- Bitcoin’s social sentiment metrics show declining commentary around price targets despite stability at $104,250.

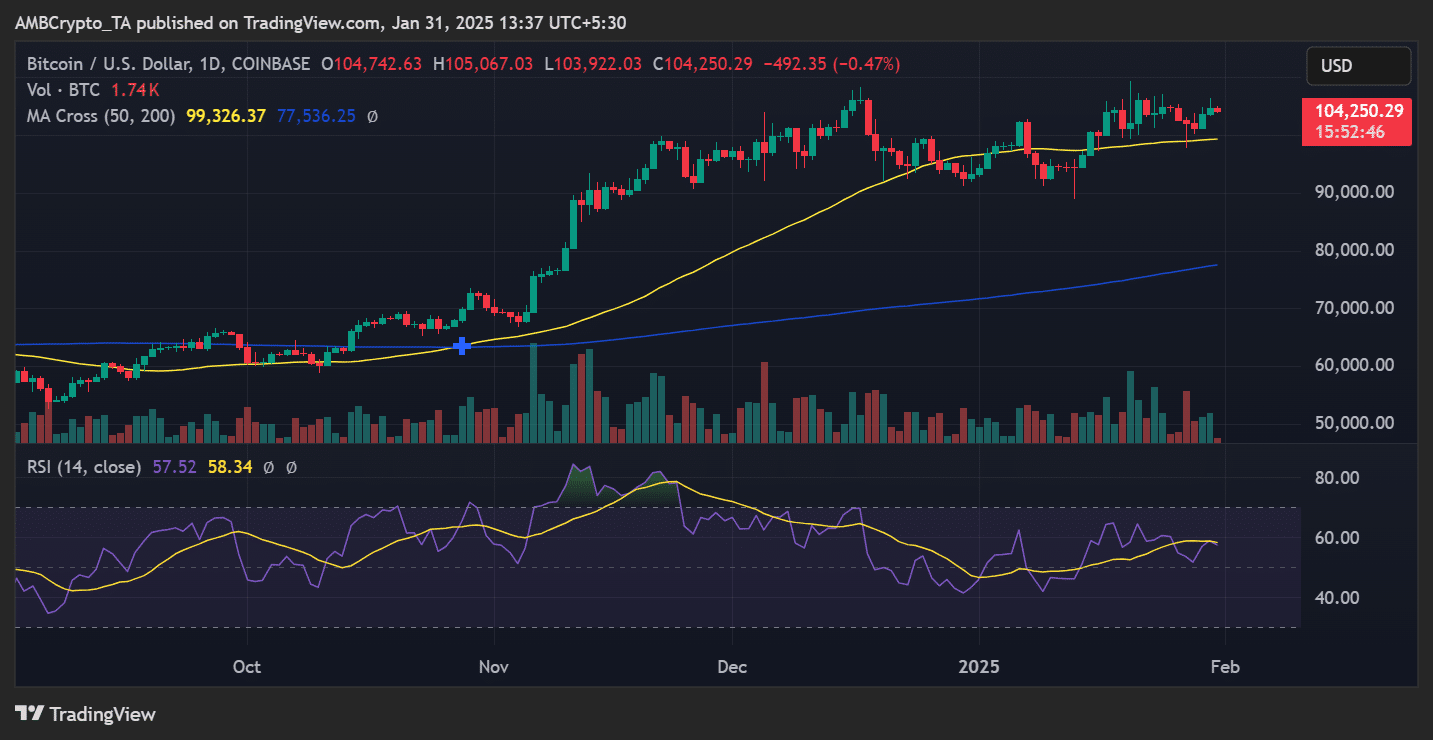

- Price maintains support above key Moving Averages at $99,326 and $77,536 despite sentiment fluctuations.

Bitcoin’s[BTC] recent price action around the $104,000 level has created an intriguing psychological battleground, with social sentiment metrics revealing complex market dynamics.

As the leading cryptocurrency trades at $104,250.29, at press time, down by 0.47% in the last 24 hours, underlying sentiment indicators suggest a notable shift in investor behavior.

Bitcoin’s social sentiment divergence

The most striking feature in recent market data is the declining commentary around both greed and fear indicators.

Bitcoin maintained its position above the crucial Moving Averages (MA) Cross levels of 99,326.37 and 77,536.25. According to Santiment data, Social Volume mentions in the $90K-$95K and $110K-$115K ranges have decreased significantly.

This indicates a potential accumulation phase as traders adopt a wait-and-watch approach.

A noteworthy pattern emerged on the 19th of January, increased social greed coincided with an immediate price decline.

This inverse correlation between sentiment and price action has been consistent throughout the analyzed period, with similar instances recorded on the 4th of December and the 16th of December 2024.

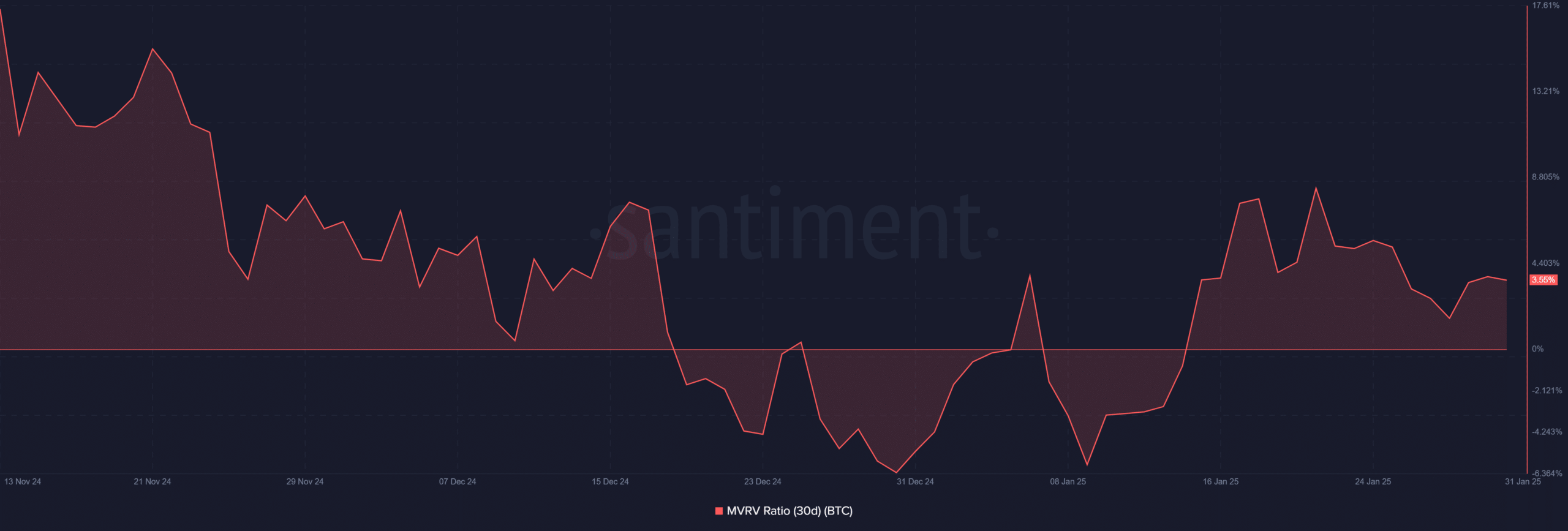

MVRV ratio insights

The 30-day Market Value to Realized Value (MVRV) ratio has entered a critical zone, suggesting potential price vulnerability.

The metric currently shows a declining trend after reaching elevated levels, historically a precursor to local price tops.

When combined with the current social sentiment, this technical indicator paints a picture of cautious optimism among long-term holders.

Bitcoin technical structure and volume analysis

The daily chart reveals a strong underlying technical structure, with Bitcoin maintaining its position above both key Moving Averages.

At the time of writing, Trading Volume stood at 1.74K BTC, showing moderate activity, while the RSI reading of 57.52 indicated balanced momentum, neither overbought nor oversold.

Sentiment Cycles and price action

The social sentiment data analysis reveals five distinct cycles since November 2024, where extreme sentiment readings preceded significant price movements in the opposite direction.

The current cycle shows declining social engagement despite price stability, a phenomenon typically associated with accumulation phases in previous market cycles.

What does this mean for Bitcoin?

The convergence of declining social commentary, moderating MVRV ratio, and stable price action above key MA suggest Bitcoin’s broader uptrend could continue.

However, increased volatility is likely in the near term. Reduced social engagement, especially in price target discussions, indicates a maturing market phase. Institutional flows may now have greater influence than retail sentiment.

– Read Bitcoin (BTC) Price Prediction 2025-26

Traders should note that while sentiment metrics provide valuable insights, they should be considered alongside traditional technical analysis and fundamental factors.

The current market structure remains constructive above the 50-day MA at 99,326.37. However, the declining social engagement suggests possible range-bound action for Bitcoin before the next significant directional move.