- BTC exchange deposits have shrunk to 2016 lows.

- CryptoQuant analyst deem this a signal for a major rally for BTC in the long run.

Since the 19th of December, Bitcoin [BTC] has struggled below $100K, but the cryptocurrency’s long-term outlook remains positive.

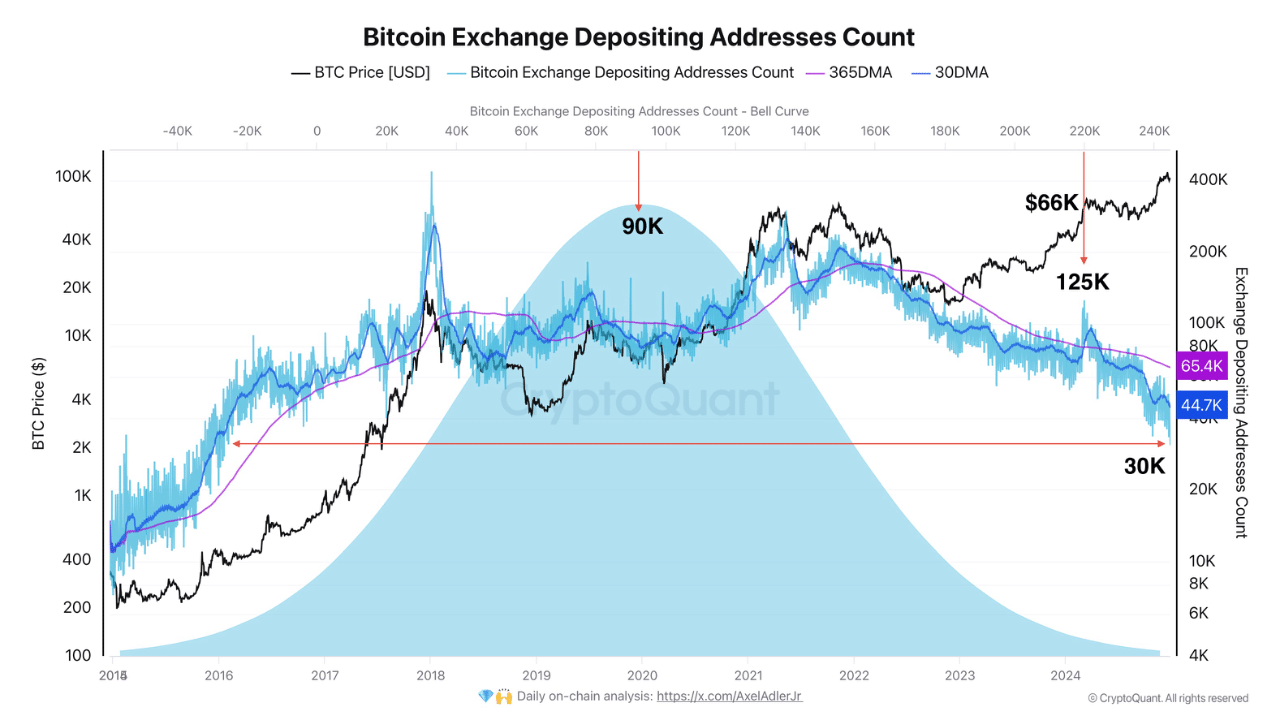

According to CryptoQuant analyst Axel Adler, the amount of BTC being moved to exchanges has dropped to 2016 levels. Adler added that the last time BTC deposits on exchanges dropped this low, a major rally followed.

“It typically suggests they prefer to keep their BTC in personal wallets rather than gearing up to sell.”

Compared to early 2024, when BTC daily deposits peaked at over 125K coins, the current reading declined below 45K BTC, mirroring 2016 levels.

More BTC leaving exchanges

Interestingly, the above positive outlook was also reinforced by more BTC being moved from the exchanges.

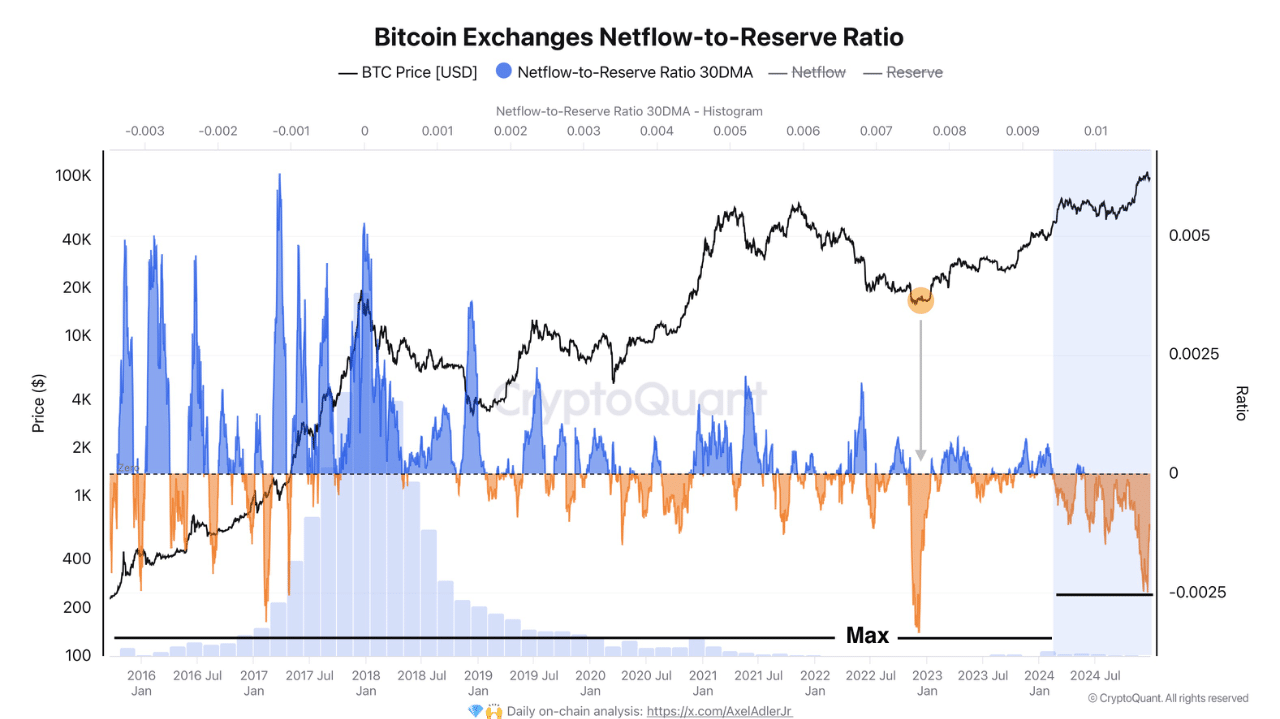

Using the BTC netflow-to-reserve ratio, Addler noted that the metric was negative, underscoring dominance in exchange outflows.

The ratio gauges the correlation between net inflows/outflows relative to exchange BTC reserves.

The negative reading suggested that, on average, more BTC left exchanges than recorded deposits. This is a typical bullish signal.

In short, BTC’s long-term prospect was still positive despite the recent spike in sell pressure that has kept the asset below $100K.

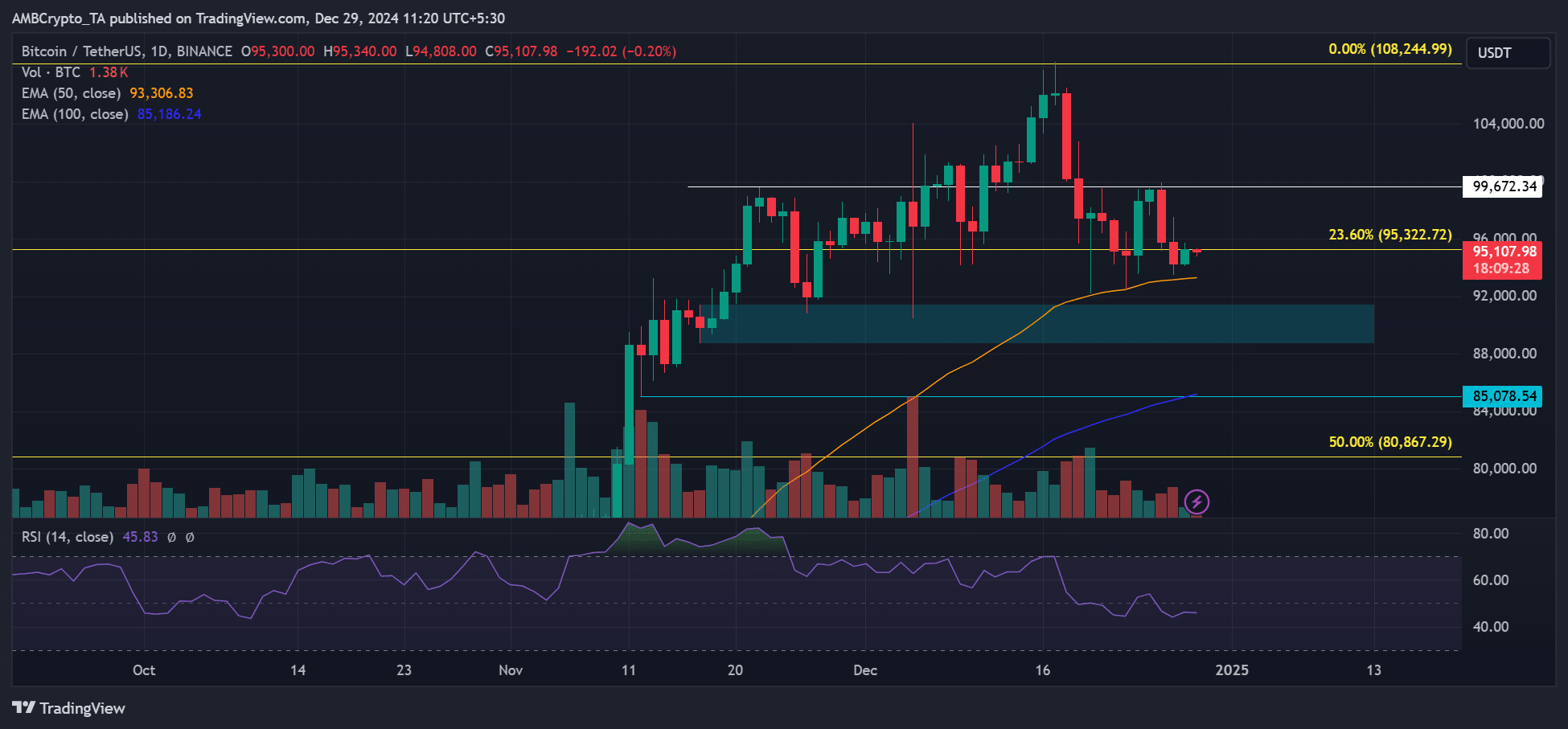

In the meantime, BTC price remained range-bound during the holiday season, consolidating between $100K and the 50-day EMA (Exponential Moving Average).

Additionally, the daily RSI slipped below 50, indicating a short-term weakening in demand.

Read Bitcoin [BTC] Price Prediction 2025-2026

Should bearish pressure persist in the short term, a drop to $90K or $85K could be on the cards.

However, holding above the dynamic support of a 50-day EMA could increase the odds of retesting $100K or a bullish breakout.