- WIF pumped +20% in 24 hours amid a broader market rally on US election day.

- Nearly $2 million worth of short positions were liquidated in 12 hours

Crypto markets soared during US election day, with Bitcoin [BTC] surging to a new all-time high (ATH) as a Trump win seemed apparent. Memecoins pumped harder, with dogwifhat [WIF] rallying 20% in 24 hours.

There was already a long wick on the daily candlestick at press time, suggesting that the election day pump could face some cool-off. But what’s next for one of the top memecoin gems after the US election?

WIF’s next step

On the price charts, WIF followed the textbook pullback scenario and eased at the golden zone on the Fib retracement tool (50%-61.8% Fib level, marked white). The $1.2 – $2.0 support zone (white) triggered the latest +20% pump.

Since some traders might book election profits from the rally, a cool-off could drag WIF to $2.245 (38.6% Fib level) or back to the golden zone. Afterward, the memecoin could continue with its uptrend.

In such a scenario, sidelined bulls could seek market re-entry at the above support levels.

That said, a close above $2.5 could accelerate WIF to October highs near $3, provided BTC maintains the bullish streak.

WIF whales exposure

That said, the election day run-up seemed driven by large players. According to Hyblock, whales added massive WIF positions on 5th November, as shown by the Whale vs Retail Delta indicator.

This was contrary to the significant de-risking seen before the election, as they reduced positions, tanking WIF. Should whale appetite persist for the memecoin, the rally could be pushed higher.

Read dogwifhat [WIF] Price Prediction 2024-2025

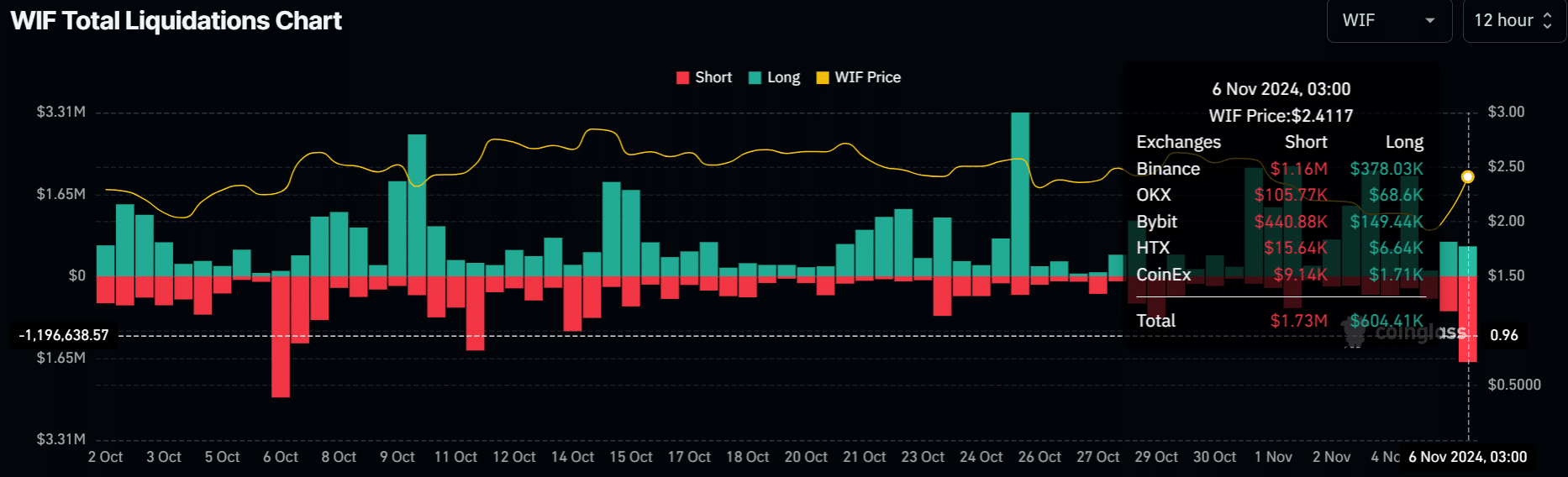

The above bullish outlook was also supported by massive liquidation of short positions. In the past 12 hours, before press time, $1.7 million worth of short positions (betting for WIF price decline) were wiped out.

In short, it appeared bears had no market edge, at least in the short-term, with election enthusiasm at a fever pitch. If so, any WIF pullback could be a great buying opportunity if the uptrend continues.

![dogwifhat [WIF]](https://ambcrypto.com/wp-content/uploads/2024/11/WIFUSDT_2024-11-06_10-03-42.png)

![dogwifhat [WIF]](https://ambcrypto.com/wp-content/uploads/2024/11/Binance-USDⓈ-M-Perp_WIFUSDT_2024-11-06_10-26-17.png)