- ADA’s consolidation was keeping greedy investors on edge: HODL for more gains or exit to break even?

- With a proven track record of resilience, can ADA defy the odds in its long-term outlook?

In just a few days, it will be two months since Cardano[ADA] reached its post-election peak of $1.24. Despite pulling back 23% from that high, it’s still holding strong, up 180% from its pre-election low.

This consolidation could be a bullish signal, keeping weak hands hungry for a ‘potential’ rebound.

Decoding the current ADA mood

A quick look at Cardano’s daily price chart reveals a clear trend: Consistency. Each dip to the $0.60 support is met with a solid rebound, suggesting steady accumulation.

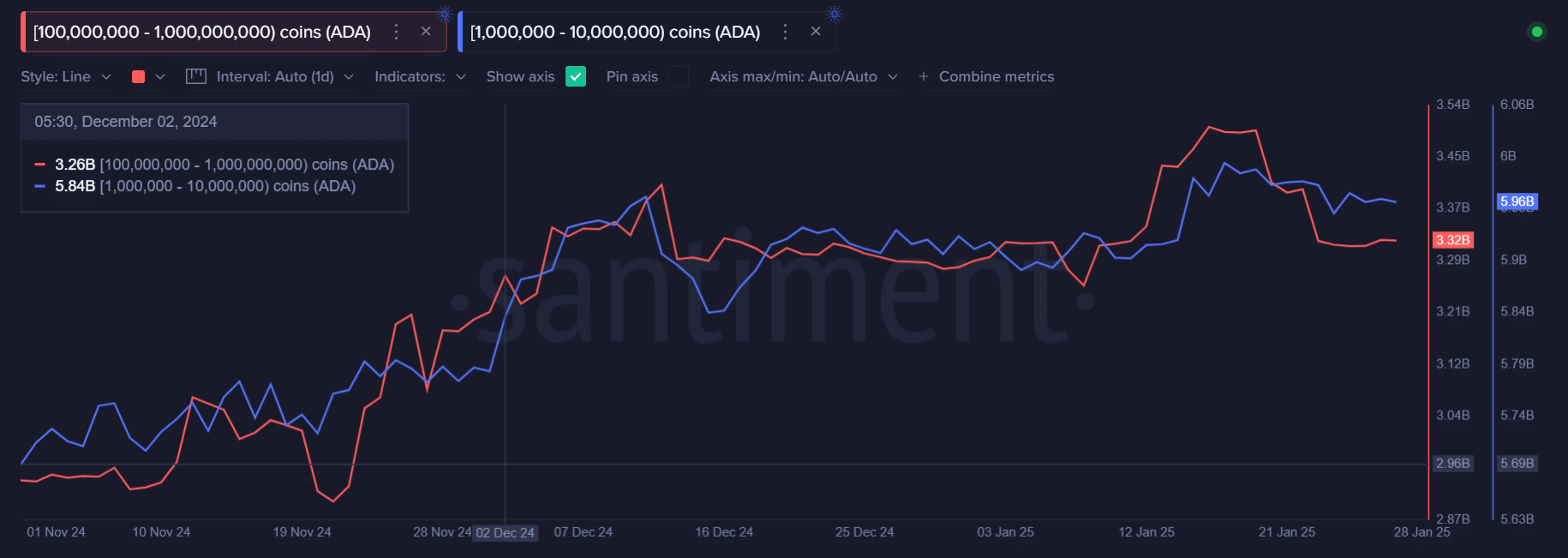

Even more telling, the top two whale wallets have been loading up on ADA since its last peak, adding billions to their holdings.

But the trading volume has slowed. The post-election pump saw a surge of over a billion in volume, but now, it’s struggling to hit 300 million. On top of that, daily active addresses on the network have dropped by a staggering 65%, now sitting at just 38.7K.

This explains why ADA struggles to stay above $1. While whales continue loading up, providing brief relief, the lack of fresh retail capital is keeping the rally shaky. Profit-taking soon drags the price back to its support level, leaving the market in a tug-of-war.

Yet, there’s a silver lining: The number of ADA holders has increased by 1 million in the past two months, reaching 4.41 million. While buying interest may have cooled, the fact that these holders are sticking around could be a game-changer.

How? Once the market rebounds, BTC breaks resistance, and fresh capital flows into the market, ADA could see a significant surge past its earlier peak.

And it doesn’t stop there

Cardano’s future isn’t just about ADA’s price swings. As a Layer 1 blockchain, its true potential lies in its ability to innovate long-term. In a recent interview, the CEO of Cardano, Charles Hoskinson, proposed an exciting possibility: A bridge with Bitcoin.

Simply put, the idea is to enable smart contracts on Bitcoin using Cardano’s underlying tech. The result? Increased liquidity and growing demand for ADA.

Read Cardano’s [ADA] Price Prediction 2025–2026

While this is still a future project, it’s definitely worth keeping an eye on. As the crypto space grows more interconnected, a Cardano-Bitcoin[BTC] partnership doesn’t seem so far off.

So, despite a dip in buying momentum, ADA’s consolidation is still a bullish sign. The developers are leveraging FOMO to attract new liquidity, making HODLing ADA a smart move.