- Whale activity and technical indicators hint at a potential bullish move for Dogecoin.

- Rising active addresses and a slight bullish market sentiment support an upward price shift.

Massive 800 million DOGE tokens, worth approximately $323 million, recently moved between unknown wallets, sparking speculation across the crypto space. According to Whale Alerts on X (formerly Twitter), such significant transfers often signal major market shifts.

At press time, Dogecoin [DOGE] was trading at $0.4067, up 0.57% in the last 24 hours. However, the question remains: Is this whale activity a precursor to a bullish breakout, or simply a routine transaction by large holders?

Is DOGE poised for a bullish move?

Looking at technical indicators, Dogecoin is showing some promising signs, though caution is still needed. The Relative Strength Index (RSI) currently stands at 68.22, just below the overbought level of 70.

This suggests that Dogecoin is in a strong position but approaching overbought territory. If buying pressure doesn’t continue, a short-term pullback could be on the horizon.

On the other hand, the 9-EMA is above the 21-EMA, a bullish sign for short-term momentum. However, there has been no confirmed crossover yet, which means traders are still waiting for confirmation before fully committing to a breakout.

Therefore, while the technical setup is encouraging, the market remains cautious.

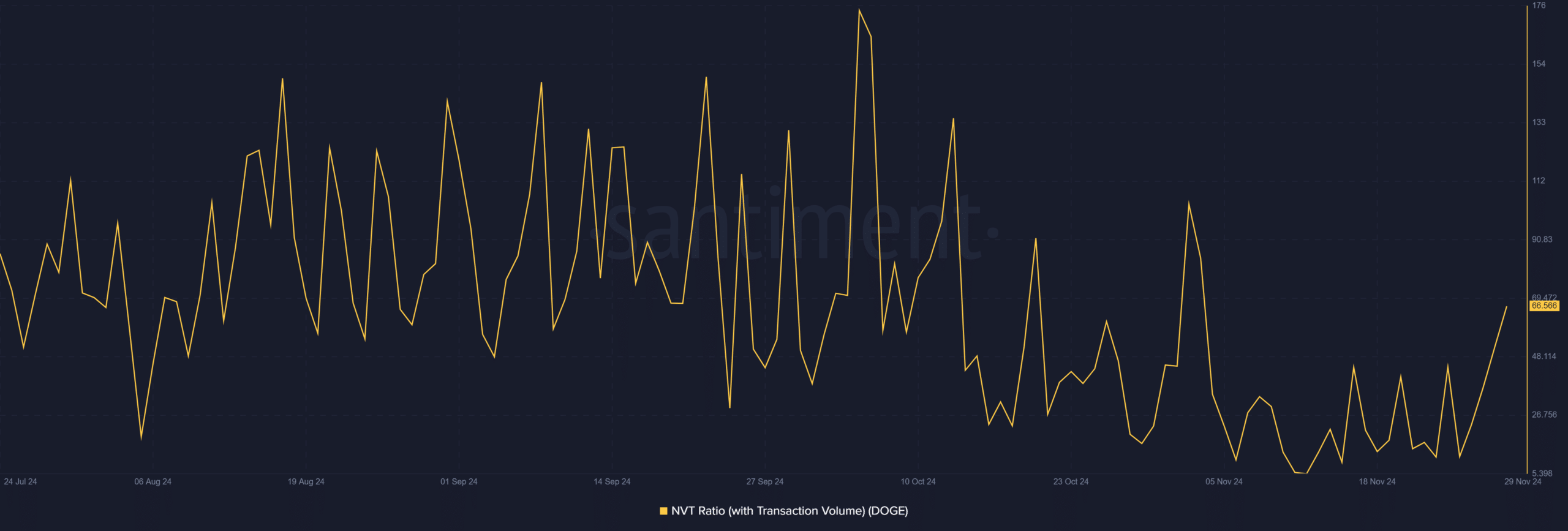

DOGE NVT ratio: Is market activity building?

The Network Value to Transactions (NVT) ratio has risen from 51.93 to 66.57 over the past 24 hours. This increase suggests that transaction volume is picking up relative to Dogecoin’s market cap, which typically signals growing market activity.

Higher NVT ratios often correlate with price increases, as more capital flows through the network. However, since the rise in NVT is relatively modest, traders should wait for more sustained growth in volume before expecting a significant price shift.

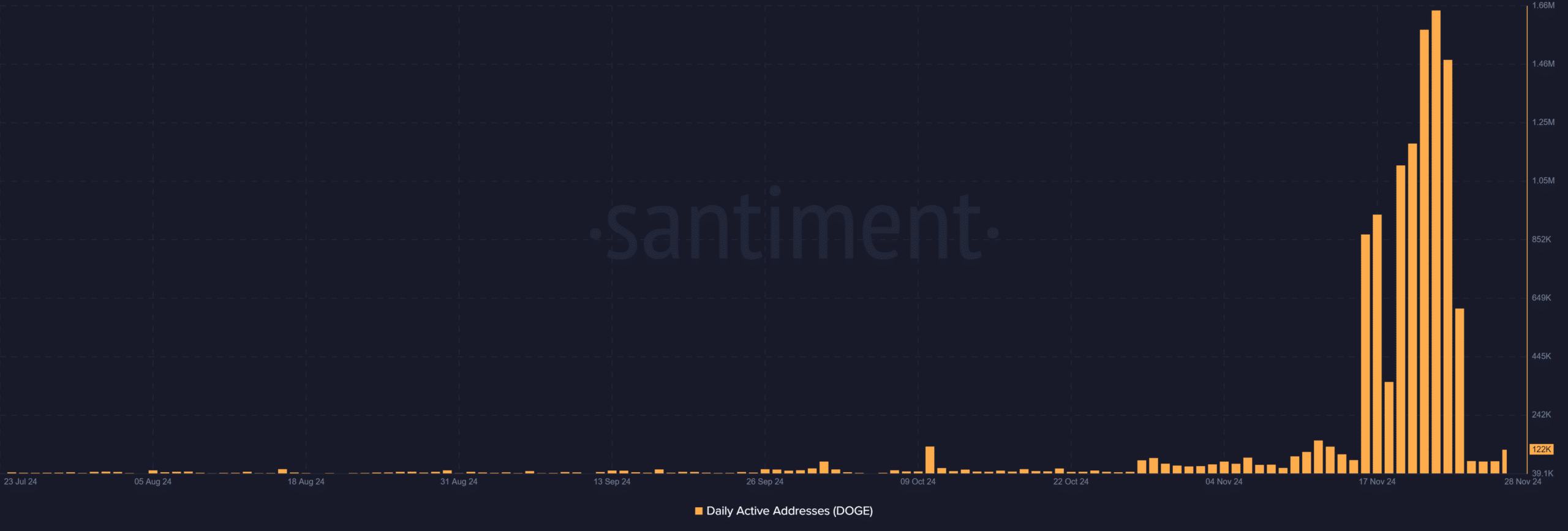

Surge in active addresses: What does it mean?

Additionally, Dogecoin’s daily active addresses surged from 82.7k to 122.84k in just one day—a 48% increase. This sharp rise suggests growing user engagement with the network, which is often a bullish signal.

More active addresses typically indicate higher investor interest, which could translate into upward price momentum. Therefore, this increase in active addresses could be a sign that Dogecoin is gaining traction with investors.

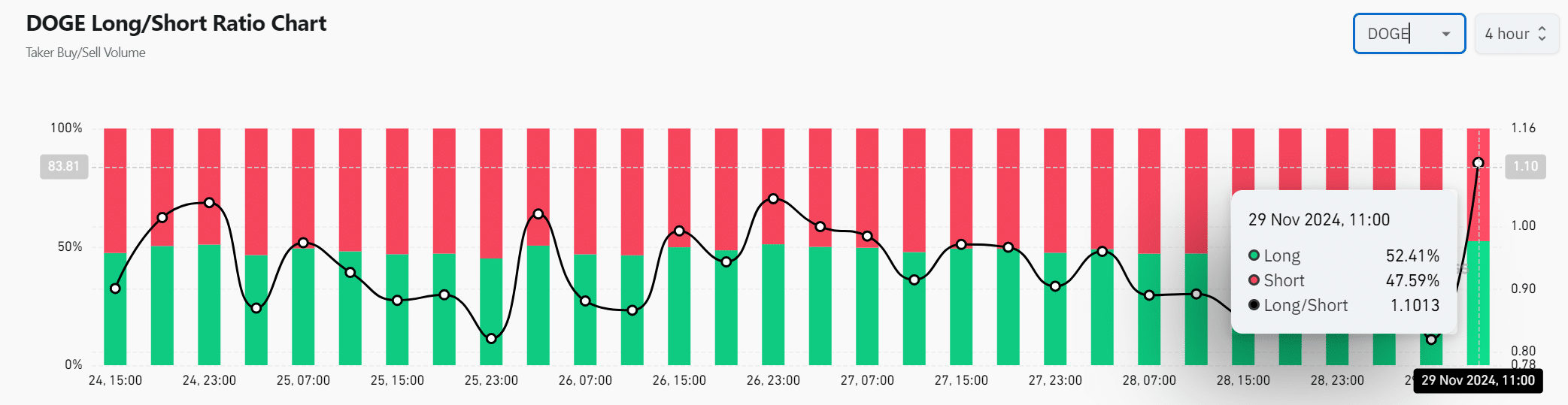

Market sentiment: Bulls slightly ahead

The long/short ratio for DOGE currently stands at 52.41% long and 47.59% short, creating a long/short ratio of 1.1013. This slight bullish bias suggests that more traders are betting on upward price movement.

However, the close ratio indicates that the market remains uncertain, with both bulls and bears waiting for clearer signals.

Is your portfolio green? Check out the Dogecoin Profit Calculator

Is a breakout imminent?

While whale activity, rising transaction volume, and increasing active addresses suggest that DOGE could be preparing for a bullish move, the mixed technical signals imply caution.

The market is still in a consolidation phase, and traders should watch for further confirmation before committing to a breakout.

Therefore, while there is potential for upside, Dogecoin’s next major move depends on sustained momentum and clearer market signals.