- Analysts had previously predicted that FET might reach its March high after approaching a significant support zone.

- However, market sentiment is currently at odds with these bullish forecasts.

Artificial Superintelligence Alliance [FET] has experienced substantial sell-offs, with selling pressure intensifying over the past week, leading to a 16.94% price drop, keeping the token near the $1 mark.

This trend has shown slight improvement over the past 24 hours, with buyers exerting some pressure, resulting in a modest 0.69% gain.

Despite this, AMBCrypto analysis indicated that the broader market trendwas still pointing toward a potential decline, with FET likely to test lower levels in the near future.

Could FET reach 2024 highs?

According to crypto analyst Mihir, at press time, FET was trading within an ascending channel pattern, which typically signals an upward trend.

This chart pattern consisted of price fluctuations between two parallel lines—known as the support and resistance levels—within which the price tends to move as it trends upward.

According to the chart, FET has recently touched the support level of this channel, a typical signal that often precedes a price surge.

Mihir thus expected FET to potentially reclaim its March 2024 high, stating,

“$FET could recover by mid-to-late December.”

Large holders are selling

Further analysis showed that, despite FET reaching a support level where significant buying activity is typically observed, the opposite is currently occurring.

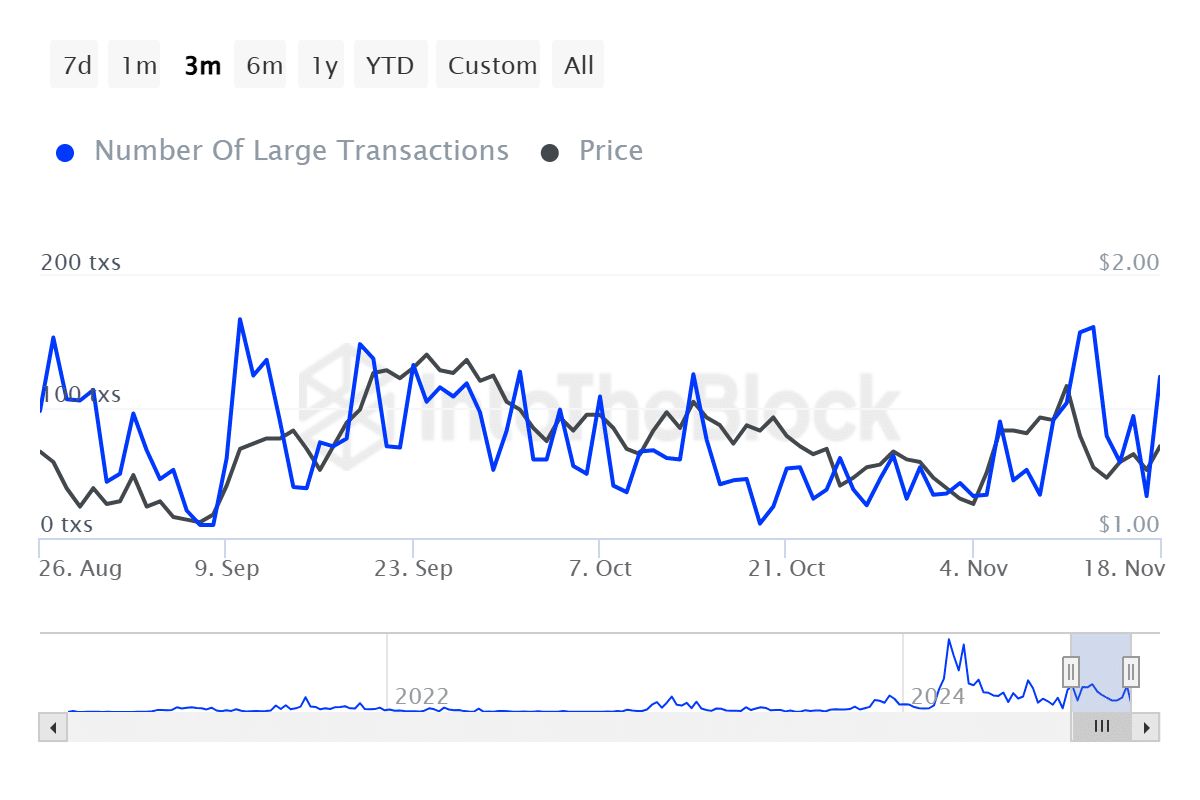

According to IntoTheBlock, there has been a noticeable spike in large-volume transactions, indicating that traders holding substantial portions of FET are actively engaging in the market.

This activity can signal either buying or selling.

However, the decline in the number of active addresses suggested that this increase in large transactions is likely the result of large holders selling off their FET.

This could be due to a loss of confidence in the asset, with these holders taking profits to avoid further losses.

In the past 24 hours, 123 large transactions were recorded, involving a total of 19.05 million FET. Meanwhile, the number of active addresses has dropped to 1,860, representing a 12.02% decline over the past week.

Increased sell-offs in the market

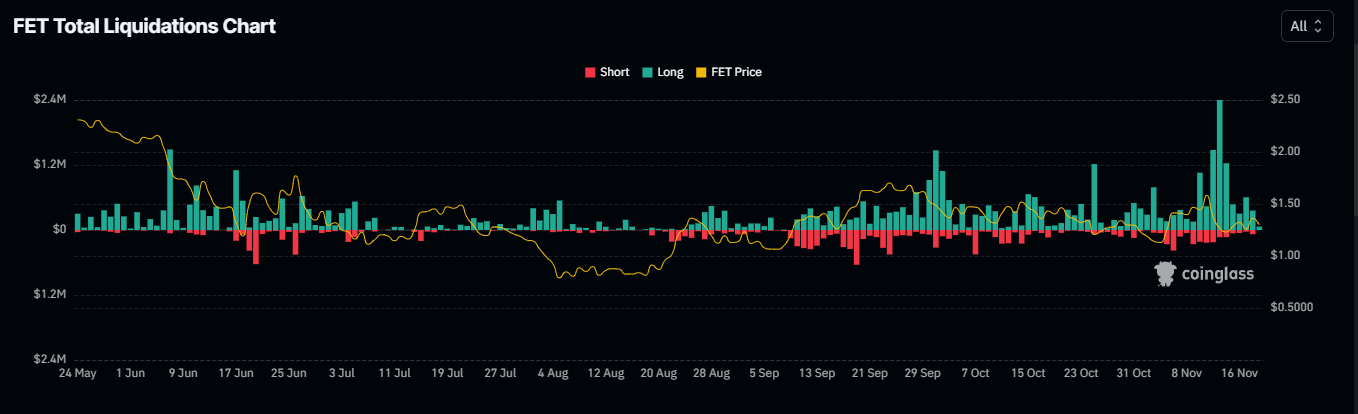

This trend has extended to derivative traders, who are now selling their FET holdings into the market.

In the first instance, Open Interest has decreased by 2.42% over the past 24 hours, bringing the total volume to 134.25 million FET.

This decline suggests that the market is currently favoring short traders, with fewer open contracts in favor of long positions.

Read Artificial Superintelligence Alliance Price Prediction [FET] 2024–2025

Additionally, the forced liquidation of $387.17K worth of FET long trades indicated that derivative traders have driven the market against the expectations of bullish traders, contributing to the price drop.

Should these sell-offs from large holders and derivative traders continue, it will delay FET’s potential rally.