- Coinbase Ventures has scooped over $20 million of AERO.

- Will the DEX growth and Coinbase’s move trigger the next upside leg for AERO?

Coinbase Ventures, Coinbase’s investing arm, has doubled down on Aerodrom Finance’s AERO, a move that market pundits have deemed a bullish signal.

According to Arthur Cheung, founder of crypto VC DeFiance Capital, Coinbase Ventures has scooped over $20 million worth of AERO, the biggest ever it has made on tokens. He stated,

“And now we have the largest ever investment made on a liquid token (>$20m) bought from the open market like every other market participant. Think about why they are so bullish and still buying more.”

Aerodrome Finance’s moat

Cheung added that Coinbase’s bullish conviction could be linked to Aerodrome Finance’s growing dominance in the Base ecosystem.

For context, Aerodrome is the largest liquidity provider and DEX (decentralized exchange) on Base, an Ethereum [ETH] L2 that has seen massive traction and interest from institutional investors.

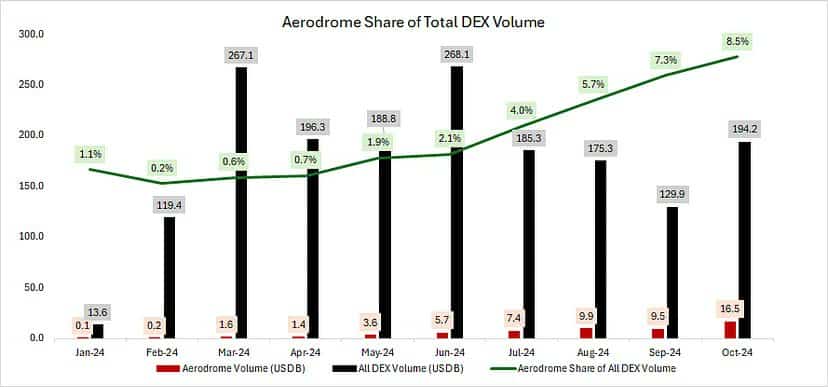

In less than a year, the Aerodrome’s DEX’s volume dominance has surged from 0% to over 8% at press time.

The remarkable growth has since pushed it to command nearly half of Base’s TVL (total value locked), noted Coinbase analyst David Han. He stated,

“Aerodrome accounts for 47% of Base’s TVL ($1.5B of $3.2B) and 58% of Base DEX volumes in the past 7 days ($7.1B of $12.2B).”

Interestingly, the token’s price action has benefited from the growth. AERO surged 1400% on YoY (year-on-year) and was valued at $1.39 at press time.

Will the projected growth in DEX volume and Coinbase’s move drive further upside traction?

AERO price action

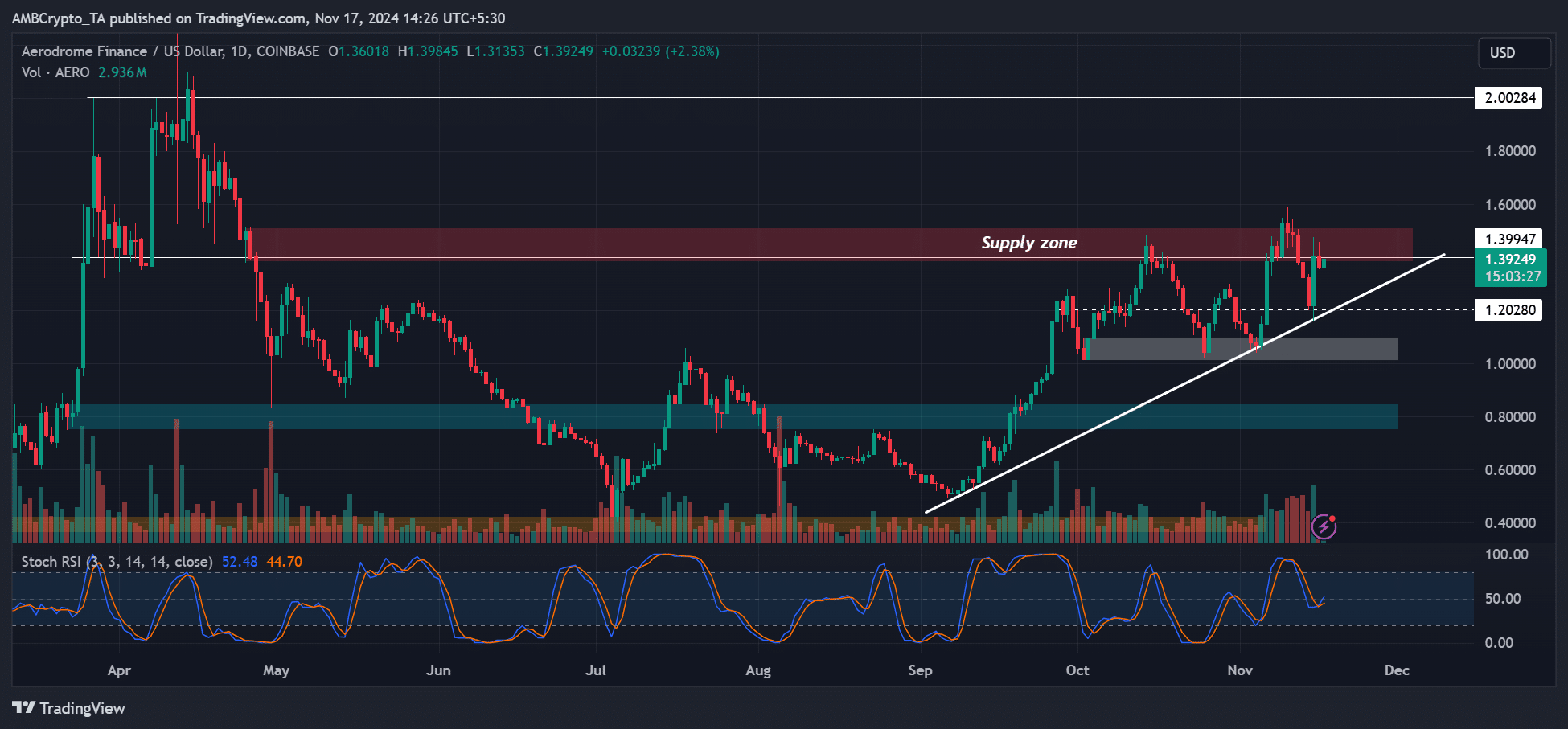

On the daily price chart, AERO has stayed above the trendline support (white line) and the Q4 support zone above $1.

Although $1.4 has acted as a strong supply zone (red) since October, clearing the resistance could allow the token to eye $2 and its all-time high.

If AERO hits $2, it could offer a great RR (risk-reward) ratio and over 40% potential gains when scooped at current levels.

Read Aerodrome Finance’s [AERO] Price Prediction 2024-2025

That said, a breach below the trendline and Q4 supports could dent the bullish outlook. These levels could act as stop losses for swing traders eyeing long AERO.

However, for investors, a potential extra bleed-out could still provide discounted buys for long-term holding.