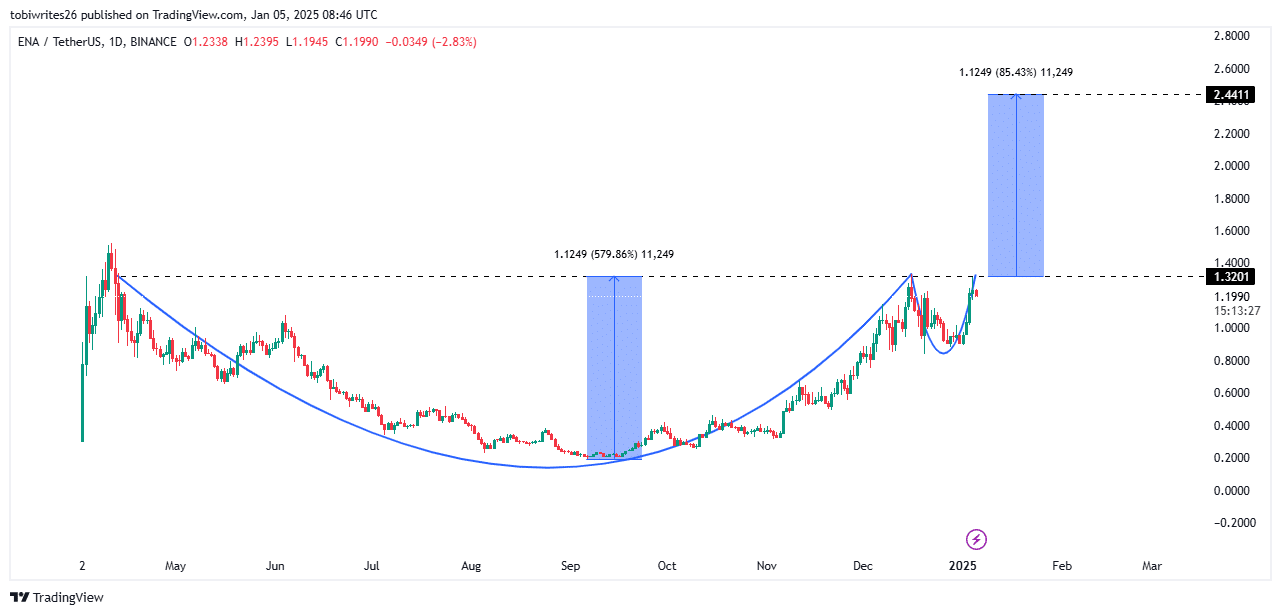

- Ethena was trading within a daily bullish cup and handle pattern at press time, signaling the potential for a new all-time high.

- However, large investors have yet to fully step in — this leaves room for further upside.

Ethena [ENA] is one of the few assets in the market that have been recording positive gains across all time frames. Over the past week and month, it has posted gains of 26.05% and 18.64%, respectively.

In the last 24 hours alone, ENA has shown upward movement with a modest gain of 0.97%. Given its current price action, and trader sentiment, there is a strong likelihood of further upward momentum.

Strong bullish outlook as demand set to rise

ENA’s current market structure suggests the potential for a significant rally in the coming days, potentially establishing a new all-time high.

On the chart, ENA was trading within a cup and handle pattern at press time, a classic bullish formation that often precedes a rally.

To confirm the breakout, ENA must first surpass the $1.32 resistance line (marked in black). Once this level is breached, the anticipated upward move could begin.

Based on historical price action, ENA is expected to replicate its previous rally, which saw a 597.86% surge from its bottom to the recent high. In this scenario, ENA could post an 85.43% gain, pushing its price to $2.44.

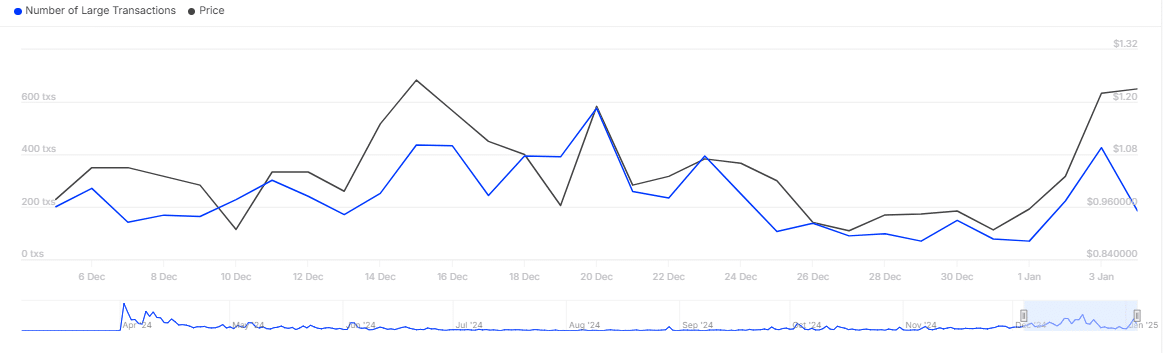

Notably, AMBCrypto’s analysis revealed that the ongoing rally was primarily driven by retail traders, as large holders—whales—have yet to fully engage. However, this group remained bullish on ENA.

Whales are bullish but remain inactive

According to IntoTheBlock, a significant disparity existed between bullish and bearish whales—or large holders—of ENA. IntoTheBlock defines whales as addresses controlling at least 1% of the asset’s total supply.

As of press time, there were 135 bullish whales compared to just 109 bearish ones. The 26-whale difference suggests that this group is inclined to bid ENA higher.

However, despite the bullish sentiment, these whales have yet to actively accumulate the asset.

Large transaction volumes have continued to decline, with only 58.97 million ENA, worth $72.71 million, traded in the past 24 hours. This reduced activity among whales indicates untapped potential for growth.

Interestingly, ENA’s recent price surges have been driven primarily by retail traders. This dynamic suggests that if large traders step in, the asset could experience a substantial rally, potentially unlocking significant gains.

Ethena: Will the historic TVL pattern repeat?

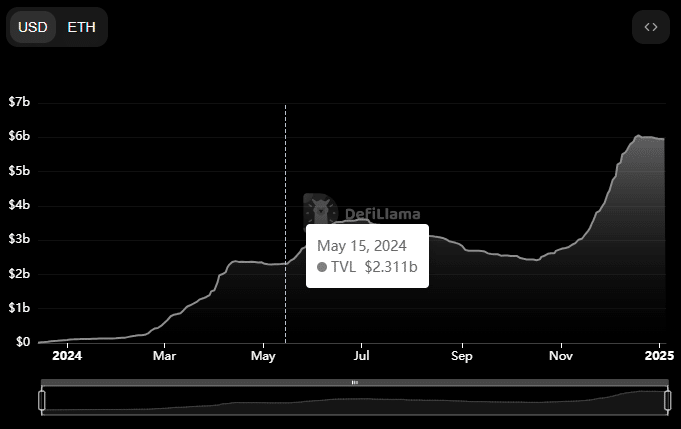

Total Value Locked (TVL), a key metric reflecting the funds staked or locked in the Ethena protocol, is currently in a phase of stasis, with growth remaining relatively steady.

As of press time, ENA’s TVL stood at $5.921 billion, a range it has maintained since the 17th of December 2024.

Read Ethena’s [ENA] Price Prediction 2025–2026

This movement mirrored its TVL behavior between the 13th of April and the 15th of May 2024, which preceded a significant upward move.

If this pattern proves to be fractal, it could signal a bullish outlook for ENA, potentially driving the asset higher from its current price levels.