- CRO has broken out of a four-month range on high trading volume.

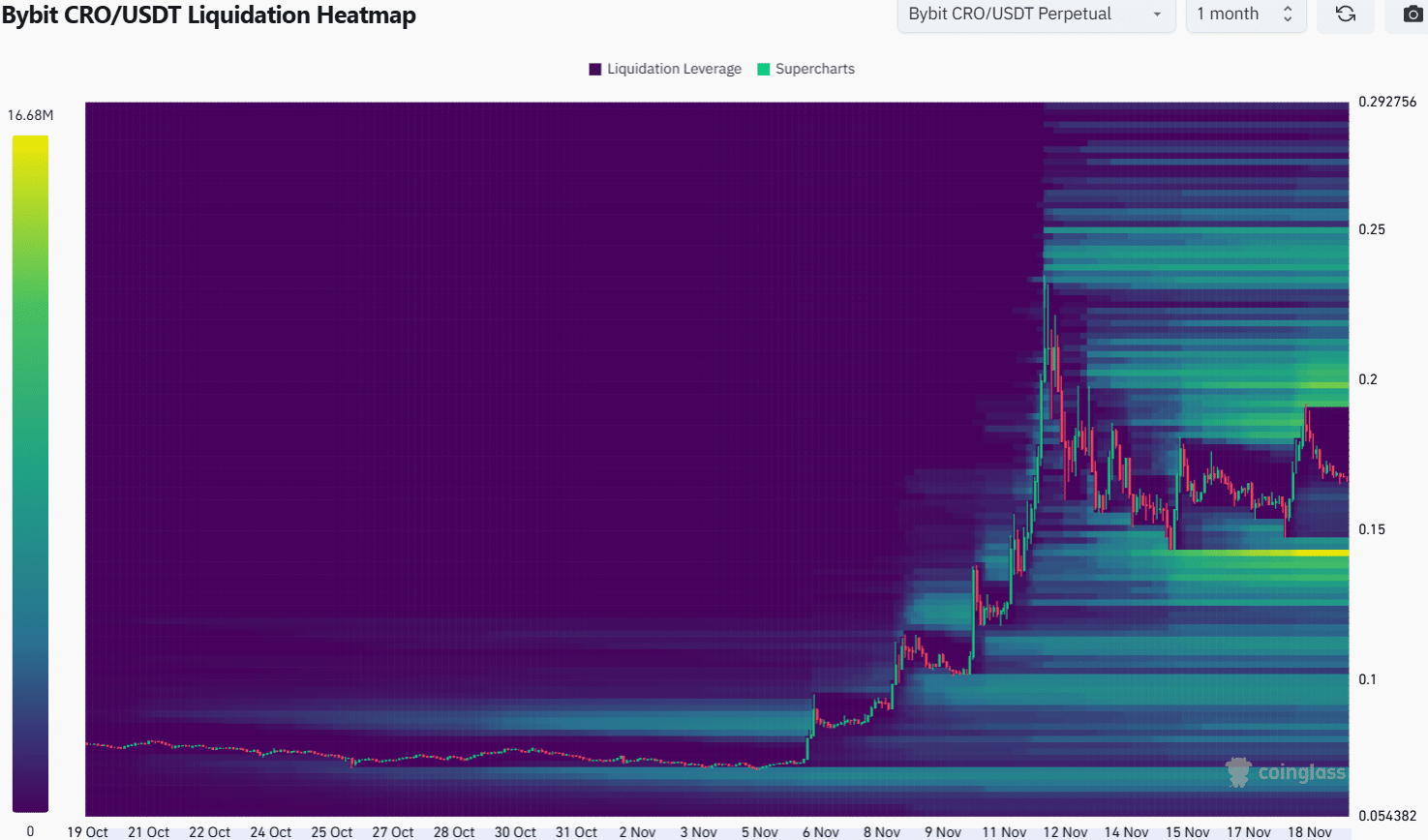

- The liquidation heatmap offered clues for buyers looking to enter long positions.

Cronos [CRO] registered strong gains in the past two weeks. It rallied 230% within a week before the recent retracement. This was a sign of bullish conviction. To the north, $0.27 and $0.33 were viable bullish targets.

The liquidation heatmap showed that the short-term Cronos price prediction is a 15%-18% dip from the current market price. Should buyers re-enter in the coming days, or will the retracement end without a deeper drop?

CRO down 28% from local highs

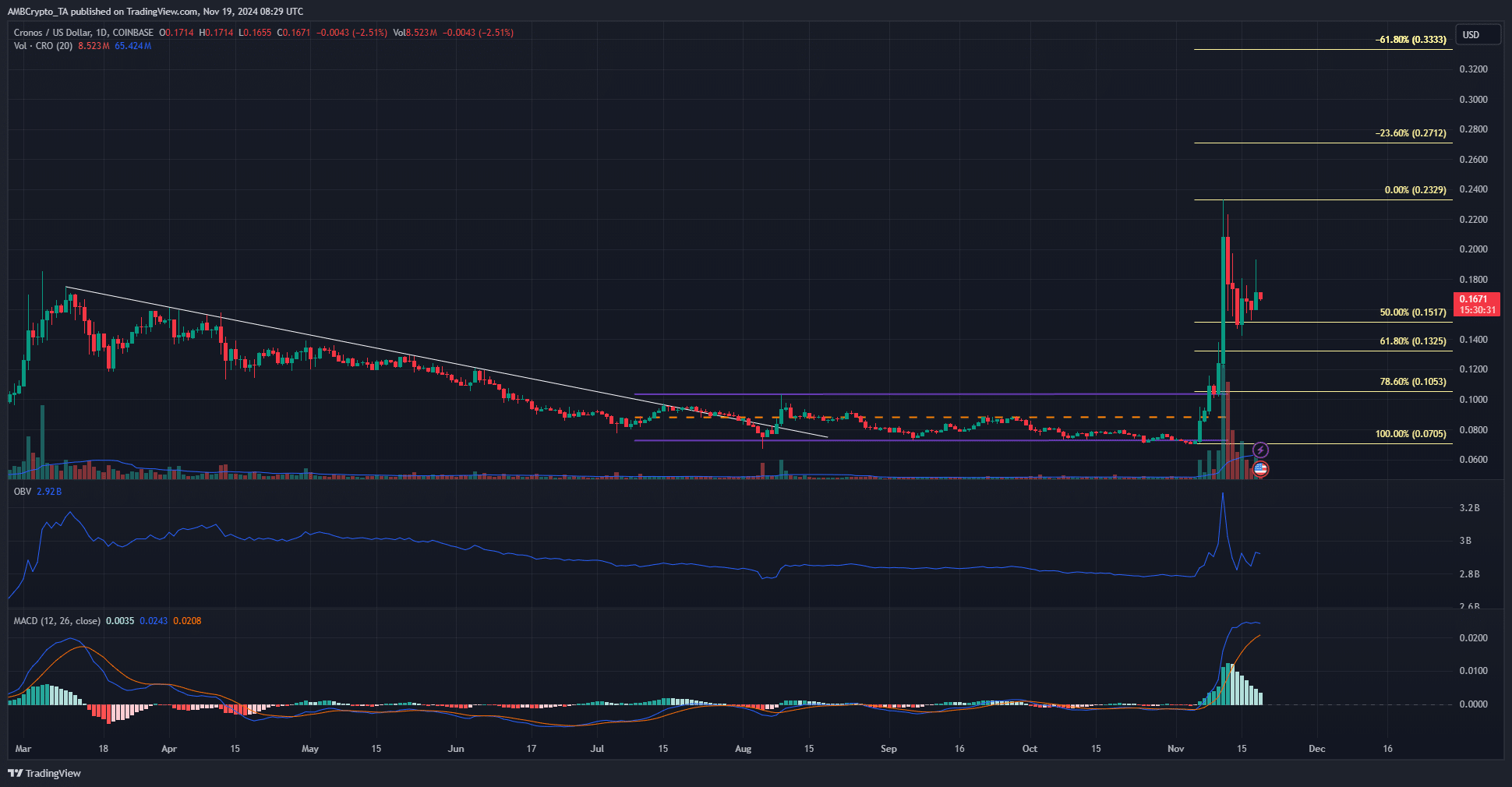

A set of Fibonacci retracement levels was plotted based on the November move from $0.0705 to $0.2329. The trading volume was at 2.7 million CRO on the 5th of November, and it soared to 50.27 million CRO on the 6th of November.

On the 11th of November, CRO’s 1-day trading volume was 308.16 million CRO on Coinbase alone. This massive increase in volume came alongside the swift gains the Cronos network token made.

Since March, Cronos crypto has been in a downtrend. It began to form a range in July and August. The recent rally was spurred from the lows of this range, marked in purple.

The retracement from $0.2329 was accompanied by high selling pressure, and the OBV has not been able to trend higher.

It is possible that Cronos will see a deeper retracement toward $0.132 and $0.105. Such a move would present a buying opportunity.

Cronos price prediction- 16% price dip ahead

Source: Coinglass

AMBCrypto found that the liquidation heatmap of the past month also provided valuable insights into support and resistance zones for CRO. The $0.142 and $0.2 had a cluster of liquidation levels that could attract the price.

Read Cronos’ [CRO] Price Prediction 2024-25

In particular, a move to $0.142 is likely to rebound higher. CRO has recently broken out of a four-month range with high volume- more gains are far likelier than a retracement into the former range.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.