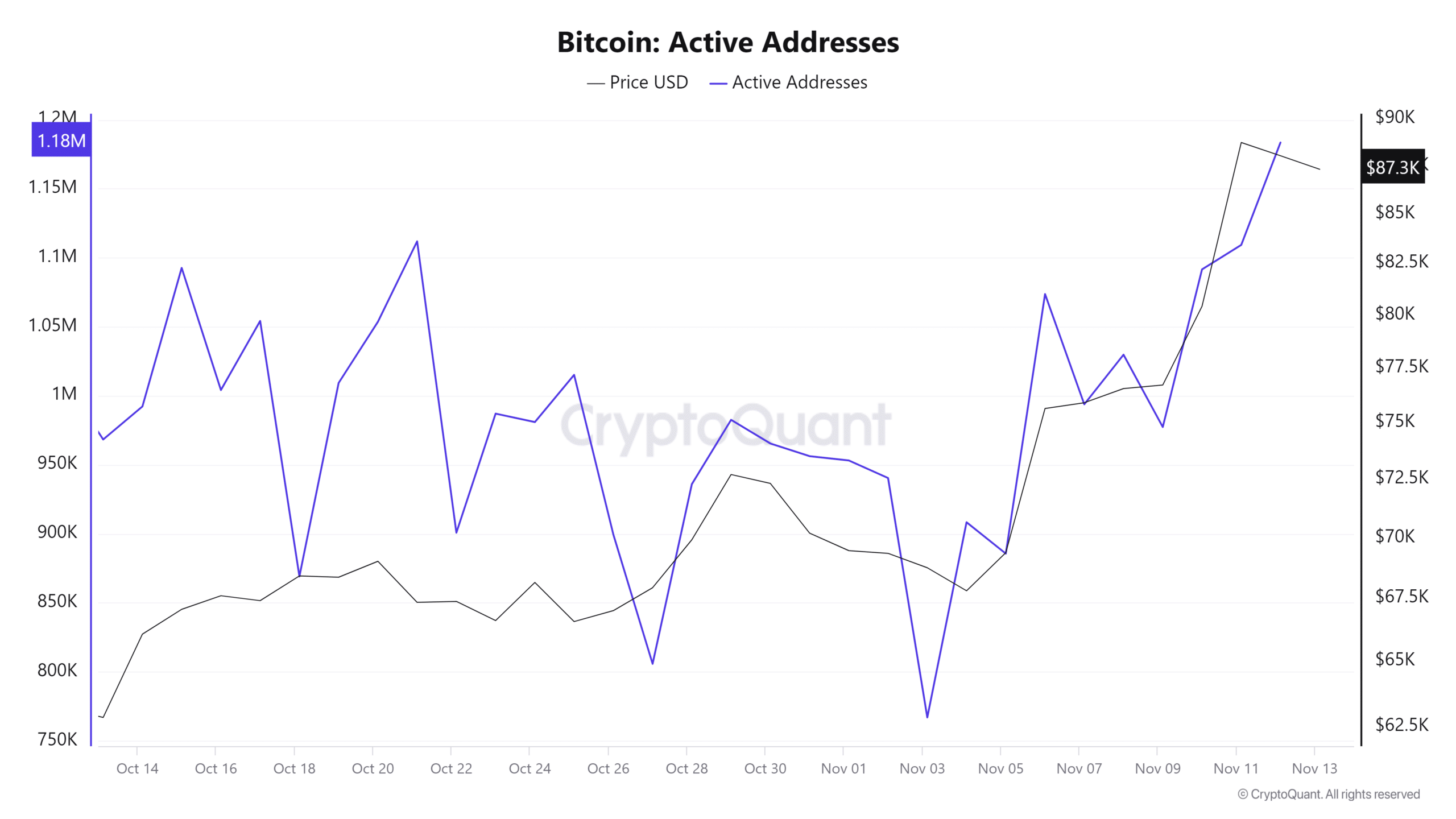

- Bitcoin’s active addresses confirmed strong FOMO as the digital asset hit new highs.

- Sell pressure intensified as mid-term HODLers engaged in profit-taking.

Abundant Bitcoin [BTC] predictions have been made so far this year, with many analysts expressing optimism in BTC soaring well above $100,000.

Its latest rally appeared to have triggered a wave of FOMO, which was evident by the surge in addresses holding BTC.

According to CryptoQuant, the latest Bitcoin rally was characterized by a surge in active addresses.

This was not only a sign of confidence in the current state of the market, but also an indication that they do not want to miss out on the rally.

The number of active addresses was as low as 766,947 on the 3rd of November, but it has rallied to over 1.18 million addresses as of the 12th of November.

This outcome highlighted a directly proportional outcome with price.

The surge in active addresses holding Bitcoin also reflectedthe heavy ETF inflows observed during the same period.

Is Bitcoin buying pressure decreasing?

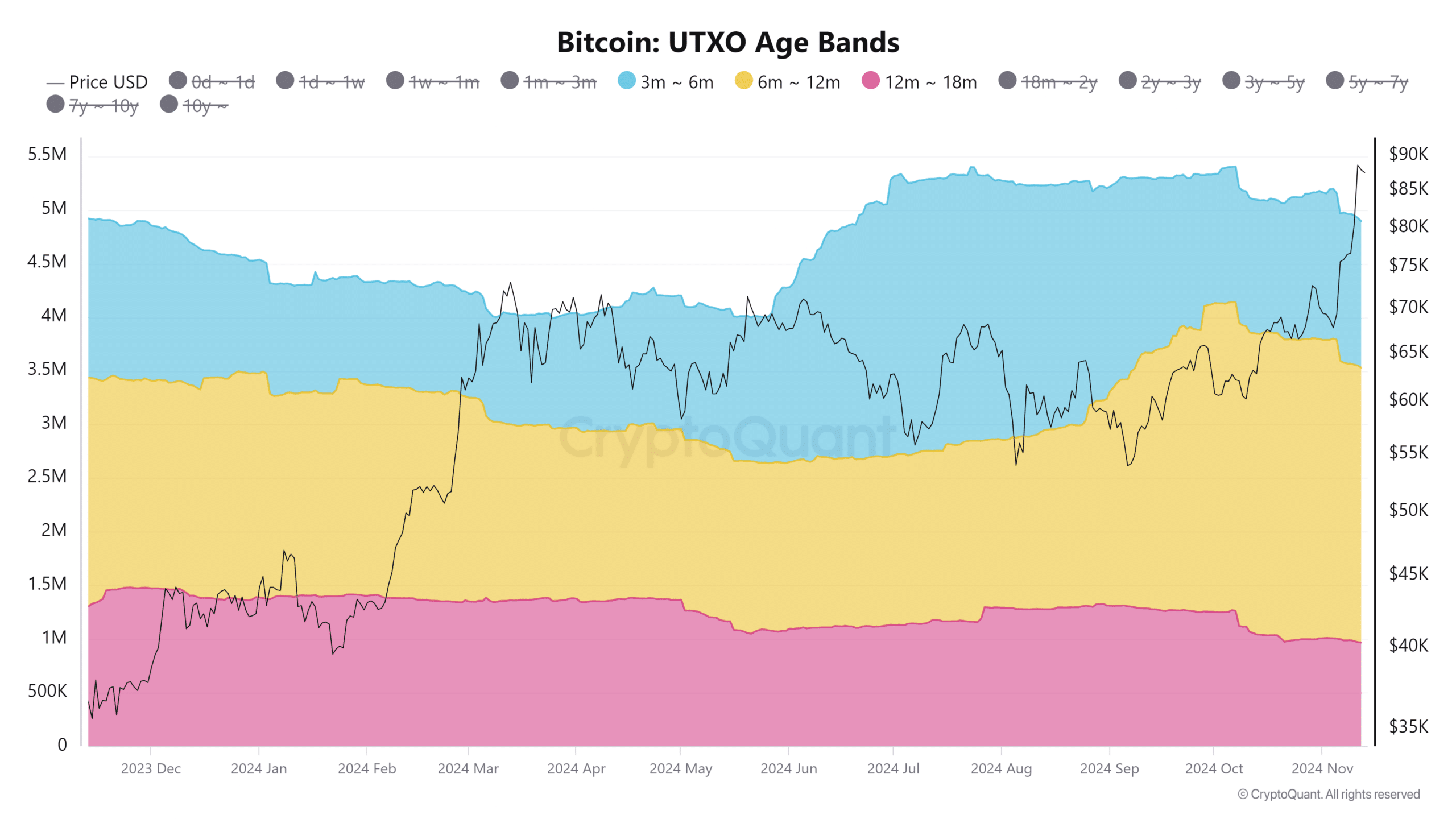

While active addresses have been contributing to bullish momentum, recent data also indicated that profit-taking was starting to intensify.

This was especially true about a particular cohort of HODLers that have been holding BTC for 6 to 18 months, especially in the spot market.

Data indicated that buyers selling recently started accumulating as far back as May 2023. Those that held up until recently have enjoyed over 200% gains during those 18 months.

According to CryptoQuant, these are mid-term holders whose average entry point was within the 28,000 price range.

Roughly 230,000 BTC moved from addresses holding for 6 to 12 months from the 3rd to the 12th of November. About 41,500 BTC moved from addresses that held for 12 to 18 months.

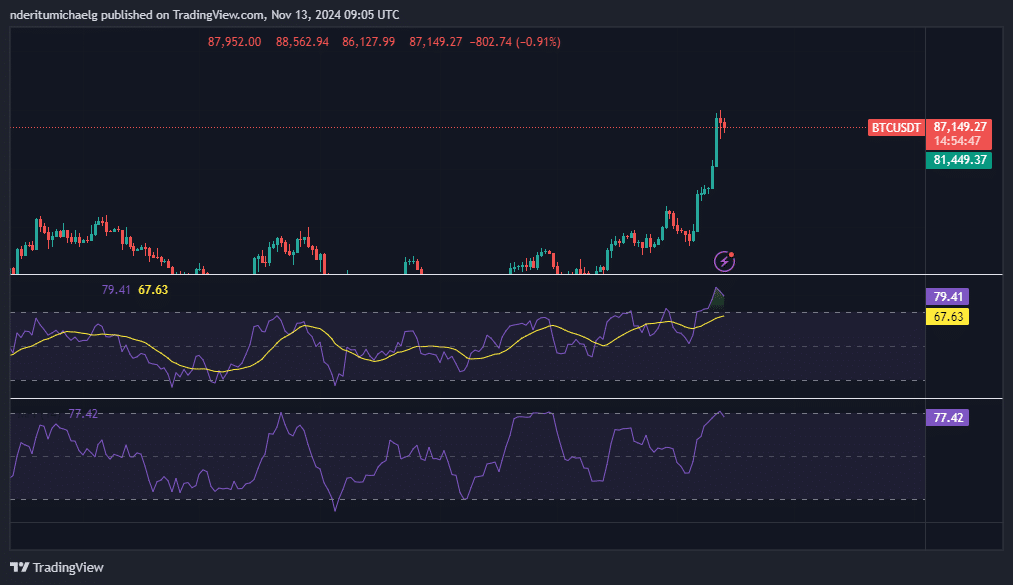

Is this the end of the latest bullish wave?

A surge in sell pressure from mid-term hodlers could indicate that Bitcoin is ready for a sizable pullback.

It recently peaked at $89,940 during the trading session on the 12th of November and has since demonstrated some bullish exhaustion and some sell pressure.

Bearish expectations have been rising based on the fact that the price was deeply overbought.

Sell pressure from mid-term holders not only confirm a surge in profit-taking, but also that long term holders may be anticipating some pullbacks after BTC’s latest rally.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Although a pullback is reasonable at current levels, bullish expectations are still high, especially as 2025 draws near.

The surge in active addresses suggested that FOMO could likely maintain a higher price floor and encourage more buying, as investors continue to consider Bitcoin as an attractive option below $100,000.