- APT’s fate rests heavily on whether bulls can successfully defend the $10.35 support

- Traders should watch for a potential bounce, one which could target $13.75, or a breakdown

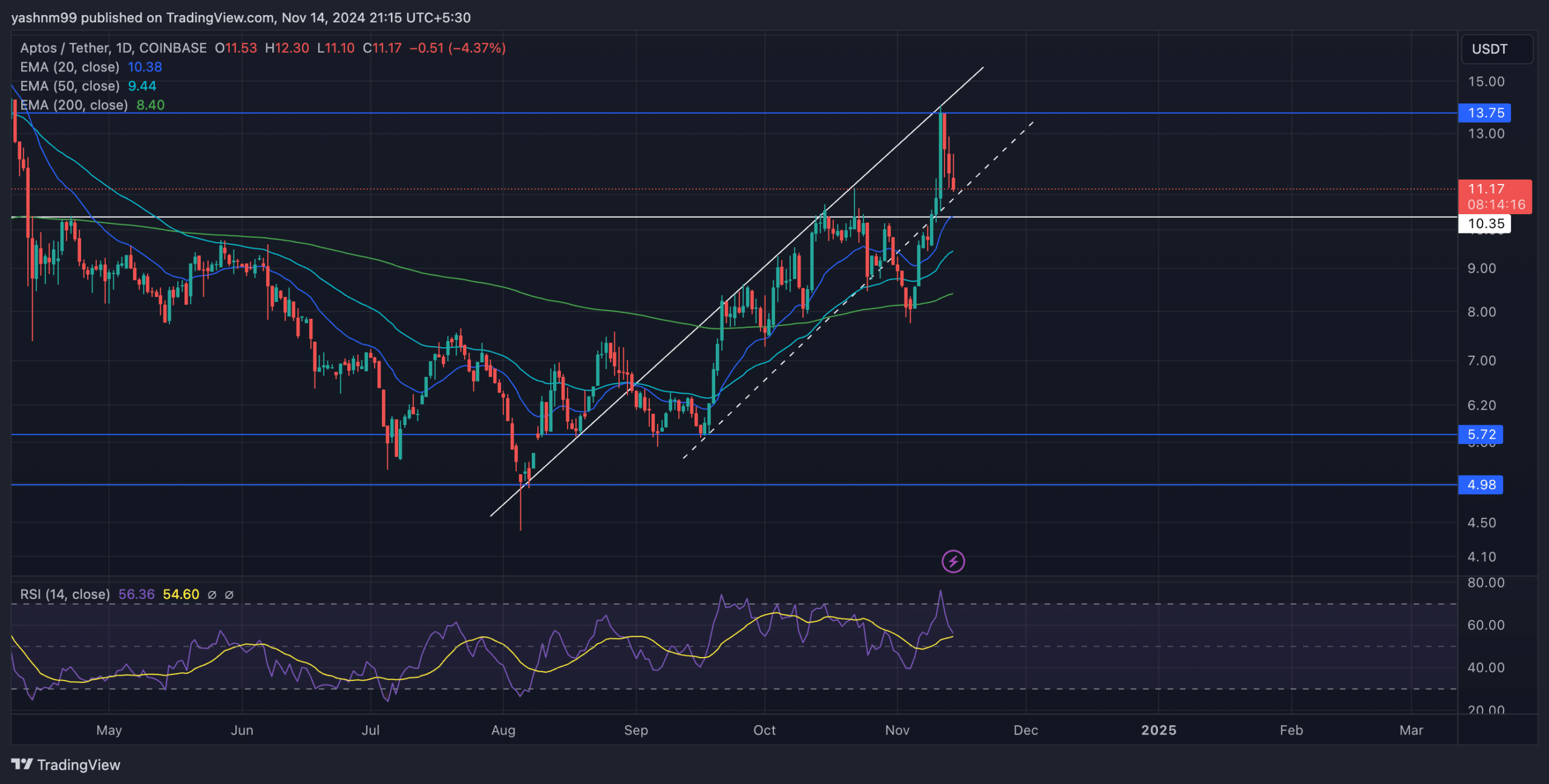

Aptos [APT] continued its strong ascent for three months before touching a 7-month high of $13.75 on 11 November.

However, its recent rejection from the trendline resistance has placed APT in a critical position, with bulls looking to defend a confluence of key support levels.

APT could go THIS way from its immediate support level

At press time, Aptos was trading at around $11.11 after a nearly 8.7% decline. The price was retesting a confluence of supports near the $10.35 zone, including the horizontal support, the ascending trendline, and the 20-day EMA. The outcome of this retest could define APT’s upcoming trend direction.

If APT bounces off the $10.35-level, buyers could aim for a swift retest of the $13.75 resistance, coinciding with the upper trendline of the ascending channel. A successful close above this level could propel APT towards a potential upside target near the $15-mark, strengthening the bullish bias.

However, if the price breaks below the support confluence, APT may see a consolidation phase near the 50-day EMA ($9.43) and the 200-day EMA ($8.40). This would suggest a lack of momentum among buyers. A failure to hold the $10.35 support may open up the possibility of a move towards the $8 zone.

The Relative Strength Index (RSI) stood at approximately 56, reflecting indecisiveness among traders. A definitive move below 50 could indicate renewed bearish momentum, while a jump below 60 might trigger more upside pressure.

Analyzing APT derivatives data

APT’s derivatives data highlighted mixed sentiment in the market. Open Interest fell by 11.96% to $251.35M, indicating that traders have been closing their positions, possibly due to uncertainty regarding APT’s next move. Similarly, trading volume fell by 25.99% – A sign of reduced trader participation.

Interestingly, Binance’s long/short ratio stood at 3.07, while OKX had a ratio of 2.39 – Revealing an optimistic bias among traders on these major platforms. However, the 24-hour long/short ratio was 0.8886, implying that slightly more traders were leaning towards short positions.

In the liquidation data, longs dominated, with around $2.36M in liquidations, suggesting an ongoing effort from bulls to hold their positions amid the recent decline.

Given the current mixed sentiment and key indicators pointing to indecisiveness, it’s important to consider Bitcoin’s movement and broader market trends before making any moves on APT.