- Cardano large transactions surged by 32% over the past 24 hours.

- ADA has surged by 14.72% over the past day.

After a sustained period of consolidation, Cardano [ADA] has seen a change in fortunes.Over the past month, the altcoin has experienced significant gains on price charts.

The recent price upsurge raises questions about what factors that are driving the price rally. According to AMBCrypto’s analysis, one factor that stands out is the increased interest shown by whales.

Cardano’s large transactions surge

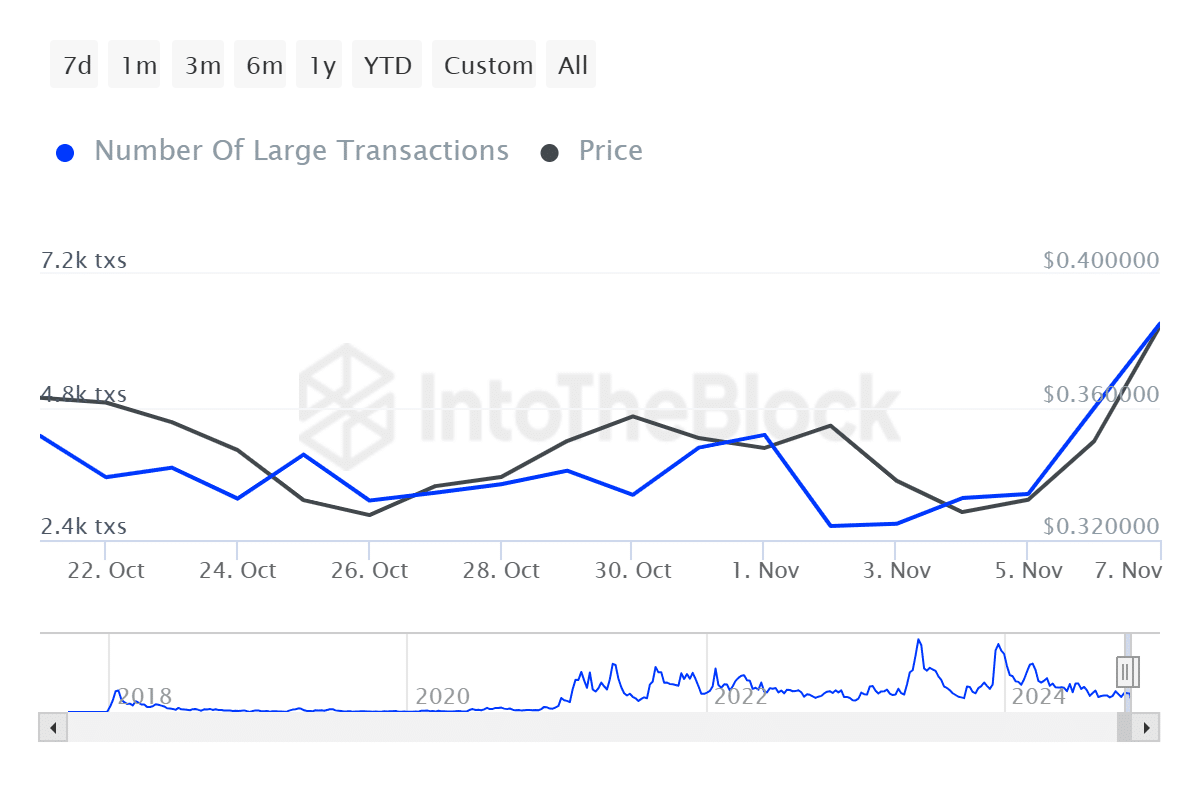

According to IntoTheBlock data, Cardano’s whale transactions have spiked over the past week.

In the last 24 hours, the transactions have surged from 4.78k to 6.31k. This marked a 32.01% increase over the same period.

Also, over the past week, Cardano’s whale transactions have spiked by approximately 138.11% hiking from a weekly low of 2.65k.

In context, large transactions involve those that are worth at least $100k. Therefore, a rise in these transactions reflects long-term holder’s perception of the market.

Historically, Cardano is widely regarded for its affinity to attract whales. When this happens, it implies that investors are betting on the altcoin’s future.

Undoubtedly, this increased whale activity reflects the renewed interest in the protocol and a higher demand. Such an increase tends to drive prices up.

Impact on ADA’s price charts?

As expected, the recent increase in whale activities has had a sustained impact on ADA’s price charts. In fact, at the time of writing, ADA was trading at $0.4265. This marked a 14.72% increase over the past day.

Equally, the altcoin has also gained on weekly and monthly charts by 24.98% and 23.26% respectively. These prevailing market conditions showed that ADA was experiencing investors’ favorability and positive market sentiments.

For example, Cardano’s transaction volume has surged from 16.42 billion to 22.21 billion tokens.

Such a surge in transactions suggested that more users were interacting with the network, which could mean rising interest and adoption.

Additionally, Cardano’s Open Interest per exchange has increased over the past week from $53.4 million to $87.65 million, at press time.

This suggested that these transactions are mainly associated with inflows, with investors opening new positions. Simply put, ADA is currently enjoying favorable market conditions, as reflected by the increase in large transactions.

Realistic or not, here’s ADA’s market cap in BTC terms

With the prevailing market conditions, ADA is well-positioned to make more gains on price charts.

Therefore, ADA could attempt the $0.5 resistance level in the short term if these conditions are maintained.