- SEC sued Elon Musk for delaying disclosure of his X share acquisitions in 2022.

- Musk criticized the SEC as the community backed him.

The U.S. Securities and Exchange Commission (SEC) has sued Elon Musk. They accuse him of failing to disclose his large Twitter share acquisition on time in early 2022.

The SEC alleges this delay allowed Musk to secure his stake at an artificially reduced price, saving $150 million.

The late disclosure also affected other investors. They missed the chance to sell their shares at potentially higher values, unaware of Musk’s involvement.

Why did the SEC sue Musk?

Under SEC rules, investors surpassing a 5% stake in a public company must report it within ten days—a requirement Musk allegedly exceeded by eleven days.

The SEC alleged stating,

“Because Musk failed to timely disclose his beneficial ownership, he was able to make these purchases from the unsuspecting public at artificially low prices.”

The SEC also added,

“That day, Twitter’s stock price increased more than 27% over its previous day’s closing price.”

For context, the SEC alleges that Tesla CEO Elon Musk began acquiring Twitter shares in early 2022. By March 14th, he had surpassed a 5% ownership threshold.

Between the 24th of March and the 4th of April 2022, Musk reportedly spent over $500 million to buy additional shares, underpaying Twitter investors by more than $150 million.

The regulator claims that Musk’s failure to disclose his ownership on time allowed him to buy shares at artificially low prices. The market was unaware of his significant stake, a material fact that would have influenced stock valuations.

This occurred days before Gensler’s resignation

Interestingly, the timing of the SEC’s lawsuit coincides with significant leadership transitions, as Chair Gary Gensler prepares to step down on 20th January, marking the start of Donald Trump’s presidency.

This period also aligns with Musk’s upcoming role as the head of the newly established “Department of Government Efficiency” (D.O.G.E.), where he will advise the incoming administration on streamlining government operations.

The overlap of these developments adds an intriguing layer to the unfolding legal and political narrative surrounding Musk and his involvement with X(formerly Twitter).

As anticipated, Musk took to X to voice his criticism of the SEC, and stated,

“Totally broken organization. They spend their time on shit like this when there are so many actual crimes that go unpunished.”

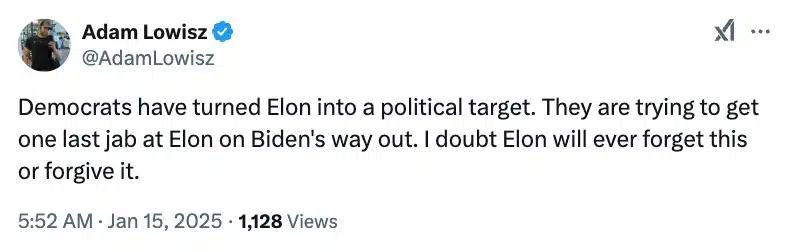

Needless to say, the community stood in favor of Musk as highlighted by an X user who said,

Musk’a previous legal battle

Well, this isn’t the first instance of tensions between the Biden administration and Musk.

Just last year, in August, Musk faced allegations of defrauding investors through Dogecoin [DOGE] manipulation and insider trading, reportedly resulting in billions in losses.

However, on the 29th of August, U.S. District Judge Alvin Hellerstein dismissed the lawsuit in Manhattan, ruling in Musk’s favor.

While memecoins like Pepe [PEPE], Shiba Inu [SHIB], and particularly DOGE often surged exponentially following Musk’s tweets, the court found no evidence directly linking him to intentional market manipulation.