- Dogecoin faces key resistance at $0.40, a crucial level for short-term price direction.

- A breakout above $0.40 could drive DOGE toward $0.43, but risks a dip to $0.36.

Dogecoin [DOGE] is at a key resistance level, just above the crucial $0.40 highlighted by analysts. It has been predicted that a sustained break above $0.40 could propel DOGE to $0.43, while a failure to clear this resistance might lead to a dip toward $0.36.

As Dogecoin now hovers at this key price point, the next few days will be critical for investors watching for signs of a breakout or a pullback.

$0.40 resistance: Why it matters

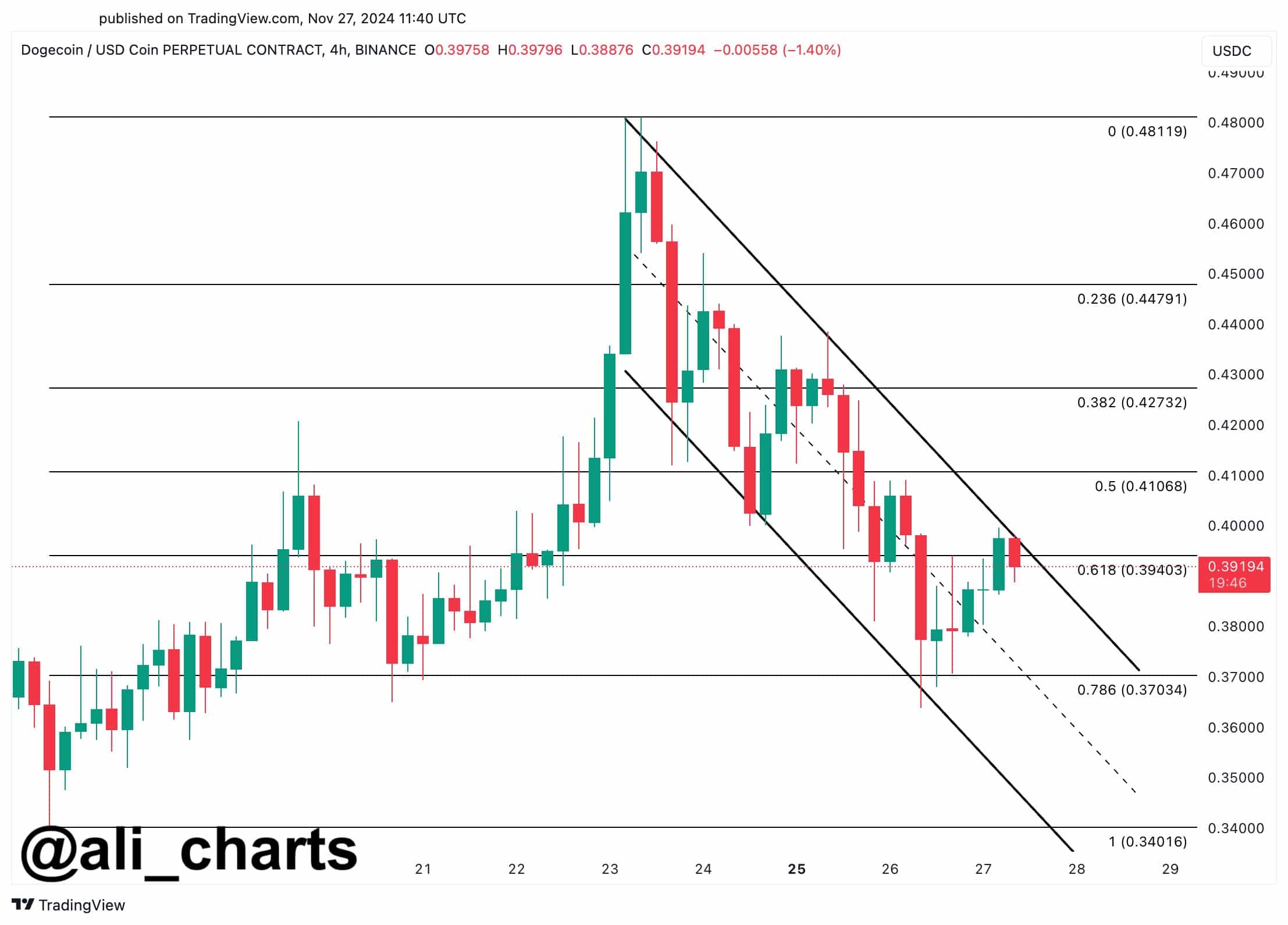

According to popular analyst Ali Martinez, $0.40 marks a crucial Fibonacci retracement level (0.5), aligning with Dogecoin’s downtrend channel. This resistance level is critical as it reflects a convergence of technical barriers – psychological significance and prior rejection zones.

Breaking above $0.40 could signal bullish momentum, potentially driving DOGE to $0.43, another Fibonacci resistance at 0.382.

However, failure at this point might confirm bearish dominance, with targets around $0.36 (0.786 Fibonacci). Martinez’s chart further illustrates the descending channel, emphasizing the $0.40 level’s role in dictating the coin’s short-term direction.

Traders should monitor volume and candlestick patterns near this threshold to anticipate a breakout or further retracement.

Potential upside: What a break above $0.40 means for DOGE

A decisive break above $0.40 could trigger a bullish breakout for Dogecoin, with $0.43 as the immediate target, corresponding to the 0.382 Fibonacci retracement level.

Beyond this, momentum could accelerate, with $0.45–$0.47 emerging as key resistance zones tied to previous price ceilings. Such a move would likely attract increased trading volume and renewed interest from retail and institutional participants.

Additionally, breaking $0.40 would invalidate the current descending channel, potentially flipping the trend bullish in the short term.

Market sentiment and whale activity, both crucial drivers of Dogecoin’s price action, could amplify the rally if confidence returns. However, sustainable upside will depend on broader market conditions and whether DOGE can hold $0.40 as newfound support.

Risks of rejection at $0.40

Failure to break above $0.40 could reaffirm bearish momentum, pushing Dogecoin toward the $0.36 support level, aligned with the 0.786 Fibonacci retracement. A drop below $0.36 would expose DOGE to further declines, potentially testing $0.34 or lower, as sellers gain control.

Such a rejection would also validate the descending channel, signaling prolonged weakness. Lack of buying pressure and reduced trading volume could exacerbate the downside, deterring investor confidence.

Read Dogecoin’s [DOGE] Price Prediction 2024–2025

Additionally, broader market conditions, including Bitcoin’s performance and macroeconomic factors, could amplify bearish risks.

Traders should be cautious of fake-outs near $0.40, as a failure to sustain gains above this level might lead to rapid sell-offs, further undermining short-term recovery prospects.