- Virtuals Protocol saw two spikes in its age consumed metric during the retracement

- Quick recovery from the local bottom gave bulls some hope

Virtuals Protocol [VIRTUAL] has performed remarkably well over the past month. It bounced by 33% from its recent lows, with the bulls raring to go again after the recent retracement.

Worth pointing out, however, that on-chain metrics showed relatively high participation and some profit-taking activity recently.

VIRTUAL set to march higher

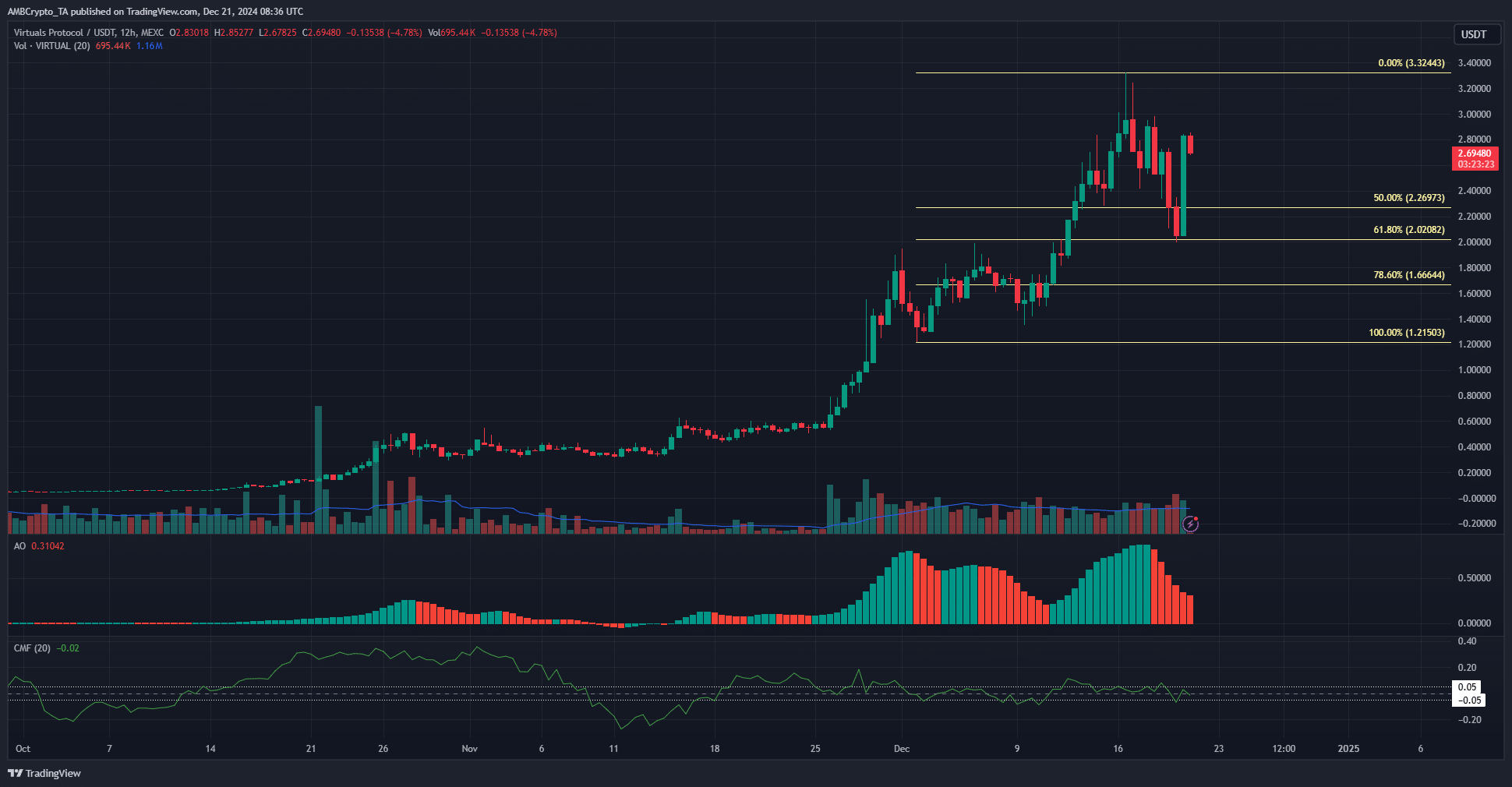

The market structure on the daily chart was bearish after the drop below the recent higher low on 15 December at $2.28. The Fibonacci levels plotted based on the December move from $1.21 to $3.32 highlighted $2.02 and $1.66 as key retracement levels.

The Awesome Oscillator on the daily chart formed red bars over the last few days to suggest that bullish momentum has been weakening. However, a crossover below neutral zero did not yet occur.

The CMF was at -0.02, but did not signal sizeable capital flows into or out of the market in recent days. The trading volume saw an uptick in early December, but maintained itself just above 1.1 million VIRTUAL traded each day.

On-chain metrics showed bullish sentiment has slowed down

Source: Santiment

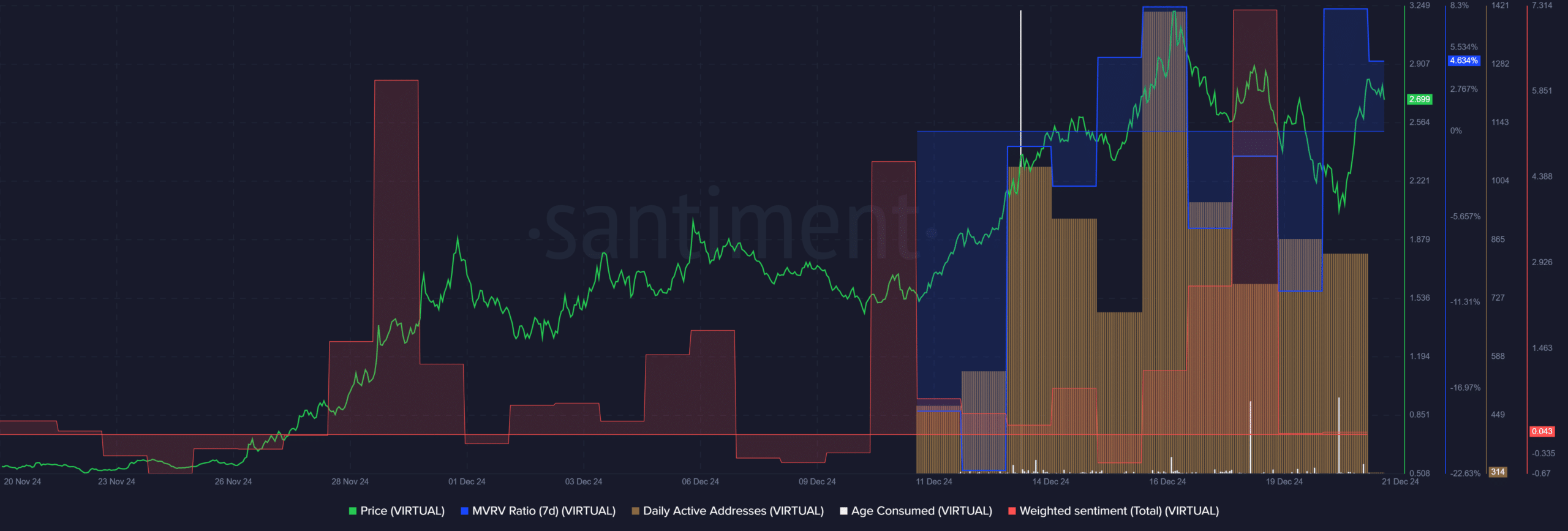

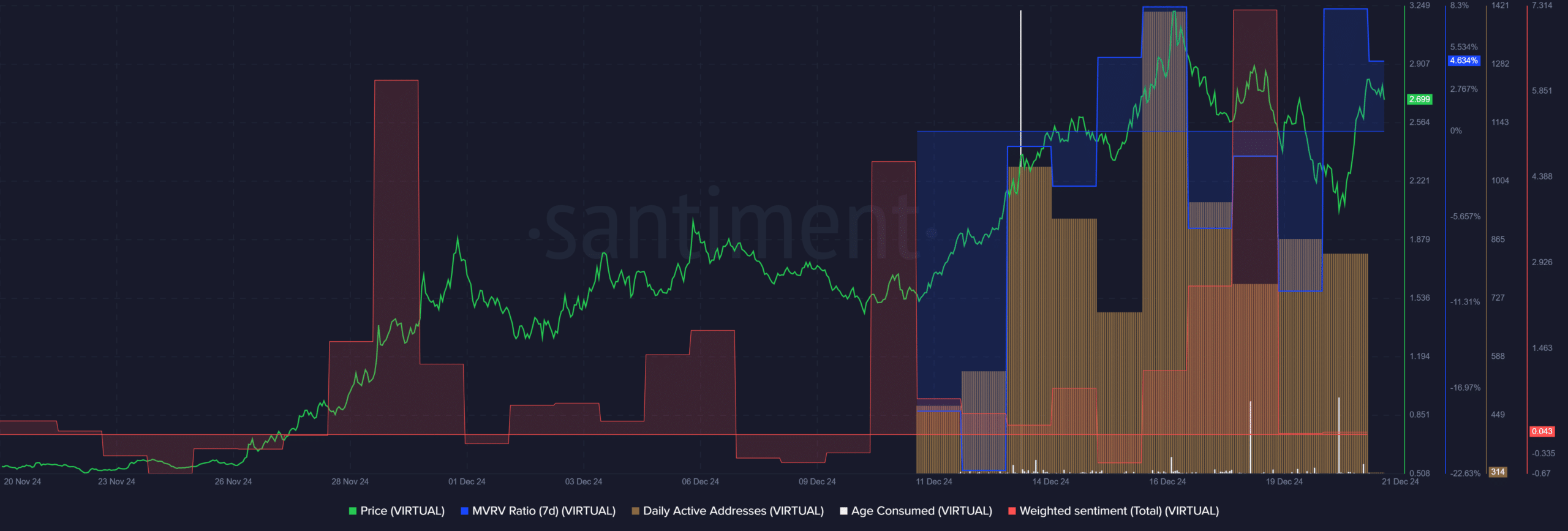

Not only has the Awesome Oscillator fallen lower, the weighted sentiment also fell dramatically. It was highly optimistic on 18 December, based on social media engagement. Since then, however, it has reverted towards the neutral level. Daily active addresses saw a decline from a few days ago too, but still remained above 800.

The age consumed metric saw two spikes in the last three days, but these were not as large as the ones seen earlier this month. This was when Virtual Protocol token was on a strong uptrend. This can be interpreted to be evidence of some selling pressure.

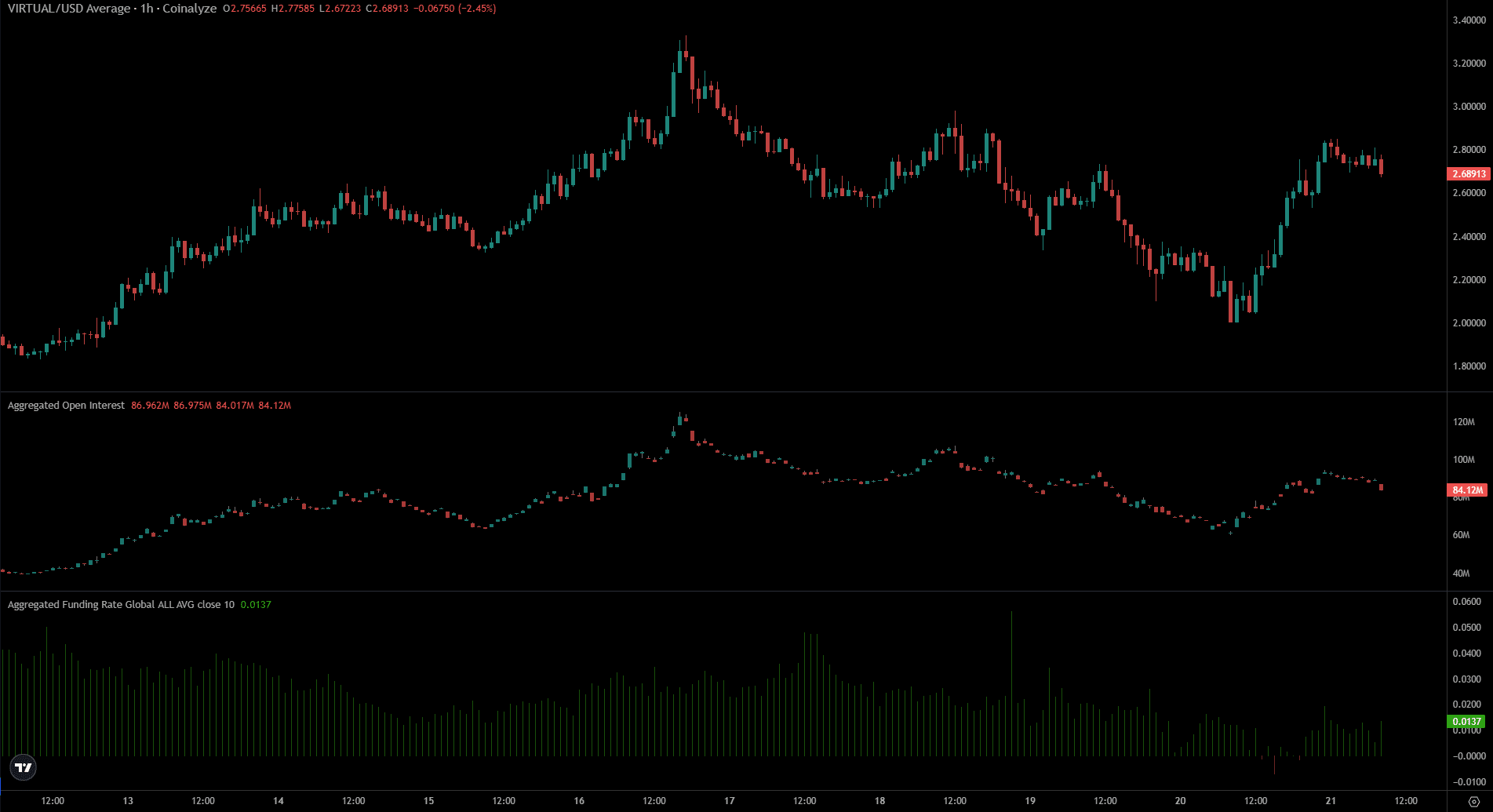

Source: Coinalyze

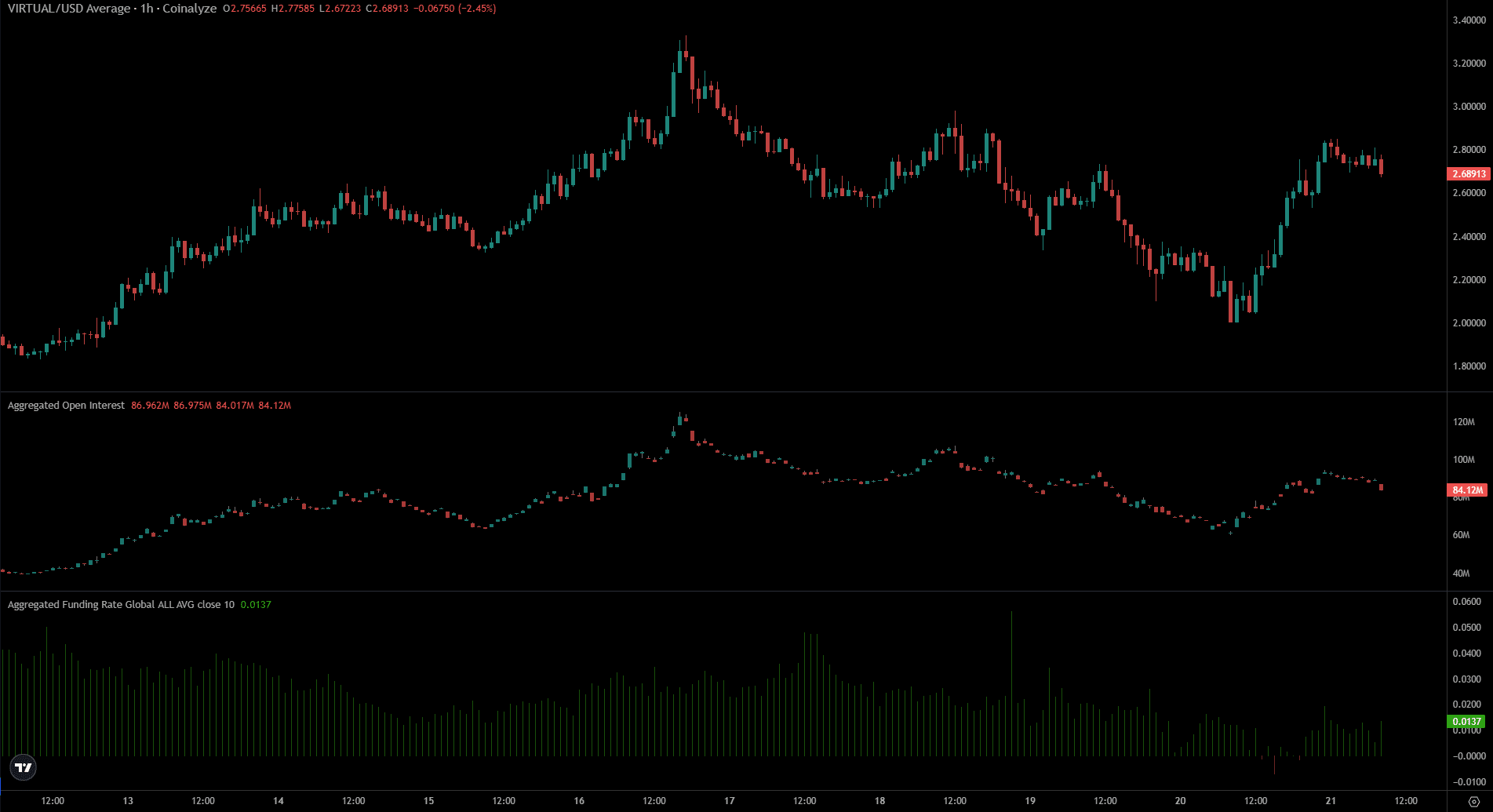

Finally, the Futures data also showed room for growth. Despite VIRTUAL’s quick jump in recent hours, the funding rate was not extremely high. This suggested that the sentiment was bullish and the spot and perpetuals price difference was small.

Realistic or not, here’s VIRTUAL’s market cap in BTC’s terms

The Open Interest saw a 33% hike over the last 24 hours while the price hiked by 27%. This also highlighted bullish momentum and speculative eagerness. If the CMF climbs above +0.05, it would be another sign of buyer dominance.