- Decreasing demand for U.S. Treasury Securities may signal a capital shift toward riskier assets, including Bitcoin.

- Currently, Bitcoin’s Social Volume is trending upward, though it remains below levels seen during the 2021 bull market.

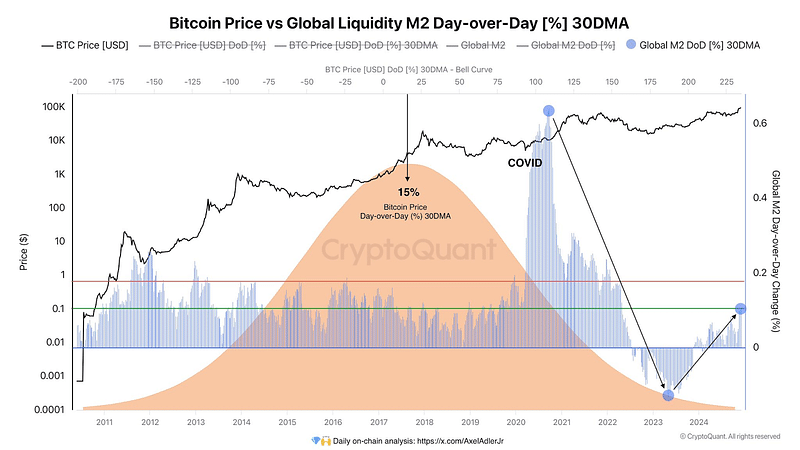

Global liquidity has consistently influenced asset prices, including Bitcoin’s [BTC]. Through analysis liquidity inflows, represented by M2 (a measure of money supply), align with Bitcoin’s growth, though with a slight delay.

On the other hand, while the U.S. Federal Reserve continues its Quantitative Tightening (QT) policy, the declining demand for U.S. Treasury securities (UST) may signal a capital shift toward riskier assets, including Bitcoin.

This potential shift, coupled with broader global liquidity dynamics, could support Bitcoin’s bull market even in the absence of direct Quantitative Easing (QE).

Bitcoin’s price movement and Global M2 Liquidity

Bitcoin’s price correlates with the Global M2 Day-over-Day (DoD) 30DMA. The most notable instance occurred after the COVID-19 liquidity injection when Bitcoin’s price surged to its all-time high following a rapid M2 increase.

More recently, despite the Federal Reserve’s QT stance, global liquidity has shown a slight uptrend, supporting Bitcoin’s current price recovery.

This recovery aligns with the historical trend of delayed responses to M2 inflows. A bell curve-shaped growth pattern in M2 aligns with Bitcoin’s long-term bullish movements, highlighting how liquidity positively impacts Bitcoin’s price.

If the Federal Reserve intervenes due to a potential crisis in T-bills, M2 could rise sharply. Such intervention would likely propel Bitcoin prices upward again.

With the current M2 uptick, Bitcoin may retest its previous highs if liquidity sustains, indicating a possible bullish breakout in 2024.

Market sentiment and Bitcoin’s potential growth

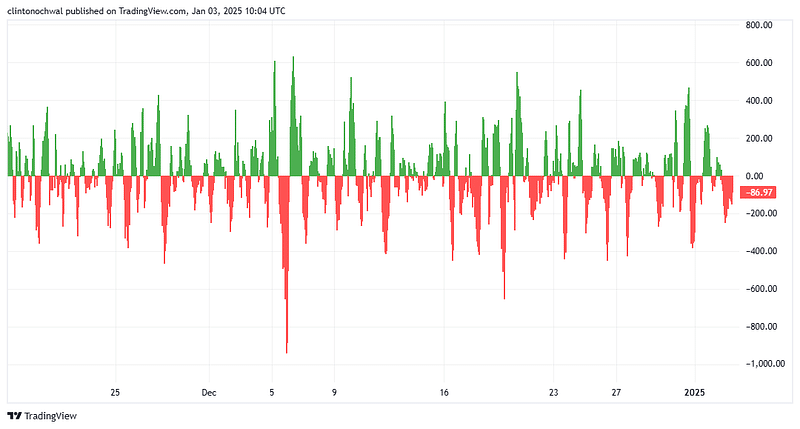

The Greed & Fear Index reflects market sentiment, significantly influencing Bitcoin’s price movement. Historically, Bitcoin tends to rally when the index shifts from extreme fear to neutral or greed levels.

Currently, this metric indicates cautious optimism, transitioning from the fear-driven lows seen earlier this year to a more neutral sentiment.

This aligns with the global liquidity chart, where a slight increase in M2 coincided with Bitcoin’s recent price recovery.

If sentiment continues improving, supported by increasing liquidity and reduced demand for USTs, traders may choose to allocate capital to riskier assets like Bitcoin, driving further price growth.

Looking ahead, the Greed & Fear Index is likely to strengthen if Bitcoin sustains above key psychological levels. However, any unexpected tightening measures from the Feds or geopolitical uncertainties could trigger fear, dampening the rally.

Traders should monitor sentiment closely as it aligns with liquidity trends for timing long positions.

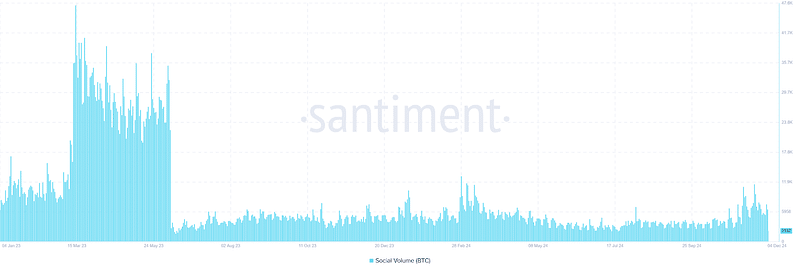

A metric of market engagement

Social Volume, which tracks the frequency of Bitcoin mentions across social media platforms, is a leading indicator of market engagement.

During significant liquidity-driven price movements, social activity often spikes, reflecting heightened interest from both retail and institutional investors.

Currently, Bitcoin’s Social Volume is trending upward, though it remains below the levels seen during the 2021 bull market. This suggests growing interest as Bitcoin recovers, but not yet a euphoric market state.

The delayed response in Social Volume corresponds with the slight lag in Bitcoin’s reaction to M2 liquidity inflows, as shown in the chart.

If Social Volume rises further, it could signal increased market participation and a strengthening bull trend. However, subdued activity might indicate hesitation among traders, potentially leading to slower price growth.

Monitoring this metric alongside liquidity trends and technical support levels could offer early signals of sustained upward momentum.

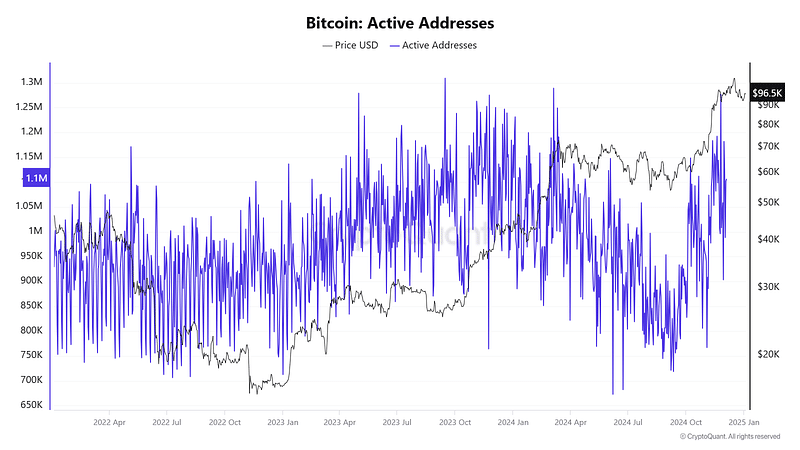

Network activity as a bullish indicator

Higher activity levels align with periods of increased price momentum, as more participants indicate stronger network demand.

Recent data shows a steady rise in active addresses, reflecting renewed interest among traders and investors.

This coincides with the slight uptick in global M2 liquidity and BTC’s recent price recovery. The pattern supports the hypothesis that liquidity inflows drive market activity, even if delayed.

If active addresses continue increasing, it signals growing confidence in the network and reinforces a potential bull market. However, a stagnation or decline in activity could suggest hesitation or profit-taking among participants.

BTC’s recent price recovery highlights its sensitivity to global liquidity trends, as depicted by the correlation with 30DMA in the chart.

Despite the Federal Reserve’s ongoing quantitative tightening, the slight uptick in global liquidity, coupled with declining UST demand, has provided a foundation for Bitcoin’s growth.

Read Bitcoin’s [BTC] Price Prediction 2024-25

A shift from fear to cautious optimism indicates improving market sentiment, while increasing social engagement reflects growing interest. Additionally, rising active addresses signal strengthening network activity.

Looking ahead, the interplay of global liquidity, market sentiment, and network activity will remain pivotal. If systemic risks prompt Federal Reserve intervention, BTC could see an accelerated bull run driven by renewed capital inflows.