- BTC broke its previous ATH when it rose to over $94,000.

- It is trading at around $92,500 at press time.

Bitcoin [BTC] experienced a dramatic reversal after reaching a record high of $94,000 in the last trading session.

This peak was followed by a sharp decline, triggered by long-term holders liquidating positions worth $3 billion.

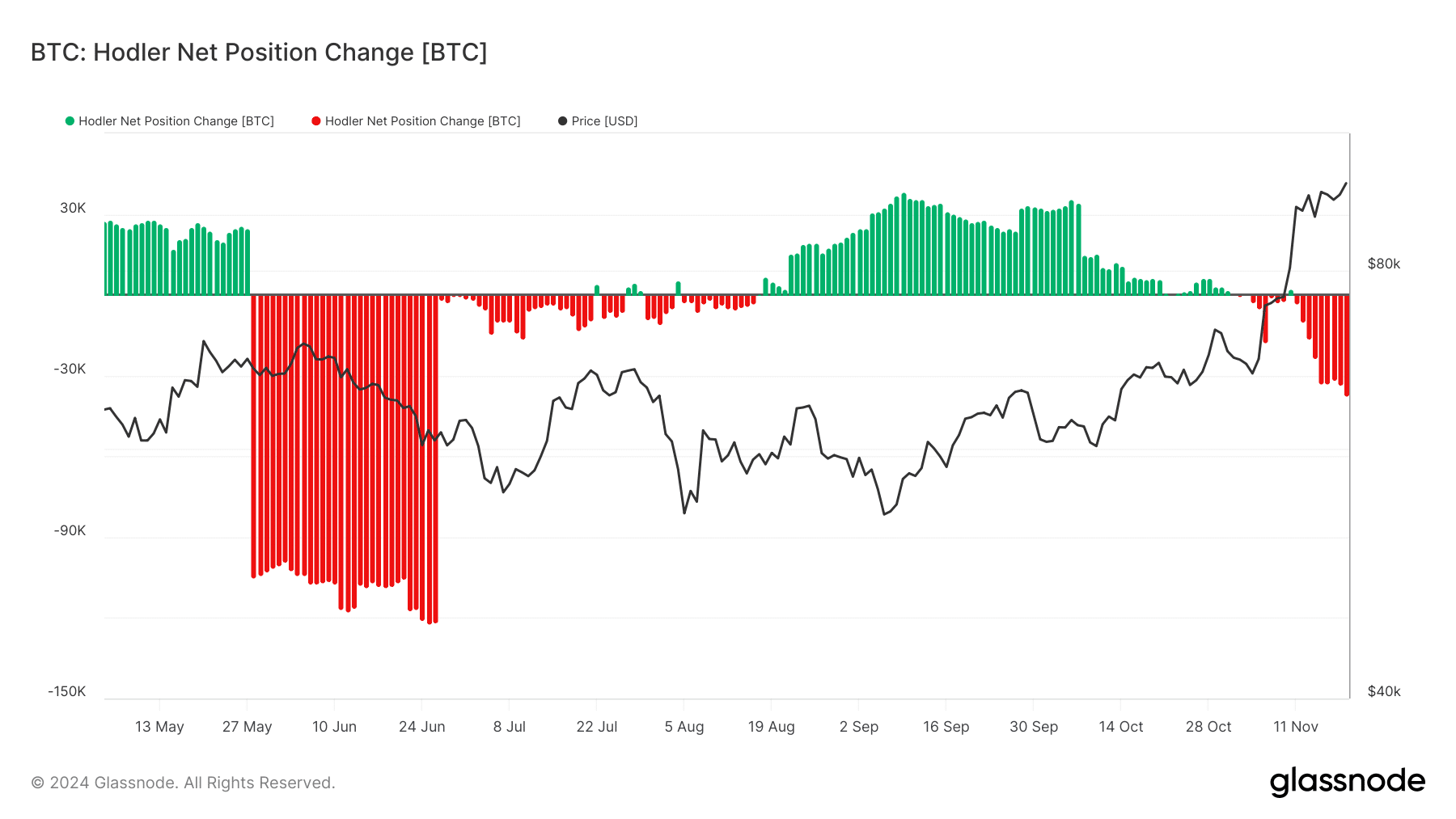

On-chain data indicated that the HODLer Net Position Change metric has plummeted to its most negative levels in months, while exchange netflows also hinted at increased selling pressure.

This combination of factors has left the market wondering: Is this the start of a deeper correction or a consolidation before further gains?

Bitcoin slumps: Price action and technical analysis

Bitcoin’s price chart highlighted its meteoric rise to $94,000 before retreating to $92,500.

Analysis by AMBCrypto showed that BTC’s price, which started at around $90,000, rose to around $94,105 in the last trading session.

The trading volume showed a significant increase, reflecting heightened activity during the sell-off.

The 50-day moving average remained above the 200-day moving average, indicating that the long-term uptrend was still intact.

However, the RSI sat at 76.62, signaling overbought conditions. This, coupled with the MACD’s weakening momentum, suggested that Bitcoin could enter a consolidation phase or even a short-term correction.

Support levels around $90,000 and $85,000 will be critical to watch, as a breach of these levels might exacerbate the downturn.

HODLer behavior: Profit-taking at peak levels

AMBCrypto’s analysis of Glassnode’s chart showed the HODLer Net Position Change revealed a significant shift in long-term holder behavior.

After months of accumulation (indicated by green bars), recent activity shows a sharp transition to distribution (red bars).

As of this writing, the HODLer chart has registered its most negative trend since June. Over 37,000 BTC, valued at over $3.4 billion, has been sold off.

Thus, long-term investors chose to realize profits as Bitcoin touched its all-time highs.

Such behavior is typical during extended rallies, where the allure of record profits motivates even the most steadfast holders to sell.

Historically, similar sell-offs have led to temporary pullbacks before Bitcoin resumed its bullish trajectory.

Exchange netflows highlight selling pressure

The CryptoQuant chart on Bitcoin’s exchange netflows further underscored the ongoing sell-off. A spike in exchange inflows suggests that holders are moving their BTC to exchanges, likely for liquidation.

AMBCrypto’s analysis showed that the negative flow spiked in the last trading session, with over 8,600 BTC registered. As of this writing, it has remained negative.

Negative netflows during previous accumulation periods had supported Bitcoin’s price rise, but the recent reversal signals a shift in market sentiment.

If exchange inflows continue to outpace outflows, it could create sustained selling pressure, making it difficult for Bitcoin to recover its all-time high in the near term.

However, a decline in inflows could indicate that most profit-taking has already occurred.

What’s next after the Bitcoin slump?

After an extended rally, Bitcoin’s retreat from $94,000 reflects a natural profit-taking phase, with long-term holders capitalizing on gains.

The technical and on-chain indicators suggest that while the broader trend remains bullish, the market could be poised for consolidation or a short-term correction.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Critical levels to watch include the $90,000 and $85,000 support zones and on-chain metrics such as HODLer activity and exchange netflows.

A reversal in selling pressure or renewed buying interest could pave the way for Bitcoin to challenge new highs, but for now, caution remains warranted as the market digests these significant moves.