- Ethereum whales added to their balances as the price extended its consolidation phase

- Directional uncertainty prevailed as ETH inflows outweighed its outflows

Ethereum [ETH] could be on the verge of another major run-up on the charts. The cryptocurrency has been showing signs of consolidation, with recent data suggesting that whales have been adding to their balances.

That’s not all though, with an analyst named Crow highlighting an interesting Ethereum fractal pattern on X (formerly Twitter) too. This finding revealed an accumulation zone, one that has lasted since August – Similar to a 2023 pattern.

In fact, the 2023 fractal yielded a bullish outcome after its mid-August to mid-October consolidation.

This was followed by a strong bullish breakout. Given these similarities, it’s worth contemplating that history might repeat itself.

Ethereum whales are adding to their balances

A consolidation phase will either conclude with a bullish outcome or a bearish trend.

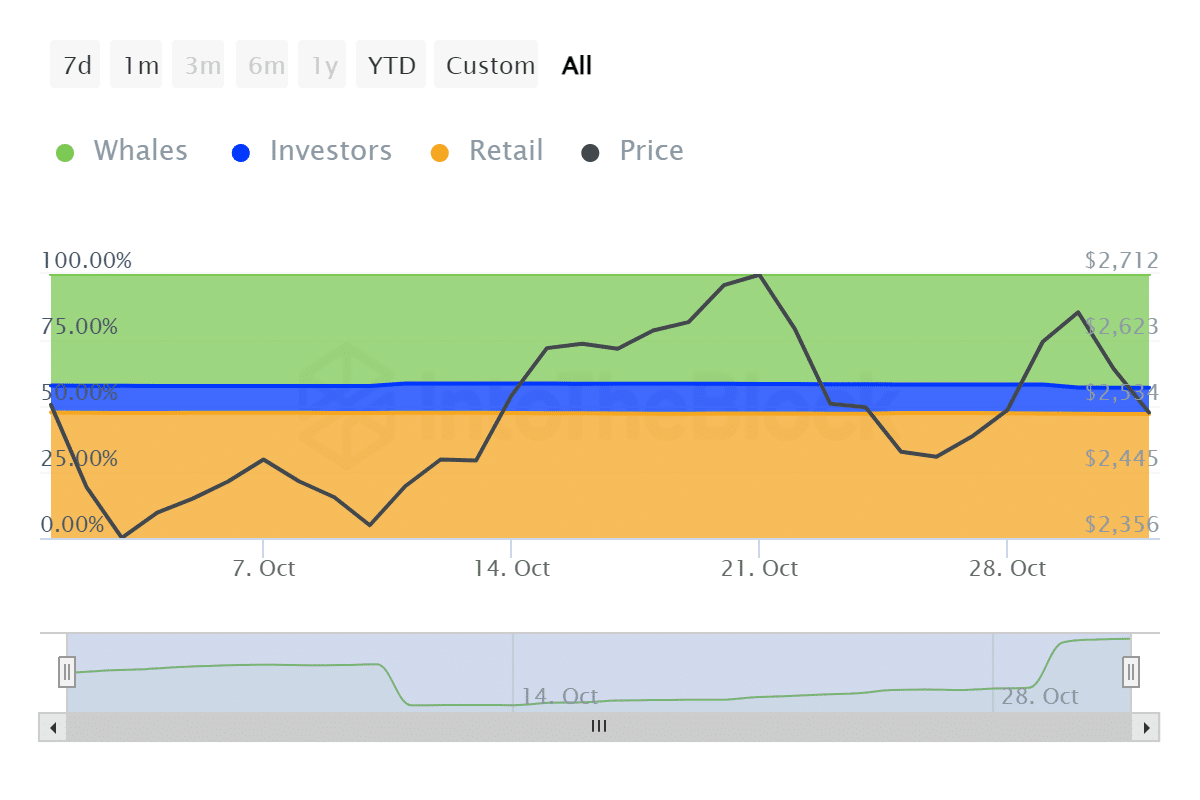

Consider this – Historical concentration data from IntoTheBlock indicated that whale balances grew significantly over the last two weeks. Whales held 56.68 million ETH by mid-October. However, their balances included 59.2 million ETH on 01 November.

Both investors and retail categories saw some outflows during the same period. The data confirmed that whales have been taking advantage of lower prices too.

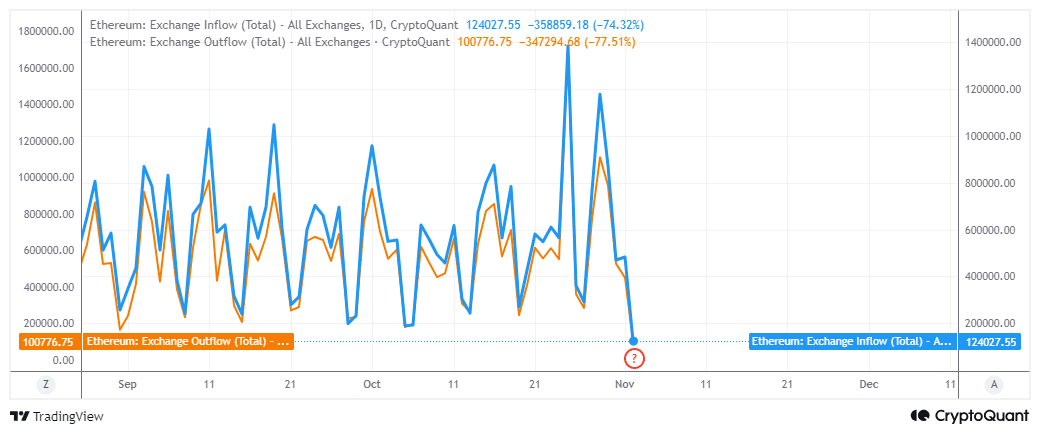

Meanwhile, Ethereum exchange flows recently dropped to levels last seen in June. Exchange outflows were higher at 124,057 ETH while exchange outflows clocked in at 100,776 ETH on 02 November. What this meant was that exchange inflows overtook outflows – A sign of persistent selling pressure over the last three days.

However, this downside resulted in a retest of ETH’s two-month support on the charts. This alluded to the possibility of a bullish pivot into the new week.

At the time of writing, ETH was valued at $2,502, with the altcoin notably struggling to secure some directional momentum.

While the support retest may offer some bullish optimism, there were also signs that the price may dip lower.The first major sign was that the RSI dipped below its 50% level. The fact that whales have been accumulating may also indicate the lack of enough demand to fuel a rally.

Additionally, ETH has been facing stiff competition from the likes of SOL and SUI, something that has been eating into its dominance.

Read Ethereum’s [ETH] Price Prediction 2024–2025

On top of that, uncertainty has returned to the market, potentially dampening sentiment and undermining ETH’s bullish potential.

In summary, accumulation by whales is a good sign that Ethereum is still attractive at its press time price point. However, a cloud of uncertainty might be holding back Ethereum.