ethereum’s future performance.

The MVRV metric measures the ratio between the market value and realized value of an asset, offering insights into whether an asset is overvalued or undervalued.

Ali noted that when Ethereum’s MVRV Momentum crosses its 180-day moving average (MA), it historically signals a period of outperformance for the cryptocurrency.

Although Ethereum’s price recently increased from $2,400 to $2,800, this cross has yet to occur, suggesting further upside potential.

In addition to the MVRV metric, Ali pointed to an increase in inflows to ETH spot ETFs. He explained that investors have shifted from distribution to accumulation, with ETH spot ETFs amassing over $147 million in ETH.

Moreover, Ethereum whales have reportedly purchased over $1.40 billion worth of ETH, further supporting Ali’s bullish outlook.

According to Ali, Ethereum’s potential price trajectory could involve testing resistance levels at $4,000 and $6,000, with a bullish scenario projecting a target as high as $10,000 if Ethereum mirrors the S&P 500’s price action.

Examining market position

While Ali’s analysis offered a promising outlook for ETH, examining key metrics could provide further insights into whether Ethereum could realistically outperform Bitcoin.

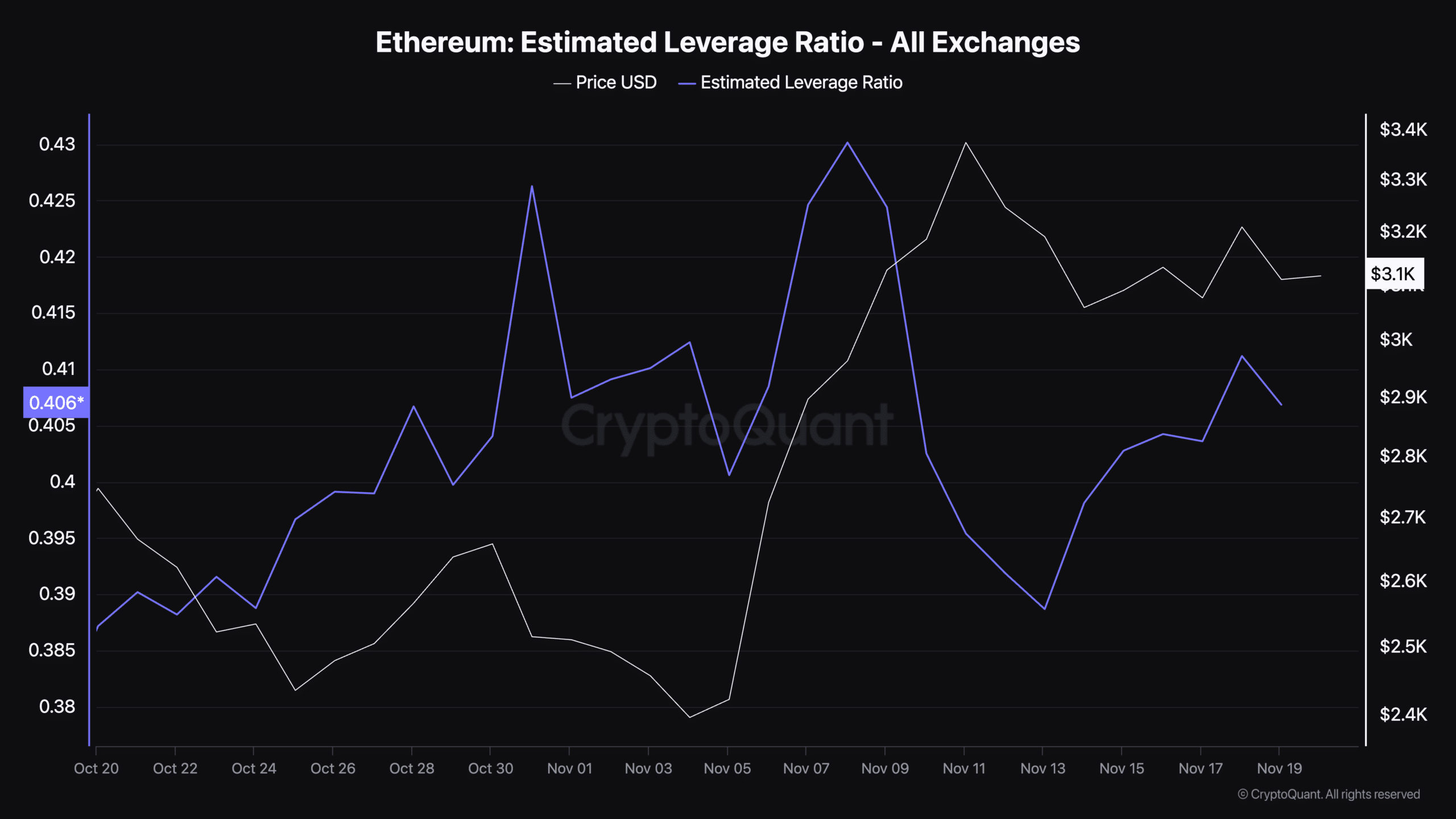

One such metric is the Estimated Leverage Ratio, which reflects the level of leverage used by traders in the derivatives market.

A high leverage ratio often indicated increased risk and potential volatility, while a decline may suggest reduced speculation.

According to data from CryptoQuant, Ethereum’s estimated leverage ratio has dropped to 0.40 as of the 19th of November, after peaking at 0.430 earlier in the month.

This decline may indicate reduced speculative activity, potentially paving the way for more stable growth.

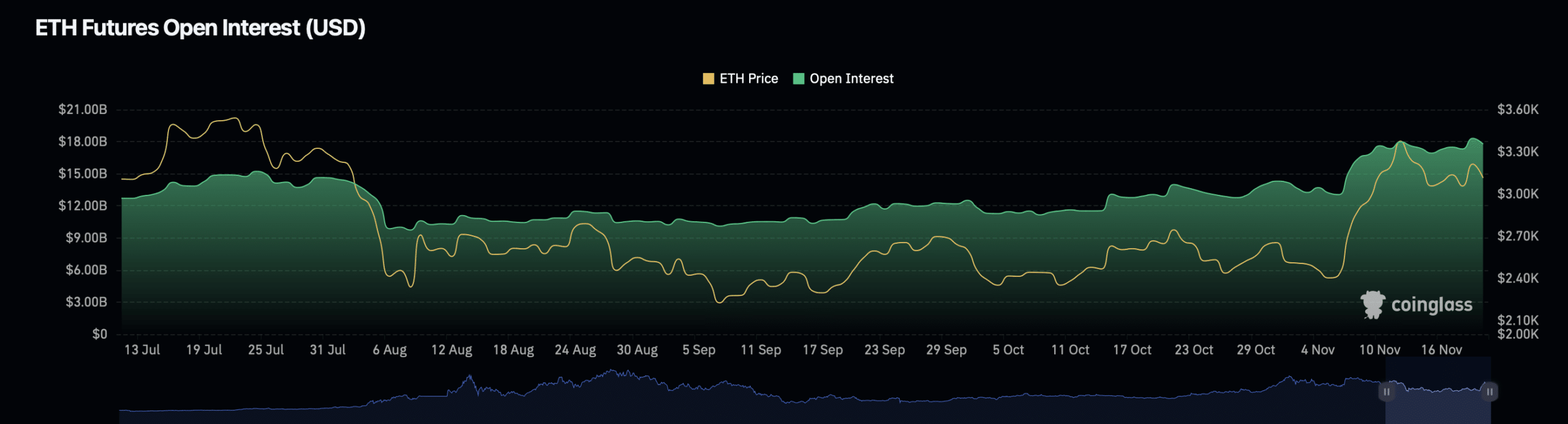

Data from Coinglass further revealed that Ethereum’s Open Interest has declined by 0.09%, bringing its current valuation to $17.88 billion.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Additionally, the Open Interest volume for ETH has decreased by 30%, now standing at $31.10 billion.

These trends could indicate a period of consolidation and reduced market activity for ETH, offering both challenges and opportunities for future growth.