- Solana’s trading volume surged by 94.85%, despite an 8.68% price drop in the last 24 hours.

- SOL faced resistance at $217; $195 support is crucial for stability as institutional interest grows.

Solana [SOL] was trading at $197.05 at press time, experiencing an 8.68% decline in the last 24 hours but posting a 4.31% gain over the past week.

Meanwhile, the cryptocurrency’s trading volume surged to $6.69 billion within 24 hours, reflecting robust market interest.

At the time of writing, with a circulating supply of 480 million SOL, the coin’s market capitalization stood at $95.54 billion, SOL’s price has fluctuated within a 24-hour range of $193.90 to $215.98, and the weekly range extends from $188.79 to $221.35.

The asset is currently 24.9% below its all-time high of $263.21, recorded on the 23rd of November 2024, and it faces resistance near key levels.

Technical indicators point to bearish momentum

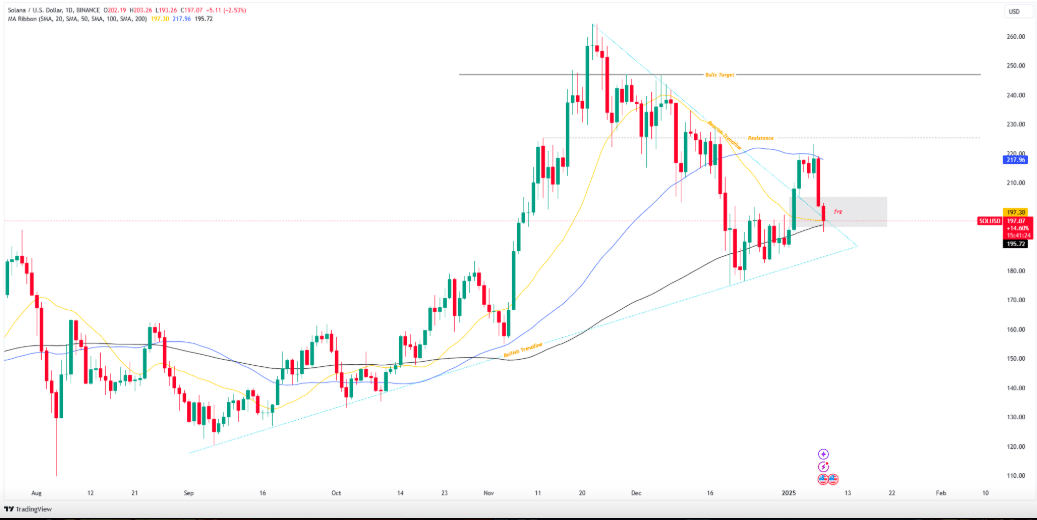

Recent price action shows a break below the bullish trendline and Fair Value Gap (FVG), with the 200-day Moving Average(MA) at $217.96 acting as strong resistance.

Immediate support lies near $195.72, with a potential downside target of $180 if the support level fails to hold.

The convergence of MA indicates possible increased volatility. Traders are monitoring whether SOL can reclaim $200 and move toward the $220 resistance.

A continued bearish trend could further test lower support levels, creating uncertainty in the market.

Derivatives data reveals trader caution

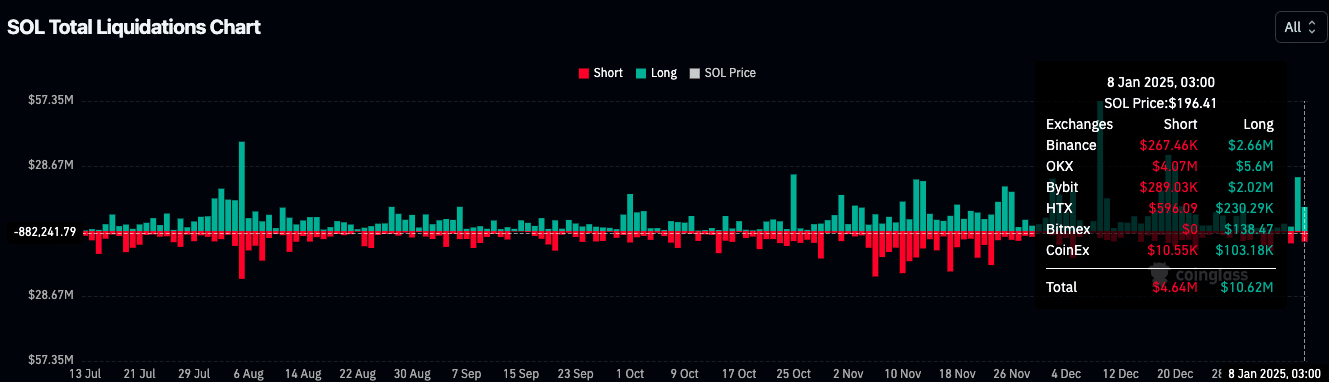

Coinglass data shows a mixed sentiment in derivatives markets. Trading volume increased by 94.85% to $12.62 billion, while Open Interest(OI) dropped 10.68% to $6.03 billion, indicating reduced leveraged positions.

Options activity also surged, with a 447.63% increase in volume to $902,320 and a 14.97% rise in OI to $1.97 million.

Liquidation data reveals that $10.62 million in long positions were liquidated compared to $4.64 million in shorts, suggesting traders betting on a rebound were caught off guard by the price drop.

The majority of liquidations occurred on Binance and Bybit, with long positions bearing the brunt of the losses.

SOL’s network activity remains strong

According to DefiLlama, Solana’s Total Value Locked (TVL) is $8.79 billion, showing a 7.59% decline in the last 24 hours.

The stablecoin market capitalization on Solana stands at $5.56 billion, while the network generated $4.35 million in fees and $2.18 million in revenue over the same period.

Network activity remains high, with 4.74 million active addresses and 62.43 million transactions recorded in the last 24 hours.

Read Solana’s [SOL] Price Prediction 2025–2026

Increased institutional involvement, such as Coinbase’s liquid staking integration with Solana, continues to support market interest despite recent price volatility.

As Solana consolidates near $197, traders and investors are focused on key technical levels and network activity for signs of recovery or further decline.