- BTC faced a strong resistance at $98.9K.

- Selling pressure on BTC could rise soon, putting an end to its bull run.

Bitcoin [BTC] has been slowly inching towards the $100K mark, following the bullish market conditions. However, is this bull run sustainable, or will BTC fall victim to a price correction soon?

Bitcoin approaches $100K

After a week of massive price rises, BTC’s value started to come closer to the $100K mark. At the time of writing, the king coin was trading at $98.2K with a market capitalization of $1.94 trillion.

In the meantime, Ali Martinez, a popular crypto analyst, posted a tweet, advising that investors should sell 25% of their BTC holdings once the coin touches $173K-$200K.

Going forward, he also mentioned selling 30% of holdings once the king coin enters the $200K-$300K range.

Since these numbers were pretty ambitious, AMBCrypto planned to dig deeper to find whether BTC’s road ahead is clear.

Decoding BTC’s future

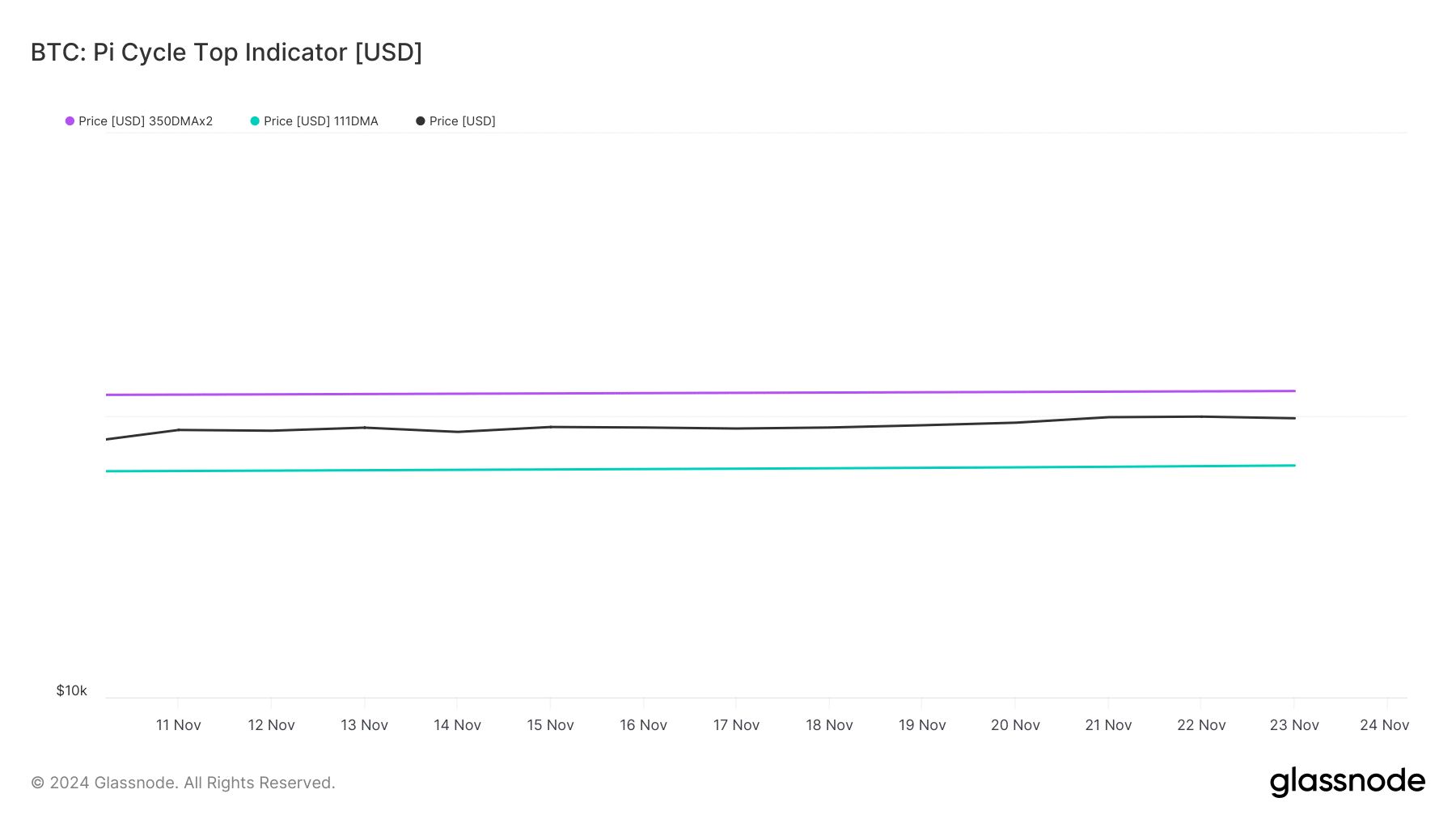

As per our analysis of Glassnode’s data, BTC was trading well inside its range. To be precise, the Pi Cycle Top indicator revealed that BTC’s possible market top was at $121K, while its market bottom was at $66K.

Therefore, the possibility of BTC going towards $100K wasn’t too ambitious.

In fact, investors were still considering buying Bitcoin. AMBCrypto reported earlier that 65K BTC were withdrawn from exchanges recently.

These coins were valued at more than $6 billion, indicating a significant push to BTC’s buying pressure.

As per CryptoQuant’s data, the buying pressure remained high. This was evident from BTC’s dropping exchange reserve.

A decline in buying pressure generally indicates that the chances of a continued price uptrend are high, as investors showed confidence in the king coin.

Apart from that, Bitcoin’s Coinbase Premium was also green. This meant that buying sentiment was dominant among U.S. investors, which could also support BTC’s growth towards $100K.

However, nothing can be said with utmost certainty.

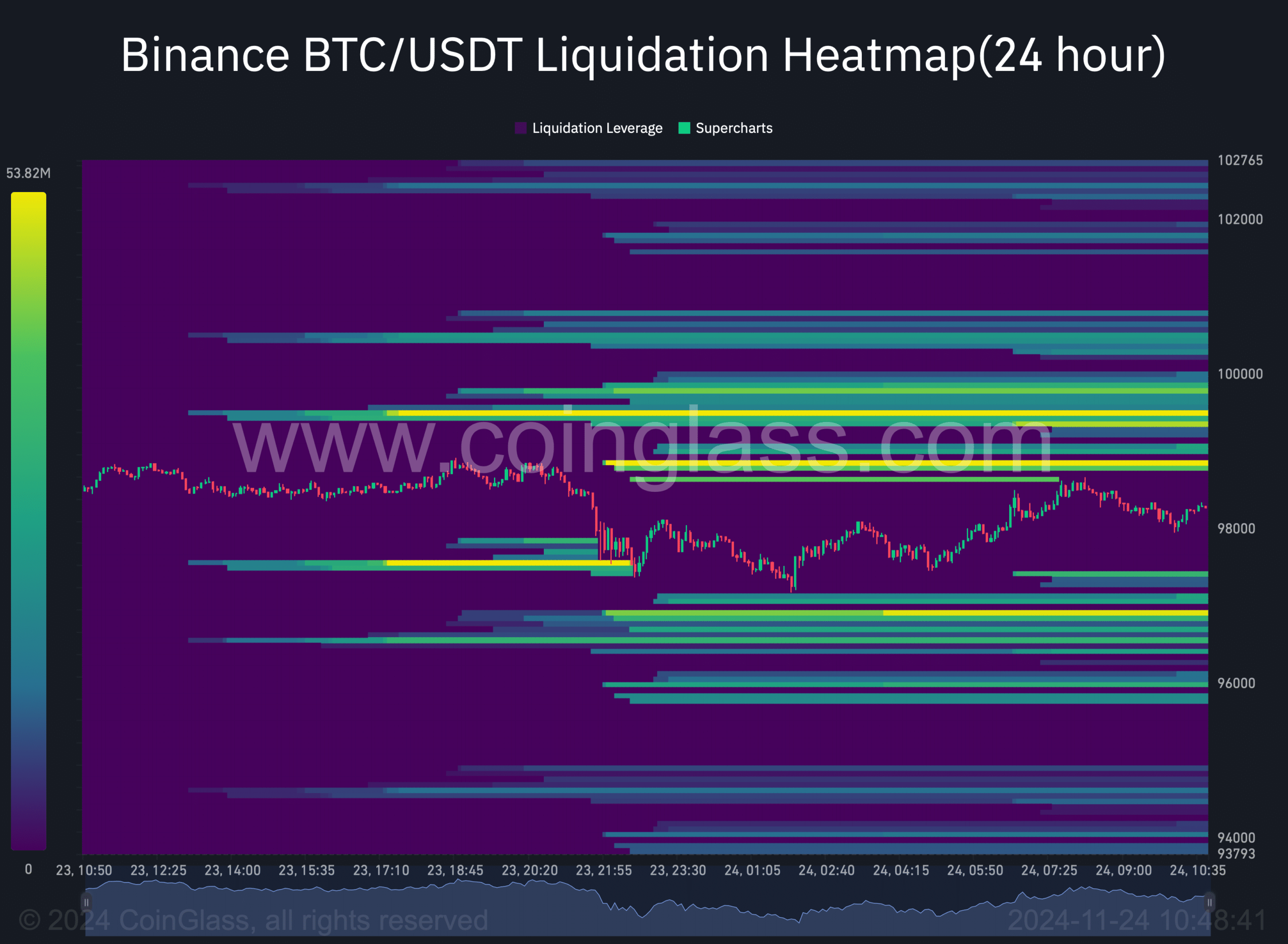

The king coin’s liquidation heatmap also suggested that it faced strong resistance at $98.9K. An increase in liquidation often acts as a barrier, which can result in a rejection and price correction.

Therefore, it will be crucial for BTC to go above that level in order for it to target $100K.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

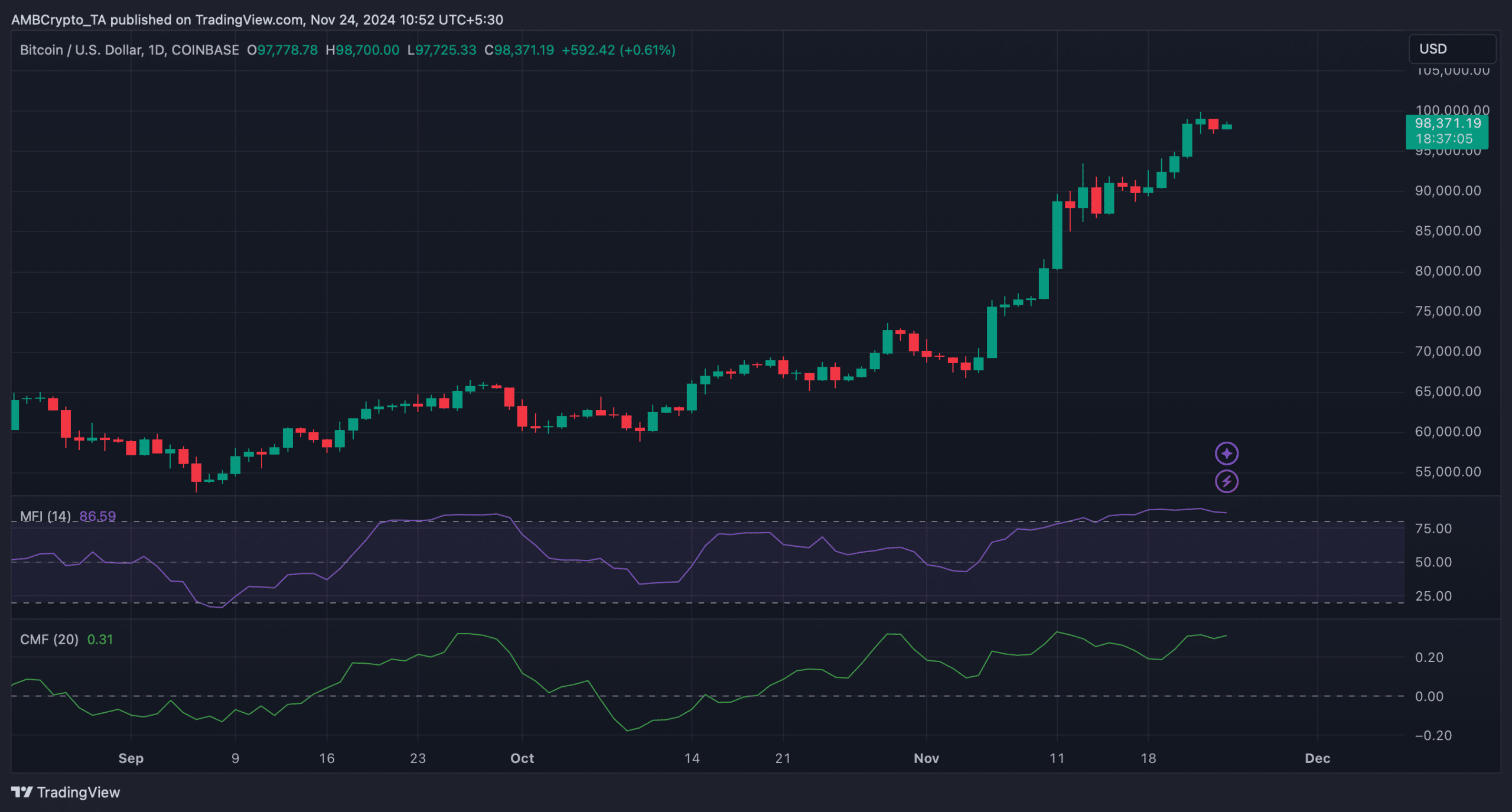

Bitcoin’s Chaikin Money Flow (CMF), which gauges buying/selling pressure, registered an uptick as well. This further supported the argument of buying pressure being high.

However, the Money Flow Index (MFI) was resting in the overbought zone, which could trigger a sell-off, in turn, pushing BTC’s price down.