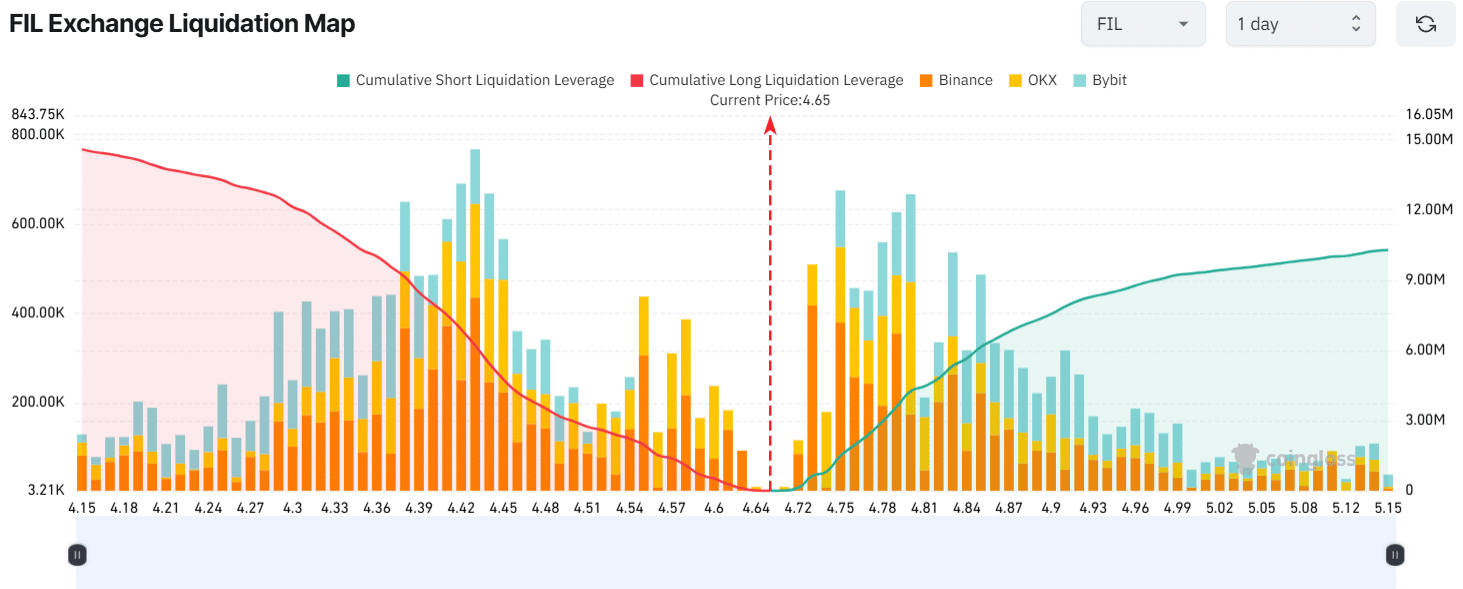

- Traders were overleveraged at $4.43 on the lower side and $4.75 on the upper side levels.

- As the price approaches the breakout level, traders have been aggressively participating.

The blockchain-based digital storage platform, Filecoin [FIL] is poised for upside momentum after trading within a tight range for nearly five months. Currently, the overall market sentiment is bullish, with the majority of cryptocurrencies experiencing breakouts and upward momentum.

Filecoin technical analysis and key levels

Amid this positive outlook, FIL has formed a bullish price action pattern on its daily chart, gaining strong support from both traders and investors.

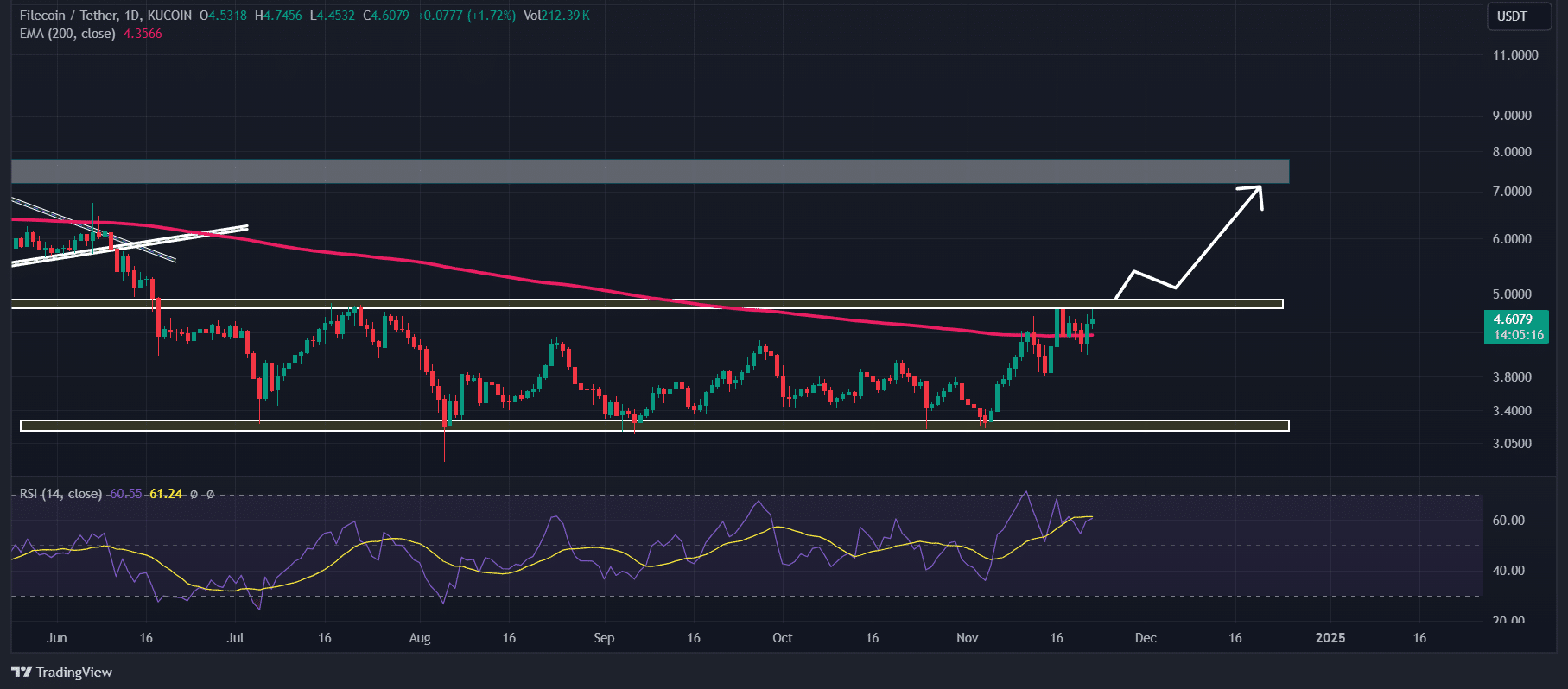

According to AMBCrypto’s technical analysis, FIL is on the verge of breaking out of the consolidation zone it has been confined to over the past five months, between the $3.18 and $4.80 levels.

Based on recent price action and technical analysis, if FIL breaks out of this zone and closes a daily candle above the $4.80 level, there is a strong possibility it could soar by up to 47%, reaching the $7.20 level.

The asset was trading above the 200 Exponential Moving Average (EMA) on the daily timeframe at press time, indicating an uptrend. Additionally, its Relative Strength Index (RSI) signals a potential rally, as it is in oversold territory.

FIL’s bullish on-chain metrics

Filecoin’s technical analysis is further supported by on-chain metrics. Recently, traders have been observed aggressively participating, resulting in a significant rise in open interest (OI).

According to the on-chain analytics firm Coinglass, FIL’s OI has surged by 7.9% in the past 24 hours and 4.65% in the past four hours. This growing OI indicates increased trader activity, leading to a rise in open positions.

As of now, the major liquidation levels are at $4.43 on the lower side and $4.75 on the upper side, with traders overleveraged at these positions, according to Coinglass data.

If market sentiment remains unchanged and the price rises to the $4.75 level, nearly $1.5 million worth of short positions will be liquidated. Conversely, if sentiment shifts and the price drops to the $4.43 level, traders holding approximately $6.21 million worth of long positions will face liquidation.

These on-chain metrics, combined with technical analysis suggest that bulls are currently dominating the asset and could help FIL breach its resistance level.

At press time, FIL was trading near $4.62 and has registered a gain of 3.5% in the past 24 hours. During the same period, its trading volume dropped by 8%, indicating reduced participation from traders and investors compared to the previous day.