- Bitcoin’s post-halving surge, fueled by supply-demand imbalances, continues to drive its price higher.

- Anthony Scaramucci supported Bitcoin’s long-term potential, while Peter Schiff remained skeptical.

Bitcoin [BTC], once struggling to break the $60,000 mark just weeks ago, was making headlines with its impressive bull run.

As of the latest update from CoinMarketCap, BTC had surged to $88,683, reflecting a significant 8.81% rise in just 24 hours.

The cryptocurrency’s performance over the past week and month is equally astounding, with gains of 28.72% and 41.21%, respectively.

Is Trump behind the crypto market surge?

This remarkable rally has propelled Bitcoin past the $89,000 threshold, contributing to a surge in the overall crypto market, which has now surpassed its pandemic-era peak.

Much of this growth was fueled by market optimism, with traders betting on a continued boom under the now President Donald Trump.

In fact, Anthony Scaramucci, CEO of SkyBridge Capital and previously a vocal critic of Trump during the election cycle, had acknowledged the impact of the Republican victory on BTC’s recent bull rally.

Scaramucci expressed growing confidence in the potential for the U.S. to create a Strategic Bitcoin Reserve, which could drive increased institutional allocations and further propel the price of the leading cryptocurrency.

He said,

Bitcoin’s surge on Trump’s win is not the main story

However not everyone seems to share the same thought as Jesse Myers, co-founder of OnrampBitcoin noted,

“Yes, the incoming Bitcoin-friendly administration has provided a recent catalyst…But, that’s not the main story here.”

He claimed,

“The main story here is that we are 6+ months post-halving.”

Myers pointed out that Bitcoin’s halving event has created a supply-demand imbalance, where the available supply was insufficient to meet the increasing demand at current price levels.

His imbalance has driven a surge in prices to restore equilibrium, a phenomenon typically seen after each halving event.

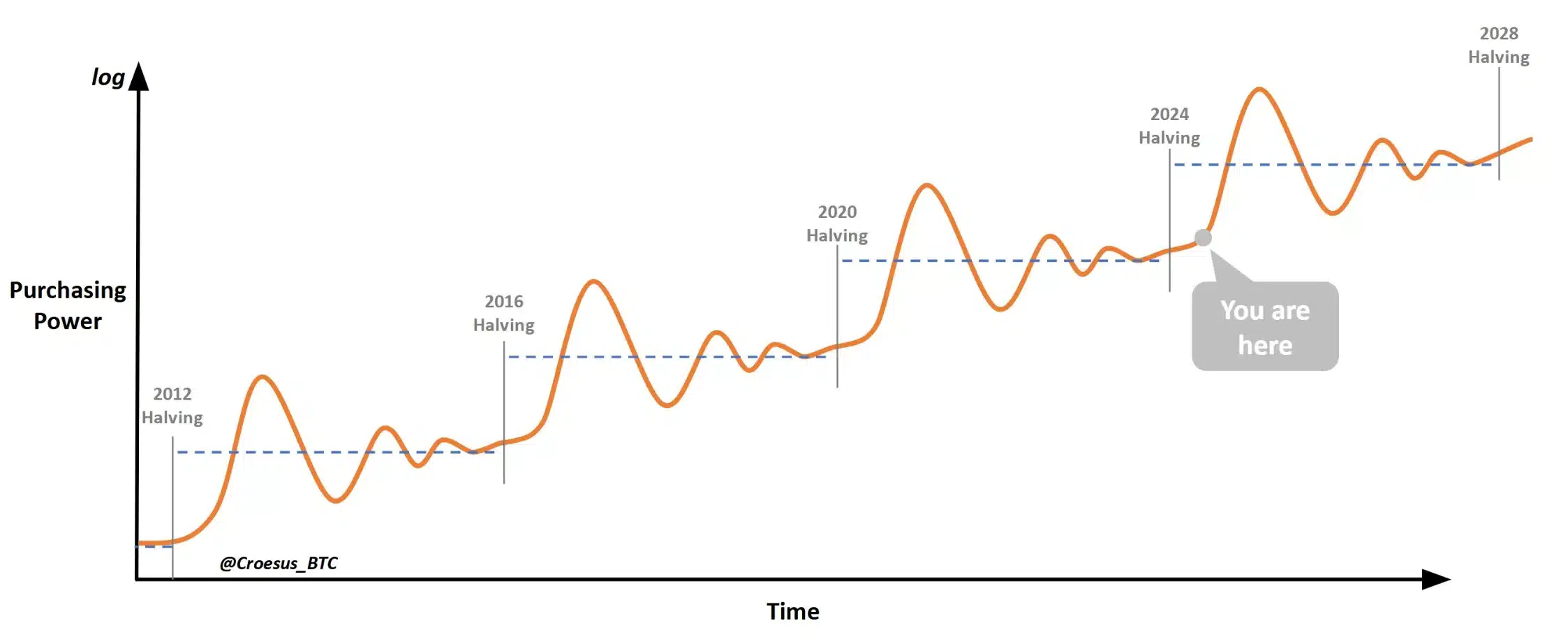

Drawing from historical trends following the halvings of 2012, 2016, and 2020, Myers predicts a similar outcome after the 2024 halving, with the market entering a bull run that will continue to push BTC’s price higher.

Thus, as per Myers, the post-halving surge is expected to fuel the next major upward trajectory for the cryptocurrency.

While Myers acknowledged that Trump may not be the sole driver behind Bitcoin’s surge, he shares confidence in Bitcoin’s long-term viability.

Despite Bitcoin making news Schiff remains unaffected

In contrast, Peter Schiff, a vocal critic of Bitcoin, expressed his skepticism on X.

Schiff dismissed the current rally, reiterating his long-held belief that Bitcoin’s rise was speculative and unsustainable, warning investors of potential risks in the long run.

He said,

“Over the years, Bitcoin promoters have corrupted many.”

Thus, as Bitcoin approached the $90K mark with the RSI in the overbought territory, the next phase for the cryptocurrency remains highly anticipated.