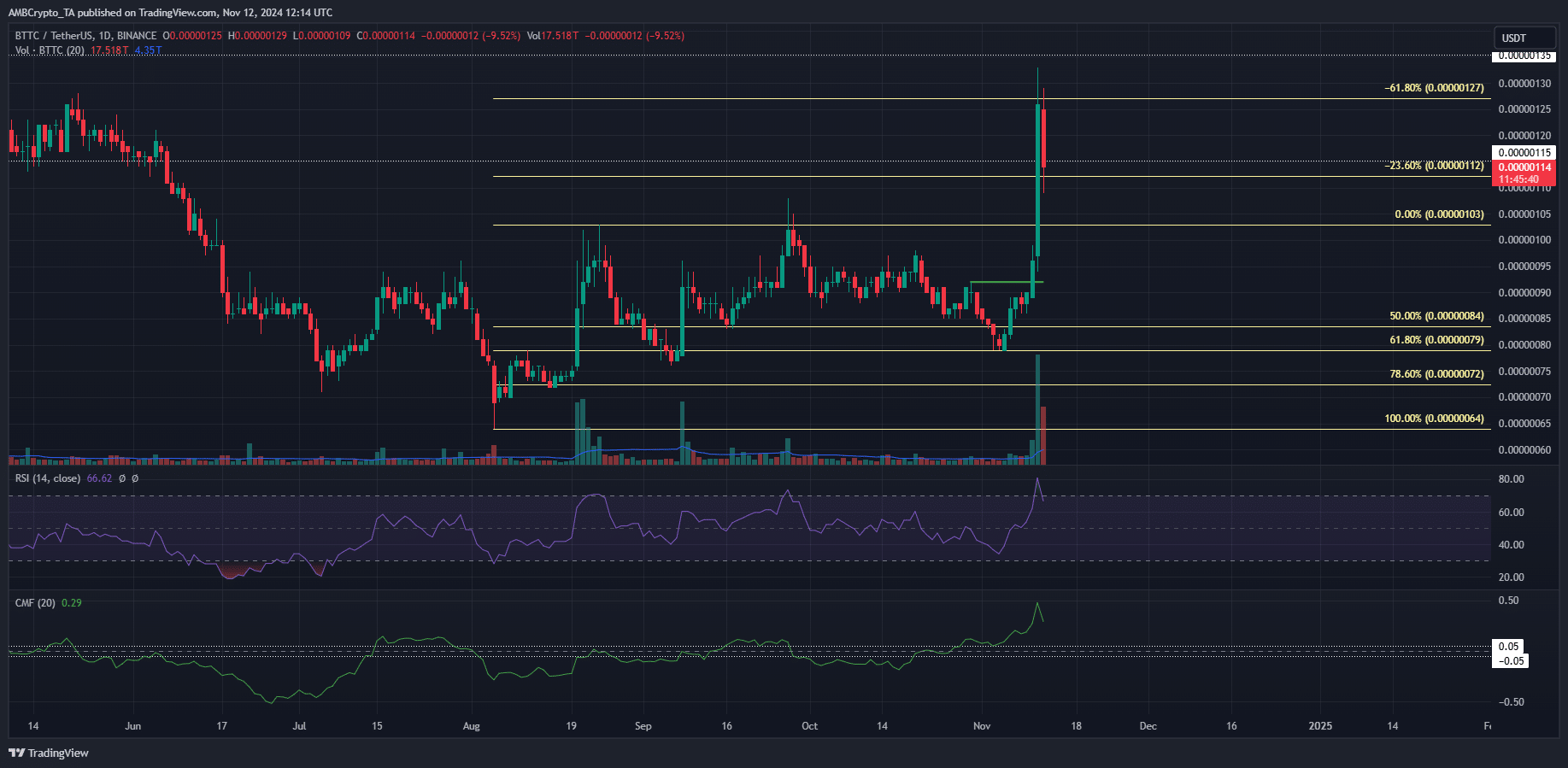

- BTT made massive gains following the structure break on high trading volume.

- Such large gains are generally accompanied by heightened volatility.

BitTorrent [BTT] has rallied 22.8% in the past 40 hours as Bitcoin [BTC] made new highs and almost reached the $90k mark. Altcoins are rallying swiftly as market sentiment turned insane bullish.

The Crypto Fear and Greed Index stood at 86 to signal extreme greed. Does that mean a price correction across the market is inbound?

BitTorrent enforces bullish break, rallies 22%

The RSI and CMF showed firm bullish momentum and capital inflows respectively. The CMF reached levels not seen since January 2023, showing the anomalous size of the capital inflows.

This has spurred BTT beyond the highs from May.

The strong trading volume and gains are by-products of a bull market and the result of capital flow.

The meme and AI sector tokens have seen the bulk of the run’s gains, and legacy tokens like BTT remain on the backfoot in comparison despite the rally.

On the lower timeframes, a 15% price dip has occurred, and the momentum was on the verge of flipping bearishly on the hourly chart. However, the higher timeframes were still strongly bullish.

The $0.00000115 level has historical significance and is likely to act as support in the coming days. Yet, deeper retracement can not be discounted.

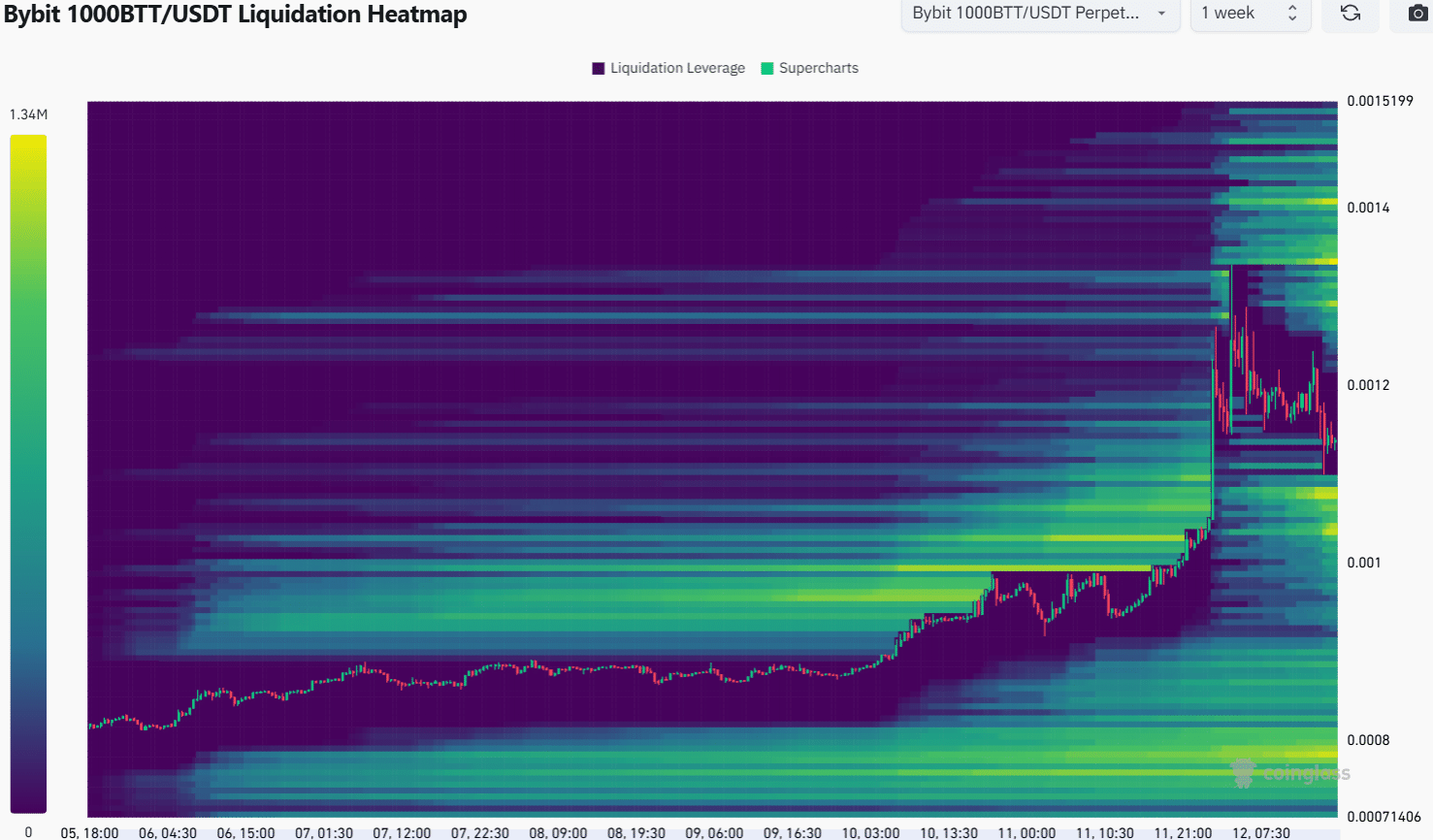

Liquidation heatmap shows a deeper dip is likely

Source: Coinglass

The 1-week look-back period showed the $0.00000107-$0.00000103 and $0.00000098 levels as significant liquidity pockets.

BitTorrent prices could revisit these levels to sweep the liquidity there before a bullish reversal.

Read BitTorrent’s [BTT] Price Prediction 2024-25

The horizontal $0.00000115 level has confluence with the 23.6% Fibonacci extension level.

Hence, despite lower timeframe volatility, it is possible that the BTT bulls defend this region on the 1-day timeframe and drive the next move higher.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion