- Bitcoin’s price fell 3.61% in 24 hours, hitting critical support levels between $98,830 and $95,830.

- Institutional transactions surged as Bitcoin withdrawals from exchanges reached 74,052 BTC this December.

Bitcoin [BTC] has experienced a recent decline in price and wallet returns, with the crypto trading at $95,397, at the time of writing. This marked a 24-hour price drop of 3.61% and a weekly decline of 1.95%.

Despite reaching an all-time high earlier this month, Bitcoin’s 30-day Market Value to Realized Value (MVRV) metric was at -1.9%. This is its lowest since the bull rally started in October.

According to Santiment, this negative MVRV suggests that many traders bought during a high-euphoria period and are now facing unrealized losses.

Santiment pointed out that Bitcoin’s historical average MVRV was 0%, reflecting its nature as a zero-sum market. Negative MVRV levels may signal buying opportunities, as positions at a loss can point to undervaluation.

The platform suggests a dollar-cost averaging (DCA) approach for traders aiming to capitalize on these conditions.

Key support levels and future price projections

Crypto analyst Ali emphasized the importance of Bitcoin’s support range between $98,830 and $95,830. Within this range, 1.09 million wallets collectively purchased over 1.16 million BTC, making it a critical level to monitor.

A breakdown below $96,000 could trigger a drop to $90,000 or $85,000, based on Fibonacci retracement levels.

Ali also pointed out the ongoing trend of Bitcoin withdrawals from exchanges, with 74,052 BTC moved off exchanges in December alone.

This pattern suggests a shift toward long-term holding, as coins removed from exchanges are less likely to be sold.

Market metrics and trading activity

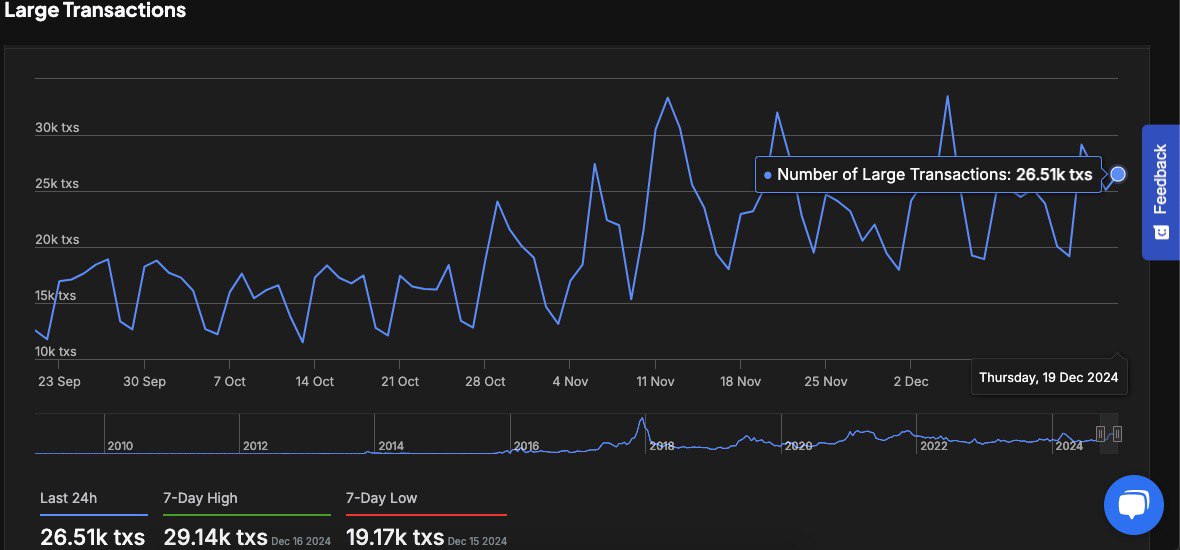

Recent data from IntoTheBlock indicates increased activity in high-value transactions of $100,000 or more. On December 18, 26,510 large transactions were recorded, slightly below the 7-day high of 29,140.

Spikes in such transactions have been observed during periods of volatility, particularly in October and November. The sustained volume of these transactions reflects continued interest from institutional or high-net-worth traders.

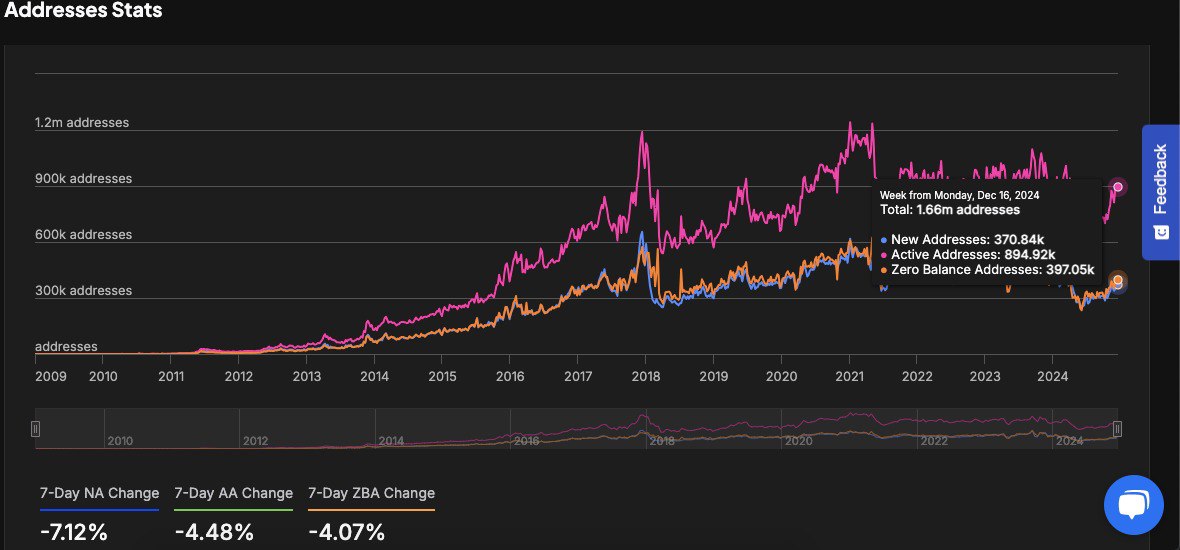

Address activity has also shown a mixed trend. There are currently 1.66 million addresses, including 370,840 new ones and 894,920 active addresses.

However, the past week saw a decline in new addresses by 7.12% and active addresses by 4.48%, indicating a potential slowdown in retail participation during the recent market correction.

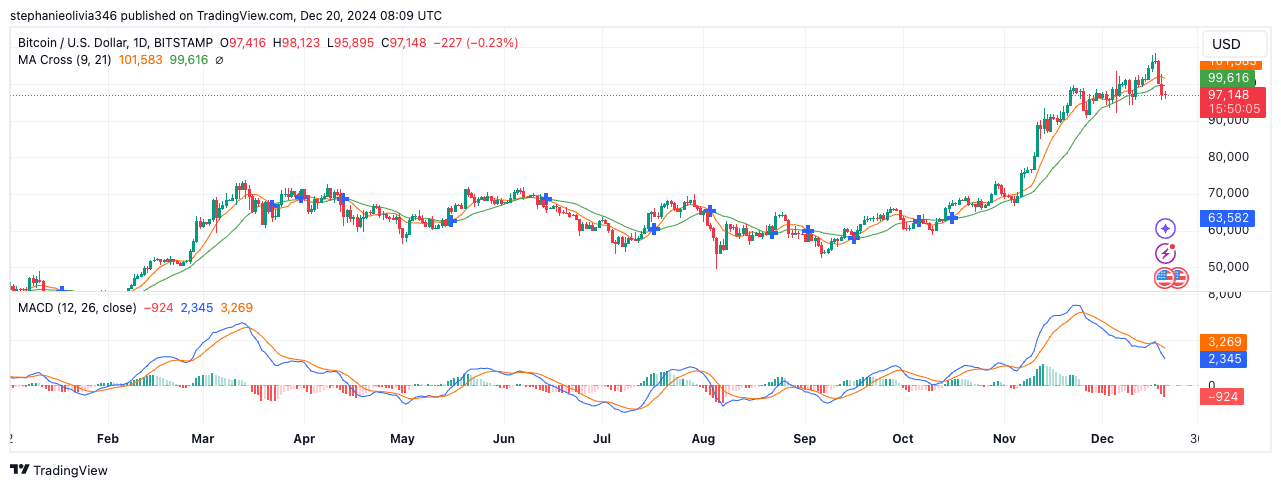

Technical indicators suggest a short-term correction

Technical analysis of Bitcoin shows it is trading above the 9-day and 21-day moving averages. This indicates an overall bullish trend since October.

However, the recent MACD crossover shows the MACD line falling below the signal line. The histogram turning red signals weakening bullish momentum.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The current resistance at $99,644 has led to a slight pullback, suggesting the possibility of consolidation or further correction.

Analysts recommend monitoring support at $95,000 to gauge whether the uptrend will continue or face further declines.