- Binance coin continued its long-term uptrend while maintaining a position well above its 200-day EMA

- Derivates data revealed a slight bullish edge while suggesting near-term caution

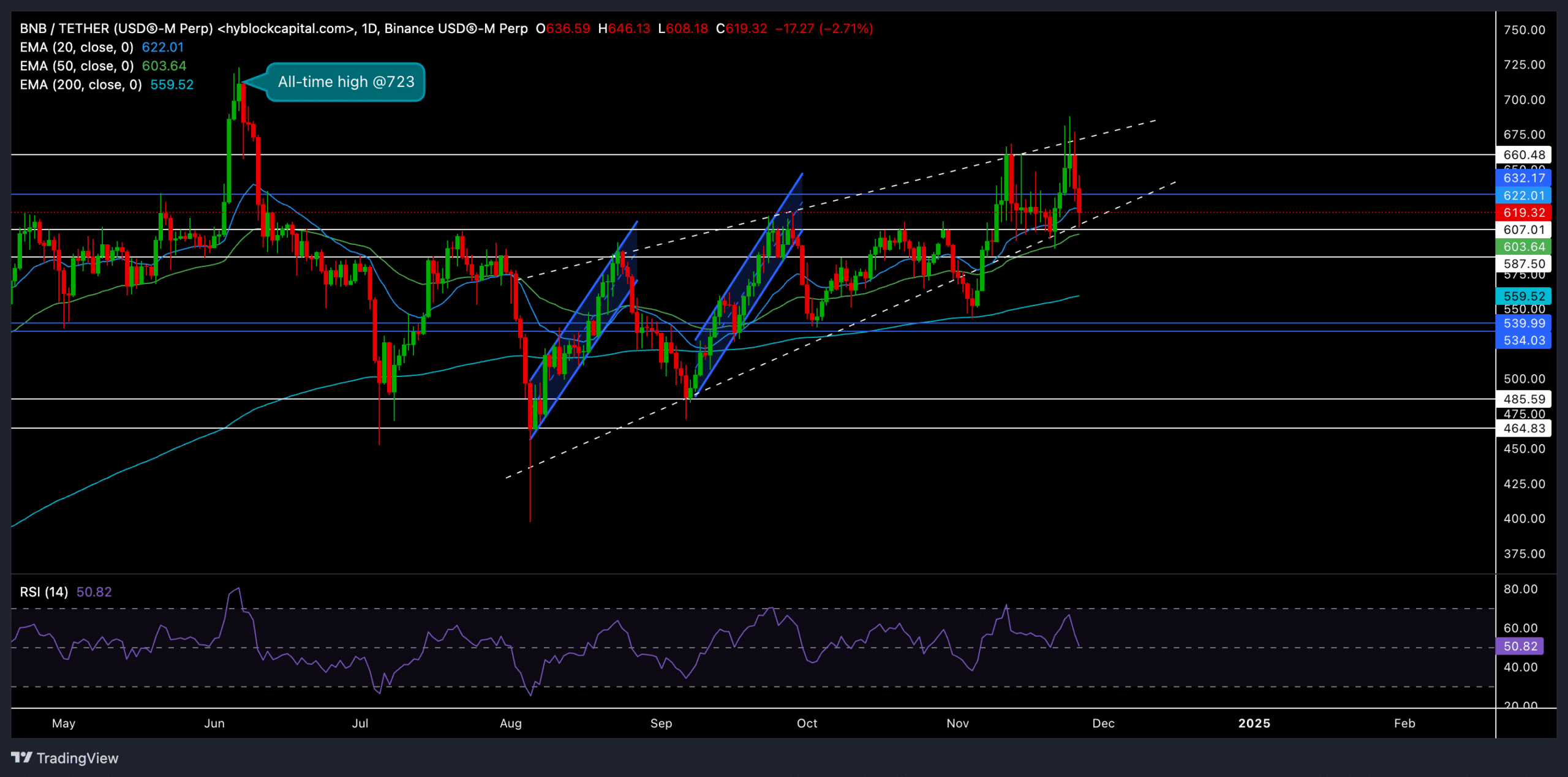

BNB’s latest price movements saw it rise above its major EMAs to solidify a medium-term bullish edge. After marking its all-time high (ATH) in June this year near the $723-level, BNB witnessed a steep decline. However, it still maintained its position above the 200-day EMA.

At the time of writing, BNB was trading at around $613.82, down by 3.58% over the last 24 hours. This drop followed the broader market seeing some selling pressure, particularly in BTC, as it posted double-digit losses in recent days.

BNB approached key support after a recent rejection

During a recent Bitcoin-led market surge, BNB recorded massive gains and broke above its 200-day EMA, establishing higher highs and lows. This price action formed a rising wedge pattern on the daily chart, typically indicating a possible trend reversal at higher levels.

The altcoin, at press time, was at a key confluence of support levels around $610 – Including the 50-day EMA, a horizontal support level, and the lower boundary of the rising wedge.

A successful rebound from this level could see BNB retest the $660 resistance zone before potentially entering a consolidation phase. Should broader market sentiment favor the bulls, a decisive move above $660 could open the door to retesting the $700 zone.

However, a decline below this support area—particularly if BTC continues its downward trajectory—could accelerate bearish momentum. In such a case, the 200-day EMA at $559 may be a major support level to watch.

The Relative Strength Index (RSI) was around 50, at the time of writing, reflecting neutral market sentiment. Buyers should look out for a potential dip below the equilibrium to gauge BNB’s near-term potential.

Derivatives data suggests mixed sentiment

The 24-hour long/short ratio had a reading of 0.8727, indicating balanced sentiment but leaning slightly towards the bears. On major platforms like Binance and OKX, however, the long/short ratios were quite bullish, standing at 3.948 and 3.02. The top traders’ long/short ratio on Binance also revealed high optimism at 3.1649.

Trading volume surged by 31.96%, hitting $2.29 billion, while Options volume grew by 47%—Indicative of greater trader activity amid the recent volatility. However, the Open Interest for Futures positions showed a slight decline of 0.08%, which might hint at some caution among traders regarding maintaining long-term exposure in the current market conditions.

Traders should remain cautious and monitor broader market sentiment, especially Bitcoin’s movements, before making any major trading decisions.